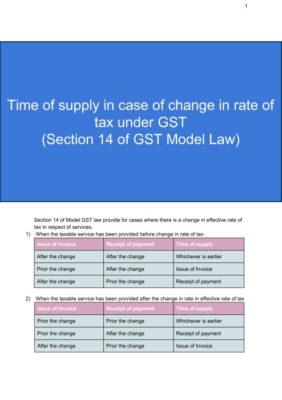

Time of supply is POT in GST regime which has replaced the all other POT in different Laws. In case of service tax taxpayer face a problem in past when there is change in tax rate. In GST regime the Law has specifically provided for the condition when the time of supply will be considered in case of change in tax rate. These provisions are given in section 14 of Model GST law. Here we have summarized these provisions for ease of understanding.