Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Oh yes, it is the buzzword. One of the boldest steps of the current government. It changes the entire taxation scenario in India. GST is a merger of all indirect taxes we had before 1-7-2017. Even at the time of […]

Introduction of GST Amnesty Scheme 2021

Amnesty means providing relief from some penal action. Recently GST amnesty scheme 2021 is announced by CBIC. It is a scheme to waive late fees. The fees are accumulated […]

With reference Notification, 15/2021-CT dated 18.05.2021, to blocking of GSTIN for e-Way Bill generation is now considered only for the defaulting Supplier GSTIN and not for the defaulting Recipient or […]

Notification No. 27/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 26/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 25/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 24/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 23/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 22/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 21/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 20/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 19/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 18/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 17/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Notification No. 16/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (ii)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

Commissioner Of Central Tax, GST, Delhi North

Facts of the Case:

The present petition was heard on 21st December 2020 along with other batch matters […]

Government of India

Ministry of Commerce and Industry

Department of Commerce

Directorate General of Foreign Trade

Udyog Bhawan, New Delhi

Dated: 26th May 2021

Trade Notice No. 07/2021-22

To,

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, Kerala issues first guidelines on blocking/unblocking of Input Tax Credit 4 years, 8 months ago

Circular bases on ‘Rule 86A’ of GST Rules; experts say CBIC should ensure its uniformity across the nation

Kerala has come out with detailed circular and Standard Operating Procedures (SoP) to streamline […]

ConsultEase Administrator wrote a new post, 9 Top Career Opportunities in GST 4 years, 8 months ago

Oh yes, it is the buzzword. One of the boldest steps of the current government. It changes the entire taxation scenario in India. GST is a merger of all indirect taxes we had before 1-7-2017. Even at the time of […]

CA Shafaly Girdharwal wrote a new post, Important FAQs About GST Amnesty Scheme 2021 for Waiver of Late Fees 4 years, 8 months ago

Introduction of GST Amnesty Scheme 2021

Amnesty means providing relief from some penal action. Recently GST amnesty scheme 2021 is announced by CBIC. It is a scheme to waive late fees. The fees are accumulated […]

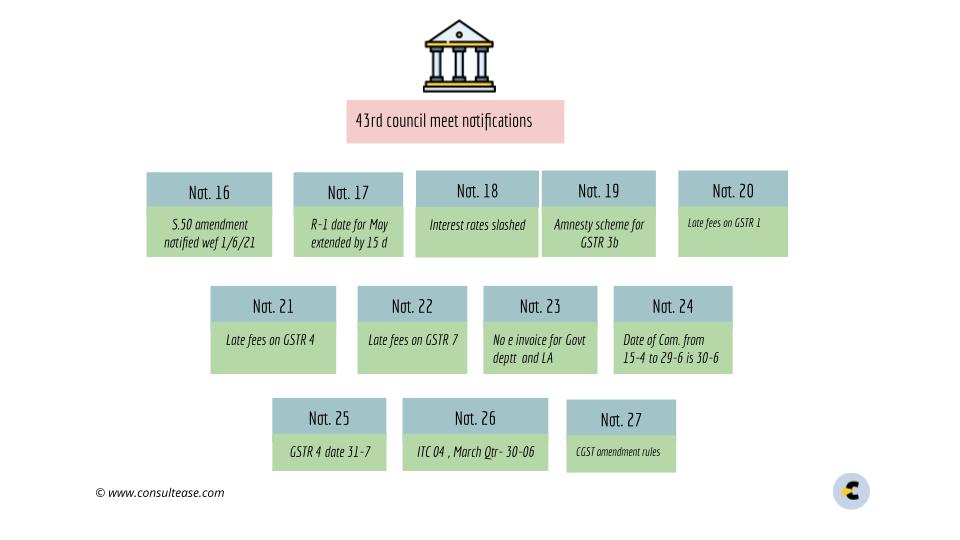

ConsultEase Administrator wrote a new post, Important changes in GST Return, Interest and Rules 4 years, 8 months ago

Not. 16/2021

Provisions of Section 112 of FA 2021 is notified applicable from 1st July 2017

112. In section 50 of the Central Goods and Services Tax Act, in sub-section (1), for the proviso, the following […]

ConsultEase Administrator wrote a new post, National Informatics Centre Release Notes: 01/06/2021 4 years, 8 months ago

With reference Notification, 15/2021-CT dated 18.05.2021, to blocking of GSTIN for e-Way Bill generation is now considered only for the defaulting Supplier GSTIN and not for the defaulting Recipient or […]

ConsultEase Administrator wrote a new post, Notification No. 27/2021 – Central Tax 4 years, 8 months ago

Notification No. 27/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 26/2021 – Central Tax 4 years, 8 months ago

Notification No. 26/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 25/2021 – Central Tax 4 years, 8 months ago

Notification No. 25/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 24/2021 – Central Tax 4 years, 8 months ago

Notification No. 24/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 23/2021 – Central Tax 4 years, 8 months ago

Notification No. 23/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 22/2021 – Central Tax 4 years, 8 months ago

Notification No. 22/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 21/2021 – Central Tax 4 years, 8 months ago

Notification No. 21/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 20/2021 – Central Tax 4 years, 8 months ago

Notification No. 20/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 19/2021 – Central Tax 4 years, 8 months ago

Notification No. 19/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 18/2021 – Central Tax 4 years, 8 months ago

Notification No. 18/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 17/2021 – Central Tax 4 years, 8 months ago

Notification No. 17/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Notification No. 16/2021 – Central Tax 4 years, 8 months ago

Notification No. 16/2021 – Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (ii)]

Government of India

Ministry of Finance

(Department of Revenue)

Central B […]

ConsultEase Administrator wrote a new post, Delhi HC Order in the case of R.R. Distributors Pvt. Ltd. Versus Commissioner of Central Tax 4 years, 8 months ago

Case Covered:

R.R. Distributors Pvt. Ltd.

Versus

Commissioner Of Central Tax, GST, Delhi North

Facts of the Case:

The present petition was heard on 21st December 2020 along with other batch matters […]

ConsultEase Administrator wrote a new post, Madhya Pradesh HC in the case of Palak Agarwal Vs Central Board Of Direct Taxes 4 years, 8 months ago

Case Covered:

Palak Agarwal

Vs

Central Board Of Direct Taxes

Order of the Hon’ble Court:

Heard through Video Conferencing.

Shri Milind Sharma learned counsel for the petitioner.

Shri Sanjay Lal […]

ConsultEase Administrator wrote a new post, Trade Notice No. 07/2021-22 4 years, 8 months ago

Government of India

Ministry of Commerce and Industry

Department of Commerce

Directorate General of Foreign Trade

Udyog Bhawan, New Delhi

Dated: 26th May 2021

Trade Notice No. 07/2021-22

To,

1. […]