CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.

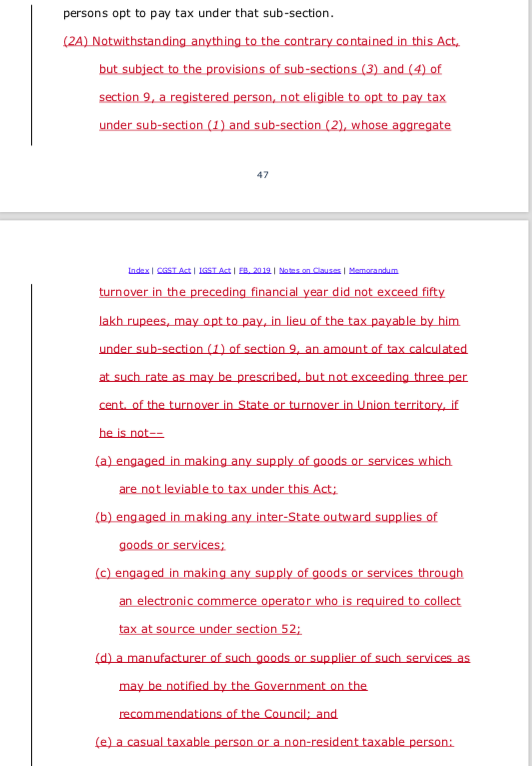

Who is eligible for composition levy after all amendments?

Now there are two types of composition levy in GST. Section 10 of CGST Act covers it. New amendments are proposed in this section. It includes the […]

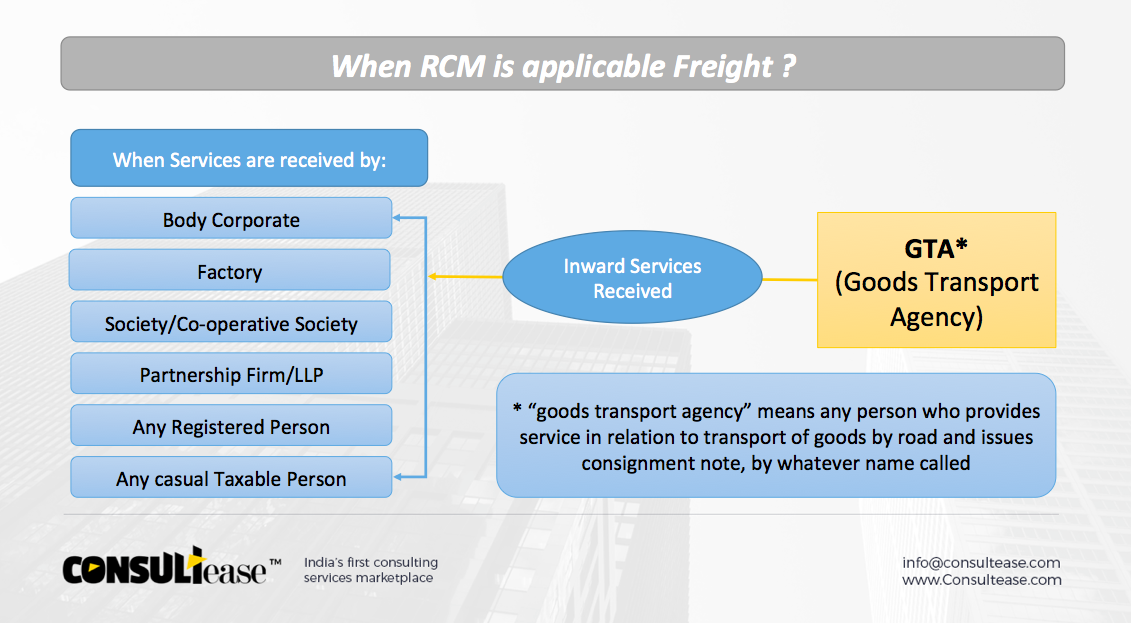

Who will be liable to pay tax on freight for services of GTA?

Recipient of services will be liable to pay tax in RCM @ 5%. GTA can also pay in forwarding charge @12%. In case they chose to pay in forwarding […]

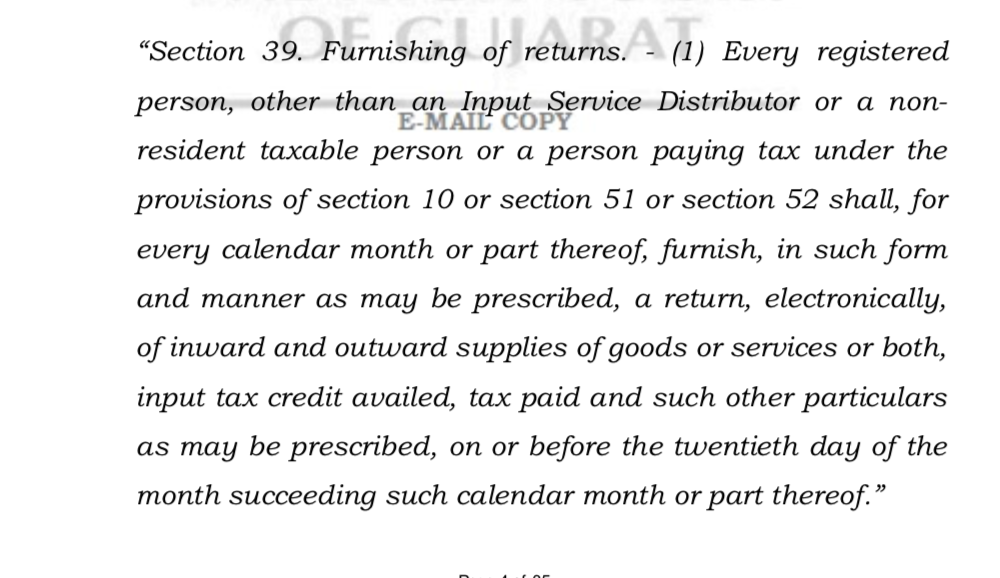

In Case of AAP AND CO., CHARTERED ACCOUNTS THROU AUTHORISED PARTNER VersusUNION OF INDIA & 3 other(s) a deep discussion was done on various GST provisions. […]

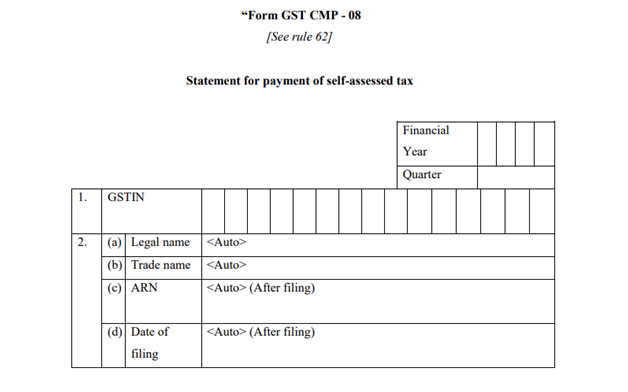

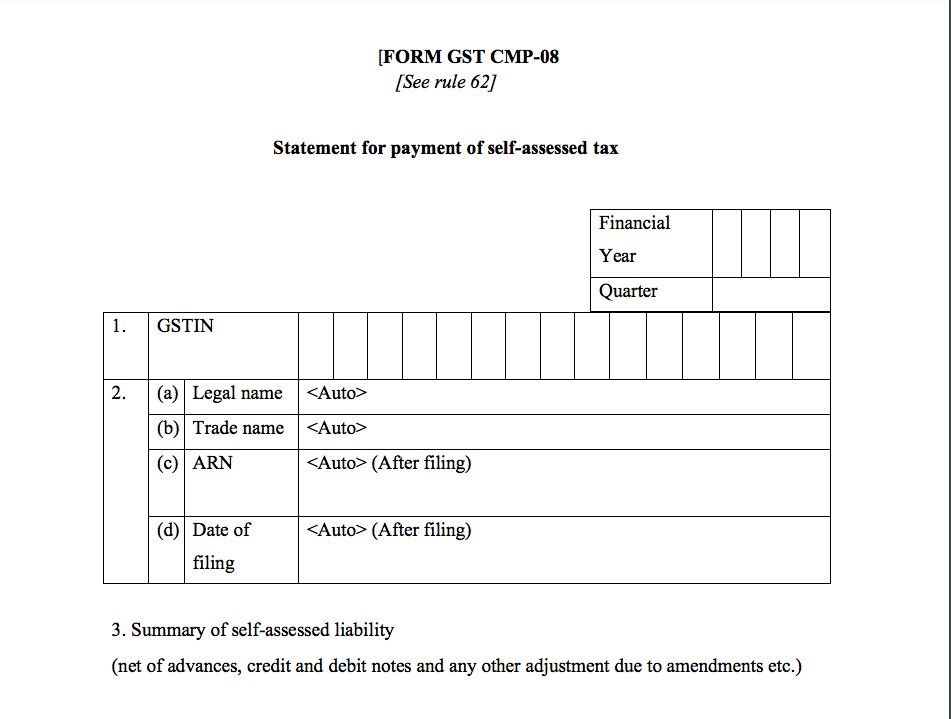

CMP 08 for composition dealers:

This new form is introduced for composition dealers. Both composition dealers and taxpayers under 02/2019 CT are required to file it. They are filing GSTR 4 till now. But they need […]

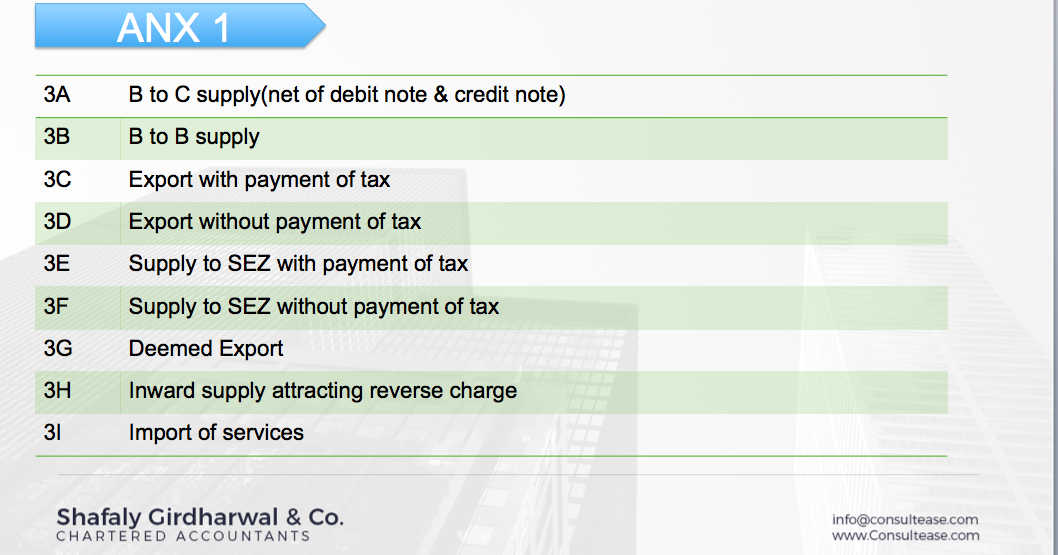

New return of GST:

GST new returns are introduced. New return system is simplified and easy. It has 3 parts. Anx 1, Anx 2 and RET 01. These anx are base for RET 01. The periodicity of return is monthly for the […]

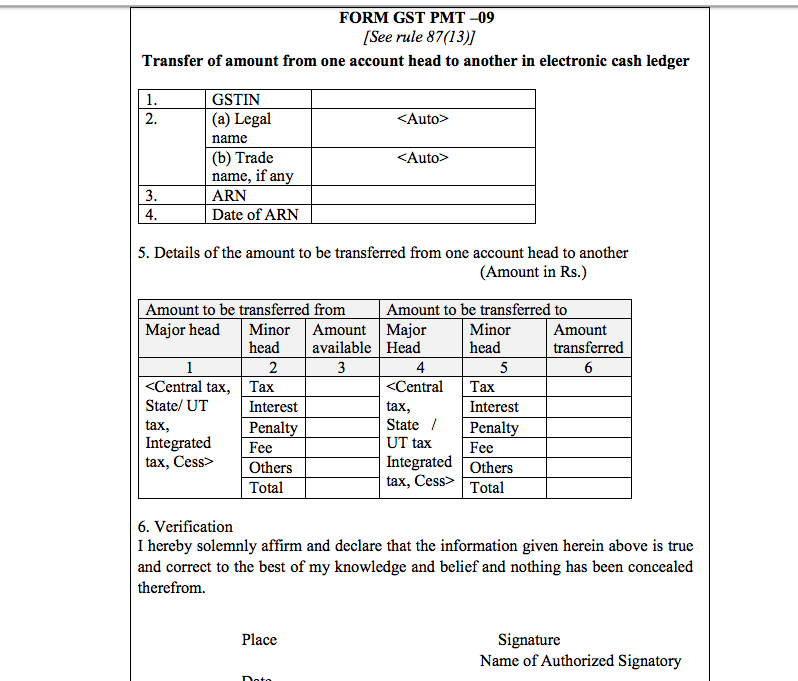

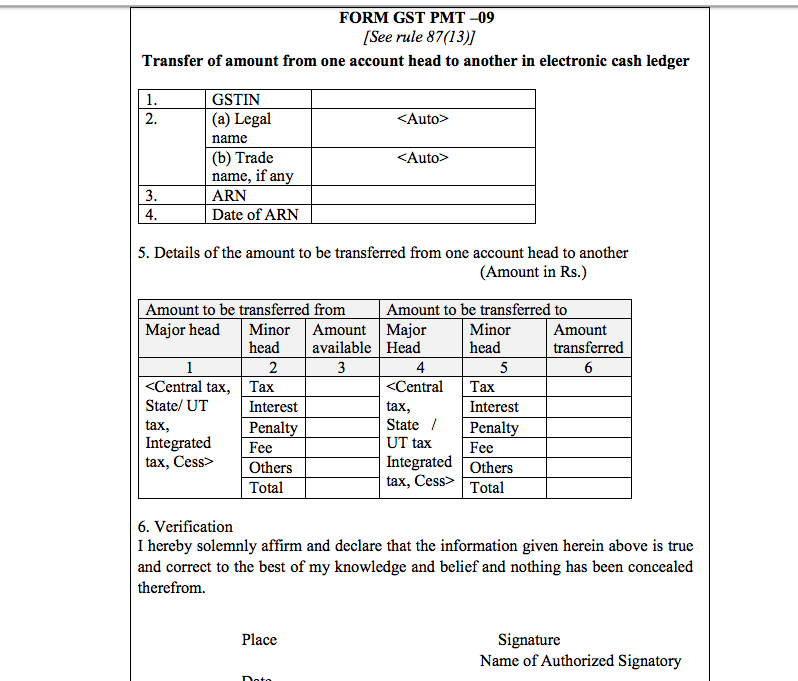

What is PMT 09?

PMT 09 is the prescribed challan for shifting the wrongly paid ITC. It is recently introduced by CBIC. If you have paid a wrong tax, like CGST in place of SGST, you can shift it using this […]

Introduction:

Wrongly paid GST can be shifted easily now. Have you also paid GST in the wrong head and now stuck due to that. Many are there like you. Tax wrongly paid under any head can be shifted to correct […]

Introduction:

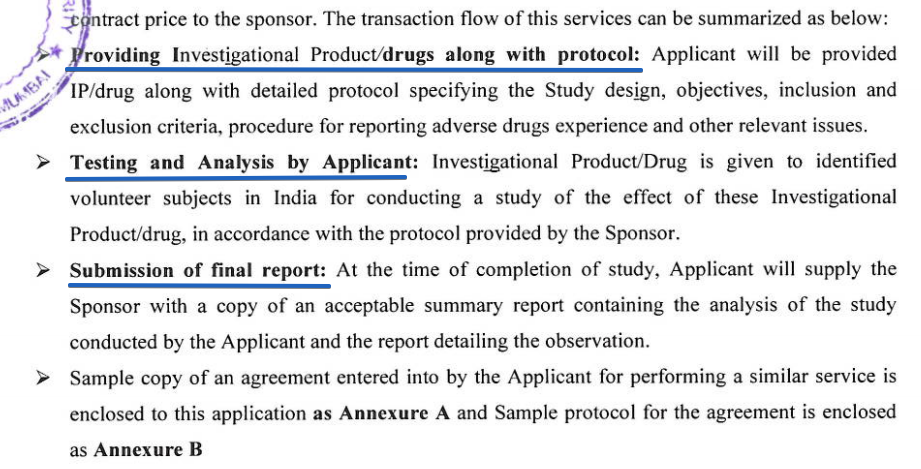

Clinical research is a buzzing service in India. The supplier provides the services of clinical research for the recipient located outside India. In these services, various activities related to […]

Introduction:

Sanofi Advance ruling on ITC of free gifts given by Maharastra AAR is an important one. Here we will discuss Sanofi Advance ruling on ITC at length. This discussion is quite important for […]

Introduction:

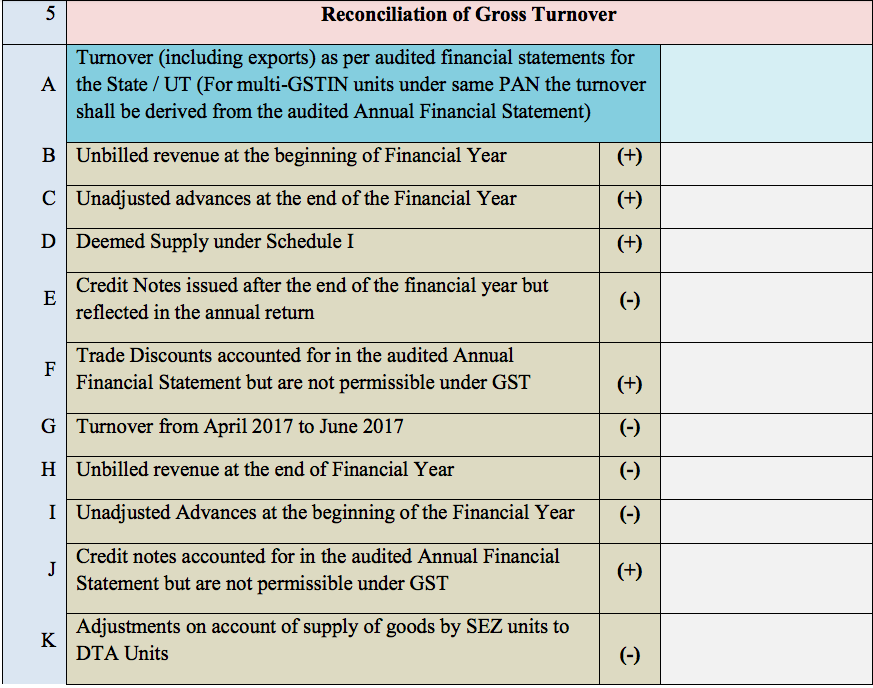

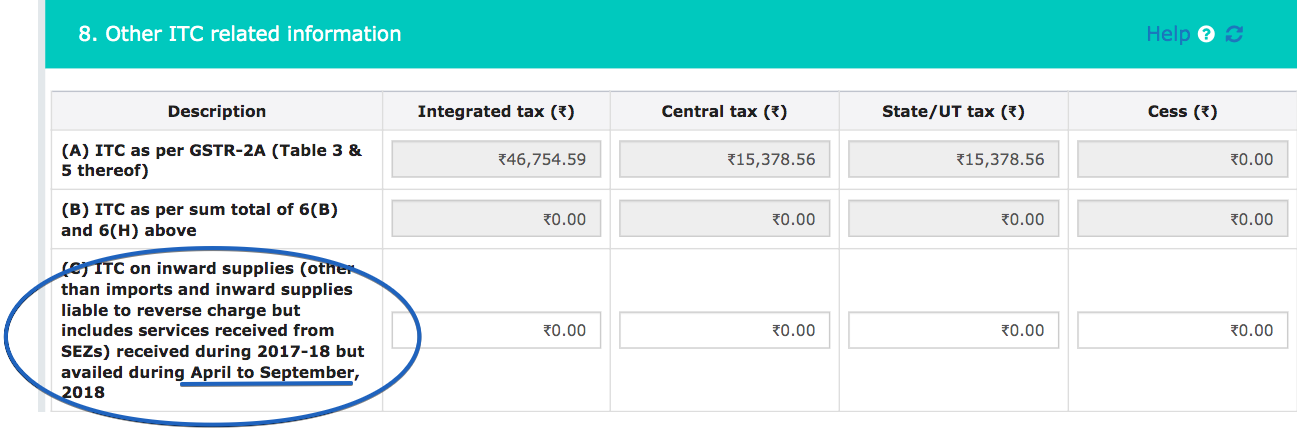

How to file annual return? it is a buzzing question.The last date for filing of annual return is approaching fast. Even after the extension of 6 months, most the taxpayers have failed to understand […]

Introduction:

A press release is issued by CBIC. Important clarifications on annual return are provided in the press release. The taxpayer was in dilemma for many reasons. Many tables were showing incorrect data. […]

Introduction:

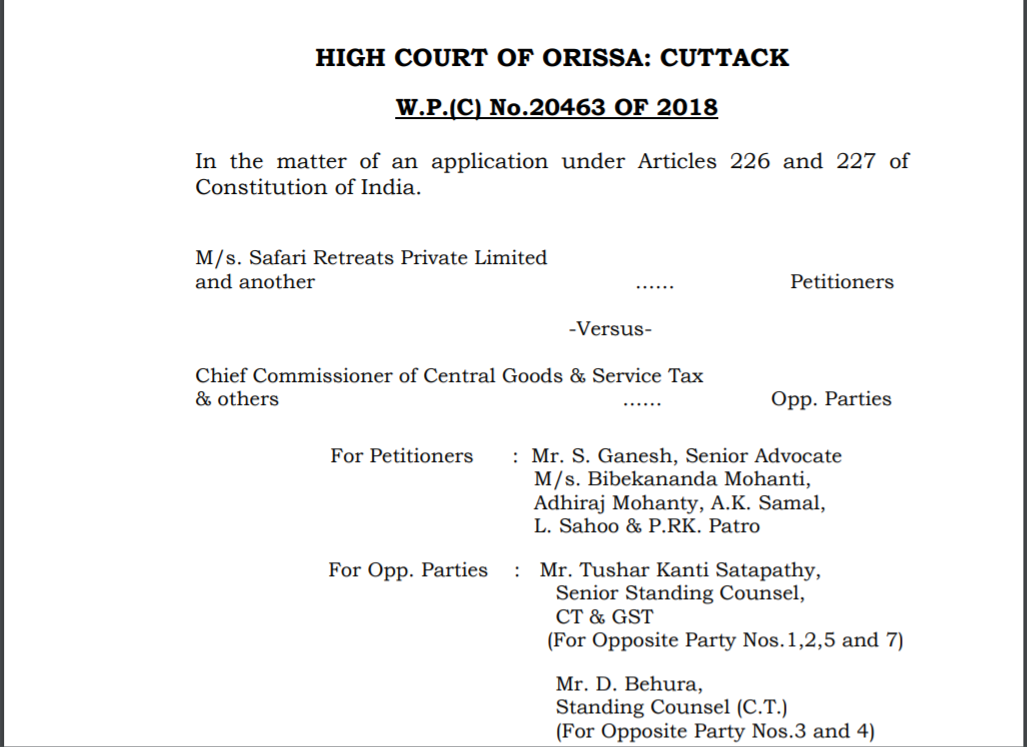

Here I would like to mention the case of Safari Retreats, by Odhisha high court. This very important judgement clarified the situation of input tax credit for the situation covered by Clause”d” of […]

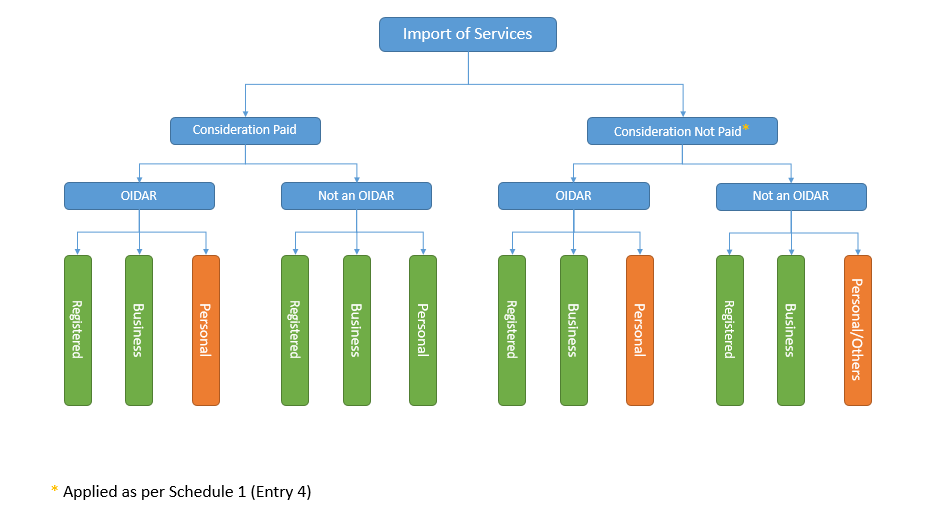

Introduction:GST on import of services

In this article we have covered the GST on import of services. Import of services into India is taxable for the recipient. In GST the recipient importing services will be […]

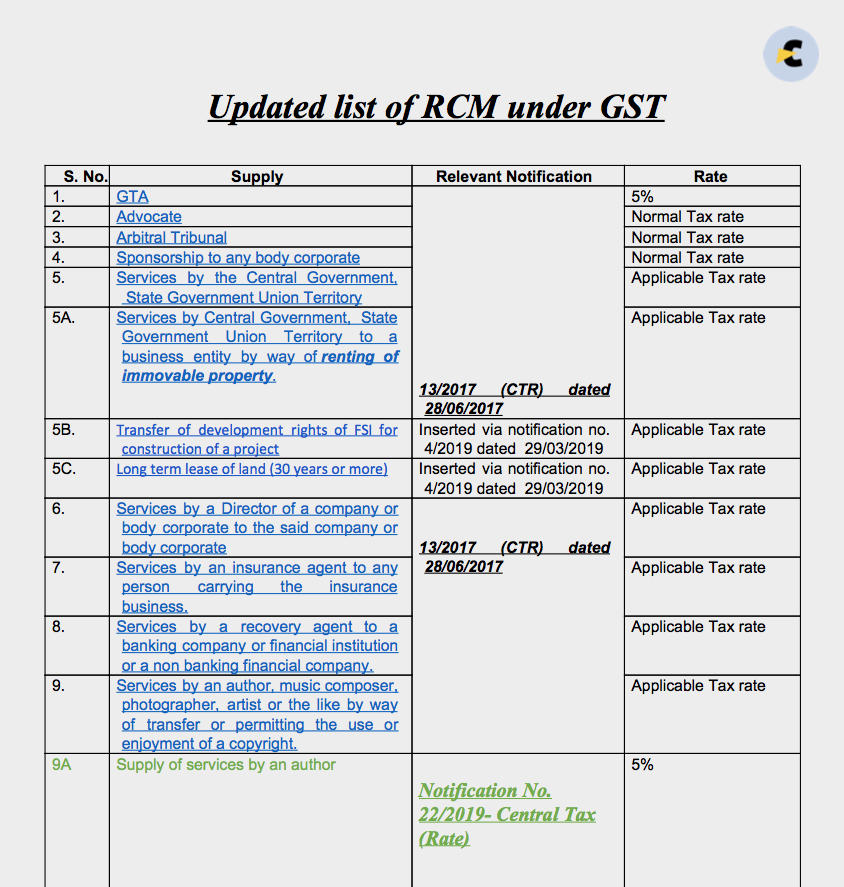

Updated list for the reverse charge in GST updated till date

Reverse charge updated list. This list contains all the services liable for payment in reverse charge. It simply means that the recipient will pay the […]

Introduction:

Reimbursement of electricity is a service for the purpose of service tax Act. In the present case the applicant was engaged in redistribution of electricity to its tenants. It is held that this […]

Section 18(a): Normal registration: In case of new registration is the taxpayer takes registration within 30 days from the date when he becomes liable. he will be eligible to t […]

CGST Act 2017 With Amendments Updated Till February 2023 – Download Free PDF

To read the CGST Act 2017 with amendments till February 2022, download the PDF added at the end of this article.

Download CGST Act […]

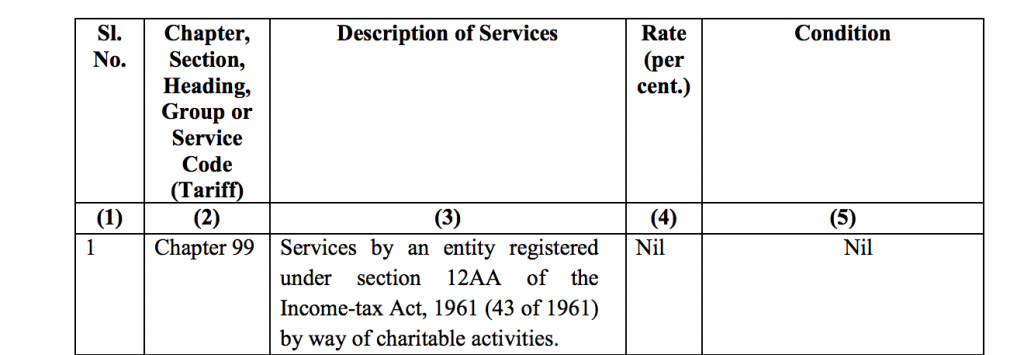

Whether charitable activities are a business?

The charitable activities are not leviable to tax. But this is important that the activities should be charitable in real. The first test to decide upon is whether […]

CA Shafaly Girdharwal

CA

Paid User

@shaifalygirdharwal

active 6 years, 5 months agoCA Shafaly Girdharwal

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.

5.0Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by CA Shafaly Girdharwal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Composition levy updated after finance bill 2019 6 years, 7 months ago

Who is eligible for composition levy after all amendments?

Now there are two types of composition levy in GST. Section 10 of CGST Act covers it. New amendments are proposed in this section. It includes the […]

CA Shafaly Girdharwal wrote a new post, RCM on GTA for freight or maal bhada 6 years, 7 months ago

Who will be liable to pay tax on freight for services of GTA?

Recipient of services will be liable to pay tax in RCM @ 5%. GTA can also pay in forwarding charge @12%. In case they chose to pay in forwarding […]

CA Shafaly Girdharwal wrote a new post, Last date of ITC is filing of annual return 6 years, 7 months ago

The historical decision of Gujrat High court:

In Case of AAP AND CO., CHARTERED ACCOUNTS THROU AUTHORISED PARTNER VersusUNION OF INDIA & 3 other(s) a deep discussion was done on various GST provisions. […]

CA Shafaly Girdharwal wrote a new post, What is CMP 08 ? How to handle negative liability and format of letter to deptt. 6 years, 7 months ago

CMP 08 for composition dealers:

This new form is introduced for composition dealers. Both composition dealers and taxpayers under 02/2019 CT are required to file it. They are filing GSTR 4 till now. But they need […]

CA Shafaly Girdharwal wrote a new post, format of new return of GST: RET 01 6 years, 7 months ago

New return of GST:

GST new returns are introduced. New return system is simplified and easy. It has 3 parts. Anx 1, Anx 2 and RET 01. These anx are base for RET 01. The periodicity of return is monthly for the […]

CA Shafaly Girdharwal wrote a new post, FAQ’s on FORM GST PMT 09 6 years, 7 months ago

What is PMT 09?

PMT 09 is the prescribed challan for shifting the wrongly paid ITC. It is recently introduced by CBIC. If you have paid a wrong tax, like CGST in place of SGST, you can shift it using this […]

CA Shafaly Girdharwal wrote a new post, Wrongly paid GST can be shifted to correct head 6 years, 7 months ago

Introduction:

Wrongly paid GST can be shifted easily now. Have you also paid GST in the wrong head and now stuck due to that. Many are there like you. Tax wrongly paid under any head can be shifted to correct […]

CA Shafaly Girdharwal wrote a new post, Clinical research is not Export: Cliantha AR 6 years, 7 months ago

Introduction:

Clinical research is a buzzing service in India. The supplier provides the services of clinical research for the recipient located outside India. In these services, various activities related to […]

CA Shafaly Girdharwal wrote a new post, Sanofi Advance ruling on ITC of free gifts 6 years, 7 months ago

Introduction:

Sanofi Advance ruling on ITC of free gifts given by Maharastra AAR is an important one. Here we will discuss Sanofi Advance ruling on ITC at length. This discussion is quite important for […]

CA Shafaly Girdharwal wrote a new post, How to file annual return: Practical guide 6 years, 7 months ago

Introduction:

How to file annual return? it is a buzzing question.The last date for filing of annual return is approaching fast. Even after the extension of 6 months, most the taxpayers have failed to understand […]

CA Shafaly Girdharwal wrote a new post, Important clarifications on annual return by CBIC 6 years, 8 months ago

Introduction:

A press release is issued by CBIC. Important clarifications on annual return are provided in the press release. The taxpayer was in dilemma for many reasons. Many tables were showing incorrect data. […]

CA Shafaly Girdharwal wrote a new post, Analysis of landmark HC decision for ITC of construction ( Safari retreats) 6 years, 8 months ago

Introduction:

Here I would like to mention the case of Safari Retreats, by Odhisha high court. This very important judgement clarified the situation of input tax credit for the situation covered by Clause”d” of […]

CA Shafaly Girdharwal wrote a new post, GST on import of services 6 years, 8 months ago

Introduction:GST on import of services

In this article we have covered the GST on import of services. Import of services into India is taxable for the recipient. In GST the recipient importing services will be […]

CA Shafaly Girdharwal wrote a new post, Reverse charge in GST: List updated 03.10.2019 6 years, 8 months ago

Updated list for the reverse charge in GST updated till date

Reverse charge updated list. This list contains all the services liable for payment in reverse charge. It simply means that the recipient will pay the […]

CA Shafaly Girdharwal wrote a new post, Reimbursement of electricity is a service: HC 6 years, 8 months ago

Introduction:

Reimbursement of electricity is a service for the purpose of service tax Act. In the present case the applicant was engaged in redistribution of electricity to its tenants. It is held that this […]

CA Shafaly Girdharwal wrote a new post, How GST interest notices causing hardship 6 years, 9 months ago

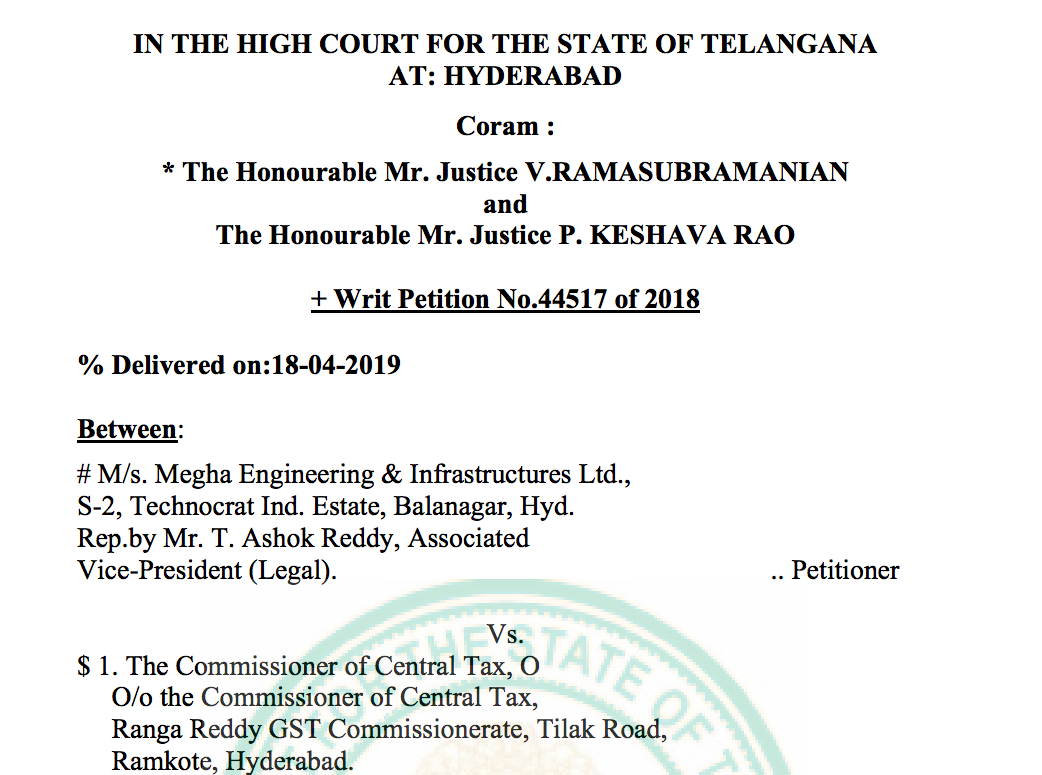

Introduction

GST interest notices are causing hardship on taxpayers. Bulk notices are issued by the department post Megha technologies Judgement.

GST interest noticesProvision related to eligibility of […]

CA Shafaly Girdharwal wrote a new post, PPT on All input tax credit forms in GST 6 years, 9 months ago

ITC 01

When to use?

Section 18(a): Normal registration: In case of new registration is the taxpayer takes registration within 30 days from the date when he becomes liable. he will be eligible to t […]

CA Shafaly Girdharwal wrote a new post, CGST Act With Amendments – Download PDF Updated Till February 2023 6 years, 9 months ago

CGST Act 2017 With Amendments Updated Till February 2023 – Download Free PDF

To read the CGST Act 2017 with amendments till February 2022, download the PDF added at the end of this article.

Download CGST Act […]

CA Shafaly Girdharwal wrote a new post, Exemption in GST#1 Charitable activities in GST 6 years, 9 months ago

Whether charitable activities are a business?

The charitable activities are not leviable to tax. But this is important that the activities should be charitable in real. The first test to decide upon is whether […]

CA Shafaly Girdharwal wrote a new post, Changes in GST introduced by Notifications and circulars issued on 23/04/2019 6 years, 9 months ago

Summary of Changes in GST introduced by Notifications and circulars issued on 23/04/2019

S. No.

Notification & Circular

Summary

1

Notification No.- 20/2019-CT

Seeks to make […]