Delhi HC Order in the case of R.R. Distributors Pvt. Ltd. Versus Commissioner of Central Tax

Table of Contents

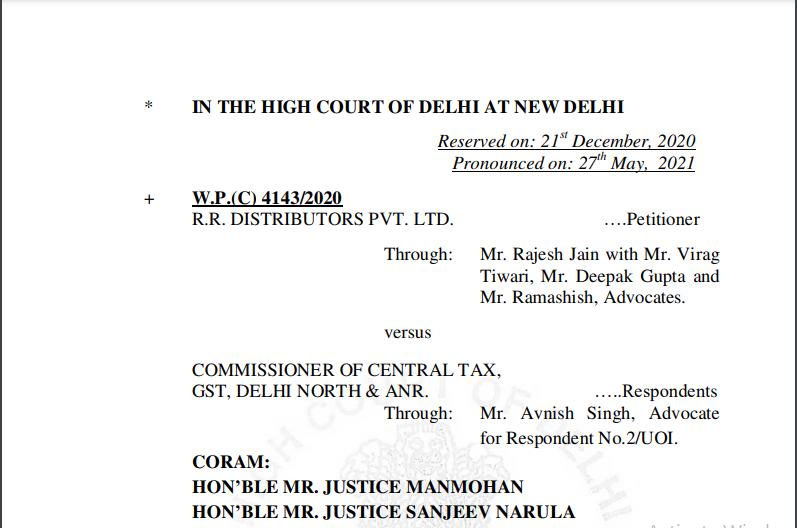

Case Covered:

R.R. Distributors Pvt. Ltd.

Versus

Commissioner Of Central Tax, GST, Delhi North

Facts of the Case:

The present petition was heard on 21st December 2020 along with other batch matters relating to difficulties faced by taxpayers in filing form GST TRAN-1 (hereinafter “TRAN-1 Form”). However, considering that the issue involved in the present petition is slightly different as compared to the other batch matters, it is being decided separately by way of this judgment.

The Petitioner- R.R. Distributors Private Limited, is engaged in the trading of paper and other like goods. It migrated from the Delhi Value Added Tax Act, 2004 into the GST regime, and as on the appointed date under the GST laws, it had a closing stock of finished goods of Rs. 7,44,41,433/- on which it was entitled to claim a transitional input tax credit (hereinafter “ITC”) in terms of Section 140(3) of the CGST Act, 2017 (hereinafter “the Act”). Accordingly, on 22nd November 2017, the petitioner filed the statutory TRAN-1 Form for transitioning ITC of Value Added Tax (hereinafter “VAT”) of Rs. 23,57,203/- under the DGST Act, 2017. On 27th December 2017, an additional claim of State tax of Rs. 59,433/- was made and transitional ITC of Rs. 52,166/- was claimed under the Act. For claiming the ITC on the stock of Rs. 7,44,41,433/-, Petitioner filed TRAN-2 Form for which no date had been specified under Rule 117(4)(b)(iii) of the CGST Rules, 2017 (hereinafter “the Rules”). On 4th January 2018, the Petitioner attempted to file the TRAN-2 Form for availing the transitional credit amounting to Rs. 17,35,293/- on the above stock under the proviso to Section 140(3) of the Act read with Rule 117(4) of the Rules. However, it was not allowed on account of the following reasoning:

a) “you have not declared anything in Part 7B of table 7(a) of TRAN-1, so you are not permitted to fill any details in table 4 of TRAN-2.

b) you have not declared anything in table 7(d) of TRAN-1, so you are not permitted to fill any details in table 5 of TRAN-2”

On the same date, the Petitioner informed GSTN about the nonacceptance of TRAN-2 Form via email, however, no response has been received till date.

Observations of the Hon’ble Court:

We have duly considered the contentions urged by the counsels. A situation similar to the one faced by the present Petitioner has already been considered by this Court in the case of Blue Bird Pure Pvt. Ltd. v. Union of India and Ors. 2 In the said case as well, the Petitioner had committed an inadvertent error in showing available stock of goods as on 30th June 2017 in Column 7(d) instead of 7(a) of the TRAN-1 Form. Noting and relying upon the judgments of this Court in Bhargava Motors v. Union of India and Ors., and Kusum Enterprises Pvt. Ltd. and Ors. v. Union of India and Ors., 4 the Court had directed the Respondents to enable the Petitioner to rectify TRAN-1 Form.

As can be seen from the aforesaid decisions, this Court has held that inadvertent and genuine mistakes in filling up the correct details of credit in TRAN-1 Form should not preclude taxpayers from having claims examined by the authorities in accordance with the law. This Court has consistently been issuing directions to the Respondents and granting relief to such taxpayers. When the Petitioner attempted to upload TRAN-2 Form, it was prevented to do so because of the error committed by him while making the declaration in the TRAN-1 Form, however, the system did not enable the Petitioner to revise TRAN-1 Form on the system. In Blue Bird Pure (supra), this Court had, in fact, observed that the Respondents ought to have provided a facility in the system itself for rectification of errors which are clearly bona fide. Further, the Court had also noticed that although the system provided for revision of a return, the deadline for making the revision coincided with the last date for filing the return i.e., 27th December 2017, rendering such facility to be impractical and meaningless.

The Decision of the Court:

In this view of the matter, we see no reason to deny the Petitioner the relief as sought for in the petition. Accordingly, the petition is allowed, and we direct the Respondents to either open the online portal so as to enable the Petitioner to file the rectified TRAN-1 Form electronically or accept the same manually with necessary corrections, on or before 30th June 2021. The Petitioner will thereafter be permitted to correspondingly file the TRAN-2 Form which also shall be accepted either electronically by opening the online portal, or manually.

The petition is disposed of in the above terms.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.