Order Now $14,550 (2)

-

4 Logo Drafts, Icon based, modern

312 Sold

-

30 Minutes Call with me

12 Sold

-

Monthly Fee

21 Sold

-

1 year shared hosting

ConsultEase.com Interviewed.

Read Interview-

Sakshi Virmani wrote a new post, Deductions under section 80C of Income tax Act for FY 2019-20 4 years, 11 months ago

What are the deductions under section 80C of the Income-tax Act 1961?

Deductions under section 80C are relevant for every person filing an ITR. Section 80C of the income tax act describes the deduction which […]

-

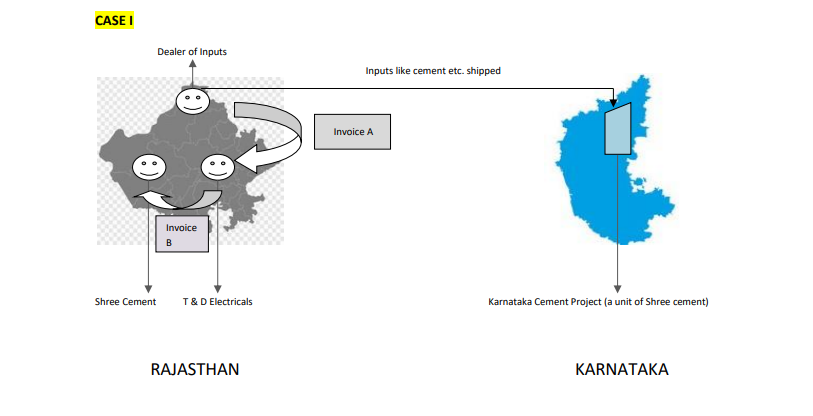

Sakshi Virmani wrote a new post, The Authority For Advance Ruling In Karnataka In Case of M/s T & D Electricals 4 years, 11 months ago

The Authority For Advance Ruling In Karnataka In Case of M/s T & D Electricals

Whether A Contractor Is Required To Take Registration In A State In Which He Is Providing Works Contract Service.

APPLICANT: […]

-

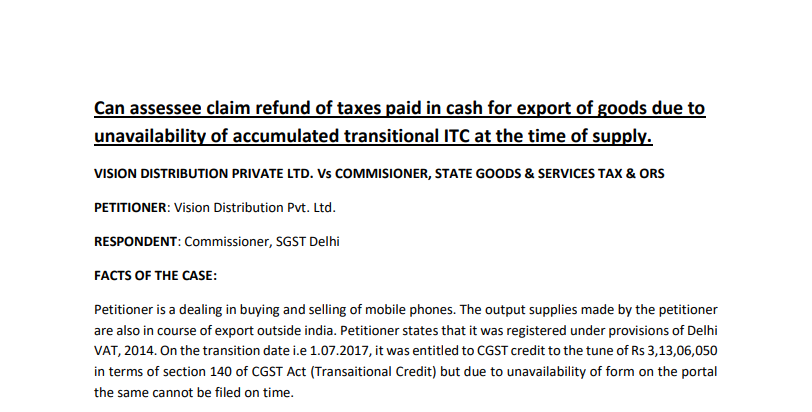

Sakshi Virmani wrote a new post, Can Assessee Claim a Refund of Taxes Paid in Cash for Export of Goods Due to the Unavailability of Accumulated Transitional ITC at the Time of Supply. 4 years, 11 months ago

Can assessee claim a refund of taxes paid in cash for export of goods due to the unavailability of accumulated transitional ITC at the time of supply.

VISION DISTRIBUTION PRIVATE LTD. Vs COMMISSIONER, STATE […]

-

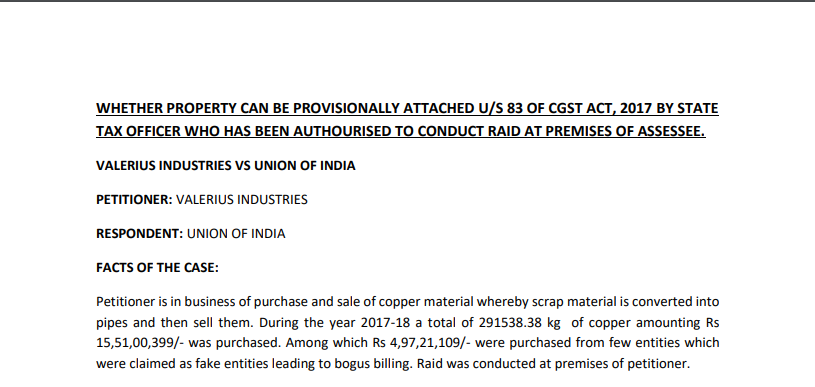

Sakshi Virmani wrote a new post, Whether Property Can be Provisionally Attached U/s 83 of CGST Act, 2017 by State Tax Officer Who Has Been Authorized To Conduct Raid at Premises of Assessee. 5 years ago

Whether Property Can be Provisionally Attached U/s 83 of CGST Act, 2017 by State Tax Officer Who Has Been Authorized To Conduct Raid at Premises of Assessee.

VALERIUS INDUSTRIES VS UNION OF INDIA

PETITIONER: […]

-

Sakshi Virmani wrote a new post, Whether interest can be recovered for delayed payment of tax by attaching the bank account of assessee without adjudicating u/s 73 or 74 of CGST Act, 2017 5 years ago

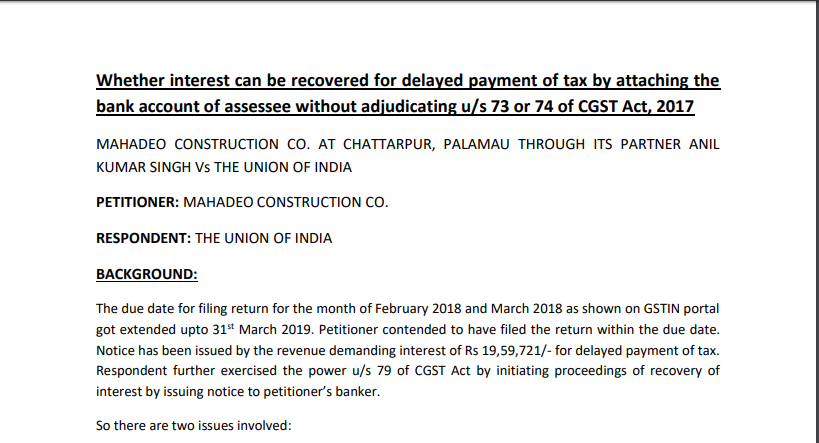

Whether interest can be recovered for delayed payment of tax by attaching the bank account of the assessee without adjudicating u/s 73 or 74 of CGST Act, 2017

MAHADEO CONSTRUCTION CO. AT CHATTARPUR, PALAMAU […]

-

Sakshi Virmani wrote a new post, Whether the sale of goods in India belonging to associate situated abroad to be treated as export service or an intermediary service thereby taxable in India 5 years, 1 month ago

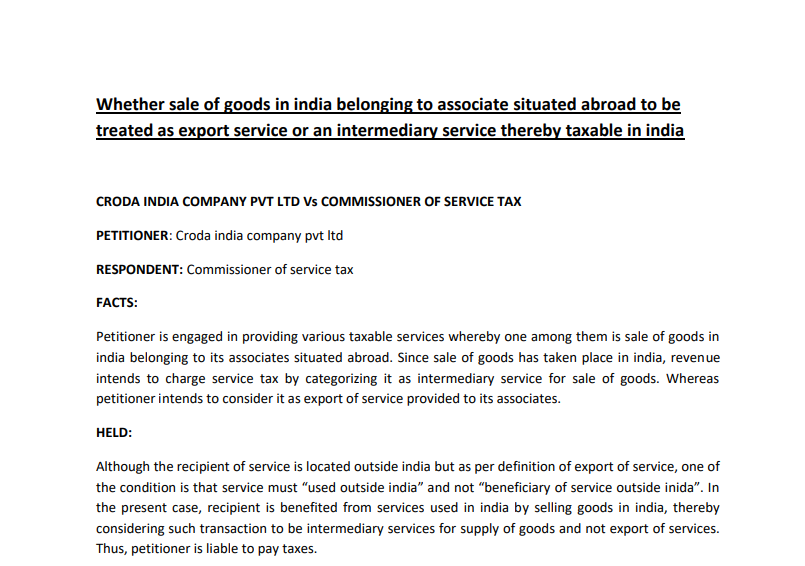

Whether the sale of goods in India belonging to associate situated abroad to be treated as export service or an intermediary service thereby taxable in India

CRODA INDIA COMPANY PVT LTD Vs COMMISSIONER OF SERVICE […]

-

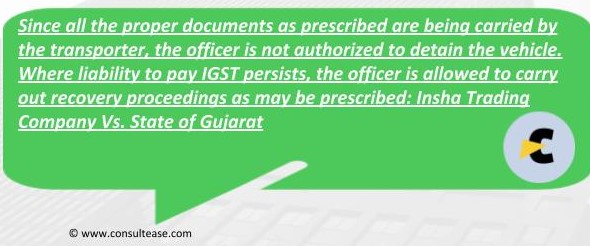

Sakshi Virmani wrote a new post, Whether goods and conveyance can be detained by the officers if any liability is unpaid at the part of the dealer but there is no deficiency in documents required for transportation. 5 years, 1 month ago

Whether goods and conveyance can be detained by the officers if any liability is unpaid at the part of the dealer but there is no deficiency in documents required for transportation.

PETITIONER: INSHA TRADING […]

-

Sakshi Virmani wrote a new post, Whether service tax is applicable on salary paid under notice period 5 years, 1 month ago

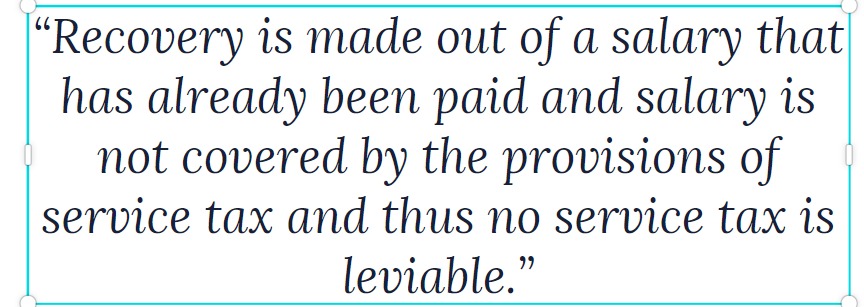

Whether service tax is applicable on salary paid under notice period

M/S HCL Learning Ltd. Vs Commissioner of CGST, Noida

PETITIONER: M/S HCL Learning Ltd.

RESPONDENT: Commissioner of CGST

FACTS:

Revenue has […]

-

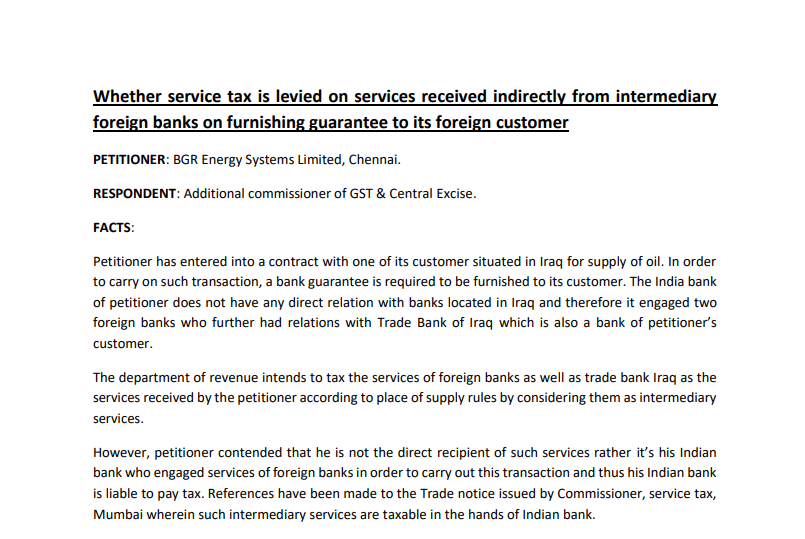

Sakshi Virmani wrote a new post, Whether service tax is levied on services received indirectly from intermediary foreign banks on furnishing guarantee to its foreign customer 5 years, 1 month ago

Whether service tax is levied on services received indirectly from intermediary foreign banks on furnishing guarantee to its foreign customer

PETITIONER: BGR Energy Systems Limited, Chennai.

RESPONDENT: […]

-

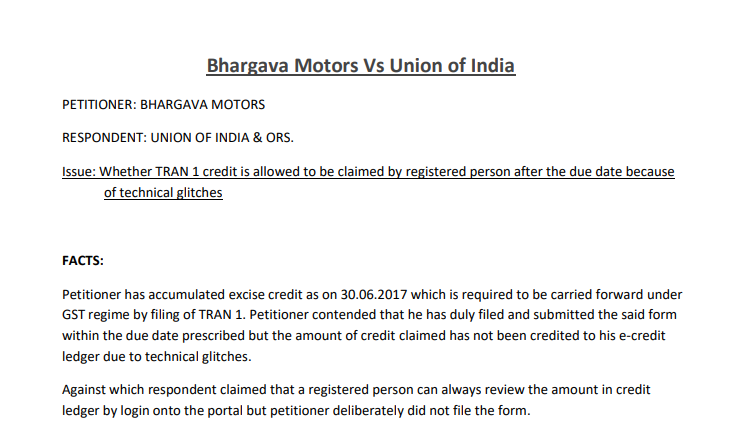

Sakshi Virmani wrote a new post, Bhargava Motors Vs Union of India 5 years, 1 month ago

Bhargava Motors Vs Union of India

PETITIONER: BHARGAVA MOTORS

RESPONDENT: UNION OF INDIA & ORS.

Issue:

Whether TRAN 1 credit is allowed to be claimed by a registered person after the due date because of […]

-

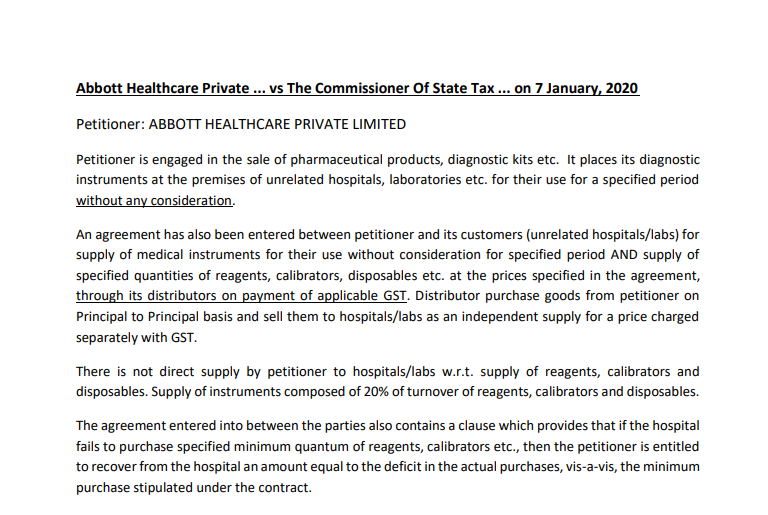

Sakshi Virmani wrote a new post, Abbott Healthcare Private … vs The Commissioner Of State Tax 5 years, 1 month ago

Abbott Healthcare Private … vs The Commissioner Of State Tax … on 7 January 2020

Petitioner: ABBOTT HEALTHCARE PRIVATE LIMITED

The petitioner is engaged in the sale of pharmaceutical products, diagnostic […]

-

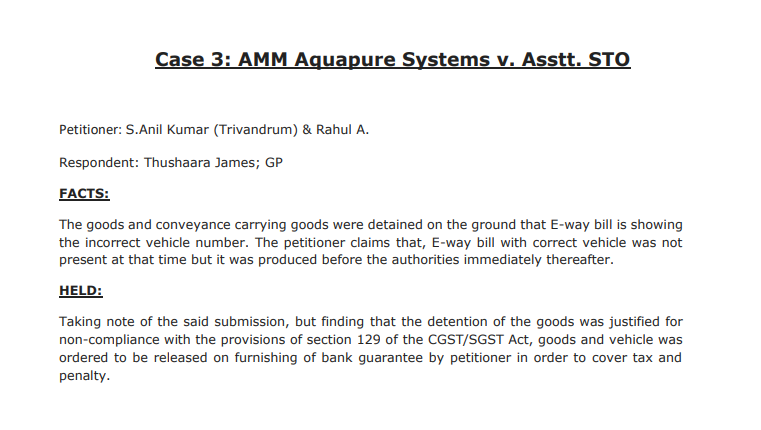

Sakshi Virmani wrote a new post, Detention of truck for wrong vehicle number on E-way bill 5 years, 1 month ago

Case 3: AMM Aquapure Systems v. Asstt. STO

Petitioner: S.Anil Kumar (Trivandrum) & Rahul A.

Respondent: Thushaara James; GP

FACTS:

The goods and conveyance carrying goods were detained on the ground that the […]

-

Sakshi Virmani wrote a new post, Bharat Raj Punj Vs Commissioner of Central Goods And Service Tax (Rajasthan High Court) 5 years, 1 month ago

Bharat Raj Punj Vs Commissioner of Central Goods And Service Tax (Rajasthan High Court)

PETITIONER 1: Bharat Raj Punj

PETITIONER 2: M/s Leel Electricals Limited

RESPONDENT: COMMISSIONER OF CGST […]

-

Sakshi Virmani wrote a new post, Arvind Kumar Munka V/s The Union of India 5 years, 1 month ago

Arvind Kumar Munka V/s The Union of India

PETITIONER: Arvind Kumar Munka

RESPONDENT: Union of India

Read the full text of the case here.

FACTS:

Petitioner is a chartered accountant by profession who has […]

Sakshi Virmani

@sakshi-virmani

active 4 years, 11 months ago