ConsultEase.com Interviewed.

Read Interview-

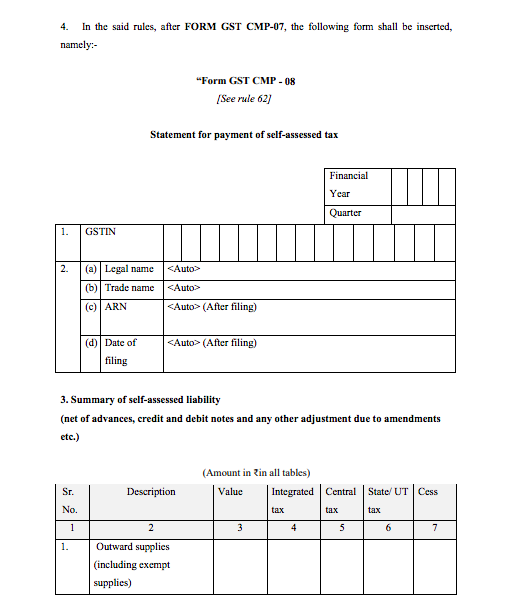

CA Shafaly Girdharwal wrote a new post, New returns for composition dealers 6 years, 3 months ago

New returns for composition dealers:

Notification No. 20/2019 – Central Tax New Delhi, the 23rd April, 2019 introduced CGST (Third amendment rules). These rules have changed the returns to be filed by a c […]

-

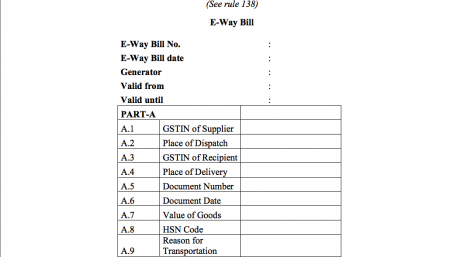

CA Shafaly Girdharwal wrote a new post, Cant make E-way bill if GST returns are not filed 6 years, 3 months ago

Cant make E-way bill if GST returns are not filed

Quantum of non filing of returns to fall in this provision

Rescue from this default

consequences on non -filing of return

Cant make E-way bill if GST re […]

-

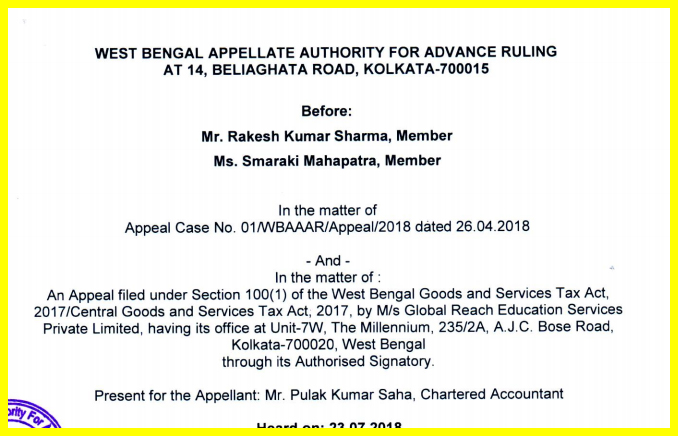

CA Shafaly Girdharwal wrote a new post, AAAR of global reach education #intermediary 1 6 years, 3 months ago

AAAR of global reach education

Facts of the case

Argument by the applicant

Observation of authority

AAAR of global reach education:

The appellant already tried the AAR of west Bengal. Where the […]

-

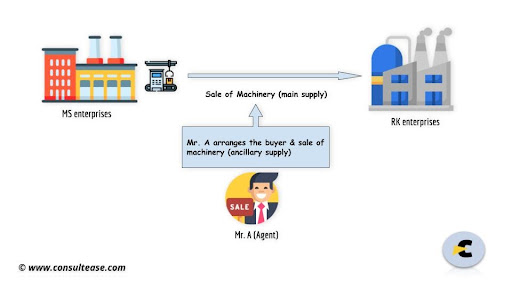

CA Shafaly Girdharwal wrote a new post, Intermediary service in GST with relevant cases 6 years, 3 months ago

Latest update

The Government has Clarified via Circular No. 159/15/2021-GST dated 20th September 2021 thatan intermediary service provider is a person who arranges or facilitates (Ancillary supply) the […]

-

CA Shafaly Girdharwal wrote a new post, composition annual return: 10 facts 6 years, 3 months ago

10 facts about composition annual return :

Here we have compiled 10 important facts about the composition annual return. Pls file it within time. Late filing of GST annual return for composition dealer is liable […]

-

CA Shafaly Girdharwal wrote a new post, Who can file nil composition annual return? 6 years, 3 months ago

Who can file nil composition annual return:

Only the following persons are allowed to file the nil composition annual return. It is important to note that all of the following conditions shall be fulfilled. Only […] -

CA Shafaly Girdharwal wrote a new post, CGST (Second amendment rules) 2019 6 years, 3 months ago

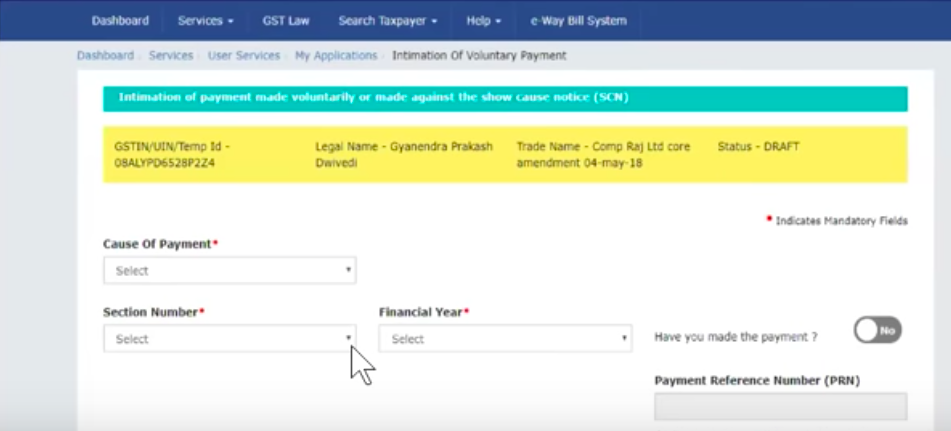

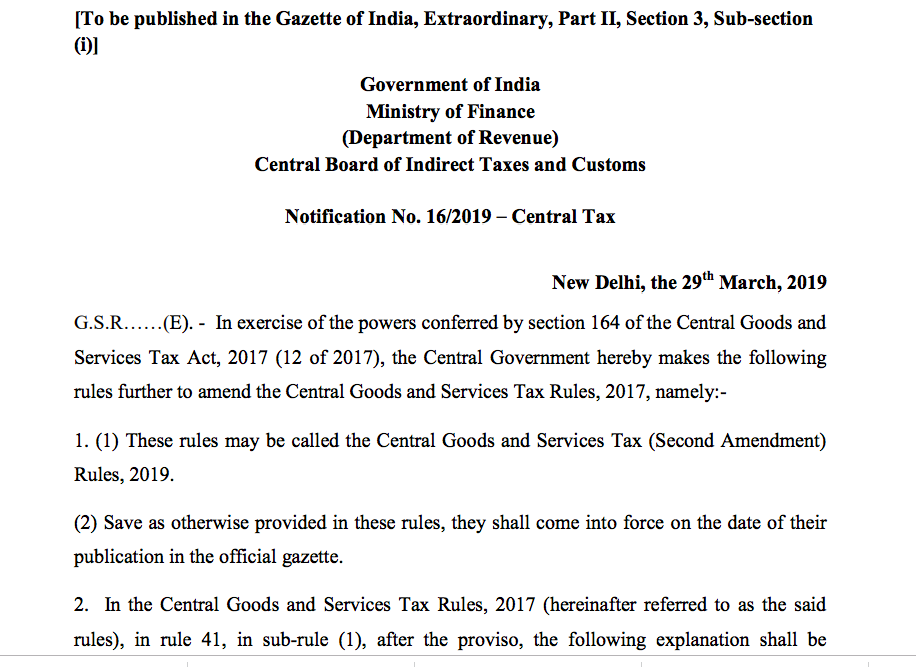

CGST (Second amendment rules) 2019:

CGST (Second amendment rules) 2019 bring into major changes for taxpayers. They are bring into force via Notification No. 16/2019 – Central Tax dated 29th March 2019. We ca […]

-

CA Shafaly Girdharwal wrote a new post, 6 Free accounting softwares by GSTIN 6 years, 3 months ago

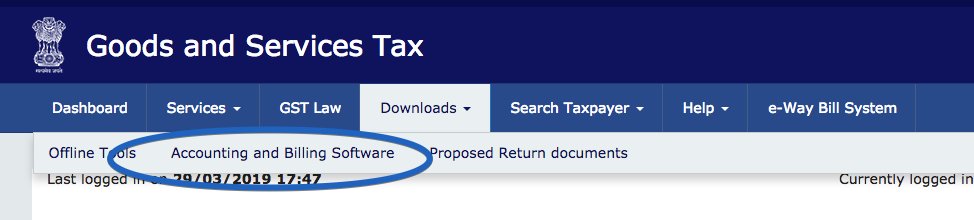

6 Free accounting softwares by GSTIN:

6 Free accounting softwares by GSTIN are recommended. Here we will give you a comparative table of all features of these softwares. You can access this list by following […]

-

CA Shafaly Girdharwal wrote a new post, Reasons to believe for GST search 6 years, 4 months ago

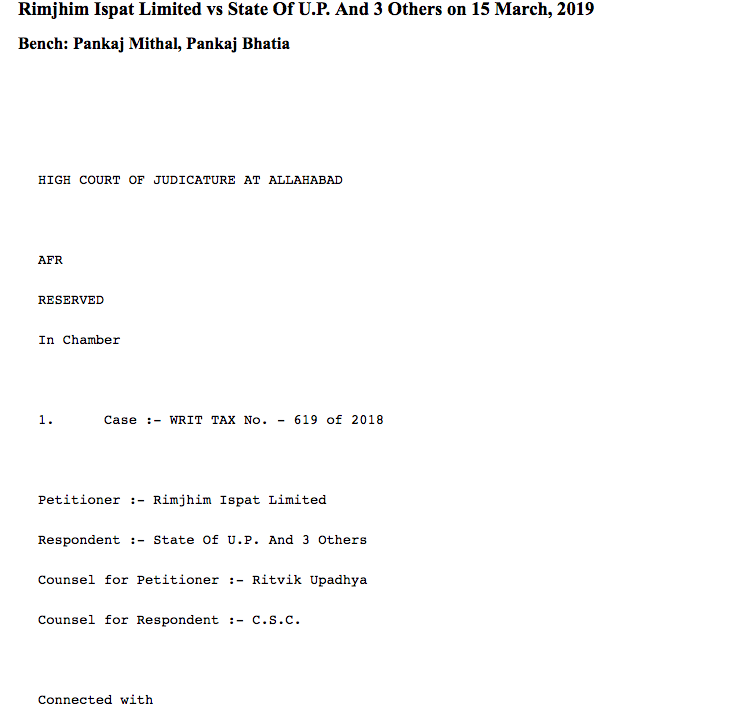

Reasons to believe is required for search & Seizure: HC:

Reasons to believe is very important for any search and seizure.It is important to have a reason to believe to record.

Case: Rimjhim Ispat Limited vs […]

-

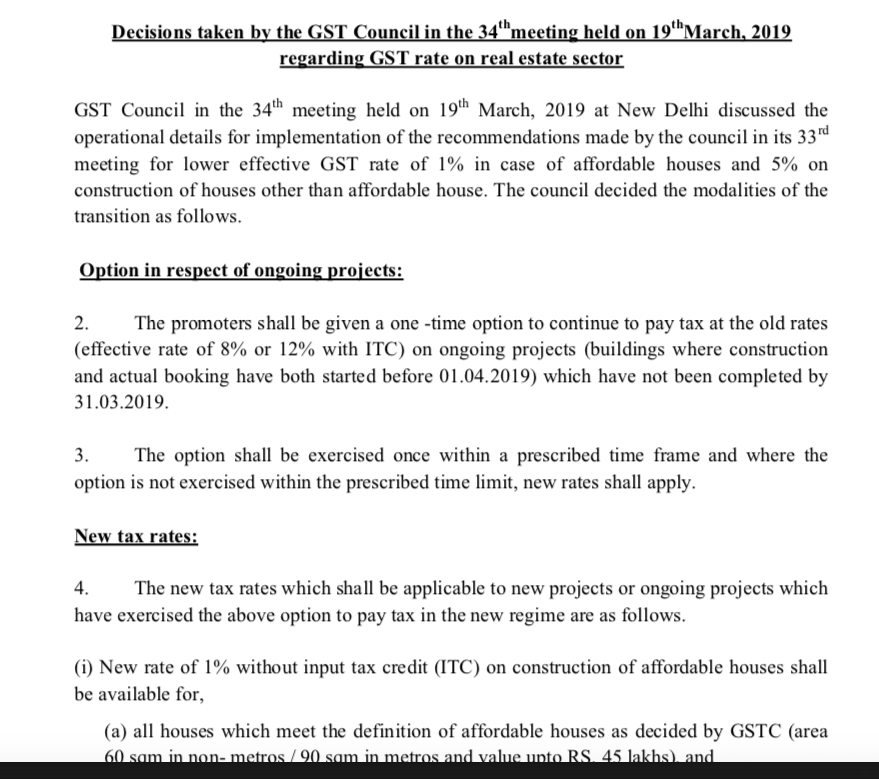

CA Shafaly Girdharwal wrote a new post, GST council 34th meeting updates for housing 6 years, 4 months ago

GST council 34th meeting updates for housing:

GST council in it’s 34th Meeting paved the way for new GST composition scheme for housing projects. Real estate was really worried for the taxation in GST. In last […]

-

CA Shafaly Girdharwal wrote a new post, Dilemma over ITC adjustment for Feb Month 6 years, 4 months ago

Dilemma over ITC adjustment for Feb Month :

Dilemma over ITC adjustment for Feb month is persisting. CGST amendment Act is applicable form 1st Feb 2019. Section 49A of the said section covers the manned […]

-

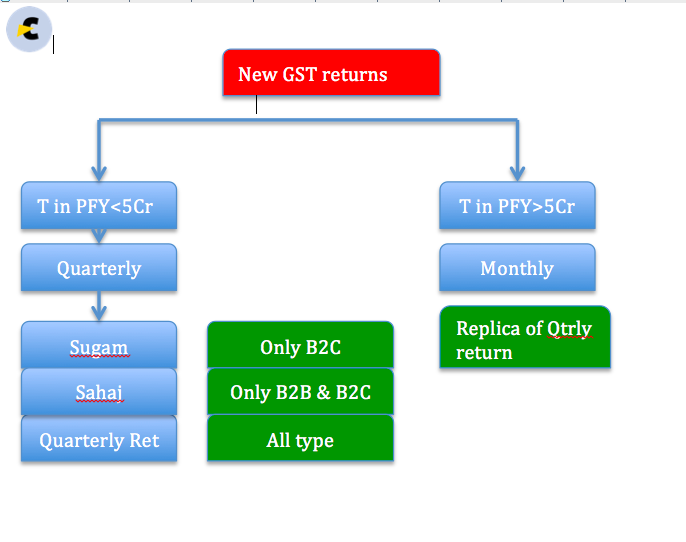

CA Shafaly Girdharwal wrote a new post, New returns of GST mandatory from 1st July 6 years, 4 months ago

New returns of GST mandatory from 1st July:

Basic scheme of new returns of GST:

Have you seen the new returns of GST. They are named as Sahaj and Sugam. Honestly when I try to understand them. I found it […]

-

CA Shafaly Girdharwal wrote a new post, Taxation of restaurant services in GST 6 years, 4 months ago

Taxation of restaurant services in GST

It is a long story of nature of foods supply with serving. In pre GST regime also it was a big confusion. It persisted for years. In GST schedule II was specifically […] -

CA Shafaly Girdharwal wrote a new post, New Composition levy of GST 6 years, 4 months ago

New Composition levy of GST:

New composition levy of GST is introduced by CBIC via notification No. 2/2019 CTR dated 7th March 2019. This Composition levy is for goods and service providers. Its important to […]

-

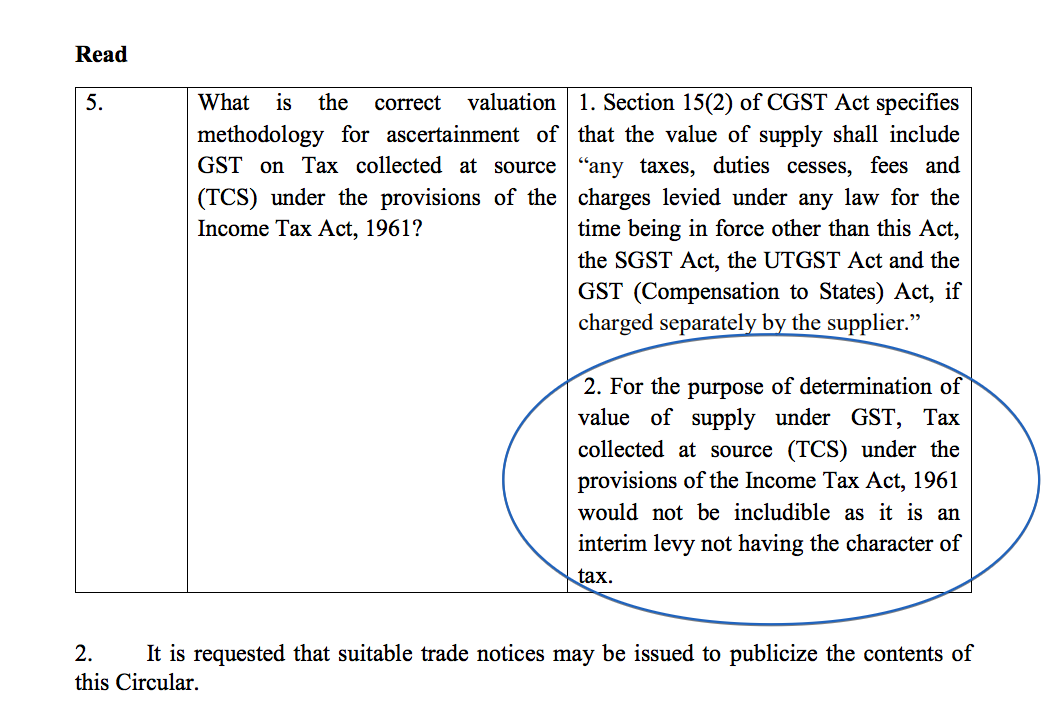

CA Shafaly Girdharwal wrote a new post, GST will not be levied on TCS: CBIC clarification 6 years, 4 months ago

GST will not be levied on TCS: CBIC clarification:

GST will not be levied on TCS.Corrigendum to Circular No. 76/50/2018-GST dated 31st December, 2018 issued vide F.No. CBEC- 20/16/04/2018-GST- Reg. The […]

-

CA Shafaly Girdharwal wrote a new post, Circular on Discounts & promotion schemes in GST 6 years, 4 months ago

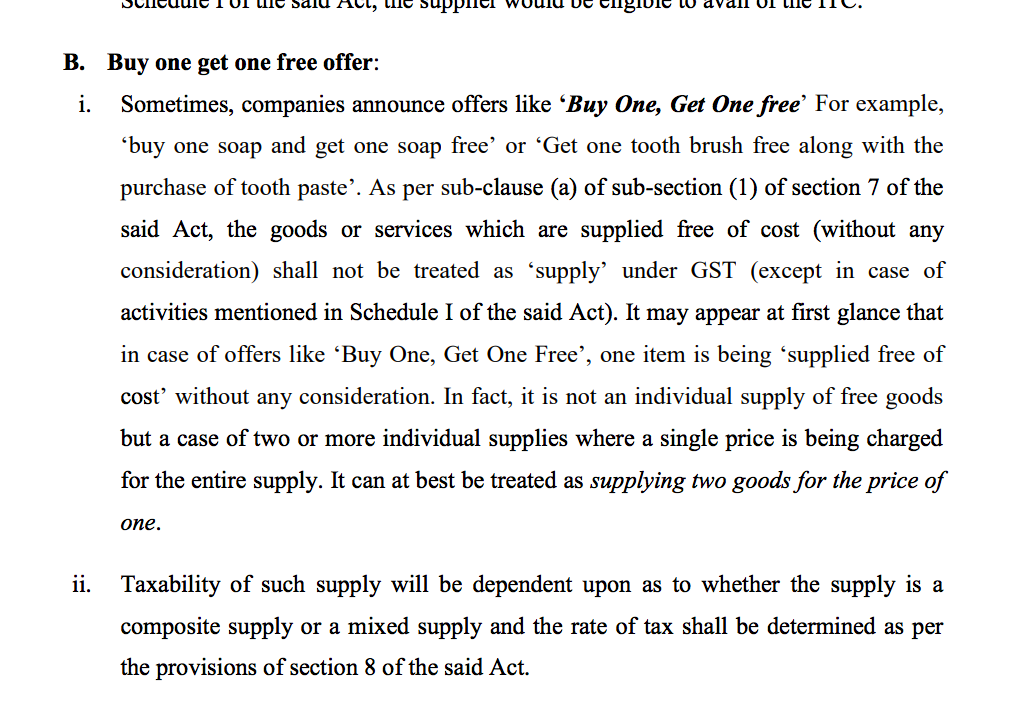

Circular on Discounts & promotion schemes in GST

CBIC via their Circular No. 92/11/2019-GST Dated 7 th March, 2019 clarified the issues related to Discounts & promotion schemes. Industry was in dilemma in […]

-

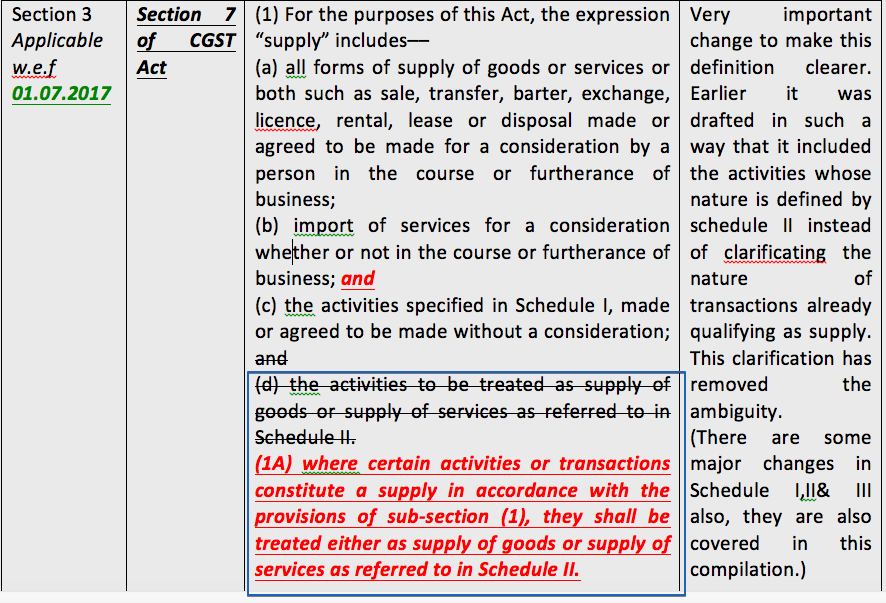

CA Shafaly Girdharwal wrote a new post, GST on slump sale in the light of amendment in Supply 6 years, 4 months ago

GST on slump sale in the light of amendment in definition of Supply

Coverage of transfer of business in the definition of supply:

It is interesting to see that definition of supply is changed […]

-

CA Shafaly Girdharwal wrote a new post, Analysis of new provisions of ITC for a motor vehicle 6 years, 5 months ago

Analysis of new provisions of ITC for a motor vehicle:

Some modifications in this entry were in demand. Bad drafting of earlier provision was leading to following confusions.Whether the input tax credit of […]

-

CA Shafaly Girdharwal wrote a new post, Important changes by CGST Amendment Act 2018 6 years, 5 months ago

Important changes by CGST Amendment Act 2018:

Dear all

We have compiled the section wise analysis of CGST Amendment Act 2018. This Act has introduced many important changes into CGST Amendment Act. Most of t […] -

CA Shafaly Girdharwal wrote a new post, Compilation of important AAR’s: Volume I 6 years, 5 months ago

Compilation of important AAR’s: Volume I

Important AAR Volume I

Important AAR Volume I

We have compiled the important AAR’s in GST. This is first publication. The rulings covered in this edition […] - Load More

Zainul Abedin wagh

@zainulabedinwagh

active 6 years, 9 months ago