Delhi HC in the case of Bhargava Motors Versus Union of India

Citations: Tara Exports v. Union of India Section 140 (3) of the CGST Act, 2017 Rule 120

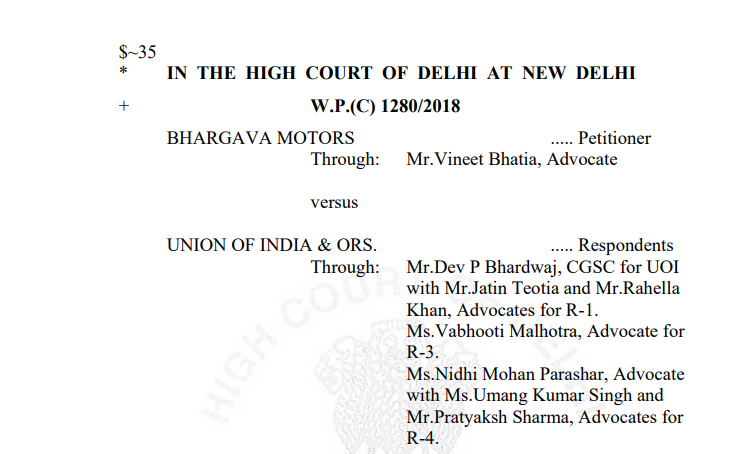

IN THE HIGH COURT OF DELHI AT NEW DELHI W.P.(C) 1280/2018 BHARGAVA MOTORS ..... Petitioner Through: Mr.Vineet Bhatia, Advocate versus UNION OF INDIA & ORS. ..... Respondents Through: Mr.Dev P Bhardwaj, CGSC for UOI with Mr.Jatin Teotia and Mr.Rahella Khan, Advocates for R-1. Ms.Vabhooti Malhotra, Advocate for R-3. Ms.Nidhi Mohan Parashar, Advocate with Ms.Umang Kumar Singh and Mr.Pratyaksh Sharma, Advocates for R-4. CORAM: JUSTICE S.MURALIDHAR JUSTICE I.S.MEHTA O R D E R 13.05.2019 Dr. S. Muralidhar, J.: 1. A procedural glitch in the GST Network that has prevented the Petitioner from claiming input tax credit of the excise duty paid by its vendor, is the subject matter of the present petition. 2. The Petitioner states that he is a trader and a dealer/distributor of the automobile company Mahindra & Mahindra Ltd. The Assessee is engaged in the business of trading of auto parts. He stands registered under the Delhi Value Added Tax Act, 2004. After the enactment of the Central Goods & Services Tax Act 2017 (CGST Act), the Petitioner was granted registration thereunder. Under Section 140 (3) of the CGST Act, the Petitioner is entitled to claim credit of eligible duties in respect of the inputs held in stock and the inputs contained in semi furnished or furnished goods held in stock on the appointed day i.e. 30th June 2017. On this basis according to the Petitioner, although he was not liable to be registered under the Central Excise Act, 1944, he is entitled to claim credit of the excise duty paid on the goods in stock with him. He has accordingly calculated the credit due to him as Rs.74,96,069/-. 3. According to the Petitioner there are certain other goods which do not involve the central excise component and the approximate credit that can be claimed by him thereon, which has to be postponed to the stage of actual sale of such goods, works out to Rs.10.5 lakhs. He states that as regards the excise duty credit he has to fill up form TRAN-1 and for the other type of credit he has to fill up form TRAN-2. 4. According to the Petitioner there were a lot of technical glitches in uploading TRAN-1 form on the common portal within the prescribed period of 90 days. The due date for furnishing TRAN-1 was accordingly postponed from time to time and finally up to 27th December 2017. The Petitioner states that he filed GST TRAN-1 on 27th December 2017 claiming the credit of Rs.74,96,069/-. He also furnished details of the stock held by him on that date. He claims to have received an e-mail from the GST Network (GSTN) portal about successful filing of the said TRAN-1 form. According to the Petitioner he was surprised to note that in his electronic credit ledger the aforementioned credit was not reflected. He thereafter approached the GST help desk and also wrote an e-mail. In the circumstances, he filed the present writ petition in which notice was issued on 13th February 2018. 5. A detailed order was passed by this Court on 7 th January 2019 discussing the affidavit filed on behalf of the GSTN (Respondent No.4) which manages/administers the electronic portal. Reference was also made to the minutes of the meeting of the IT Grievance Redressal Committee held on 21st August 2018. The Court then observed in paras 5, 6 and 7 in order dated 7 th January 2019. “5. Given these circumstances and the fact that the petitioner has asserted that substantial credit was available to it on the transactions which it conducted prior to 30.03.2017, for which the law entitled it to credit, it appears to the Court that the authorities have so far not looked into the merits of the claim for input credit but rather rejected his entire entitlement itself on the ground that the credit reflected in the electronic ledger does not show any figure. The conundrum which the Court is presented with here is that if the petitioner were to obtain a screenshot of the figures it had filled just before it actually uploaded TRAN-I, the Revenue would have then contended that those figures were inchoate as the document would not have been final and was merely at the stage of preparation. It also appears to the Court that after the electronic form is filled, no provision for its "review" was made available to the assessee before uploading it. The lack of this facility has complicated the issue, because if such facility or provision would be made available, the individual assessees could have obtained screenshots just before uploading the form. The other method by which this issue could have been resolved was that the automatically generated response could have itself indicated the figures. That, however, does not appear to be the case. 6. In these circumstances, the Court is of the opinion that the respondents should disclose as to what was actually filled in the TRAN-I Form [whether for the first time or the second time when it was uploaded], by the petitioner in this case and the basis of its assertion that no credit was available to it, having regard to the fact that the petitioner claims credit on the basis of real transactions in real goods. 7. The concerned respondents, i.e. GST Council and the respondent No.4 shall file affidavits before the Court within two weeks. The respondent No.4 shall also make available to the Court the necessary files relating to this case.” 6. Pursuant thereto affidavits have been filed on behalf of the GSTN and on behalf of the Commissioner, Central Tax GST, Delhi. In the affidavit dated 14th February 2019 it is stated on behalf of the GSTN as under: “16. I state that once value is entered in the FORM GST TRAN-1 and is duly saved and submitted, the same is posted in electronic ledger of the taxpayer for use to set off liabilities when the taxpayer "submits" FORM GST TRAN-1. The electronic ledger is visible on the portal to the taxpayer. The taxpayer can also view the FORM GST TRAN-1 by clicking on individual TRAN-1 form by logging into GST Portal. This FORM GST TRAN-1 is available with the Petitioner even after submission and the Petitioner has deliberately not filed the same. The logs as available with the Respondent No.4 are being placed before this Court hereinabove.” 7. It is not in dispute that the documents with the Petitioner to support its claim for the aforementioned excise duty and other credit are yet to be examined by the authorities. At this stage they find themselves precluded from doing so because the TRAN-1 filled by the Petitioner on the portal does not reflect the amount claimed as a credit towards excise duty already paid. 8. Counsel for the Petitioner points out that as of present the portal does not permit a registered trader/dealer to save on his/her system the filled up TRAN-1 or TRAN-2 form. According to him it does not even permit a print out of a filled up form. This makes it difficult for the trader/registered dealer to know whether the form has been correctly filled up. Counsel for the Respondents on the other hand points out that a revision is possible, but only once in terms of Rule 120 A. She states that despite the Petitioner having availed of the facility of revision, the TRAN-1 form still does not reflect the credit amount. 9. At this stage, the Court is not concerned with the issue whether the Petitioner is entitled to the input tax credit as claimed by him. This is yet to be examined by the authorities. However, the issue is about the technical glitch in the system which does not permit a rectification in a situation where a dealer may have, due to inadvertence, or a bonafide error, not correctly filled up a form or where the system, due to a limitation in the algorithm/software programme, does not accept the entries sought to be made by the dealer. 10. The GST system is still in a „trial and error phase‟ as far as its implementation is concerned. Ever since the date the GSTN became operational, this Court has been approached by dealers facing genuine difficulties in filing returns, claiming input tax credit through the GST portal. The Court‟s attention has been drawn to a decision of the Madurai Bench of the Madras High Court dated 10th September 2018 in W.P.(MD) No.18532/2018 (Tara Exports v. Union of India) where after acknowledging the procedural difficulties in claiming input tax credit in the TRAN-1 form that Court directed the Respondents “either to open the portal, so as to enable the petitioner to file the TRAN 1 electronically for claiming the transitional credit or accept the manually filed TRAN 1” and to allow the input credit claimed “after processing the same, if it is otherwise eligible in law”. 11. In the present case also the Court is satisfied that the Petitioner‟s difficulty in filling up a correct credit amount in the TRAN-1 form is a genuine one which should not preclude him from having his claim examined by the authorities in accordance with law. A direction is accordingly issued to the Respondents to either open the portal so as to enable the Petitioner to again file TRAN-1 electronically or to accept a manually filed TRAN-1 on or before 31st May 2019. The Petitioner‟s claims will thereafter be processed in accordance with law. 12. With a view to ensure that in future such glitches can be overcome, the Court directs the Respondents to consider providing in the software itself a facility of the trader/dealer being able to save onto his/her system the filled up form and also a facility for reviewing the form that has been filled up before its submission. It should also permit the dealer to print out the filled up form which will contain the date/time of its submission online. The Respondents will also consider whether there can be a message that pops up by way of an acknowledgment that the Form with the credit claimed has been correctly uploaded. 13. The petition is disposed of in the above terms. 14. Dasti.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.