Order Now $14,550 (2)

-

4 Logo Drafts, Icon based, modern

312 Sold

-

30 Minutes Call with me

12 Sold

-

Monthly Fee

21 Sold

-

1 year shared hosting

ConsultEase.com Interviewed.

Read Interview-

Sakshi Virmani wrote a new post, Section 194J – TDS on Professional or Technical Fees 4 years, 8 months ago

Meaning and applicability of Section 194J – TDS – Professional, Technical Fees

Section 194J – TDS – Professional, Technical Fees- Any person who is paying fees to any resident person for specified services, then […]

-

Sakshi Virmani wrote a new post, Section 194C – TDS on payment to contractor or subcontractor 4 years, 8 months ago

Meaning and applicability of Section 194C

Section 194C deals with the provisions for tax deduction at source at the time of payment to contractors/subcontractors.

This section says that any person who pays money […]

-

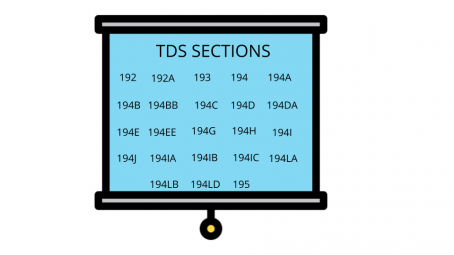

Sakshi Virmani wrote a new post, TDS Provisions under Income Tax Act, 1961 for FY 2019-20 4 years, 8 months ago

TDS Provisions under Income Tax Act, 1961 for FY 2019-20

TDS stands for tax deducted at source. As per income tax act, any specified person making a specified payment is required to deduct tax at specified rates, […]

-

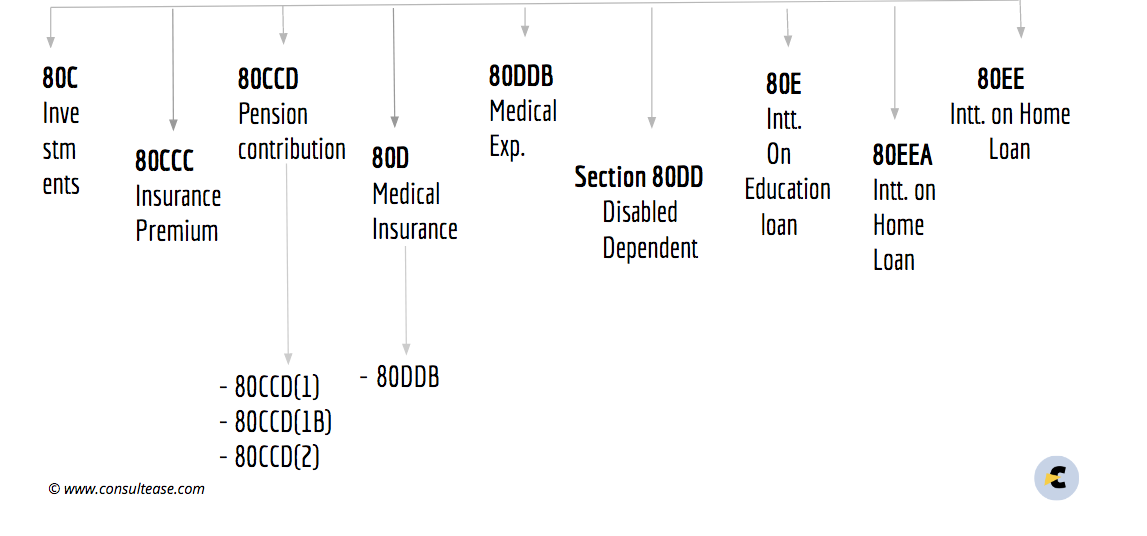

Sakshi Virmani wrote a new post, Income Tax Deductions – Individuals and HUF (FY 2019-20) 4 years, 8 months ago

Income Tax Deductions – Individuals,HUF (FY 2019-20)

Income Tax Deductions – Individuals,HUF. Income Tax Deduction is an investment/expenditure that helps in reducing the tax payable. The income tax deduction […]

-

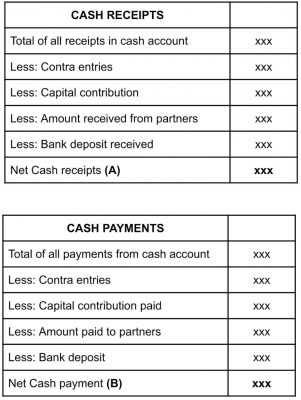

Sakshi Virmani wrote a new post, How to compute 5% cash transactions limit for tax audit u/s 44AB 4 years, 8 months ago

5 percent cash transactions limit – Tax audit u/s 44AB

This write up explains how to compute the limit of 5% of the aggregate of transactions for the purpose of tax audit u/s 44AB. As we are all aware that this […]

Sakshi Virmani

@sakshiconsultease-com

active 4 years, 1 month ago