Export Promotion Capital Goods (EPCG SCHEME) And Advance Authorizations (AA SCHEMES) Under GST

Export Promotion Capital Goods (EPCG SCHEME) And Advance Authorizations (AA SCHEMES) Under GST

Table of Contents

1.0 Overview

Before the implementation of GST in India, various tax benefits, entitlements, and export promotion schemes were provided to exporters to augment foreign reserves of India, provide employment opportunities, development of some regional and backward areas, etc.

Most of the schemes are managed by the Director-General of Foreign Trade (DGFT) and are provided in Foreign Trade Policy FTP issued by the government every five years. As of now, FTP 2015-20 is in effect from the financial year 2015 to the year 2020. Some duty drawbacks on exports are provided by Department of Revenue (DoR), Ministry of Finance (MoF), Government of India and some trade-specific incentives are also provided by various departments and ministries like Rebate of State Levies (RoSL) schemes provided by Ministry of Textile for promoting the textile industry.

Some of these benefits are activity-based incentives like Duty drawbacks, MEIS/SEIS, Advance Authorisations, DFIA, EPCG, Rosl, special schemes for jewelers, special schemes for textiles, etc. while other benefits were location-based like incentives for units located in DTA, SEZ / EHTP / STP managed and controlled by Ministry of Commerce and Industries, etc. Exporters are allowed to procure imported goods without payment of Customs duty, CVD, etc and at the same time, they are also allowed to purchase indigenous goods without payment of taxes.

So, both Pre-export and Post-export benefits are provided to the exporters. Most of the pre exports benefits in form of advance authorizations / EPCG schemes etc. are based upon actual user conditions and are provided only upon fulfillment of certain export obligation (EO) along with the time-bound realization of export proceeds in freely convertible foreign currency. Some of these Export obligations are either general obligations or others are based upon average export performances of the exporters during the previous financial years. In some cases to obtain the benefit of these schemes, exporters are also required to maintain positive net foreign exchange (NFE) figures. There are many situations where even sales realization in Indian rupees is considered for calculating discharge of export obligations or achievement of NFE like in case of deemed exports or supplies to SEZ etc. even though consideration is received in INR, but it is deemed to be received in foreign currency.

Related Topic:

Merchant Export vs Deemed Exports in GST

Post-exports benefits are mainly in form of duty drawbacks in cash, advance authorizations and duty-free scrips enabling the holder of such scrip to procure duty-free inputs against them. Some of these scrips are even freely transferable and often sold in an open market.

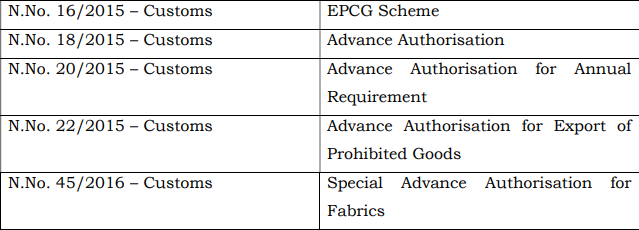

Recently, notification no. 18/2020-Customs issued on 30.03.2020 has amended five principal customs notifications related to pre-export benefits provided to the exporters in the form of EPCG schemes and Advance Authorisations. So In this article, we will understand the impact of this notification on EPCG and advance authorizations under GST. Details of notifications amended are as follows:

This article has been divided into two sections viz. EPCG and Advance Authorisations. An attempt has been made to first familiarize the readers about the benefits provided by the government under this scheme under the Pre-GST era, then we will discuss the status of these schemes under the GST era and changes made by the government from time to time under the GST regime. Initially, these schemes covered Customs duties and so, GST benefits were not provided in these schemes. However, with effect from 13th October 2017, GST benefits were also included in EPCG schemes and Advance Authorisation schemes. Though a Pre-import condition in case of advance authorization was introduced with effect from 13th October 2017, the same was also removed later on. We will discuss all these issues in detail, but to start with let us gain some basic understanding of these schemes.

2.01 Basis of Advance Authorisation

Like post export benefits and schemes provided by the government, some pre-export entitlements to the exporters are also provided through Chapter 4 of Foreign Trade Policy 2015-2020. This chapter of FTP provides various duty exemption/remission schemes so as to enable duty-free import of inputs for export production, including replenishment of input or duty remission. These exemptions or remissions as provided in Chapter 4 of Foreign Trade Policy can be broadly classified as follows:

(a) Duty Exemption Schemes.

The Duty Exemption schemes consist of the following:

(i) Advance Authorisation (AA) (which includes Advance Authorisation for Annual Requirement).

(ii) Duty-Free Import Authorisation (DFIA).

(b) Duty Remission Scheme.

Duty Drawback (DBK) Scheme, administered by the Department of Revenue.

Earlier, a booklet on Duty Drawback was provided to the readers, in this article we will discuss advance authorization in detail.

2.02 Advance Authorisation

Under this scheme, inputs that are physically incorporated in the export products are allowed to be imported without payment of any duty. In addition, fuel, oil, catalyst, etc. which is consumed/utilized in the process of production of export product, may also be allowed to be imported without payment of any duty. Advance Authorization for the annual requirement is also issued for items having standard input-output (SION) norms, those exporters having the past export performance of minimum two preceding financial years are entitled to apply for Advance Authorization for Annual requirement which shall only be issued for items having SION.

Except for some supplies which treated as deemed exports of a category covered under paragraph 7.02 (c), (d) and (g) of FTP 2015-20, Imports under Advance Authorisation are exempted from payment of Basic Customs Duty, Additional Customs Duty, Education Cess, Anti-dumping Duty, Safeguard Duty and Transition Product Specific Safeguard Duty, wherever applicable. However, exemptions from Basic Customs Duty & Additional Customs Duty are available even if such supplies are covered under the paras stated above.

Advance Authorisation is issued for inputs in relation to a resultant product, on the following basis:

(i) As per Standard Input Output Norms (SION) notified; (Annual Authorisations may also be issued for goods which do not appear in annexure 4-J)

OR

(ii) On the basis of self-declaration. (Annual Authorisations shall not be issued on Adhoc norms)

DGFT may, by notification, impose pre-import conditions for inputs for Advance Authorisation. For example, the Import of drugs from unregistered sources shall have pre-import conditions.

Advance Authorisation is available to only eligible exporters for eligible commodities only. These are as follows:

(a) Advance Authorisation can be issued either to a manufacturer exporter or merchant exporter tied to a supporting manufacturer.

(b) Advance Authorisation for pharmaceutical products manufactured through Non-Infringing (NI) process shall be issued to manufacturer exporter only.