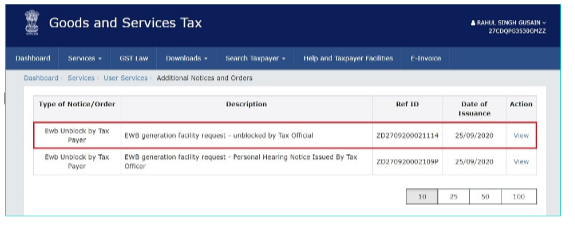

Unblocking of E-Way Bill Generation Facility

In terms of Rule 138E (a) and (b) of the CGST Rules, 2017, the E-Way Bill (EWB) generation facility of a taxpayer is to be blocked, in case the taxpayer fails to file […]

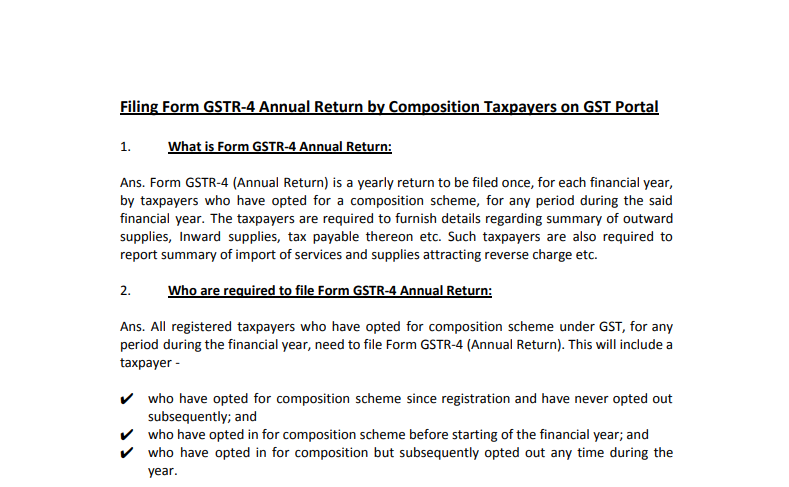

Filing Form GSTR-4 Annual Return by Composition Taxpayers on GST Portal

1. What is Form GSTR-4 Annual Return:

Ans. Form GSTR-4 (Annual Return) is a yearly return to be filed once, for each financial year, by […]

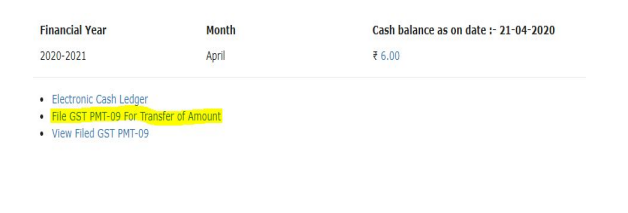

Details Analysis on Filing of PMT-09

The CBIC has recently introduced Form PMT-09 for the transfer of an amount from one head to another head. This enables a registered taxpayer to transfer any amount of tax, […]

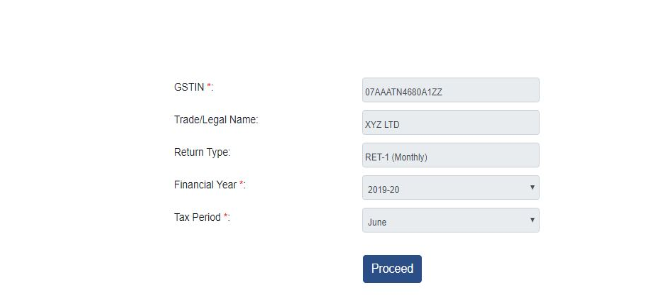

GST ANX-1 and ANX-2 of New Return Prototype

In these, we will see the new functionalities launch by the GSTN related to the new return as a demo to the taxpayer. The detailed analysis is:

1. What is this web […]

Concept of Mixed Supply & Composite Supply under GST

This is a new concept introduced in GST which will cover supplies made together whether the supplies are related or not. Supplies of two or more goods or […]

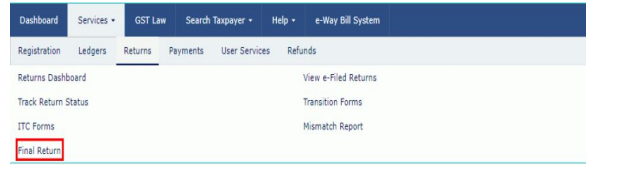

Steps to resolve the error “Invalid Summary Payload” in GSTR-10.

In this article, we will see the resolution to resolved the error of “Invalid Summary Payload”. The steps to resolved the error are:

What is Form […]

CS Shashank Kothiyal

Honesty Speaks Itself.

Paid User

@shashank020293

active 5 years, 5 months agoCS Shashank Kothiyal

Company Secretary (Certfied GST Professional) with more than 2.5 years of experience in GST Related Work.

Registered Categories

Location

East Delhi, India

OOPS!

No Packages Added by CS Shashank Kothiyal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewShashank Kothiyal wrote a new post, Unblocking of E-Way Bill Generation Facility 5 years, 2 months ago

Unblocking of E-Way Bill Generation Facility

In terms of Rule 138E (a) and (b) of the CGST Rules, 2017, the E-Way Bill (EWB) generation facility of a taxpayer is to be blocked, in case the taxpayer fails to file […]

Shashank Kothiyal wrote a new post, Filing Form GSTR-4 Annual Return by Composition Taxpayers on GST Portal 5 years, 6 months ago

Filing Form GSTR-4 Annual Return by Composition Taxpayers on GST Portal

1. What is Form GSTR-4 Annual Return:

Ans. Form GSTR-4 (Annual Return) is a yearly return to be filed once, for each financial year, by […]

Shashank Kothiyal wrote a new post, Details Analysis on Filing of PMT-09 5 years, 7 months ago

Details Analysis on Filing of PMT-09

The CBIC has recently introduced Form PMT-09 for the transfer of an amount from one head to another head. This enables a registered taxpayer to transfer any amount of tax, […]

Shashank Kothiyal wrote a new post, GST ANX-1 and ANX-2 of New Return Prototype 5 years, 7 months ago

GST ANX-1 and ANX-2 of New Return Prototype

In these, we will see the new functionalities launch by the GSTN related to the new return as a demo to the taxpayer. The detailed analysis is:

1. What is this web […]

Shashank Kothiyal wrote a new post, Concept of Mixed Supply & Composite Supply under GST 5 years, 8 months ago

Concept of Mixed Supply & Composite Supply under GST

This is a new concept introduced in GST which will cover supplies made together whether the supplies are related or not. Supplies of two or more goods or […]

Shashank Kothiyal wrote a new post, Steps to Resolve The Error “Invalid Summary Payload” in GSTR-10. 5 years, 8 months ago

Steps to resolve the error “Invalid Summary Payload” in GSTR-10.

In this article, we will see the resolution to resolved the error of “Invalid Summary Payload”. The steps to resolved the error are:

What is Form […]

Shashank Kothiyal‘s profile was updated 5 years, 8 months ago

Shashank Kothiyal‘s profile was updated 5 years, 8 months ago

Shashank Kothiyal changed their profile picture 5 years, 8 months ago

Shashank Kothiyal became a registered member 5 years, 8 months ago