Credit Availment & Reversals in Real estate sector

Credit Availment & Reversals in Real estate sector – Unfulfilled promises

The Credit Availment & Reversals in Real estate sector is pretty tricky under the GST. The calculation of the credit and the reversal of credit is confusing under the GST. Let us discuss the Credit Availment & Reversals in Real estate sector.

Introduction:

Para 4 of Statement of Objects and Reasons of CGST Act, 2017 prescribes the following:-

“In view of the above, it has become necessary to have a Central legislation, namely the Central Goods and Services Tax Bill, 2017. The proposed legislation will confer power upon the Central Government for levying goods and services tax on the supply of goods or services or both which takes place within a State. The proposed legislation will simplify and harmonise the indirect tax regime in the country. It is expected to reduce cost of production and inflation in the economy, thereby making the Indian trade and industry more competitive, domestically as well as internationally. Due to the seamless transfer of input tax credit from one stage to another in the chain of value addition, there is an in-built mechanism in the design of goods and services tax that would incentivise tax compliance by taxpayers. The proposed goods and services tax will broaden the tax base, and result in better tax compliance due to a robust information technology infrastructure.”

The above paragraph shows that the GST law is expected to make indirect taxes a simple and harmonized tax levy and the one wherein input tax credit is seamlessly available.

In this article, we will discuss the relevant input tax credit provisions as applicable to Real estate sector and how the Lawmakers and the Executors have failed to fulfill the standards set by them at the time of implementing GST.

The system of credit availability is divided into three parts viz.

i) Credit availment

ii) Credit blockage

iii) Credit reversal.

The same is as discussed below:-

Credit Availment:

Section 16(1) allows a registered dealer to avail input tax credit of taxes paid on inputs (hereinafter inputs will include input goods and input services) received by him, used or intended to be used by him, in the course or furtherance of business and if such inputs are actually used in making exempt supply, non-taxable supply or for any other purpose as mentioned under Section 17 then, the credit on such inputs is not allowed i.e. blocked or the same is liable to be reversed.

Therefore, a real-estate developer is entitled to claim credit of all inputs received by him which are used or intended to be used in the course or furtherance of business subject to the provisions of Section 17 which is explained hereunder:-

Blocked credits:

Section 17(5) prescribes a list of inputs, the credit on which shall be blocked. Out of the said list, in this article, we shall discuss blockage of credit as prescribed under Section 17(5)(c) and Section 17(5)(d) which are relevant for a real-estate developer.

Section 17(5)(c) is as reproduced below:-

“(c) works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service;”

If the recipient procures works contract services then, he is eligible to claim credit of tax paid on procurement of works contract services only if he himself is the supplier of works contract services.

One of the relevant question that arises here is whether the developer is eligible to claim credit of tax charged by his sub-contractor for works contract services which the developer has received for supply of construction services?

Let us review the chain of a real-estate transaction:-

a. A buyer approaches a developer for procurement of a residential/commercial unit.

b. The unit may be fully developed or under-developed.

c. If the unit is under-developed then, from the date of signing of the agreement to sale, a developer becomes the works contractor for the buyer. This is because after the buyer has agreed to buy a unit, all the value accretion towards the unit will belong to the buyer. So technically, the agreement to sale partakes the character of a works contract and the developer steps into the shoes of a works contractor. Therefore, the provision of construction service by the developer takes the colour of a works contract service. The same view is upheld by Honourable Supreme Court in the case of M/s Larsen and Turbo as reported in 2013-VIL-03-SC-LB.

Coming back to credit eligibility, a contractor executing a works contract can avail credit of tax charged by another contractor. In the same manner, a developer (works contractor for the buyer) can also claim credit of tax charged by another contractor.

Let us now discuss the implications of Section 17(5)(d). The same is as follows :-

(d) goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business.

This clause restricts a registered person from claiming credit of taxes paid on procurement of inputs used for construction of an immovable property notwithstanding the fact that such inputs have been used in the course or furtherance of his business.

Explanation.––For the purposes of clauses (c) and (d), the expression “construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalisation, to the said immovable property;

The explanation to Section 17 prescribes that the activity of construction is not restricted to construction only. The credits pertaining to re-construction, renovation and such activities shall also be blocked if these activities are capitalized in the books of accounts.

It is interesting here to ponder on the usage of words. The term “to the extent of capitalization” denotes that the property should be capitalized in the books of accounts. One may say that this phrase means that the credit is blocked if the expense are eligible for capitalization under the applicable Accounting Principles. So the authorities may question the decision of the assessee behind capitalization of the asset.

Clauses (c) and (d) are drafted on similar lines. Some of the common points in both the clauses are:-

Procurement is for construction of an immovable property

This sentence is most crucial. There are two aspects covered in this sentence. One aspect is that if the procurement is for construction of an immovable property then, the credit shall be blocked and such blocked credit would include all the expenses incurred for bringing into existence an immovable property.

Any other expense incurred after the construction of an immovable property may require special attention. For example: – the services of an interior decorator received after completion of construction of office may not be blocked as it is not used for construction of an immovable property.

A contract for supply and installation of machine (plant and machinery not covered in explanation as discussed below) which results into creation of an immovable property is blocked, however if the company procures testing services to ensure that the machine is intact then, taxes paid on such activity would be eligible as input tax credit.

The second aspect is the meaning of the term immovable property. Any services or goods procured for construction of an immovable property is blocked and therefore it is pertinent to understand the meaning of the term immovable property. The term immovable property is not defined under GST Act. One may have to refer General Clauses Act for the same.

Section 3(26) of General Clauses Act, 1867 prescribes that:-

“(26) “immovable property” shall include land, benefits to arise out of land, and things attached to the earth, or permanently fastened to anything attached to the earth;”

Immovable property cover the following elements in its ambit viz.:-

– Land – It covers bare land.

– Benefits to arise out of land – This expression is not defined under GST.

However, the judiciary has given a lot of precedents demarcating the scope of this term. All such precedents boils down to one conclusion that land gives us a lot of commercial opportunities to exploit such as renting, leasing, development, agriculture etc. All these opportunities are nothing but the benefits that can be derived from land.

– Things attached to earth –Here, we may refer to Section 3 of Transfer of Property Act, 1882 which defines the term “attached to earth”. The definition is reproduced below:-

“attached to the earth means-

(a) rooted in the earth, as in the case of trees and shrubs;

(b) imbedded in the earth, as in the case of walls or buildings; or

(c) attached to what is so embedded for the permanent beneficial enjoyment of that to which it is attached;”

Clause (a) and (b) includes things rooted in earth like trees and things imbedded in earth like walls. If any property is attached to another imbedded property for the beneficial enjoyment of imbedded property then, it is classified in the third category.

For example:- windows are attached to walls and walls are imbedded in earth. Windows increase the beneficial enjoyment of walls and therefore windows would rightly fit in what is intended to be covered in clause (c) above.

– Things which are permanently fastened to anything attached to earth This category include things which are intended to be permanently attached to a property which is already attached to earth. The activity of fastening to earth should have permanency and it should be coupled with the fact that the property to be attached cannot be removed without substantial damage to the earth.

For example: – An electric generator is fixed to earth with nuts and bolts for prevention of vibration and wobbling effect. The intention of fastening here is the enjoyment of electric generation and it does not add any value to land. Further, the earth will not suffer substantial damage on removal of electric generator.

Therefore, although generator is attached to earth, it would still be considered as a movable property.

On the contrary, a borewell underneath thethe surface of earth is not possible to be removed without substantial damage to land. They add value to land & is generally laid down for a very long period and therefore it is immovable property in nature.

To sum up, the degree of annexation, the nature of annexation and the intention of annexation of any property decides whether a property is immovable or movable in nature.

Plant and Machinery is an exception to the provision i.e. credits for construction of plant and machinery can be claimed :

If the resultant immovable property is a plant or machinery then, the credits can be claimed. The expression plant and machinery is defined under explanation as reproduced below:-

“Explanation.––For the purposes of this Chapter and Chapter VI, the expression “plant and machinery” means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes—

(i) land, building or any other civil structures;

(ii) telecommunication towers; and

(iii) pipelines laid outside the factory premises.”

The expression plant and machinery covers all kinds of machineries fixed to earth by foundation or structural support. However, it excludes land, building and any other civil structure like boundary walls, telecommunication towers and pipelines laid outside the factory.

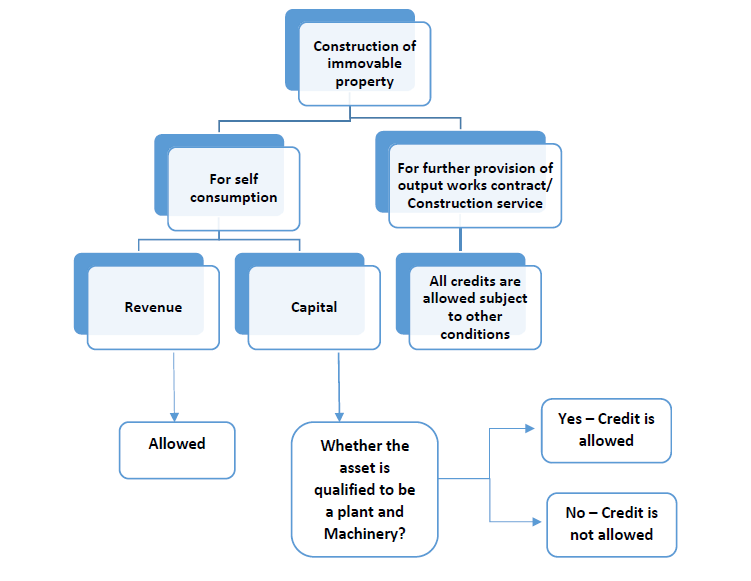

After analysing the entire gamut of conditions in details, let us check a flow chart which summarises the conditions of claiming input tax credit read with the list of inputs on which credit is blocked:-

Reversal of credits:

Section 17(2) read with Section 17(3) prescribes that the credit used for sale of land or sale of building after receipt of completion certificate is liable to be reversed. The method for reversal of credits is prescribed under Rule 42 which is applicable in cases where the exempt and taxable supplies both are provided together in a particular tax period and the rule is applicable on credits availed in a particular tax period.

For example:- Mr. A is a labour contractor. He is executing two contracts. One contract is for Government which is exempt and other contract is awarded by Mr. B and it is taxable. In the month of July, Mr. A receives Rs. 100 from Government and Rs. 500 from Mr. B. He avails credit of Rs. 50 on inputs received by him. As per Rule 42, he will have to apportion the credit of Rs. 50 in the ratio of exempt and taxable supplies. The credit apportioned to exempt supplies is liable to be reversed.

In Real estate sector, 100% consideration received from units booked after completion certificate is not exigible to tax whereas consideration received from units booked before receipt of completion certificate is taxable. The taxable supply and non-taxable supply may not take place in the same tax period. Further, the input tax credit on inputs used for construction of units sold after completion certificate is already claimed during the project execution period. Therefore, Rule 42 is inapplicable in Real-estate sector on two grounds viz.:-

1. Taxable and non-taxable supply may not occur in the same tax period.

2. Major credits are already utilised before receipt of completion certificate.

If the methodology prescribed under Rule 42 is inapplicable then, the question that arises is whether the developer needs to reverse input tax credit of common inputs attributable to both taxable as well as non-taxable supplies?

There are two possible views. One view is that the machinery provisions prescribed for calculation of reversal of credit cannot be applied and law does not provide any other method of reversal which is suitable and applicable to real-estate sector and it is a well settled law that if the machinery provisions fails then, the provision casting liability also fails. Therefore, legally one may take the stand of not reversing any credit.

However, more logical view is that as the tax is not payable, the credit should also not be claimed. The same situation was there under Service tax regime as well. Under CENVAT Rules, until 1.4.2016, the sale of immovable property was not covered in the scope of exempt supply and therefore legally the requirement to reverse credit at the time of receipt of completion certificate did not arise. However, this question was raised before Ahmedabad CESTAT in the case of M/s Alembic Ltd as reported in 2018-VIL-708- CESTAT-AHM-ST dated 16.07.2018. The tribunal held that in absence of specific provisions for credit reversal, the credit not reversed cannot be retained by the assessee because such credit is not actually used for provision of taxable services. The relevant portion from the judgement is as mentioned below:-

“6. We find some merit in the submission made by the Ld. Counsel for the Appellants that for the purpose of invoking provisions of Rule 6 of the Cenvat Credit Rules, 2004, in the resent set of facts and circumstances, the output service must first be exempt service. That upon receipt of Completion Certificate for the projects, the output activity of sale of residential units becomes “non-service” as per provisions of Section 65B of the Finance Act, 1994 read with definition of the term “exempt service” under Rule 2(e) of the CCR, 04. This is further supported by specific amendment carried out in Rule 6(1) of the CCR, 04 whereby w.e.f. 1.4.16, Explanation 3 was inserted specifically dealing with a situation as in the present case, where a deeming fiction was created that for the purposes of Rule 6 of CCR, 04, exempted services as defined in clause (e) of rule 2 shall include an activity, which is not a ‘service’ as defined in section 65B(44) of the Finance Act, 1994 provided that such activity has used inputs or input services. That there was no such stipulation prior to 1.4.16 in law and prima facie such situation was not to be treated as exempt service and did not attract the mischief created under Rule 6 of the CCR, 04.

7. However, for the period prior to 1.4.16, does this mean that a service provider can take and retain full credit on input services received even after receipt of Completion Certificate? In our considered view, the situation will be governed by Rule 3 of the CCR, 2004 till such time, i.e. till the time Rule 6 was specifically made applicable by virtue of the deeming fiction created.”

Going in line with the thought that credit is liable to be reversed on some logical grounds, let us understand other complexities prevailing for reversal of credits. One of the complexity is deciding when the credits should be reversed. There are three possible events which may attract reversal viz.:

Availment of credit: – At the time of availment of credit, the intention of the developer is to sell the units before receipt of completion certificate. Therefore, the developer is eligible to claim the credit under Section 16(1). The same is upheld in the case of M/s Alembic Ltd (supra). The relevant portion is as reproduced below:-

“19. We accordingly hold that the Appellants were not legally required to reverse any Credit which was availed by them during the period 2010 till obtaining Completion Certificate, i.e. during the period when output service was wholly taxable in their hands, merely because later on, some portion of the property was converted into immovable property on account of receipt of Completion Certificate and on which no Service Tax would be paid in future.”

On the above grounds, reversal of proportionate credit at the time of availment is not justified.

Time of receipt of completion certificate: – This is a reasonable time to reverse credit. The logic behind this is that the law requires reversal when the inputs are used for effecting non-taxable supplies. When the completion certificate is received, the inputs cannot be said to be used with an intention of effecting taxable supplies as the tax is not applicable on units sold after receipt of completion certificate. Further, the credit reversal is required to be made in a tax period therefore, one may reverse credit in the period in which completion certificate is received.

Reversing credit at the time of sale of units: – Department may reject reversal at this stage and therefore reversal at the time of sale of units after receipt of completion certificate may attract levy of interest.

Rule 42 prescribes the method of reversal of common inputs. However, as discussed above, the said method is not workable for Real Estate Sector. Hence, on a logical basis, one may reverse the credit in the proportion of square foot area sold after receipt of completion certificate.

For example: Let total area of a project be 100 square feet. Out of this 60 square feet is sold before receipt of B.U. In such a scenario, the available ITC is restricted to 60% whereas the balance ITC 40% shall be subject to reversal. Further, the credit reversal methods followed by the industry is subjective and industry is following many methods for the same. The method of reversing credit on the basis of square feet is also upheld in the case of M/s Alembic judgement (supra).

Conclusion:

Blocked credits and credit reversals are grey areas in the Real-estate sector and the future is filled with litigations followed by clarifications and amendments. After understanding the above complexities & complications involved, one could guess the deviation of actual provisions from the benchmark set by Lawmakers themselves.

Pooja Jajwani

Pooja Jajwani

Ahemdabad, India