Data Flow in GSTR 9 and 9C

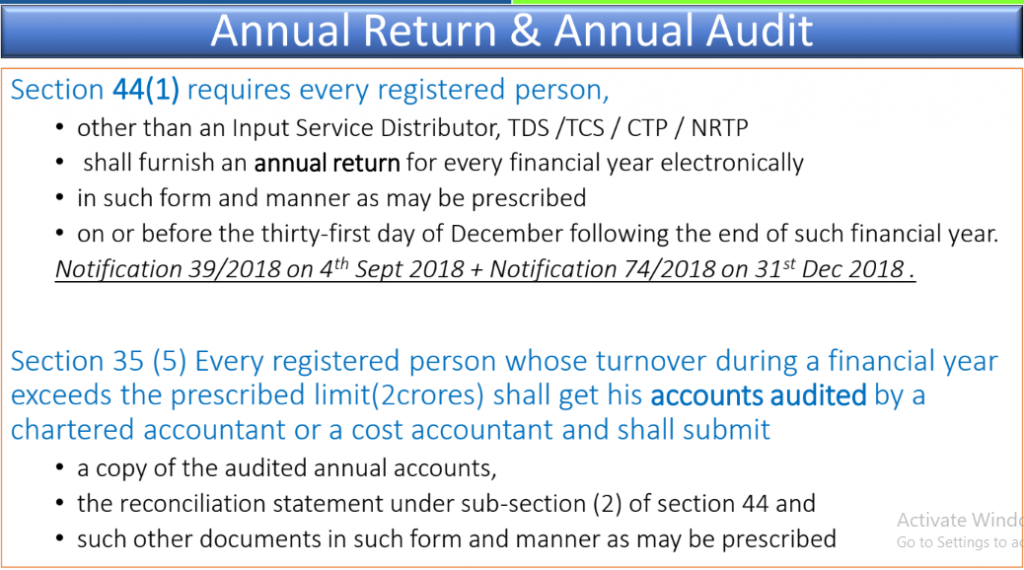

Introduction:

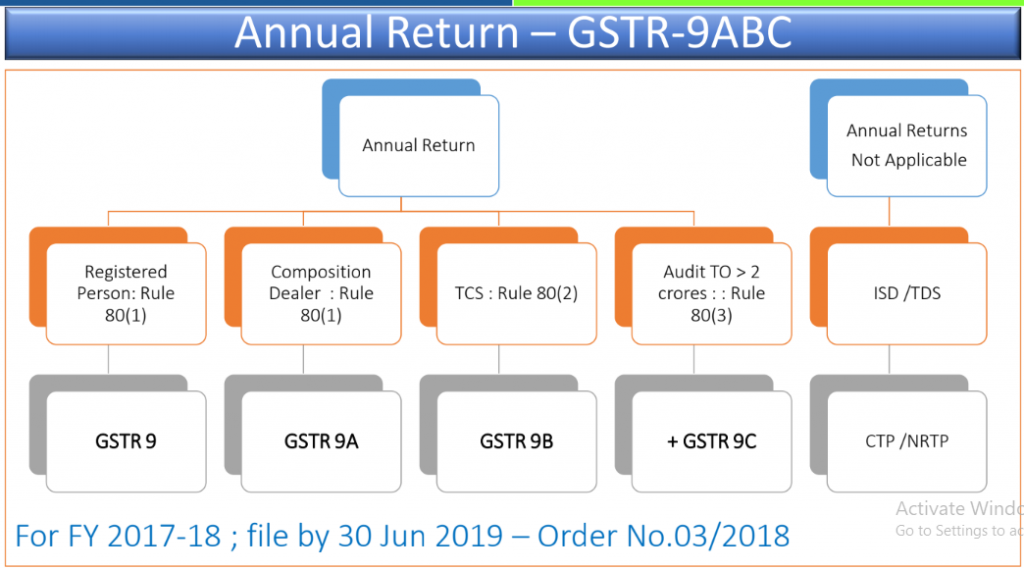

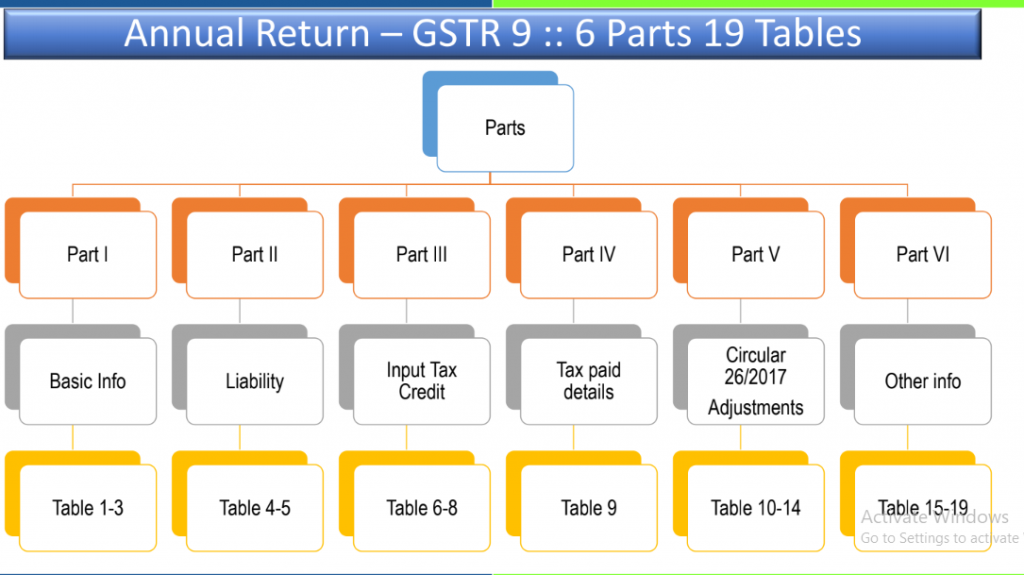

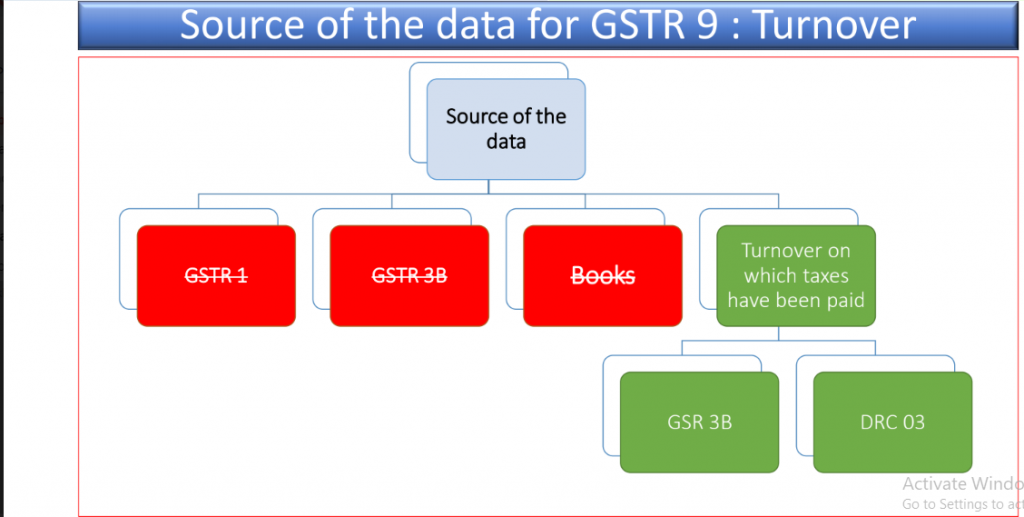

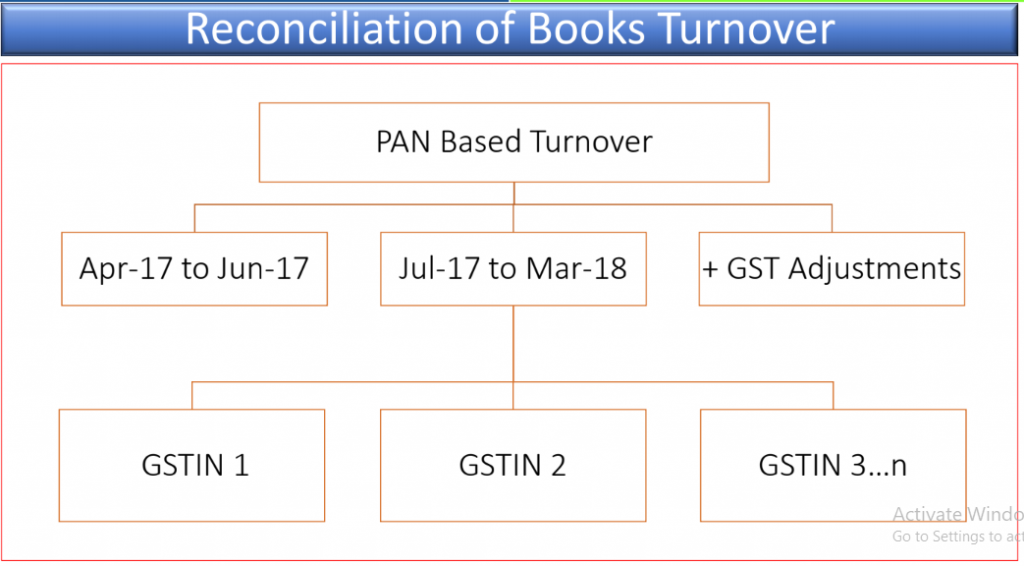

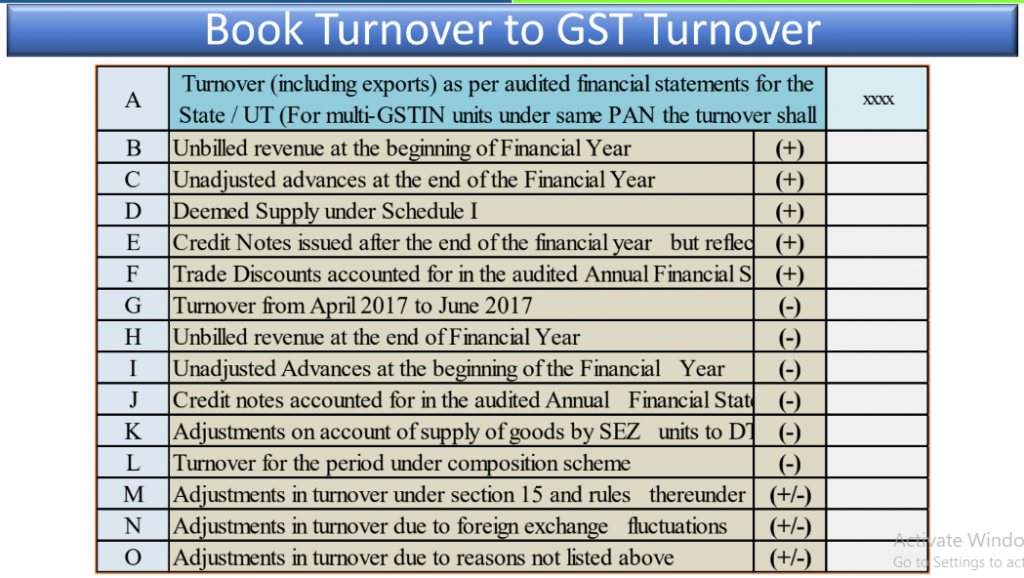

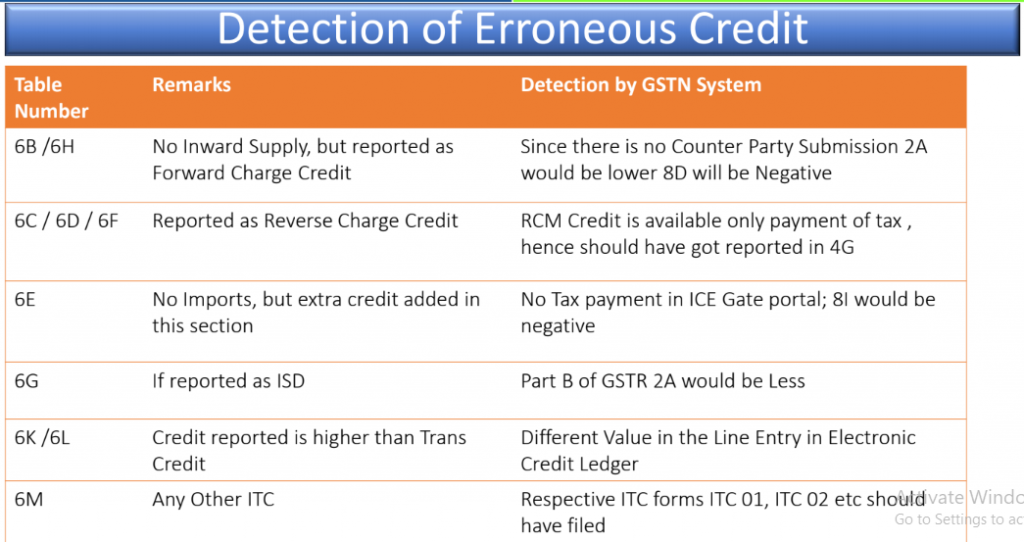

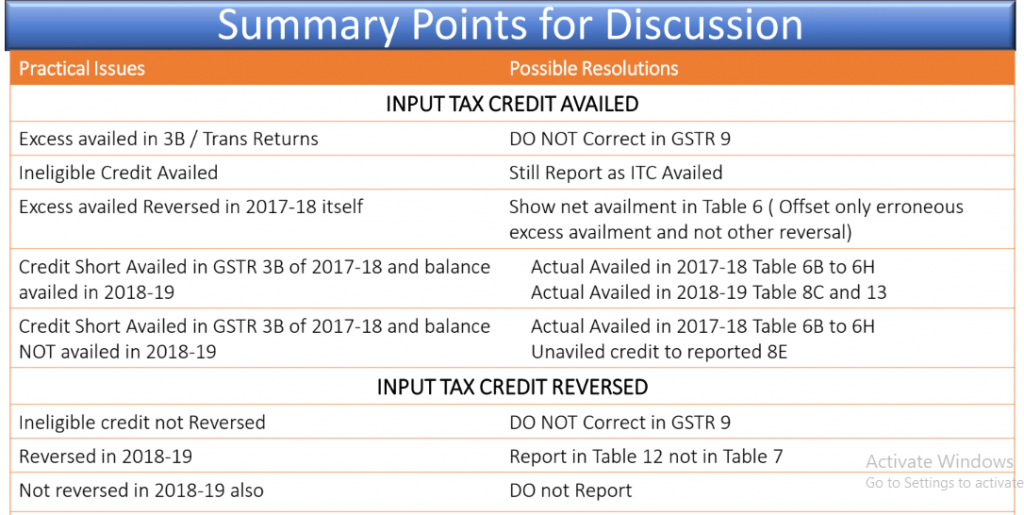

Data Flow in GSTR 9 and 9C to file both forms. This article is based on the presentation on GSTR 9 and 9C form. Various issues related to these forms are also covered. Possible solutions to those issues are also provided. There are many open issues hitting GST taxpayer. Now how to show all those errors in annual return form GSTR 9.

- Period Coverage : 1st July 2017 to 31st March 2018

2. Mandatory Filing of : FORM GSTR-1 and FORM GSTR-3B for the FY 201718

3. Late Filing Fees : Rs. 100/- per day per Act (CGST + SGST/UTGST), subject to a maximum amount of (0.25% CGST + 0.25% SGST/UTGST) of the turnover in the State.

4. Notice for Non filer : Sec 46 read with Rule 68, A notice in FORM GSTR-3A shall be issued with in fifteen days, electronically, to a registered person who fails to furnish return under section 44.

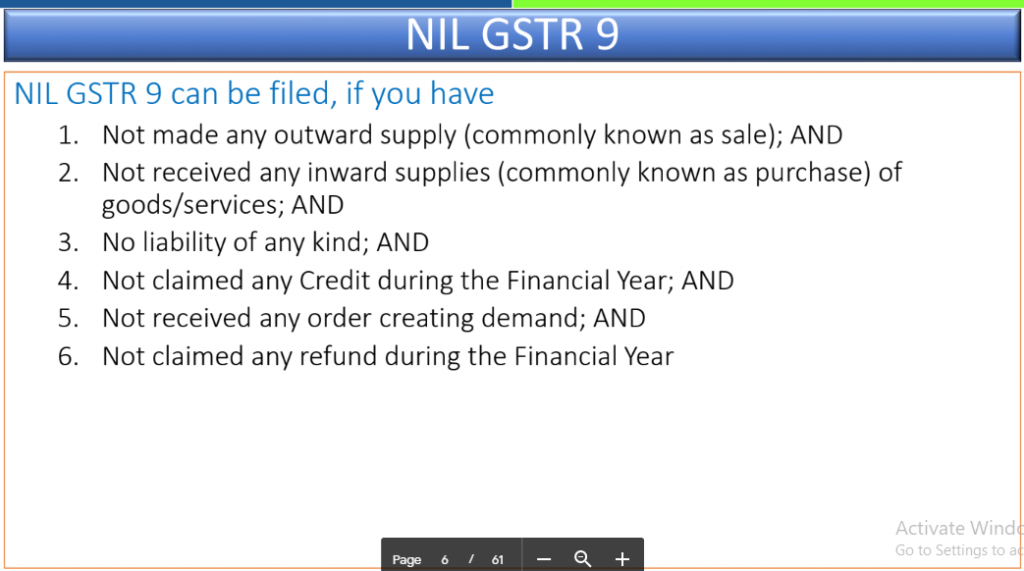

5. Thresh hold Limit : All Registered Tax payers even if the turnover is NIL shall file.

6. PAN / GSTIN : This is not an Entity Level reporting, its GSTIN based filing.

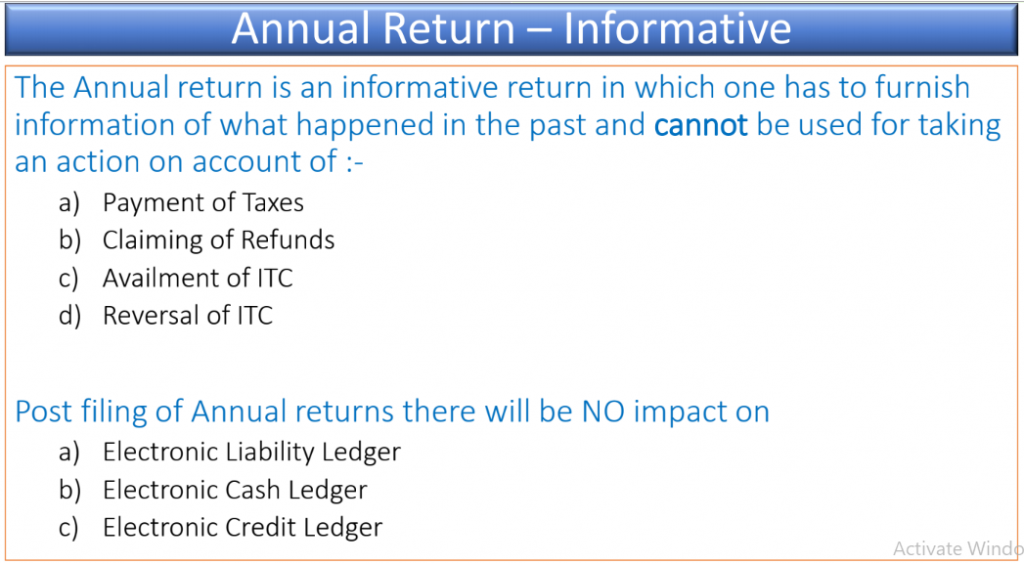

7. Revision of GSTR 9 : Once Filed this form cannot be revised

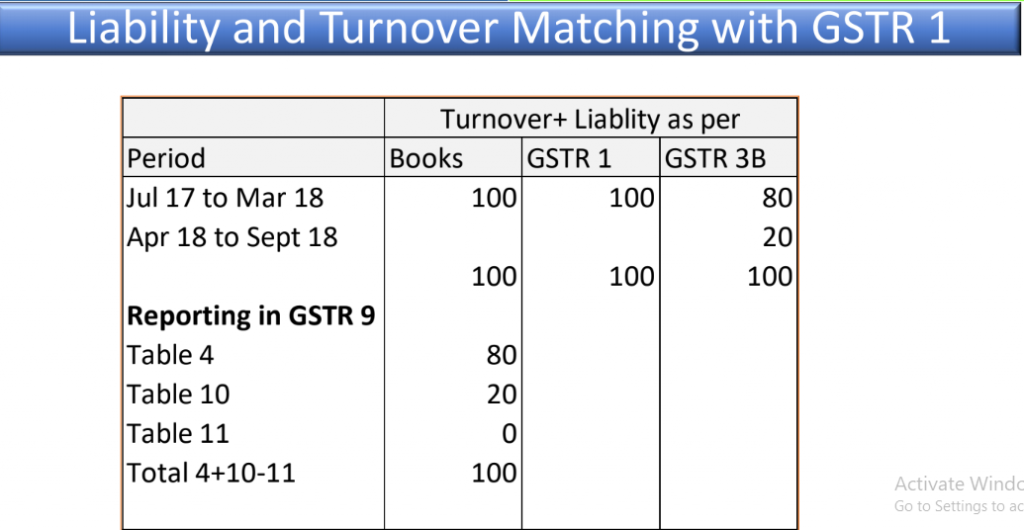

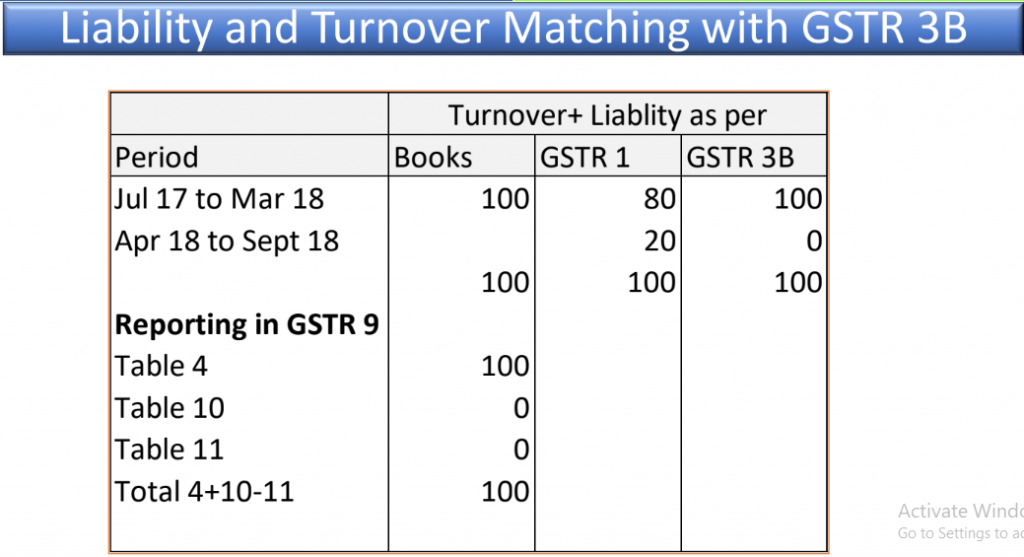

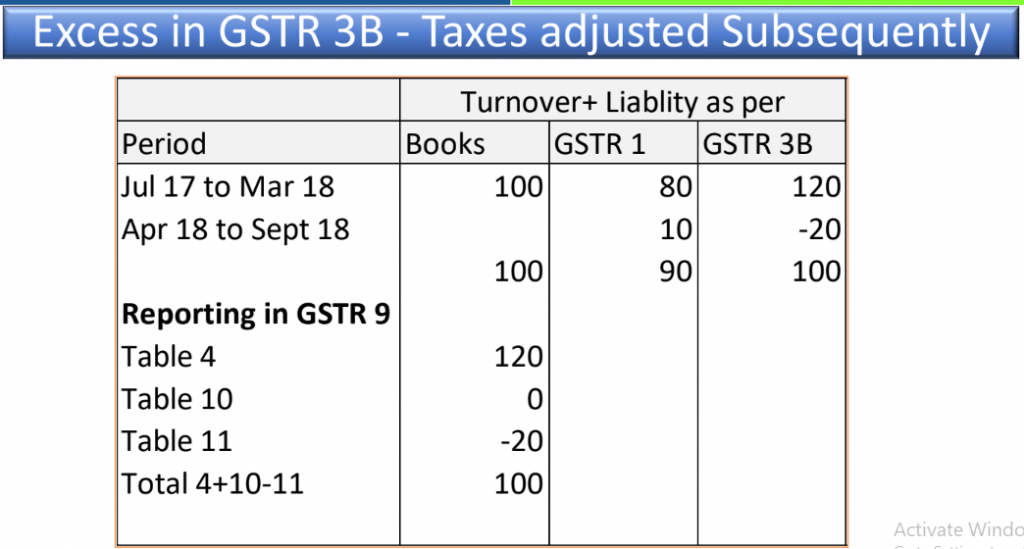

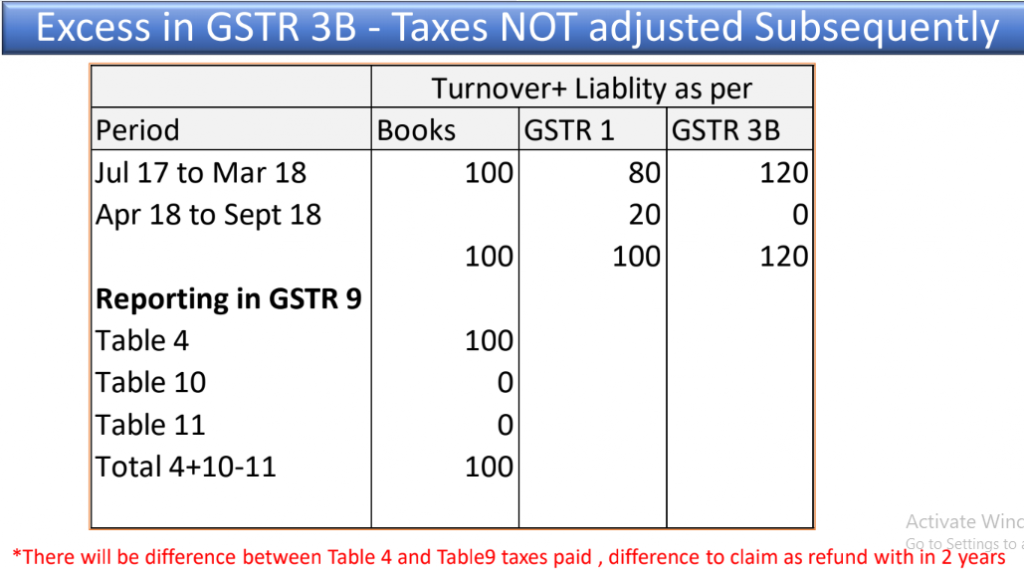

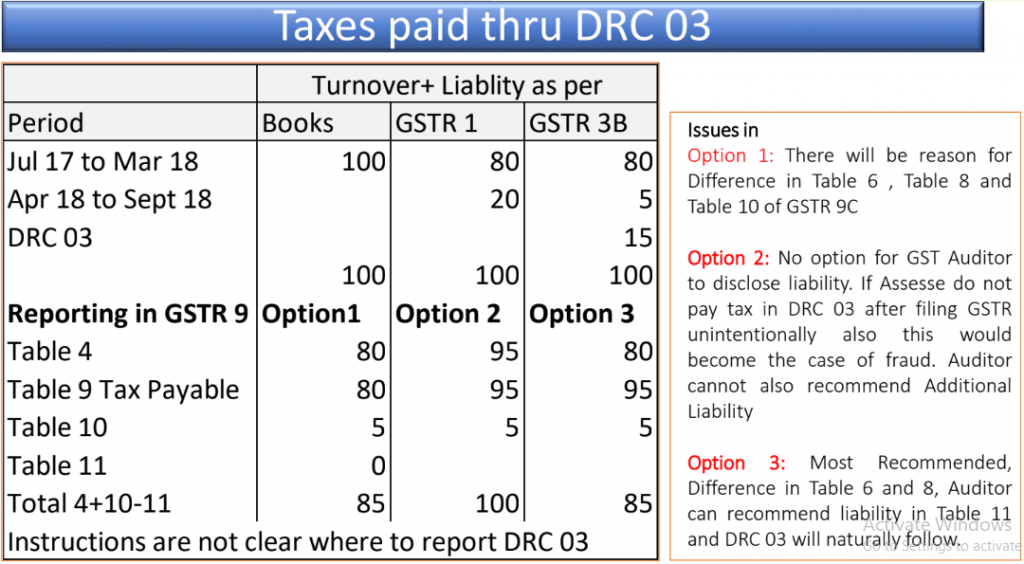

EXAMPLES

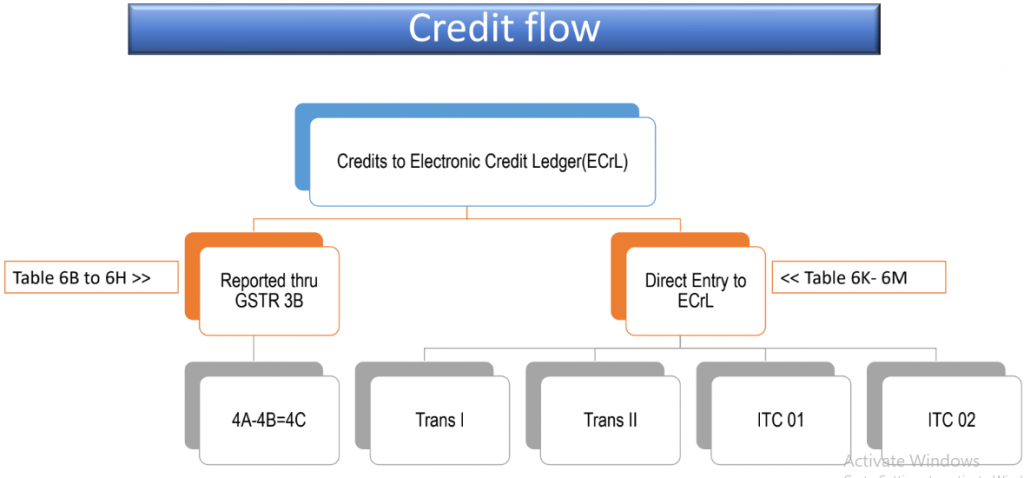

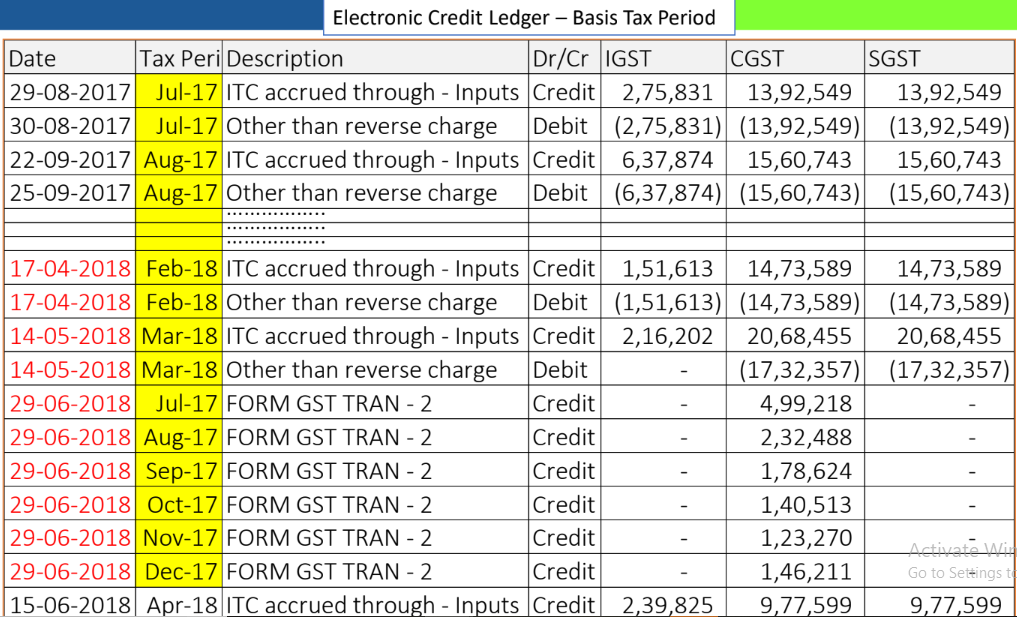

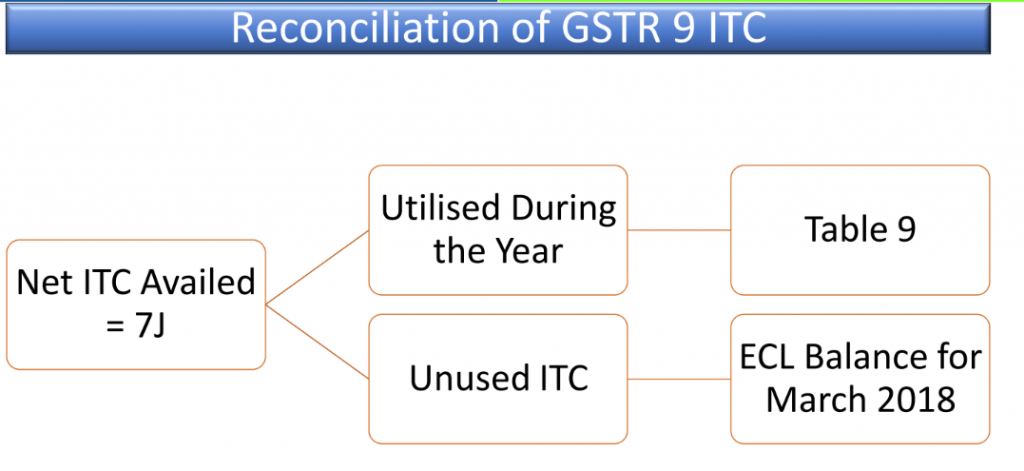

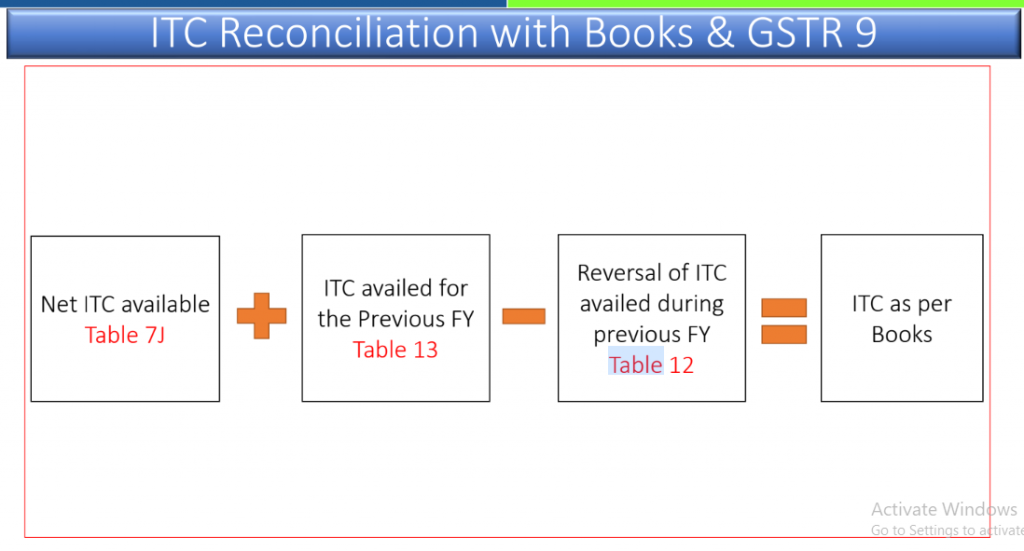

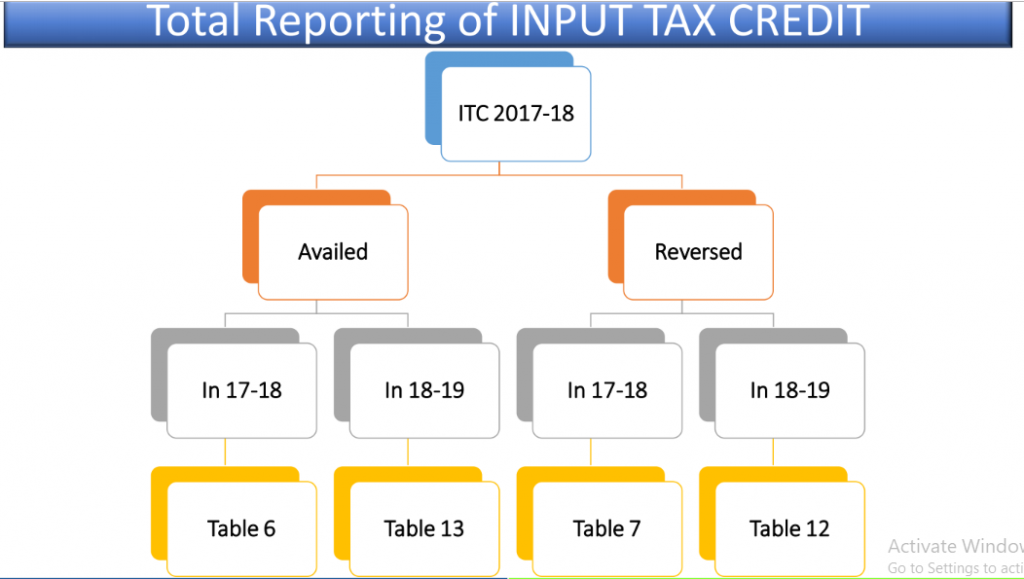

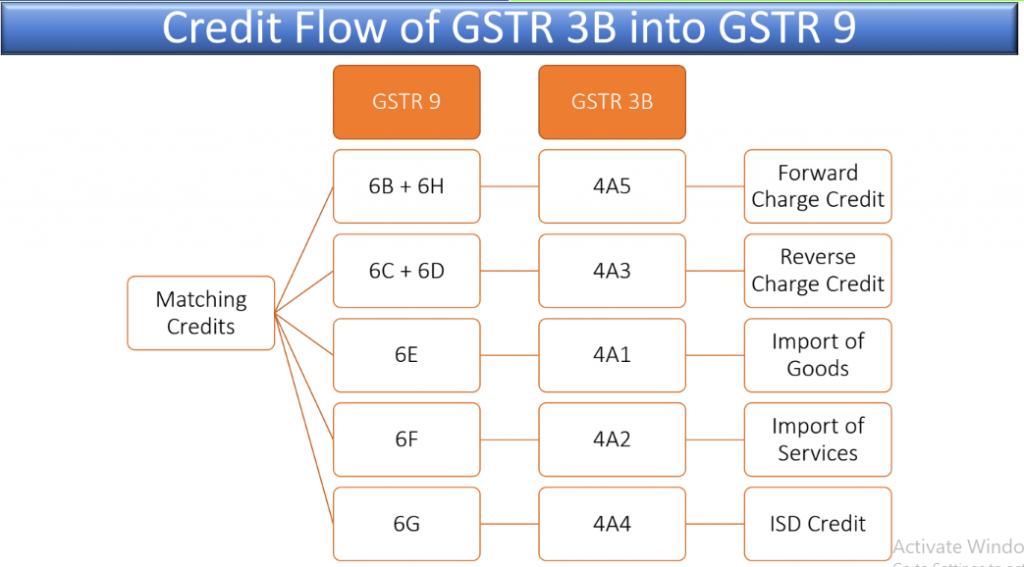

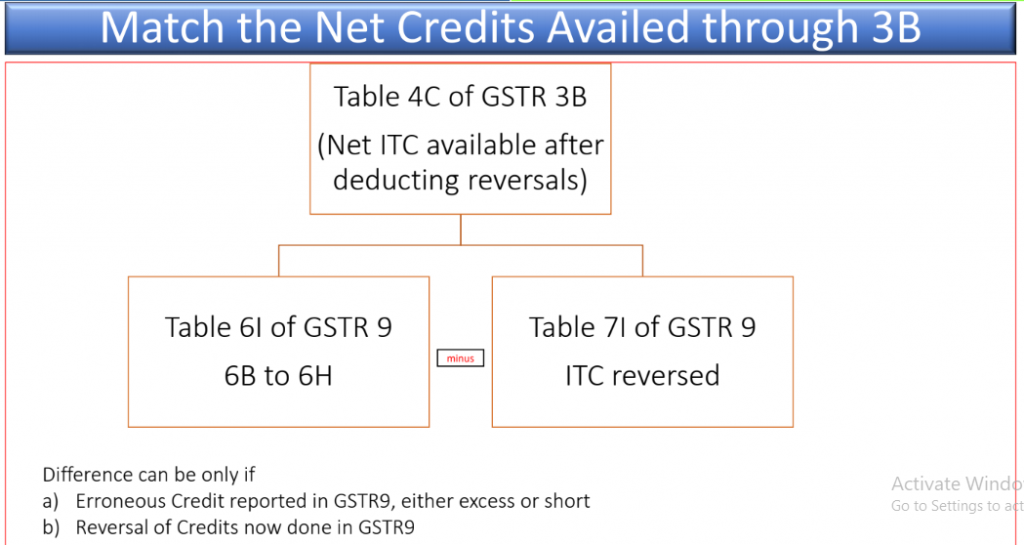

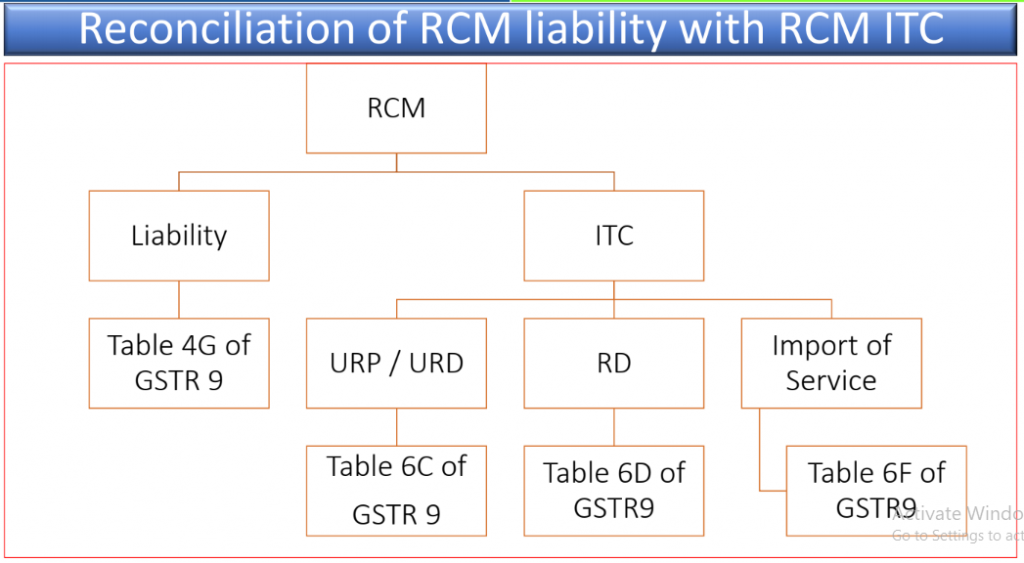

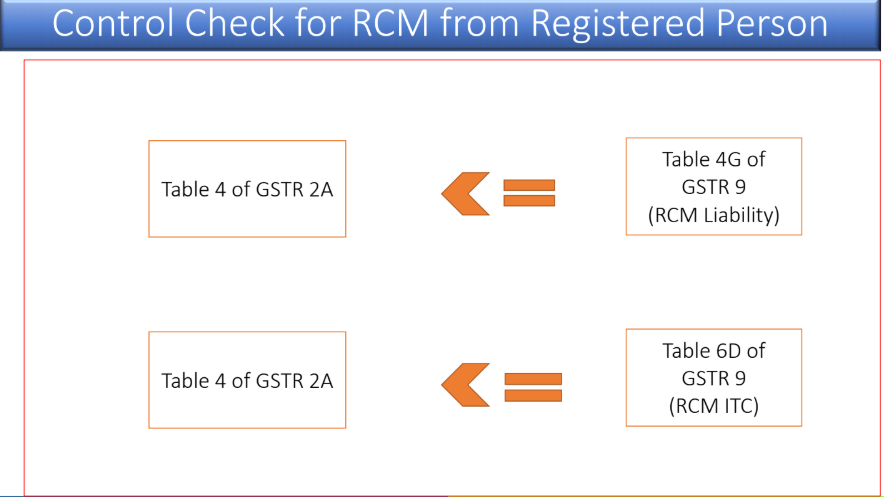

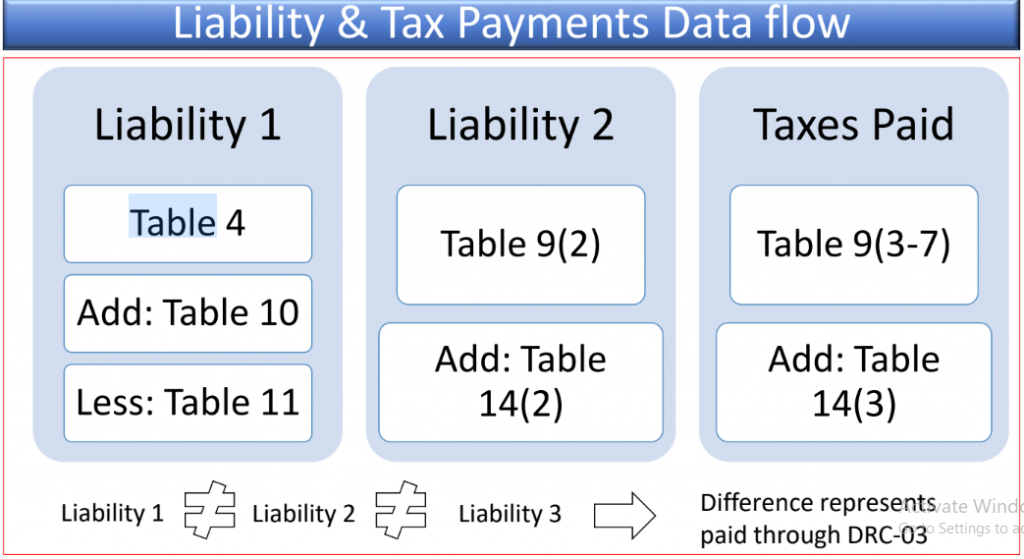

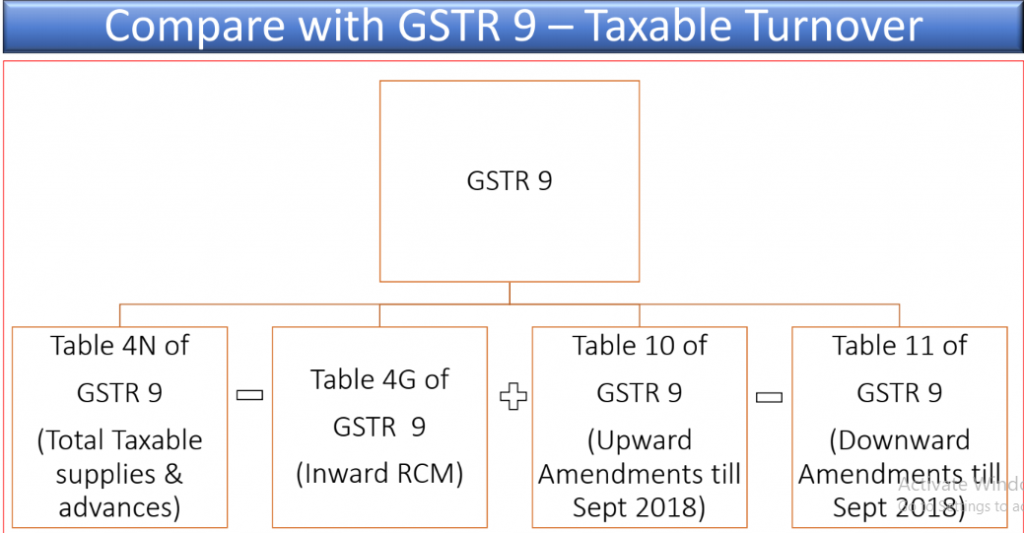

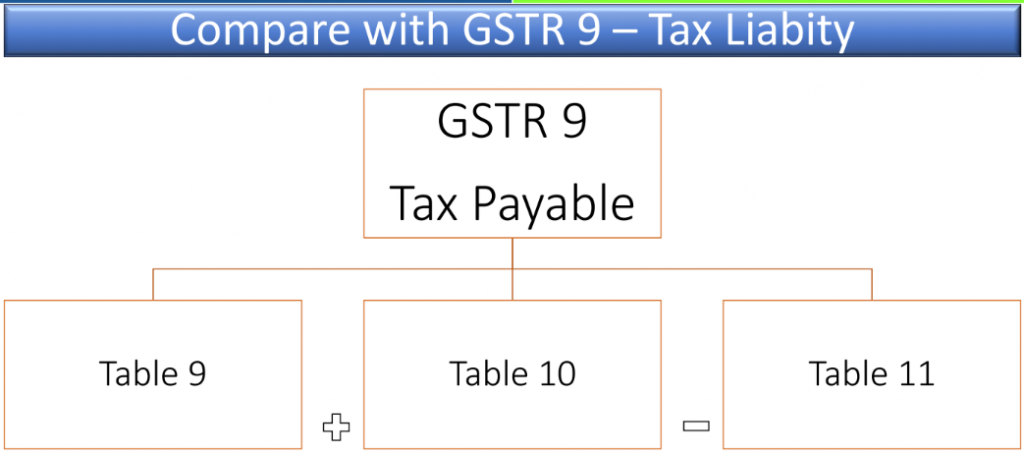

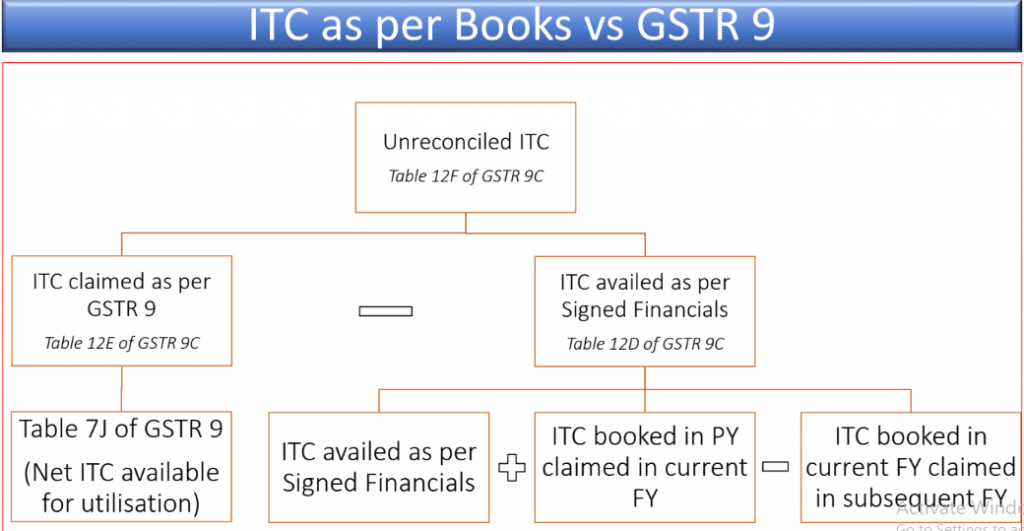

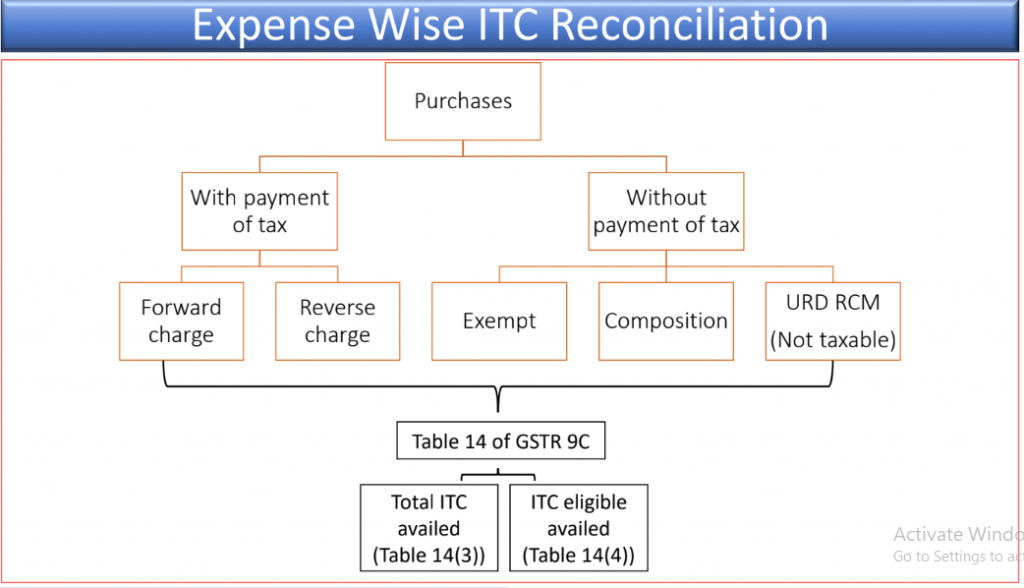

DATA FLOW OF INPUT TAX CREDIT

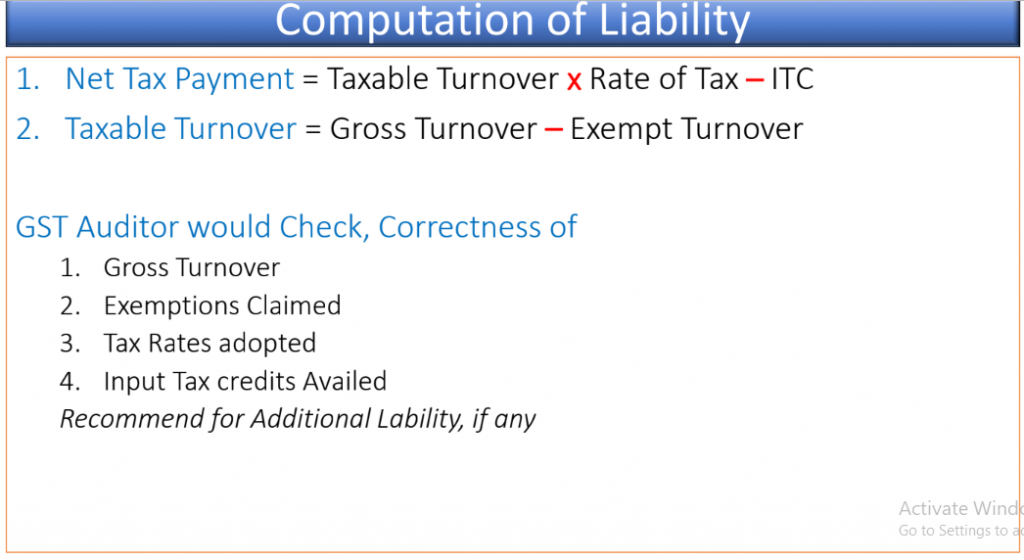

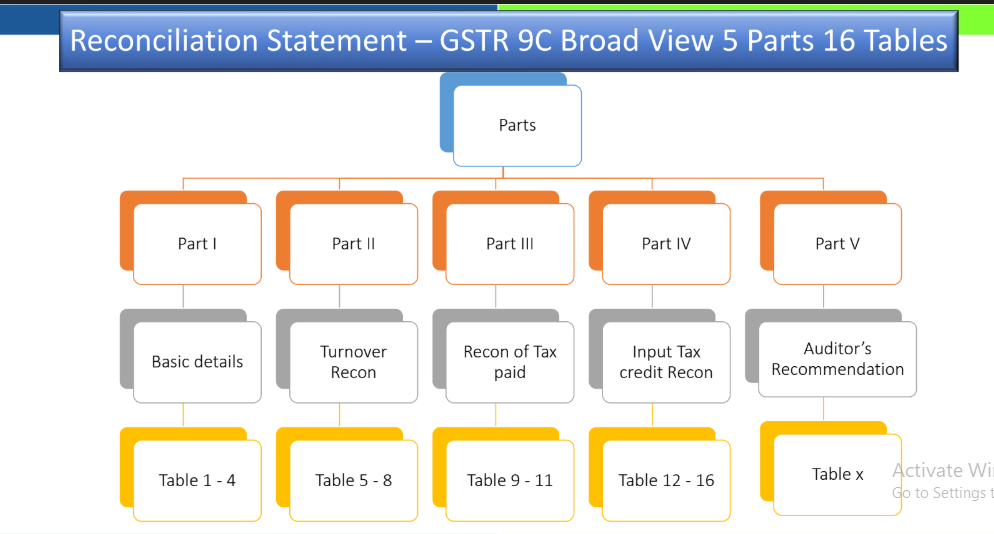

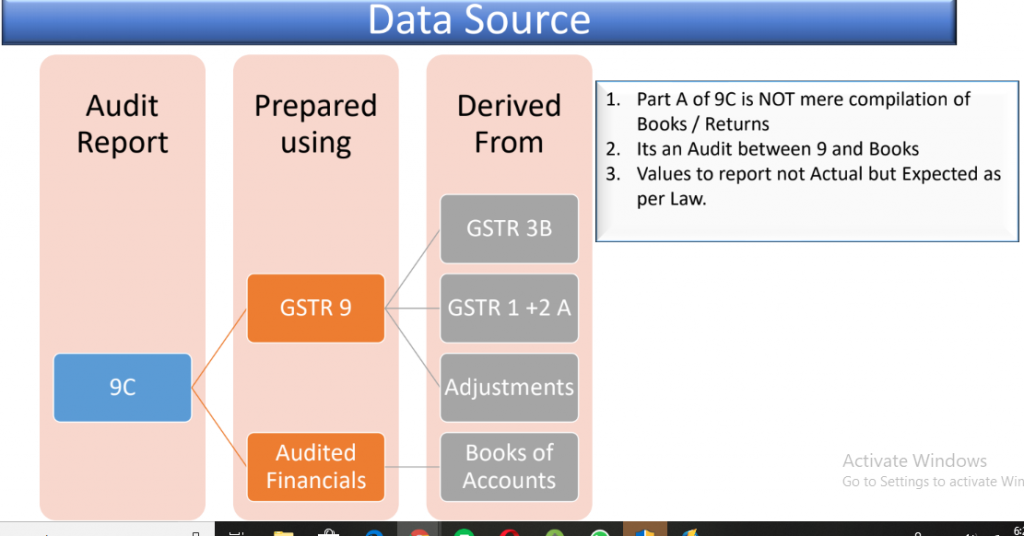

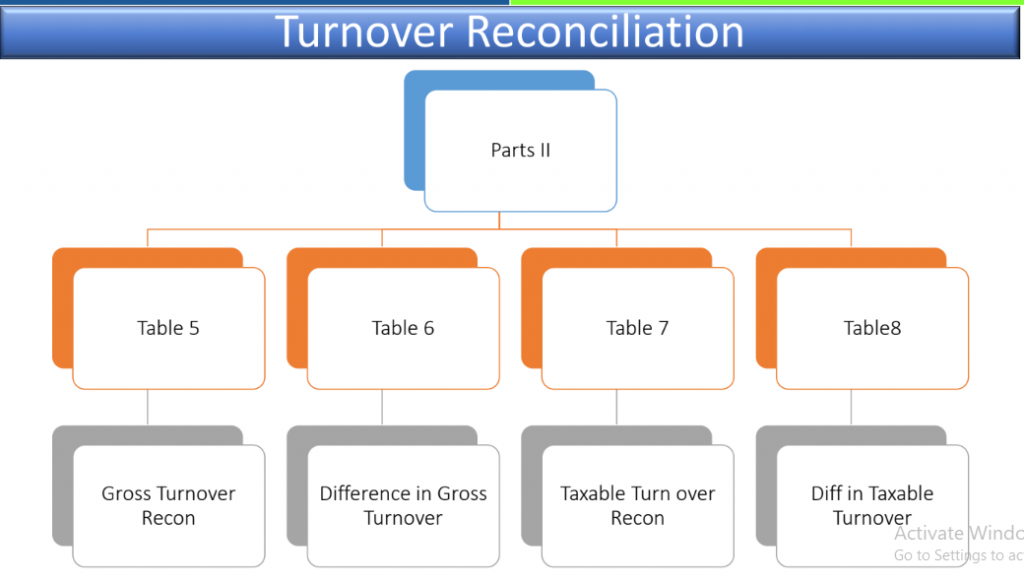

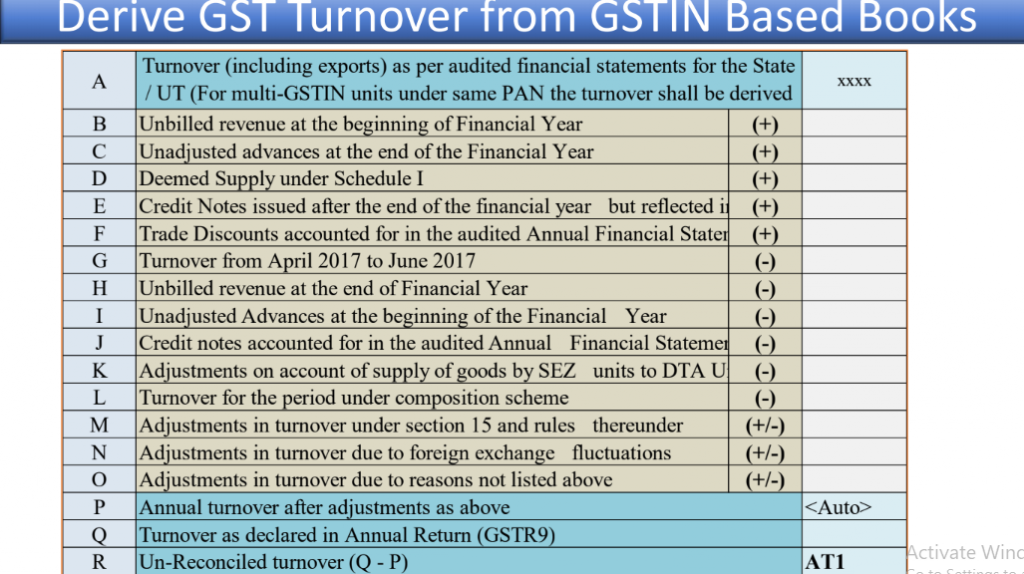

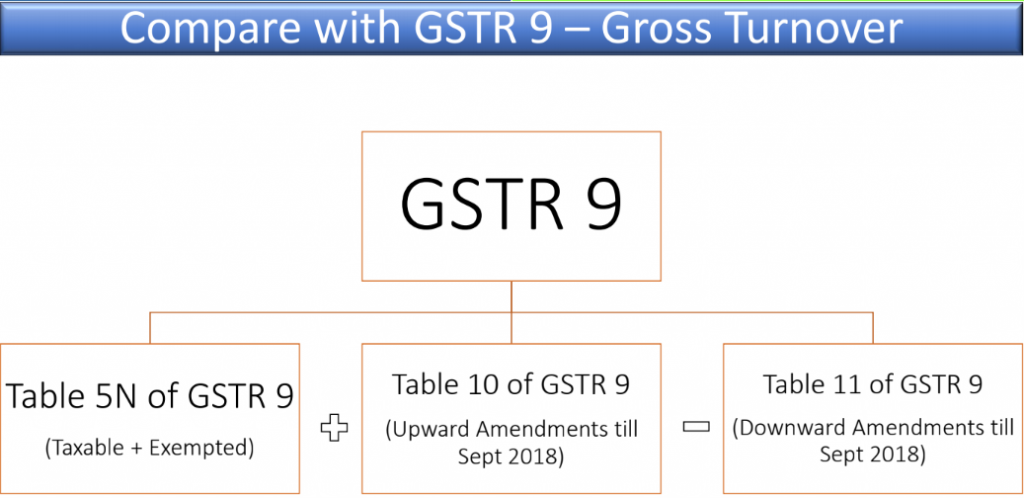

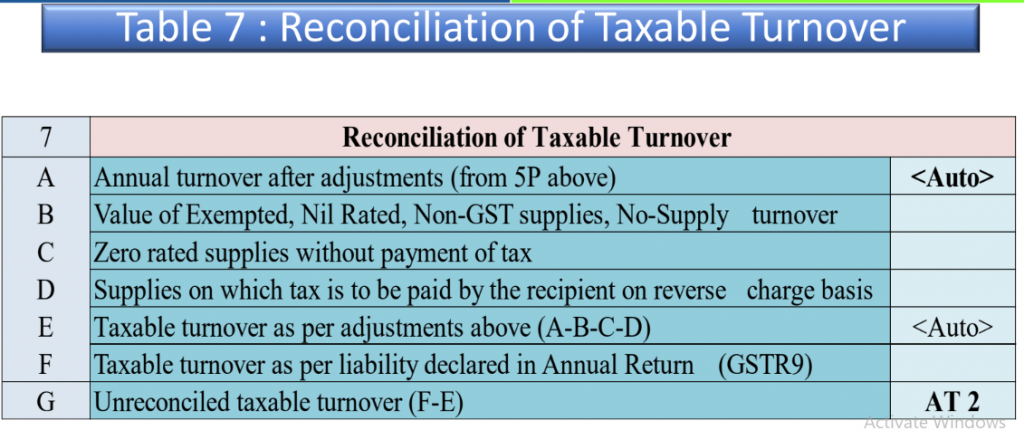

GSTR 9C

GST Annual Audit

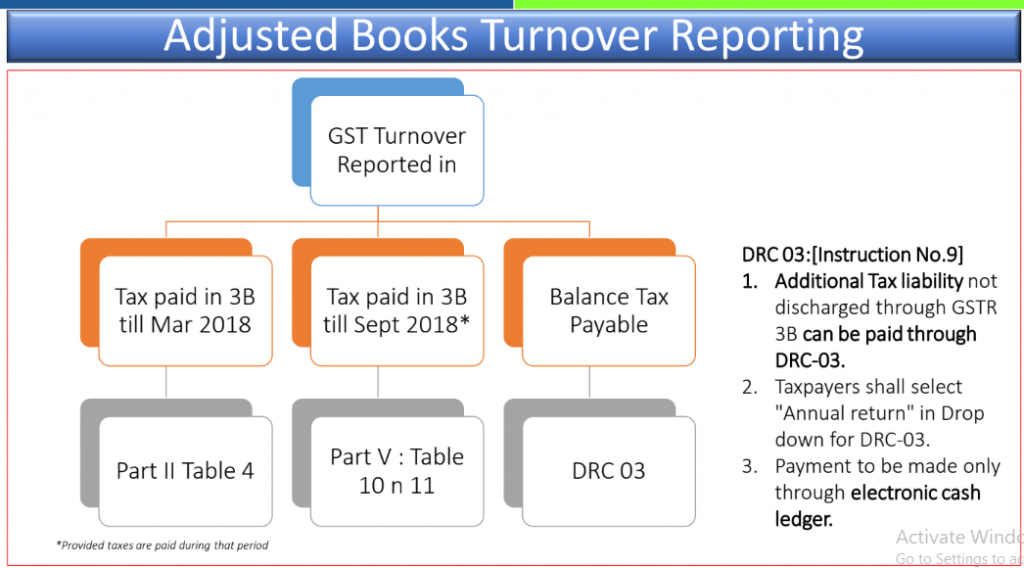

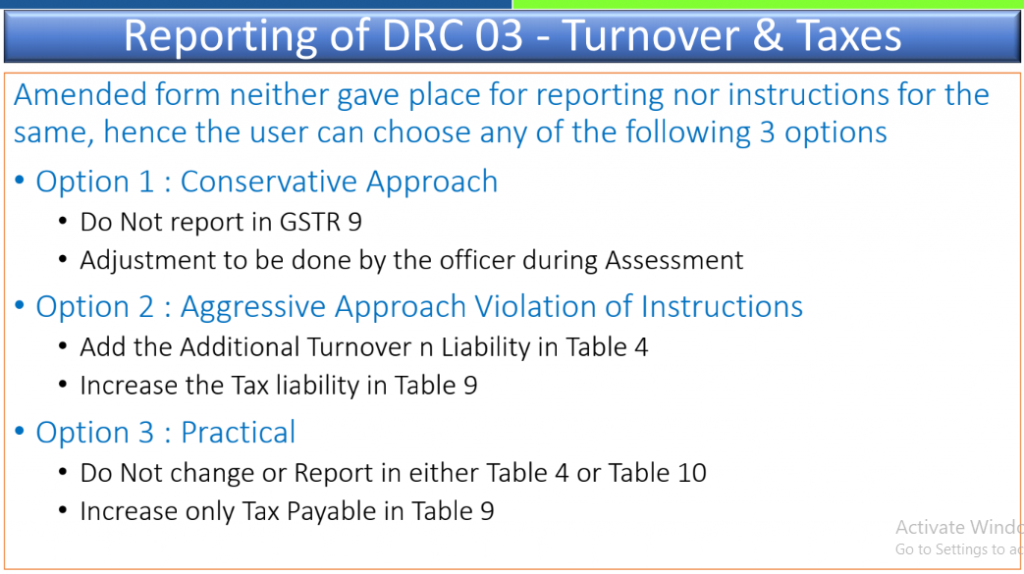

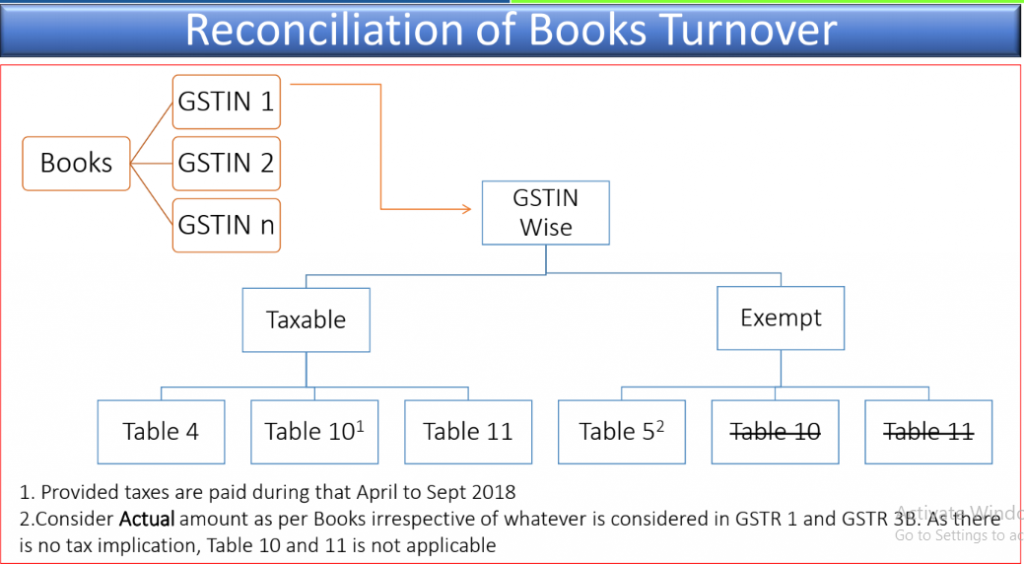

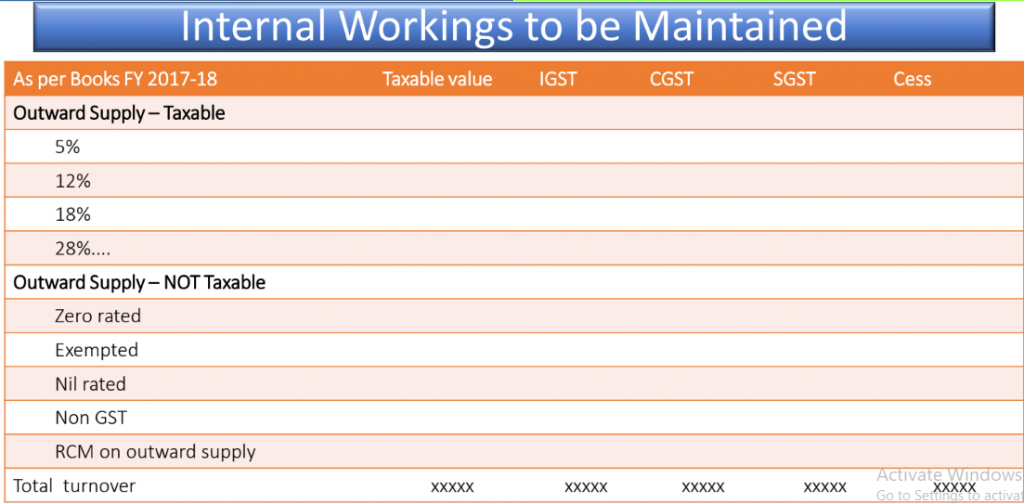

adjustments to books of accounts

FY2018-19

CA Venu Gopal Gella

CA Venu Gopal Gella

Keep learning

Banglore, India

GST