PPT on Correctness Outward Supplies under GST

PPT on Correctness Outward Supplies under GST by CA Rohit Vaswani

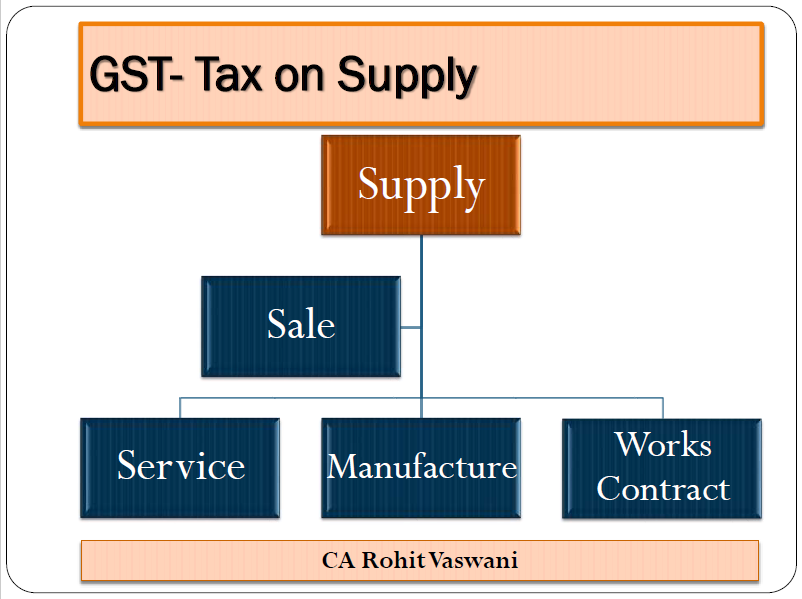

What is the outward supply? Not every sale can be classified as supply. So, let us know more about the Correctness Outward Supplies under GST. By the PPT on Correctness Outward Supplies under GST by CA Rohit Vaswani:

Section 2(52): “goods” means

- every kind of movable property

- other than money and securities

- but includes the actionable claim, growing crops, grass, and things attached to or forming part of the land which is agreed to be severed before supply or under a contract of supply;

Section 2(52): “Services” means

- anything other than goods, money, and securities

- but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged;

Download the full PPT on Correctness Outward Supplies under GST by CA Rohit Vaswani:

Types of Supply:

Whether the following supplies effected by the registered person have been considered in returns (if any)?

(a) Sale

(b) Transfer

(c) Barter

(d) Exchange

(e) License

(f) Rental

(g) Lease

(h) Disposal (including disposal of the business asset as per Schedule I)

(i) Other services

(j) Any other supplies (please specify)