ConsultEase.com Interviewed.

Read Interview-

CA Shafaly Girdharwal wrote a new post, Case -3 Historical judgement on maintenance of Muslim divorced women and how it was reversed 2 years, 1 month ago

Cases Covered:

Mohd. Ahmad Khan vs. Shah Bano Begum.

Background:

An Act was passed and its name was Muslim Women (Protection on Divorce Act),1986. What did you think of it? That it should be an Act passed to […]

-

CA Shafaly Girdharwal wrote a new post, GST refund can be filed even after cancellation of registration(Pdf Attach) 2 years, 1 month ago

Cases Covered:

C.P. Ravindranath Menon & Another Vs Deputy Commissioner of State Tax & Ors.

Facts of the Cases:

The brief facts of the case are that the Petitioners had entered into an agreement for s […]

-

CA Shafaly Girdharwal wrote a new post, Three important changes to remove RCM from importer implementing the Mohit Minerals Judgment 2 years, 1 month ago

What was the Mohit Minerals Judgment?

The judgment of Mohit Minerals is a famous one between Importers. The RCM liability on Ocean freight was made via notification no. 10/2017. It has been disputed since the […]

-

CA Shafaly Girdharwal wrote a new post, Judgement no. 2 When SC removed the ban on circulation of a news paper by the government citing the freedom of speech 2 years, 1 month ago

Cases Covered:

Romesh Thapar Vs State of MadrasMost of these cases will have a political connections. In 1950 a weekly journal was writing against the Congress government. The name of the journal was “Cross […]

-

CA Shafaly Girdharwal wrote a new post, SC upheld the requirement of Pre deposit for filing an appeal in Tribunal(Pdf Attach) 2 years, 1 month ago

Cases Covered:

M/S CLASSIC DECORATORS Vs COMMISSIONER (APPEALS-I) CENTRAL EXCISE/GST, DELHI & ANRFacts of the Cases:

In this case the petitioner appealed to waive off the requirement of pre deposit for […]

-

CA Shafaly Girdharwal wrote a new post, Stay on demand if 20% deposited and commit to reach tribunal when it is formed(Pdf Attach) 2 years, 1 month ago

Cases Covered:

M/s Hariyana Trading Co Vs State of BiharCitations:

1. Angel Engicon Private Limited vs. the State of Bihar & Anr

Facts of the cases :

In this case the appellant lost the appeal. He wanted […]

-

CA Shafaly Girdharwal wrote a new post, Case 1- A case which was held a mistakes after 34 years by SC- 101 cases that changed India 2 years, 1 month ago

Cases Covered:

Additional District Magistrate, … vs S. S. Shukla Etc

This is not less than a story of a movie. The Supreme Court reversed the judgement that was taken 34 years back. It started with the lok […]

-

CA Shafaly Girdharwal wrote a new post, Aggrieved party is entitled to receive compensation whether or not actual damage or loss is proved 2 years, 1 month ago

Cases Covered:

A.S. Motors Pvt. Ltd. v. Union of India Ors

Citations:

1. Suresh Koshy George v. University of Kerala,

2. Russel v. Duke of Norfolk,

3. Keshav Mills Co Ltd. v. Union of India,

4. […]

-

CA Shafaly Girdharwal wrote a new post, SC in the case of ALD Automotive Pvt. Ltd. Vs Commercial Tax Officer 2 years, 1 month ago

Case Covered:

ALD Automotive Pvt. Ltd.Versus

The Commercial Tax Officer

Facts of the case:

In this case a provision of Tamil Nadu VAT was challenged. It curtailed the input tax credit and put a condition […]

-

CA Shafaly Girdharwal wrote a new post, Refund cant be rejected without giving an opportunity of being heard 2 years, 1 month ago

Cases Covered:

M/S SHIVBHOLA FILAMENTS PRIVATE LIMITED versus ASSISTANT COMMISSIONER CGST & ANRFacts of the Cases:

The petitioner filed the refund application under the inverted rated supply. The […]

-

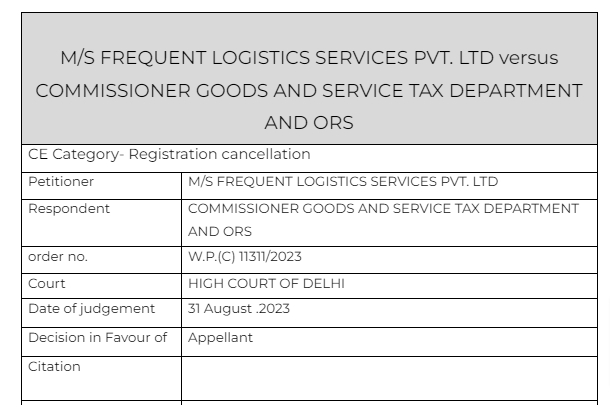

CA Shafaly Girdharwal wrote a new post, Cancellation of registration order should be reasoned(Pdf Attach) 2 years, 1 month ago

Cases covered:

M/S FREQUENT LOGISTICS SERVICES PVT. LTD versus COMMISSIONER GOODS AND SERVICE TAX DEPARTMENT AND ORSFacts of the cases:

A SCN was sent to the appellant for cancellation of their […]

-

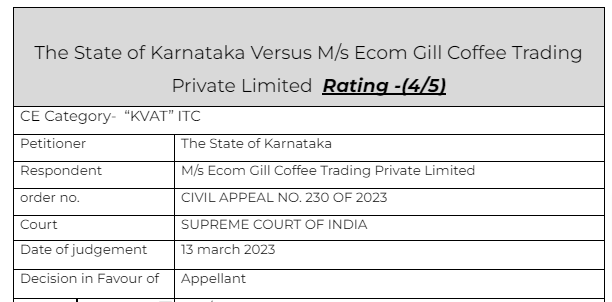

CA Shafaly Girdharwal wrote a new post, Only production of invoice and payment proof are not enough for ITC (Pdf Attach) 2 years, 1 month ago

Cases covered:

The State of Karnataka Versus M/s Ecom Gill Coffee Trading Private LimitedCitations:

1. M/s. Bhagadia Brothers Vs.Additional Commissioner of Commercial Taxes,

2. Madhav Steel Corporation […]

-

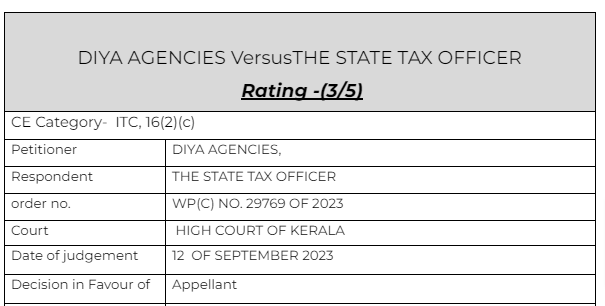

CA Shafaly Girdharwal wrote a new post, ITC cant be denied for non appearance in GSTR 2A (Breaking) (Pdf Attach) 2 years, 1 month ago

The GSTR 2A was introduced in GST in 2018. Many taxpayers had the confusion whether they can take the ITC if not appearing in GSTR 2A. At that time a clarification was given by the department that it is only to […]

-

CA Shafaly Girdharwal wrote a new post, Bail granted on conditions by High court(Pdf Attach) 2 years, 1 month ago

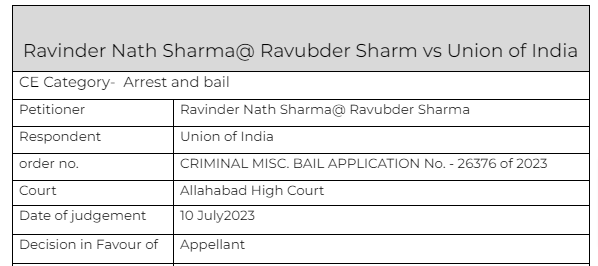

Cases Covered:

Ravinder Nath Sharma@ Ravubder Sharm vs Union of IndiaFacts of the cases:

Learned counsel for the applicant submits that the applicant is innocent and has been falsely implicated in the […]

-

CA Shafaly Girdharwal wrote a new post, SLP rejected by Honorable Supreme court when the alternate remedy was time lapsed(Pdf Attach) 2 years, 1 month ago

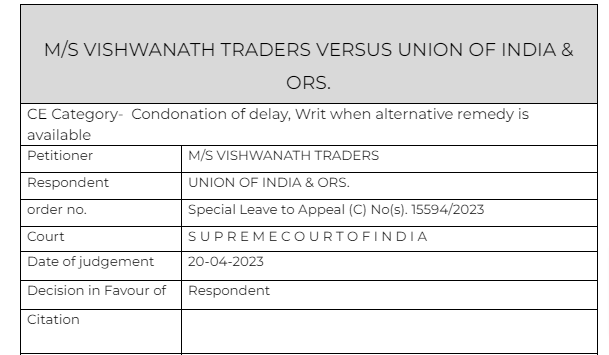

Cases Covered:

M/S VISHWANATH TRADERS VERSUS UNION OF INDIA & ORS.Facts of the cases:

In this case the Patna high court was approached by the petitioner. They received a notice but the date for filing an […]

-

CA Shafaly Girdharwal wrote a new post, Detention order set aside by the court (Pdf Attach) 2 years, 1 month ago

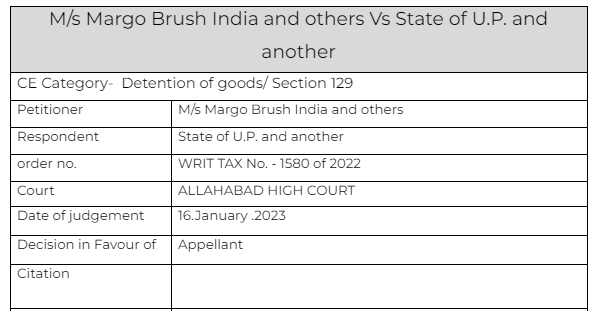

Cases Covered:

M/s Margo Brush India and others Vs State of U.P. and anotherFacts of the cases:

It is a case in which the goods in transit were accompanied by proper documents. When show cause notice was […]

-

CA Shafaly Girdharwal wrote a new post, Cancellation of registration when returns were filed set aside by the court (Pdf Attach) 2 years, 1 month ago

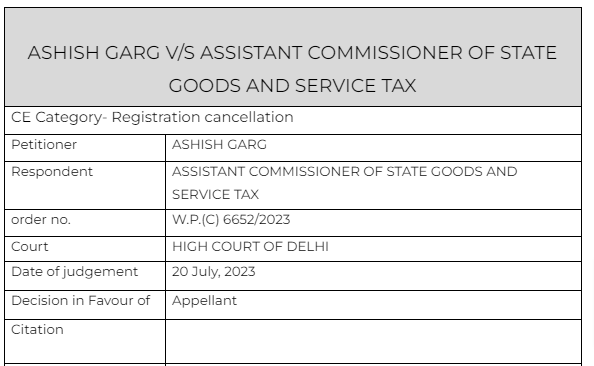

Cases Covered:

ASHISH GARG V/S ASSISTANT COMMISSIONER OF STATE GOODS AND SERVICE TAXFacts of the cases:

It is the petitioner’s case that the respondent took no immediate steps to process the said a […]

-

CA Shafaly Girdharwal wrote a new post, Interest on loan given for eligibility of Credit card is not chargeable to tax 2 years, 1 month ago

Cases Covered:

Ramesh Kumar Patodia Vs. City Bank N.A. and Ors.Facts of the cases:

The bank offered the loan to the petitioner. It was given due to his eligibility on the credit card. The loan was […]

-

CA Shafaly Girdharwal wrote a new post, Prosecution in GST and FIR under IPC both can be done simultaneously (Pdf Attach) 2 years, 1 month ago

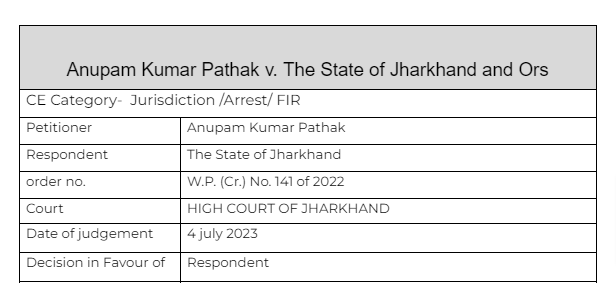

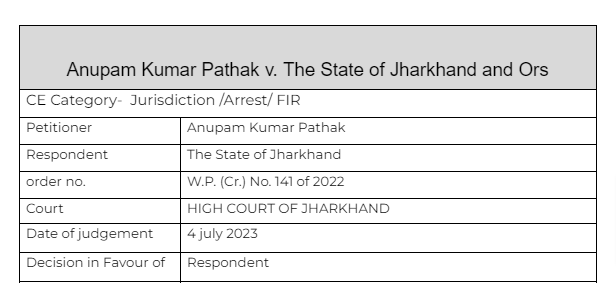

Cases Covered:

Anupam Kumar Pathak v. The State of Jharkhand and OrsCitations:

1. Ramesh Chandra Jain & another v. State of Jharkhand

2. The State of Maharashtra & another v. Sayyed Hassan Sayyed […]

-

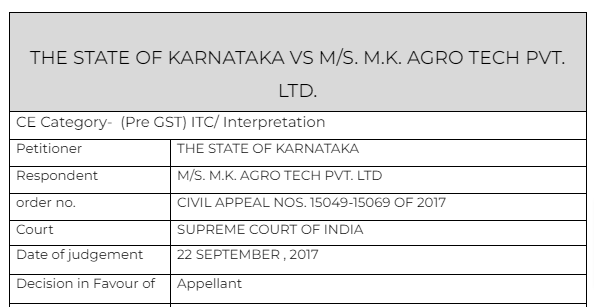

CA Shafaly Girdharwal wrote a new post, Exempted by product is also liable for ITC reversal (Pdf Attach) 2 years, 1 month ago

Cases Covered:

THE STATE OF KARNATAKA VS M/S. M.K. AGRO TECH PVT. LTD.Citations:

1. Commissioner of Central Excise, Jaipur v. Mahavir Aluminum Ltd.

2. Ravi Prakash Refineries Private Ltd. v. State of […]

- Load More

SHUBHAM SINGH RAWAT

@shubhamgst

active 5 years ago