CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance (Department of Revenue)

Central Board of Excise and Customs

Notification […]

Challan for movement of Goods by job worker:

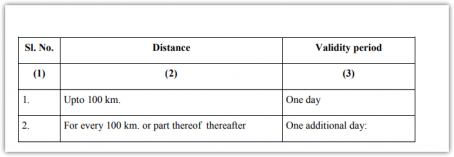

In their notification no. 14/2018 CT cbec has clarified for the document by job worker. CGST 3rd amendment rules 2018 have inserted this provision.Following cases are […]

Government Notified section 132(11) of Companies Act. This part of law provide for the appointment of chairperson and members of NFRA. It is to speed up the implementation of NFRA. Although there is an opposition […]

Why a taxpayer is required to file FORM GST TRAN 2:

Proviso to Section 140(3) of CGST Act provided for the benefit of input tax on stock for dealers not registered in Excise.The similar provision in State GST […]

Important issues in GST refund resolved

In a recent circular cbec has clarified on various important matters related to refund in GST. We all know that exporters are stuck with their money in government’s […]

ITC of non business, exempted, section 17(5) and taxable including zero rated (T1,T2,T3,T4) supply is required to be declare every month while filing GSTR 2. […]

CGST 2nd amendment rules 2018

(1) These rules may be called the Central Goods and Services Tax (Second Amendment) Rules, 2018.

(2) Save as otherwise provided in these rules, they shall come into force on such […]

Ineligible ITC in GST for works contract supply

It is very important to reverse the ITC not eligible for a taxpayer. Construction contracts are treated as a composite supply. In this article we will discuss all […]

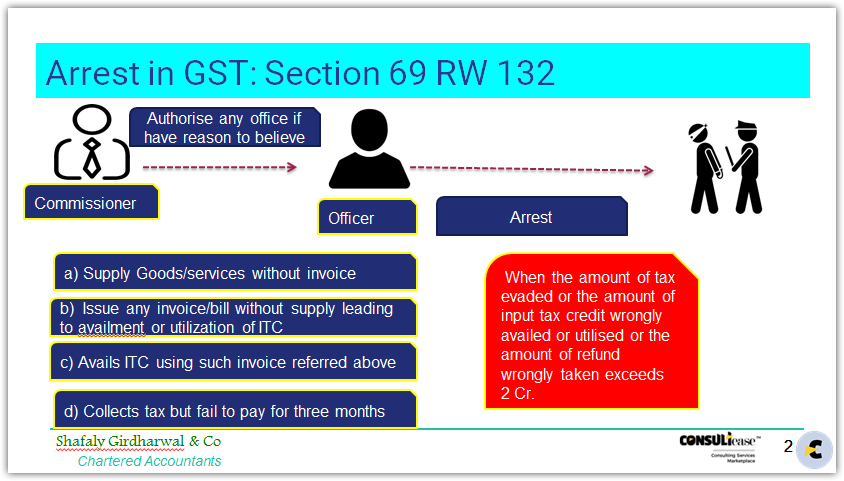

Section 69 provide for arrest by a GST officer authorised by commissioner:

GST provisions provide for arrest by a GST officer for any of following offence. Arrest by GST officer can be done when amount of tax […]

How to file a payment related complaint on GSTN:

Here is our guide on How to file a payment related complaint on GSTN. You can file it with or without login.Let us first discuss it without login:

New features in GSTR 3b from 20-01-2018:

Following new features in GSTR 3b are introduced. Now it will become easier to file GSTR 3b. It will put an end to your sufferings.

10 GST compliance to save you from penalty:

Here we have compiled a list of 10 GST compliance to save you from penalty

1. Take registration in every state where it is required

It is important to understand […]

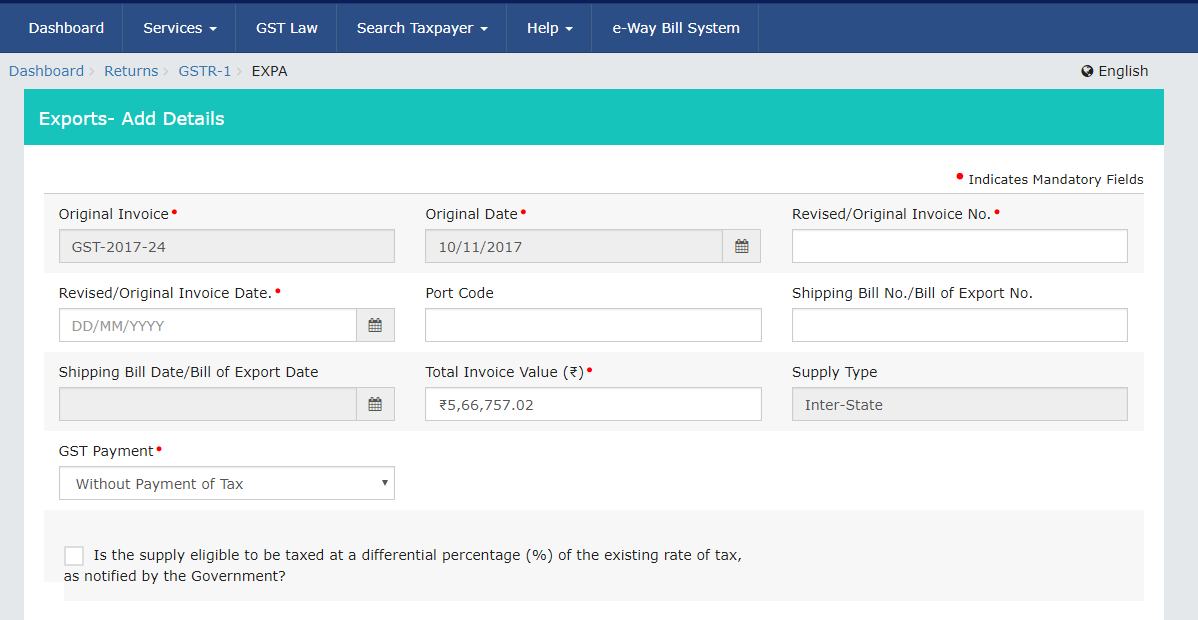

CGST (Thirteenth Amendment) Rules, 2017:

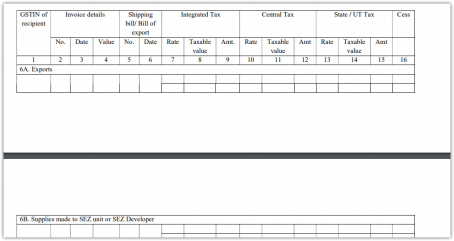

In the Central Goods and Services Tax Rules, 2017, – (i) in FORM GSTR-1, for Table – 6, the following shall be substituted, namely:-

In the Central Goods and Services T […]

CGST (Fourteenth Amendment) Rules, 2017:

2. In the Central Goods and Services Tax Rules, 2017, –

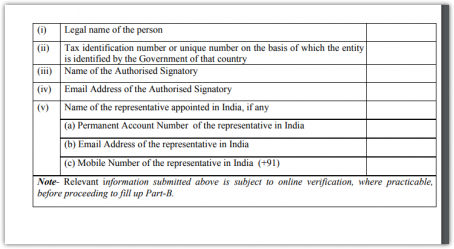

(i) in rule 17, after sub-rule (1), the following sub-rule shall be inserted, namely:-

“(1A) The Unique I […]

CGST rules 1st amendment 2018:

(i) in rule 3, in sub-rule (3A), for the words “ninety days”, the words “one hundred and eighty days” shall be substituted

(ii) with effect from 1 st January, 2018, in rule 7, in t […]

CA Shafaly Girdharwal

CA

Paid User

@shaifalygirdharwal

active 6 years, 5 months agoCA Shafaly Girdharwal

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.

5.0Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by CA Shafaly Girdharwal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Clarification on issues related to Job Work: Circular 38/12/2018 7 years, 10 months ago

Clarification on issues related to Job Work: Circular 38/12/2018 :

Circular No.38/12/2018 F. No. 20/16/03/2017-GST

Government of India

Ministry of Finance Department of Revenue

Central Board of Excise a […]

CA Shafaly Girdharwal wrote a new post, CGST Rules 3rd amendment Act 2018: 14/2018 CT 7 years, 10 months ago

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance (Department of Revenue)

Central Board of Excise and Customs

Notification […]

CA Shafaly Girdharwal wrote a new post, Challan for movement of Goods by job worker 7 years, 10 months ago

Challan for movement of Goods by job worker:

In their notification no. 14/2018 CT cbec has clarified for the document by job worker. CGST 3rd amendment rules 2018 have inserted this provision.Following cases are […]

CA Shafaly Girdharwal wrote a new post, Due date for GSTR 3b from April to June 7 years, 10 months ago

Due date for GSTR 3b from April to June:

Sl. No

Month

Last date for filing of return in FORM GSTR-3B

1.

April, 2018

20th May, 2018

2

May, 2018

20th June, 2018

3.

June, 2018

20th July, […]

CA Shafaly Girdharwal wrote a new post, 132(11) of CA notified to appoint chairperson and members of NFRA 7 years, 10 months ago

Government Notified section 132(11) of Companies Act. This part of law provide for the appointment of chairperson and members of NFRA. It is to speed up the implementation of NFRA. Although there is an opposition […]

CA Shafaly Girdharwal wrote a new post, FORM GST TRAN 2: Be careful of these things 7 years, 10 months ago

Why a taxpayer is required to file FORM GST TRAN 2:

Proviso to Section 140(3) of CGST Act provided for the benefit of input tax on stock for dealers not registered in Excise.The similar provision in State GST […]

CA Shafaly Girdharwal wrote a new post, Important issues in GST refund resolved 7 years, 10 months ago

Important issues in GST refund resolved

In a recent circular cbec has clarified on various important matters related to refund in GST. We all know that exporters are stuck with their money in government’s […]

CA Shafaly Girdharwal wrote a new post, GST Quick Update:UR RCM/TDS/TCS postponed upto June 2018 7 years, 11 months ago

GST Quick Update:UR RCM/TDS/TCS postponed upto June 2018

Following changes were proposed by GST council meeting today.

GSTR 3B along with GSTR 1 will continue upto June 2018.

RCM of 9(4) leviable on […]

CA Shafaly Girdharwal wrote a new post, Rule 42: simplified 7 years, 11 months ago

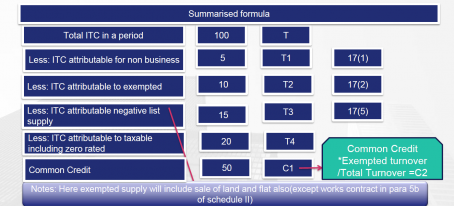

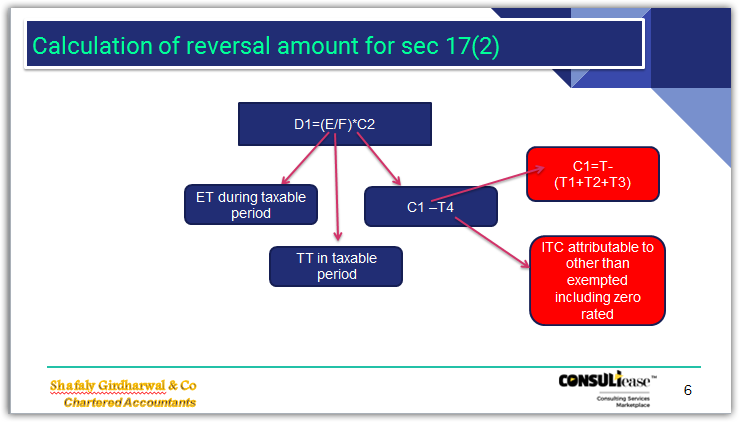

Rule 42: simplified

Important point to take care

ITC of non business, exempted, section 17(5) and taxable including zero rated (T1,T2,T3,T4) supply is required to be declare every month while filing GSTR 2. […]

CA Shafaly Girdharwal wrote a new post, Quick update: CGST 2nd amendment rules 2018 7 years, 11 months ago

CGST 2nd amendment rules 2018

(1) These rules may be called the Central Goods and Services Tax (Second Amendment) Rules, 2018.

(2) Save as otherwise provided in these rules, they shall come into force on such […]

CA Shafaly Girdharwal wrote a new post, Ineligible ITC in GST for works contract supply 7 years, 11 months ago

Ineligible ITC in GST for works contract supply

It is very important to reverse the ITC not eligible for a taxpayer. Construction contracts are treated as a composite supply. In this article we will discuss all […]

CA Shafaly Girdharwal wrote a new post, provisions for arrest by a GST officer 7 years, 11 months ago

Section 69 provide for arrest by a GST officer authorised by commissioner:

GST provisions provide for arrest by a GST officer for any of following offence. Arrest by GST officer can be done when amount of tax […]

CA Shafaly Girdharwal wrote a new post, How to file a payment related complaint on GSTN 7 years, 11 months ago

How to file a payment related complaint on GSTN:

Here is our guide on How to file a payment related complaint on GSTN. You can file it with or without login.Let us first discuss it without login:

First of go […]

CA Shafaly Girdharwal wrote a new post, Advisory to Taxpayers on Improved GSTR-3B Return Filing Process 7 years, 11 months ago

Advisory to Taxpayers on Improved GSTR-3B Return Filing Process:

Filing of GSTR 3B Return made easier and user friendly.

Optimum utilization of ITC is displayed by System, which however can be […]

CA Shafaly Girdharwal wrote a new post, New features in GSTR 3b from 20-01-2018 7 years, 11 months ago

New features in GSTR 3b from 20-01-2018:

Following new features in GSTR 3b are introduced. Now it will become easier to file GSTR 3b. It will put an end to your sufferings.

Fill either CGST or SGST/UGST […]

CA Shafaly Girdharwal wrote a new post, 10 GST compliance to save you from penalty 7 years, 11 months ago

10 GST compliance to save you from penalty:

Here we have compiled a list of 10 GST compliance to save you from penalty

1. Take registration in every state where it is required

It is important to understand […]

CA Shafaly Girdharwal wrote a new post, CGST (Thirteenth Amendment) Rules, 2017 7 years, 11 months ago

CGST (Thirteenth Amendment) Rules, 2017:

In the Central Goods and Services Tax Rules, 2017, – (i) in FORM GSTR-1, for Table – 6, the following shall be substituted, namely:-

In the Central Goods and Services T […]

CA Shafaly Girdharwal wrote a new post, CGST (Fourteenth Amendment) Rules, 2017 7 years, 11 months ago

CGST (Fourteenth Amendment) Rules, 2017:

2. In the Central Goods and Services Tax Rules, 2017, –

(i) in rule 17, after sub-rule (1), the following sub-rule shall be inserted, namely:-

“(1A) The Unique I […]

CA Shafaly Girdharwal wrote a new post, CGST rules 1st amendment 2018 7 years, 11 months ago

CGST rules 1st amendment 2018:

(i) in rule 3, in sub-rule (3A), for the words “ninety days”, the words “one hundred and eighty days” shall be substituted

(ii) with effect from 1 st January, 2018, in rule 7, in t […]

CA Shafaly Girdharwal wrote a new post, CGST Rules Updated till 19/02/2018 7 years, 11 months ago

CGST Rules Updated till 19/02/2018:

03/2018-Central Tax ,dt. 23-01-2018

First Amendment 2018, to CGST Rules

75/2017-Central Tax ,dt. 29-12-2017

CGST (Fourteenth Amendment) […]