Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Introduction:

The coal sector plays a pivotal role in India’s economy, contributing significantly to both the Centre and state governments’ revenue through various channels such as GST, […]

Introduction:

The Reserve Bank of India (RBI) has recently introduced the Master Direction – Reserve Bank of India (Filing of Supervisory Returns) Directions – 2024, aiming to enhance reg […]

Introduction:

In a recent development, Hyderabad law enforcement has apprehended Srinath Rathi, a 29-year-old proprietor of a YouTube educational channel, on accusations of deceiving chartered […]

Introduction:

In recent developments, Pricol, a prominent manufacturer of instrument clusters, finds itself embroiled in a tax dispute following a showcause notice from the Directorate General […]

Introduction:

The recent judgments in Writ Petitions (WP) Nos. 1251, 1255, and 1258 of 2024 by the High Court of Judicature at Madras shed light on the challenges faced by taxpayers in the assessment process […]

In the realm of international trade, the Directorate General of Foreign Trade (DGFT) has introduced a transformative change with the launch of the revamped Electronic Bank Realisation Certificate (eBRC) system. […]

At present, the taxpayers of the country are not only troubled but also unhappy and feeling offended by the continuous and large number of notices related to various issues related to both GST and Income Tax […]

Introduction:

In a recent ruling, the Telangana Authority for Advance Ruling (AAR) tackled a significant issue concerning the taxation of rental income from government welfare hostels. This ruling has […]

Introduction:

In an effort to address disparities between reported interest and dividend income by taxpayers and the data received from third-party sources, the Income Tax Department has taken […]

Introduction:

In a recent directive, the Supreme Court called upon the Chief Justice of the Bombay High Court to ensure swift adjudication of bail and anticipatory bail […]

Introduction:

On February 22, 2024, the GST enforcement department of Chhattisgarh conducted a targeted operation at manufacturing plants in Urla and Siltara, revealing significant tax evasion […]

Background:

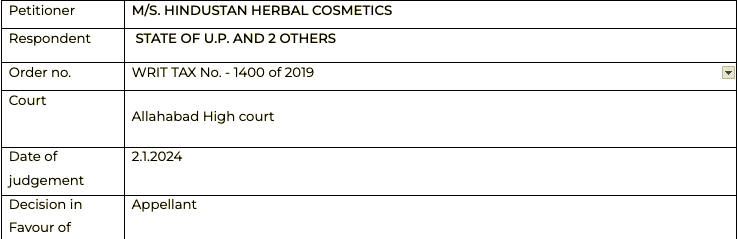

Justice Shekhar B Saraf, in a ruling on the penalty under Section 129 of the Uttar Pradesh Goods and Service Tax Act, 2017, emphasized that while petitioners must demonstrate absence […]

Introduction:

In a recent ruling by the West Bengal Authority for Advance Ruling (AAR), the GST exemption status for dredging services provided to the government was clarified. This ruling, issued in the case of […]

Refund Claim: M/s. MPPKVV Co. Ltd. sought a refund of INR 3,83,67,782/- for the period between January 20, 1978, and January 07, 1991.

Rejection and Appeals: The Assistant […]

Introduction:

In the dynamic realm of real estate, ensuring transparency and protecting consumer interests are paramount. Real Estate Regulatory Authorities (RERAs) play a pivotal role in […]

Background:

In a recent legal development, the Allahabad High Court has made a significant ruling in a case involving the e-commerce giant Flipkart. This ruling, delivered by Justices Saumitra […]

Commentary on the case-

In this judgment there was a typographical error in the vehicle number in E-way bill. The documents were cross checked at a check point and there was difference in vehicle number filled in […]

Few important functionalities were made available on the GSTN portal. As we all know GSTN portal has many issues. Seamless flow to move from one tab to another is missing. But to help the taxpayers some new […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, Coal Sector’s Economic Contribution: A Vital Pillar of Revenue Generation 1 year, 11 months ago

Introduction:

The coal sector plays a pivotal role in India’s economy, contributing significantly to both the Centre and state governments’ revenue through various channels such as GST, […]

ConsultEase Administrator wrote a new post, RBI’s Streamlined Supervisory Returns: Enhancing Clarity 1 year, 11 months ago

Introduction:

The Reserve Bank of India (RBI) has recently introduced the Master Direction – Reserve Bank of India (Filing of Supervisory Returns) Directions – 2024, aiming to enhance reg […]

ConsultEase Administrator wrote a new post, Hyderabad Police Detain YouTube Educator for Alleged Chartered Accountant Scam 1 year, 11 months ago

Introduction:

In a recent development, Hyderabad law enforcement has apprehended Srinath Rathi, a 29-year-old proprietor of a YouTube educational channel, on accusations of deceiving chartered […]

ConsultEase Administrator wrote a new post, “Unraveling Tax Disputes: Pricol’s Journey Through the GST Investigation” 1 year, 11 months ago

Introduction:

In recent developments, Pricol, a prominent manufacturer of instrument clusters, finds itself embroiled in a tax dispute following a showcause notice from the Directorate General […]

ConsultEase Administrator wrote a new post, “Case of S. Lakshmipathy v. The State Representative 1 year, 11 months ago

Introduction:

The recent judgments in Writ Petitions (WP) Nos. 1251, 1255, and 1258 of 2024 by the High Court of Judicature at Madras shed light on the challenges faced by taxpayers in the assessment process […]

ConsultEase Administrator wrote a new post, “Revolutionizing Export Documentation with the New eBRC System” 1 year, 11 months ago

In the realm of international trade, the Directorate General of Foreign Trade (DGFT) has introduced a transformative change with the launch of the revamped Electronic Bank Realisation Certificate (eBRC) system. […]

Prem wrote a new post, Government should reduce the number of notices issued in Income Tax and GST 1 year, 11 months ago

At present, the taxpayers of the country are not only troubled but also unhappy and feeling offended by the continuous and large number of notices related to various issues related to both GST and Income Tax […]

ConsultEase Administrator wrote a new post, Taxation of Rent from Government Hostels: Telangana AAR Decision 1 year, 11 months ago

Introduction:

In a recent ruling, the Telangana Authority for Advance Ruling (AAR) tackled a significant issue concerning the taxation of rental income from government welfare hostels. This ruling has […]

ConsultEase Administrator wrote a new post, Resolving Income Discrepancies: IT Department’s Initiative 1 year, 11 months ago

Introduction:

In an effort to address disparities between reported interest and dividend income by taxpayers and the data received from third-party sources, the Income Tax Department has taken […]

ConsultEase Administrator wrote a new post, Supreme Court Urges Expedited Bail Decisions by Bombay High Court 1 year, 11 months ago

Introduction:

In a recent directive, the Supreme Court called upon the Chief Justice of the Bombay High Court to ensure swift adjudication of bail and anticipatory bail […]

ConsultEase Administrator wrote a new post, Uncovering Tax Evasion: Chhattisgarh’s GST Enforcement Operation 1 year, 11 months ago

Introduction:

On February 22, 2024, the GST enforcement department of Chhattisgarh conducted a targeted operation at manufacturing plants in Urla and Siltara, revealing significant tax evasion […]

ConsultEase Administrator wrote a new post, “Court Ruling: Burden of Proof in Tax Evasion Cases” 1 year, 11 months ago

Background:

Justice Shekhar B Saraf, in a ruling on the penalty under Section 129 of the Uttar Pradesh Goods and Service Tax Act, 2017, emphasized that while petitioners must demonstrate absence […]

ConsultEase Administrator wrote a new post, GST Exemption: Government Dredging Services 1 year, 11 months ago

Introduction:

In a recent ruling by the West Bengal Authority for Advance Ruling (AAR), the GST exemption status for dredging services provided to the government was clarified. This ruling, issued in the case of […]

ConsultEase Administrator wrote a new post, “Supreme Court’s Ruling: Clarifying Appeals Deadline” 1 year, 11 months ago

Background:

Refund Claim: M/s. MPPKVV Co. Ltd. sought a refund of INR 3,83,67,782/- for the period between January 20, 1978, and January 07, 1991.

Rejection and Appeals: The Assistant […]

ConsultEase Administrator wrote a new post, Deciphering RERA-GST: Real Estate and Taxation 1 year, 11 months ago

Introduction:

In the dynamic realm of real estate, ensuring transparency and protecting consumer interests are paramount. Real Estate Regulatory Authorities (RERAs) play a pivotal role in […]

ConsultEase Administrator wrote a new post, “Fairness Upheld: Allahabad HC’s Landmark Flipkart Ruling” 1 year, 11 months ago

Background:

In a recent legal development, the Allahabad High Court has made a significant ruling in a case involving the e-commerce giant Flipkart. This ruling, delivered by Justices Saumitra […]

ConsultEase Administrator wrote a new post, “Curbing Legal Misuse: Allahabad High Court’s Landmark Ruling” 1 year, 11 months ago

Introduction

Overview of the Case: Manmohan Krishna vs State of UP and Another

Importance of Upholding Integrity of Legal System

Misuse of Laws: A Growing Concern […]

CA Shafaly Girdharwal wrote a new post, Typographical error in vehicle number- High court decision on penalty 1 year, 11 months ago

Commentary on the case-

In this judgment there was a typographical error in the vehicle number in E-way bill. The documents were cross checked at a check point and there was difference in vehicle number filled in […]

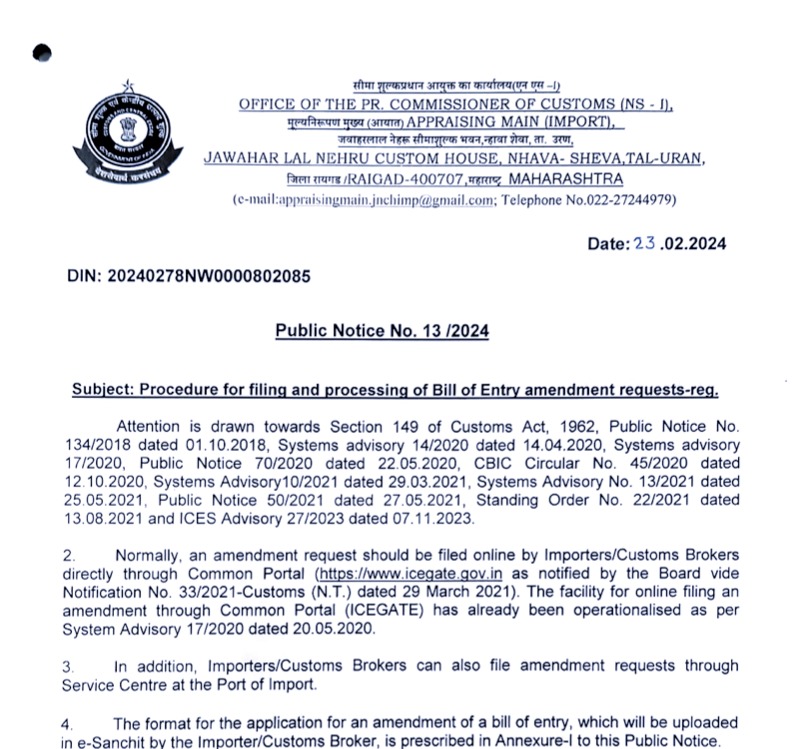

CA Shafaly Girdharwal wrote a new post, CBIC issued procedure for amendment in Bill of entry [download pdf] 1 year, 11 months ago

CBIC has issued a notification for the process of amendment in bill of entry. The procedure will be based on various amendments as per their nature.

Author can be reached at shaifaly.ca@gmail.com

Self […]

ConsultEase Administrator wrote a new post, New functionalities on GSTN portal from 24.02.2024 1 year, 11 months ago

Few important functionalities were made available on the GSTN portal. As we all know GSTN portal has many issues. Seamless flow to move from one tab to another is missing. But to help the taxpayers some new […]