Department didn’t adjourned the time for reply and rejected refund- Rejection dropped by court

Table of Contents

Cases Covered:

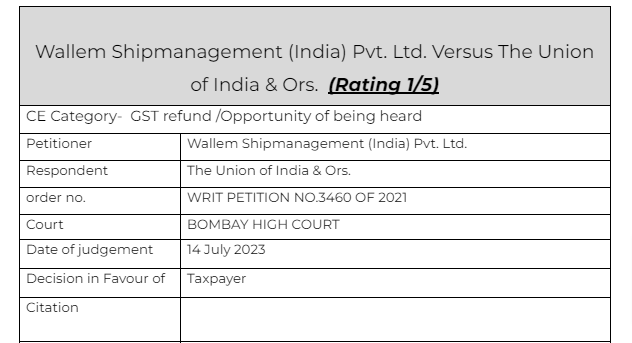

Wallem Shipmanagement (India) Pvt. Ltd. Versus The Union of India & Ors

Facts of the case

A refund application was filed by the taxpayer. The respondent issued a SCN. The applicant requested for the extension of the hearing date as there was a PANDEMIC and he was unable to file a reply in such a short period. The deptt extended the date for three days in answer to his request of 15 days. The taxpayer again requested to extend the date.

The department rejected the refund.

The applicant approached the court for this behaviour of the department

Observations & Judgement of the court

The court observed that in this case the conduct of the department is unjust.

Certainly prejudice has been suffered by the Petitioner by the impugned order dated 20th October 2020 rejecting the application of the Petitioner for refund of Rs.69,96,170/-.

For such reasons, the impugned order is required to be set aside on account of violation of principle of natural justice. We, therefore, order as under:-

(a) Order dated 20th October 2020 rejecting the refund application of the Petitioner is set aside; (b) Respondent No.2 shall issue a fresh show cause notice to the Petitioner within a period of two weeks from today;

(c) The Petitioner to fle its reply to the show cause notice within a period of two weeks from the date of intimation of the show cause notice referred to in (b) above;

(d) Respondent No.2 to consider the reply of the Petitioner and pass a fresh speaking order within a period of four weeks from the date of fling the reply;

(e) Needless to say that Respondent No.2 will give an opportunity of personal hearing before passing the order;

(f) All contentions of the parties are expressly kept open.

Read & Download the Full Wallem Shipmanagement (India) Pvt. Ltd. Versus The Union of India & Ors

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.