Detailed Analysis of GSTR 9 and GSTR 9C

Table of Contents

Detailed Analysis of GSTR 9 and GSTR 9C

Requirement of Audit

Annual Return

Section 44(1): A registered person is required to furnish an annual return.

Reconciliation & Audit

Section 35(5): Requirement to get accounts and other records audited by a CA/CWA if aggregate turnover during a financial year exceeds Rs.2 crores.

Section 44(2): A reconciliation statement to be furnished along with an annual return for the registered person required to get the accounts audited.

Related Topic:

GSTR 9 & 9C with FEW SAMPLE DISCLOSURES

Due date

Annual Return and Audit Report to be furnished on or before 30.9.2020 for the FY 2018-19.

Outward Supply

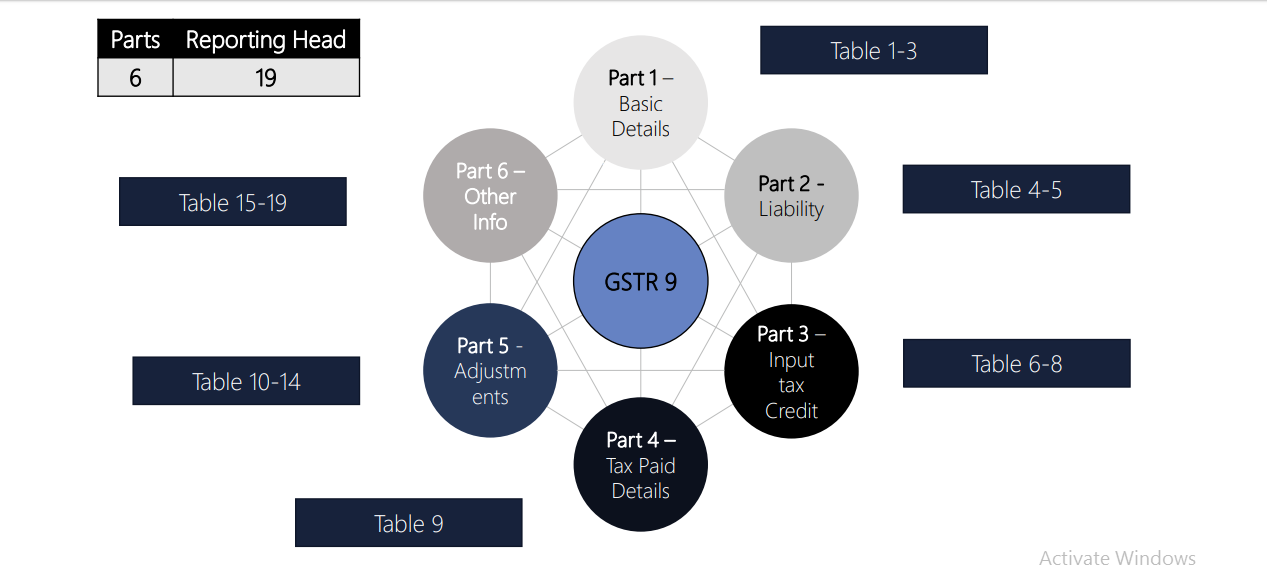

Overview of GSTR 9

Details of GSTR 9

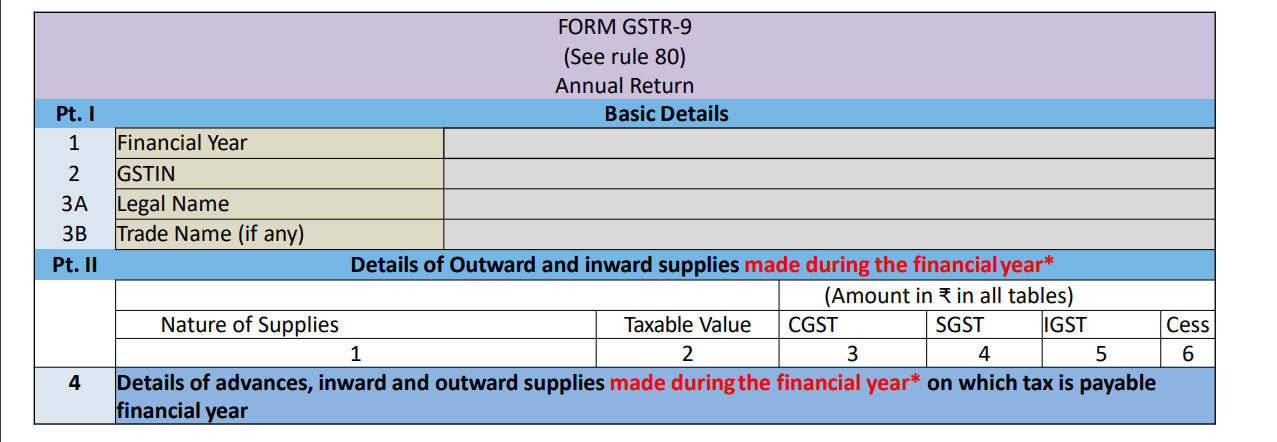

GSTR9- Annual Return

Outward heads Details

▪ Table 4: Details of Outward supplies & Inward Supplies on which tax is payable

▪ Table 5: Details of Outward supplies on which tax is not payable

▪ Table 10 & 11: Supplies/tax declared/reduced through Amendments

▪ Note: Reconciliation of GSTR1, GSTR 3B and Books important before filling of information in the above tables

Related Topic:

Specific points for GSTR 9 and GSTR 9C for FY 2019-20

Inward Details

▪ Table 6: Details of ITC Availed

▪ Table 7: Details of ITC reversed

▪ Table 8: Reconciliation of ITC availed with GSTR 2A

▪ Table 12 &13: Details of ITC availed/reversed through Amendments

▪ Note: Reconciliation of GSTR2A, GSTR 3B and Books important before filling of information in the above tables

Related Topic:

Mapping of turnover from GSTR 9 to GSTR 9C

Others

▪ Basic Details, Details of Taxes Paid, Details of Demands and Refunds

▪ Information on supplies received from composition taxpayers, deemed supply under section 143 and goods sent on approval basis.

▪ HSN wise summary of inward and outward supplies

Related Topic:

Instructions of Form GSTR-9

Outward Supplies

Table 4:-

• Details of Outward supplies & Inward Supplies on which tax is payable

Table 5:-

• Details of Outward supplies on which tax is not payable

Table 10&11:-

• Supplies/tax declared/reduced through Amendments

Note: Reconciliation of GSTR1, GSTR 3B, and books is important before the filing of information in the above tables.

Related Topic:

CREATING JSON FOR GSTR 9C

Walkthrough of GSTR9 outward supplies

- GSTR 9 requires verification by the taxpayers. But no requirement to obtain certification from auditors.

- Additional tax can be paid along with this form through Form DRC-03.

- Information of Apr 18 to Mar 19 to be reported in this form, except Part V where details of April 19 to Sep 2019 are submitted

Related Topic:

Errors in Generating or Downloading GSTR-9C JSON File and their Resolution

Read & Download the Full Copy in pdf:

CA Tushar Aggarwal

CA Tushar Aggarwal