Deduction available to Individual and HUF

Deduction available to Individual and HUF from Gross Income under IT Act

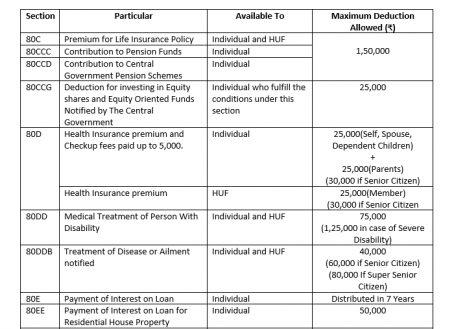

The date for filing the Income Tax Return may have extended by the Government from 31st July 2018 to 31st August 2018. But still, the individuals and HUF’s have to file the return. So, the major problems faced by the people are that they don’t know about the deductions to be claimed properly. So we have brought you the Summary of the deduction available to Individual and HUF Under Section 80C to 80U. These deductions should be deducted after the calculation of the Gross Taxable Income.

Following are the deductions available in the brief:

Deduction Table

|

Section |

Particular |

Available To |

Maximum Deduction Allowed (₹) |

|

Premium for Life Insurance Policy |

Individual and HUF |

1,50,000 |

|

|

Contribution to Pension Funds |

Individual |

||

|

Contribution to Central Government Pension Schemes |

Individual |

||

|

Deduction for investing in Equity shares and Equity Oriented Funds Notified by The Central Government |

Individual who fulfill the conditions under this section |

25,000 |

|

|

Health Insurance premium and Checkup fees paid up to 5,000. |

Individual |

25,000(Self, Spouse, Dependent Children) + 25,000(Parents) (30,000 if Senior Citizen) |

|

|

Health Insurance premium |

HUF |

25,000(Member) (30,000 if Senior Citizen |

|

|

Medical Treatment of Person With Disability |

Individual and HUF |

75,000 (1,25,000 in case of Severe Disability) |

|

|

Treatment of Disease or Ailment notified |

Individual and HUF |

40,000 (60,000 if Senior Citizen) (80,000 If Super Senior Citizen) |

|

|

Payment of Interest on Loan |

Individual |

Distributed in 7 Years |

|

|

Payment of Interest on Loan for Residential House Property |

Individual |

50,000 |

|

|

Rent Paid for Residential Accommodation |

Individual not Receiving HRA |

Least of: (a)Rent – 10% Total Income (b)25% Total Income (c)5,000/Month |

|

|

Royalty for Books(Other than Text Book) |

Individual(Author) |

In Lump sum – 3,00,000 15% of Book Sold in PY |

|

|

Royalty on Patents registered on or Before 1st April 2003 |

Individual(Patentee) |

3,00,000 |

|

|

Interest on saving account |

Individual and HUF (Other than Senior Citizen) |

10,000 |

|

|

Interest on saving account |

Individual (Senior Citizen) |

Senior Citizen |

|

|

Person certified to be with Disability (Certified in PY) |

Individual |

75,000 1,25,000(Severe Disability) |

Note: There may certain condition to avail the deduction. So, please also refer the bare act by Clicking on the Sections mentioned In the Table. Confirm the Available Deduction available to Individual and HUF before Claiming Such deduction.

Neeraj Kumar Rohila

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

New Delhi, India

A Learner, who wants to learn from the experience.