Critical Issues in Annual Return

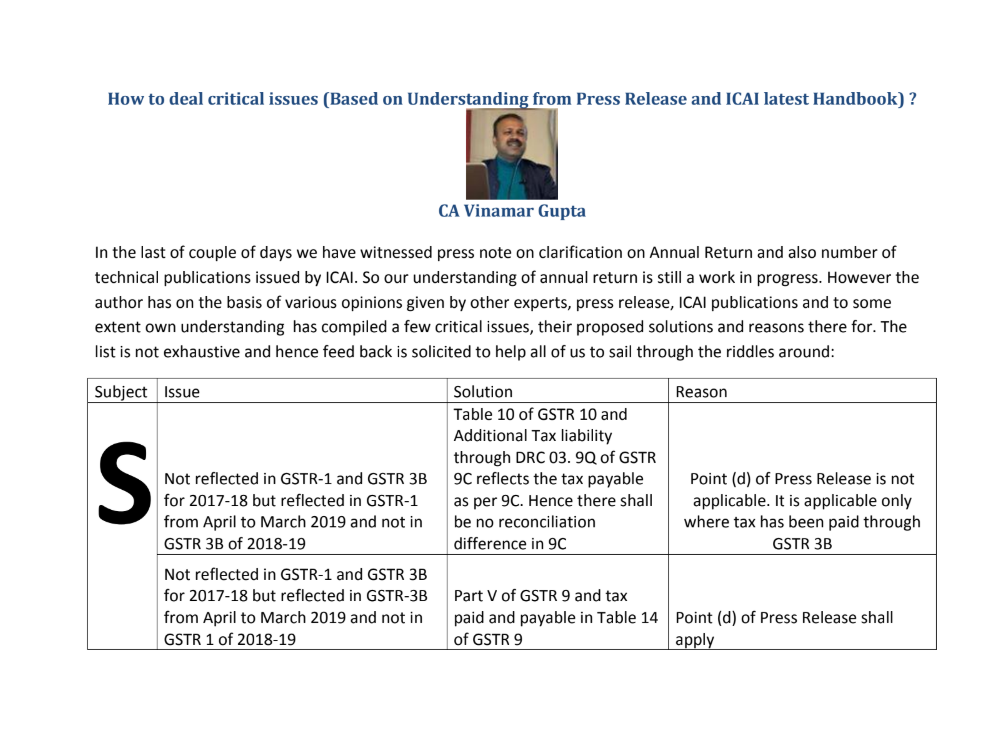

In the last of couple of days we have witnessed press note on clarification on Annual Return and also number of technical publications issued by ICAI. So our understanding of annual return is still a work in progress. However the author has on the basis of various opinions given by other experts, press release, ICAI publications and to some extent own understanding has compiled a few critical issues, their proposed solutions and reason s there for. The list is not exhaustive and hence feed back is solicited to help all of us to sail through the riddles around:

Table of Contents

- Download the pdf on Critical Issues in Annual Return by clicking the below image:

- Not reflected in GSTR-1 and GSTR 3B for 2017-18 but reflected in GSTR-1 from April to March 2019 and not in GSTR 3B of 2018-19

- Point (d) of Press Release is not applicable. It is applicable only where tax has been paid through GSTR 3B

- Not reflected in GSTR-1 and GSTR 3B for 2017-18 but reflected in GSTR-1 of 2018-19 and also in GSTR 3B of 2018- 19

- Reflected in GSTR-1 for 2017-18 but reflected in GSTR 3B for 2018-19

- Reflected in GSTR 3B of 2017-18 but GSTR-1 of 2018-19

- Neither disclosed in GSTR -1 and GSTR 3B of 2017-18 nor in 2018-19

- Tax paid correctly in 3B but turnover is incorrect

- Excess Tax Paid in 2017-18 and adjsuted in 18-19

- Excess Tax Paid in 2017-18 not adjsuted in 18-19

- Not reflected in GSTR 3B for 2017-18 and 2018-19

- RCM claimed without payment in cash

- ITC required to be reversed

- neither reversed in 2017-18 nor in

- 2018-19. Also not reversed in

- books

- Relating to 2017-18. Reversed in

- books for 2018-19 and also

- reversed in GSTR 3B for 2018-19

- Relating to 2017-18. Reversed in books relating to 2017-18, but not reversed in GSTR 3B

- Hypothectcal Sale and Hypothetical ITC

Download the pdf on Critical Issues in Annual Return by clicking the below image:

|

Issue |

Solution |

Reason |

Not reflected in GSTR-1 and GSTR 3B for 2017-18 but reflected in GSTR-1 from April to March 2019 and not in GSTR 3B of 2018-19 |

Table 10 of GSTR 10 and Additional Tax liability through DRC 03. 9Q of GSTR 9C reflects the tax payable as per 9C. Hence there shall be no reconciliation difference in 9C |

Point (d) of Press Release is not applicable. It is applicable only where tax has been paid through GSTR 3B |

Point (d) of Press Release is not

|

Part V of GSTR 9 and tax paid and payable in Table 14 of GSTR 9 | Point (d) of Press Release shall apply |

Not reflected in GSTR-1 and GSTR 3B for 2017-18 but reflected in GSTR-1 of 2018-19 and also in GSTR 3B of 2018- 19 |

Part V Table 10 and Table 14 of Part V of GSTR 9 | Point (d) of Press Release shall apply |

Reflected in GSTR-1 for 2017-18 but reflected in GSTR 3B for 2018-19 |

Reduce from Auto Populated figure in Part II. Then add turnover to Part V and refelect tax paid in Table 14 | Point (d) of Press Release shall apply |

Reflected in GSTR 3B of 2017-18 but GSTR-1 of 2018-19 |

Reflect in Part II of GSTR 9. There is no auto population in Part V. Hence no impact in Part V to be considered | Point (d) of Press Release shall apply |

Neither disclosed in GSTR -1 and GSTR 3B of 2017-18 nor in 2018-19 |

Reflect in Part II of GST9 and additional taxa payable in Table 9(Part IV) and discharge liability through DRC-03. 9Q of GSTR 9C reflects the tax payable as per GSTR 9. Hence there shall be no reconciliation differences in GSTR 9C | Point ( e) of Press Release shall apply |

Tax paid correctly in 3B but turnover is incorrect |

Reflect in Part II or Part V of GSTR 9 as per tax paid in 3B. Ignore turnover declared in 3B | As per point (d) of Press release on Clarifications |

Excess Tax Paid in 2017-18 and adjsuted in 18-19 |

Reflect excess tax paid in Table 11 |

|

Excess Tax Paid in 2017-18 not adjsuted in 18-19 |

Tax Payable in Table 9 shall be lesser than tax paid. Excess to be claimed as refund |

| Not reflected in Books of Accounts e.g. Cross Charge , Services to employees |

Reflect in 5D of GSTR 9C. Additional tax libility to be discharged through DRC 03 | |

| Not reflected in Books of Accounts e.g. Sale of Car | Reflect in 5O of GSTR 9C. Additional tax libility to b discharged through DRC 03 | |

| Supply not refelcted in books | Reflect in 5O of GSTR 9C. Additional tax libility to be discharged through DRC 03 | |

| Taxable Supply treated as Exempt | Shift Sale from Table 5 to Table 4 of GSTR 9. Tax payable in Table 9 of GSTR 9 and discharge liabiliy through DRC 03. Reduced Exempt Turnover in Table 5 of GSTR 9 shall travel to 7B of GSTR9C and taxable turnover shall get corrected in 9C as per Table 4. No tax difference shall arise in 9C |

|

|

Exempt Supply Treated as Taxable

Tax paid in returns in wrong head |

Shift Sale from Table 4 to Table 5 of GSTR 9. Increased sale in Table 5 of GSTR 9 shall travel to Table 7B of GSTR 9C. Taxable Turnover Place tax in correct head in GSTR 9.Additional tax liability to be discharged throgh DRC 03. Excess tax paid shall be reflected in unreconciled tax in 9R of GSTR 9C. Also short tax paid shall apeear in 9C Table 9R under relevant head |

|

| a. Reflect in Table 8C of GSTR 9 | ||

| b.Reflect in Table 13 of GSTR 9 | ||

| c. Reflect in Table 12C of GSTR 9C | ||

| Not reflected in GSTR 3B for 2017-18 but reflected in 3B for 18-19 |

d. Reflect in Un reconciled ITC in 14T and provide reasons in Table 15 of GSTR 9C | |

| Not reflected in GSTR 3B for 2017-18 but reflected in GSTR 3B for October to March 2018 without invoices up loaded by the supplier |

a. To be placed in 8E of GSTR 9 (ITC available but not availed) |

|

| b. To be placed in 8K of GSTR 9 (ITC to be lapsed) |

| c.Not to be placed in ITC reversal under Table 7 or Table 12 GSTR9 | ||

| d. reflect in reconciled ITCin 12F and 14Tand provide reasons in Table 15 of GSTR9C | ||

| e. Additional Tax liability may be disclosed in Table 16 and Auditor’s recommendations in GSTR 9C and may be discharged through DRC 03 | ||

| a. To be placed in 8E of GSTR 9 (ITC available but not availed) | ||

| b.To be placed in 8K of GSTR 9 (ITC to be lapsed) | ||

Not reflected in GSTR 3B for 2017-18 and 2018-19 |

c. Shall appear unreconciled ITC in 12 F and 14S |

|

RCM claimed without payment in cash |

Reversal to be made in Table 7 and additional tax liability to be discharged through DRC-03 | |

ITC required to be reversedneither reversed in 2017-18 nor in2018-19. Also not reversed inbooks |

Reflect in Table 7 of GSTR 9. Discharge liability through DRC-03. ITC as per GSTR 9 in 7J shall appear at reduced figure and shall travel to 12E and 14S of GSTR 9C. Unreconciled ITC shall appear in 12F and 14T |

Where ineligible credits are found to be availed in GSTR 3B and is now accepted to be reversed, taxpayer may identify whether such ineligible credit has already been utilized or remains unutilized. Where it is utilized, then the same is to be paid in cash through DRC 03. But where it is lying unutilized, author is of the view that the same may be reversed through DRC-03 by By filling point 7 the registered person will be able to ensure accuracy of consolidated figures of reversal for the year in GSTR 9. However, if any tax liability arises due to wrong reversal and the same is not rectified in next FY, then the same may be declared here (Page 95 of Handbook issued by ICAI) |

Relating to 2017-18. Reversed inbooks for 2018-19 and alsoreversed in GSTR 3B for 2018-19 |

Reflect in Table 12 of GSTR 9. Reflect in Table 14 of GSTR 9. There shall be no additional tax liability. No reconciliation differences in 9C |

|

Relating to 2017-18. Reversed in books relating to 2017-18, but not reversed in GSTR 3B |

Reflect in Table 7 of GSTR 9. Discharge liability through DRC-03. ITC as per GSTR 9 in 7J shall appear at reduced figure and shall travel to 12E and 14S of GSTR 9C. However ITC in 9C shall match |

Hypothectcal Sale and Hypothetical ITC |

Reverse excess ITC in Table 7 and reflect correct tax payable and turnover in Part II of GSTR 9. However if ITC taken is lesser then additional ITC can not be taken |

CA Vinamar Gupta

CA Vinamar Gupta

Amritsar, India