Details Analysis on Filing of PMT-09

Table of Contents

Details Analysis on Filing of PMT-09

The CBIC has recently introduced Form PMT-09 for the transfer of an amount from one head to another head. This enables a registered taxpayer to transfer any amount of tax, interest, penalty, etc. that is available in the electronic cash ledger, to the appropriate tax or cess head under IGST, CGST and SGST in the electronic cash ledger.

Hence, if a taxpayer has wrongly paid CGST instead of SGST, he can now rectify the same using Form PMT-09 by reallocating the amount from the CGST head to the SGST head.

Key points to note about Form GST PMT-09:

- If the wrong tax has already been utilized for making any payment, then this form is not useful. This Form only allows the transfer of the amounts that are available in the electronic cash ledger.

- For instance, in case an amount has been misreported in the GSTR-3B, there is no way to rectify the same as the GSTR-3B is non-editable. In such a case, only an adjustment in the next month’s return can be made.

- The amount once utilized and removed from the cash ledger cannot be reallocated.

- The major head refers to- Integrated tax, Central tax, State/UT Tax, and Cess.

- Minor head refers to- Tax, Interest, Penalty, Fee, and Others.

Filing Procedure of PMT-09

To file the GST PMT-09 on the GST Portal, perform the following steps:

1. Access the GST URL. The GST Home page is displayed.

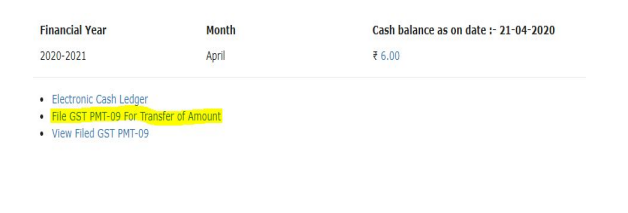

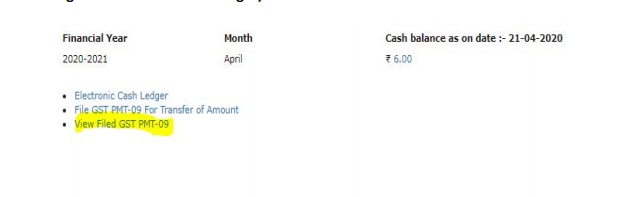

2. Click the Services > Ledgers > Electronic Cash Ledger.

3. Click on “File GST PMT-09 For Transfer of Amount”, then the following window is displayed with following details:

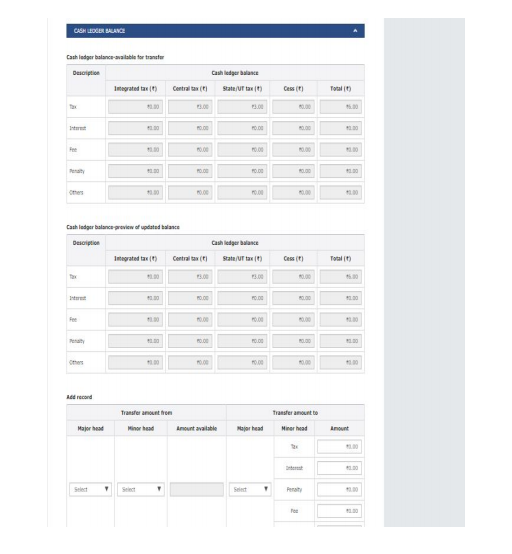

- Cash ledger balance-available for transfer: In this table, we will able to view the balance available in an electronic cash ledger.

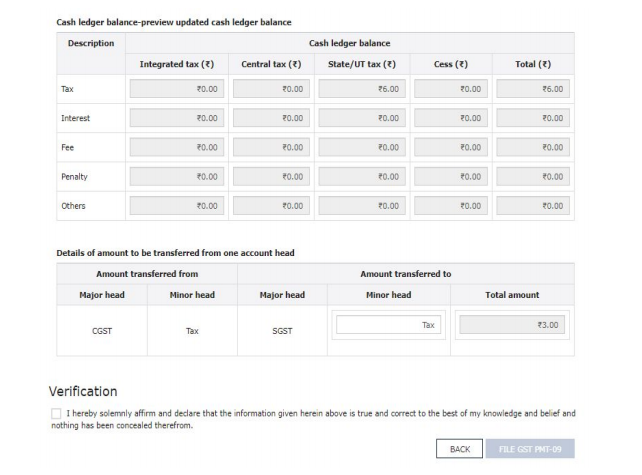

- Cash ledger balance-preview of updated balance: In this table, we will able to view the updated balance of cash ledger after updating the details as per the requirement (Under Major head / Minor head).

- Add record: In these tables, we will enter the details in “Transfer amount from” and “Transfer amount to” column as per the requirement

4. We need to enter the details in the “Add record” table to proceed with the Form. Let’s discuss this with the help of an example.

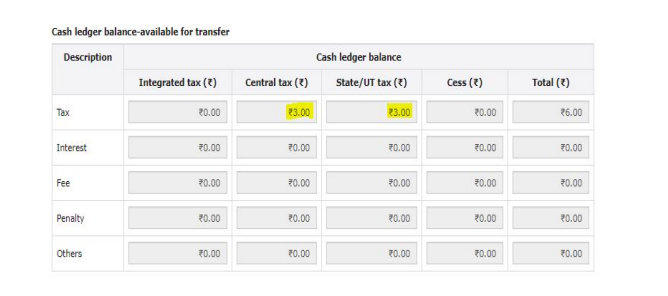

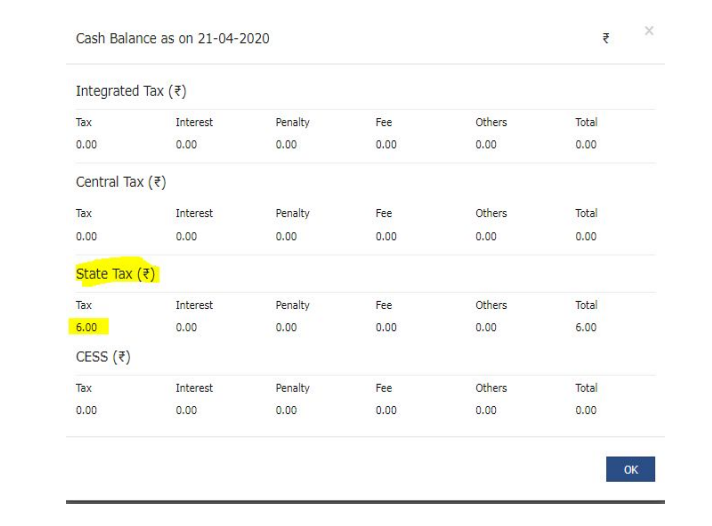

My electronic cash ledger balance is Rs. 6 ( Rs. 3 under CGST and SGST) under tax head and I need to transfer the CGST amount in SGST head with the same minor head i.e. tax. Let’s see with the help of a screenshot:

i. Please see my Cash ledger balance-available for transfer, where Rs. 6 balance is reflected under tax head.

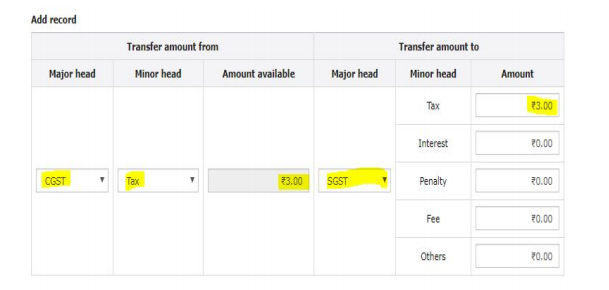

ii. We will enter the details in “Add record” table:

As per the example, I need to transfer the CGST amount in SGST head with the same minor head i.e. tax. The following details I have entered:

Transfer Amount From In this table, we need to enter the details of the head (Major, Minor, and Amount available) from which amount needs to be transferred.

Transfer Amount to In this table, we need to enter the details of the head (Major, Minor, and Amount) where we need to transfer the amount.

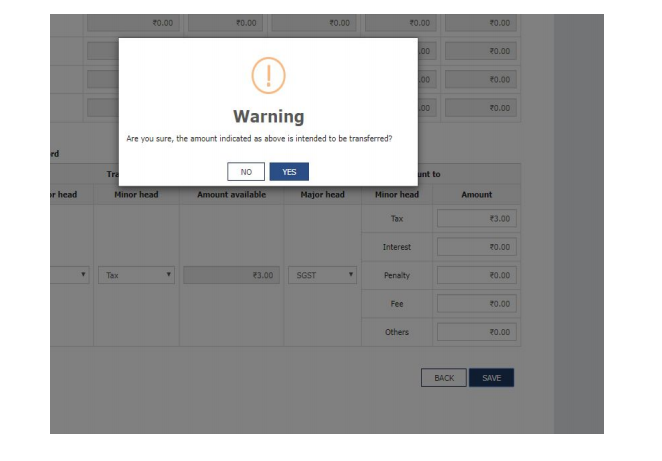

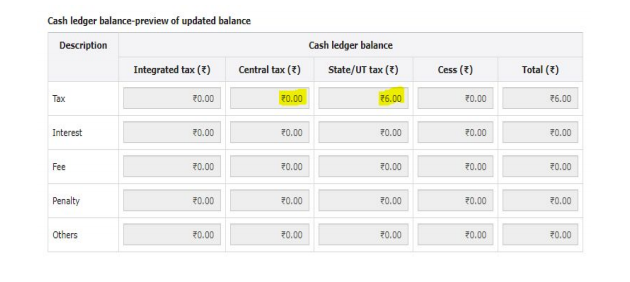

iii. After entering the details in add record, the amount will get updated in Cash ledger balance-preview of updated balance after clicking on the save tab.

* Updated balance of Rs. 6 is reflected in SGST under tax head.

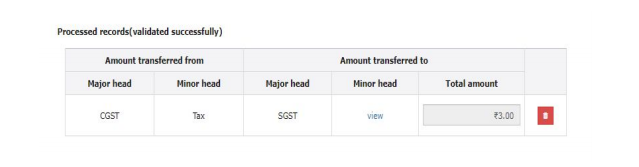

5. When we saved the details, the entered details will get reflected with processed records.

6. Click on “Proceed to file”, then the following screen is displayed.

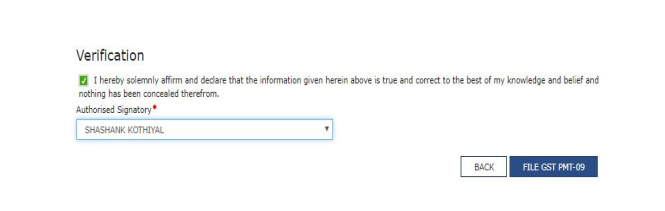

7. Click on the declaration box and select the authorized signatory.

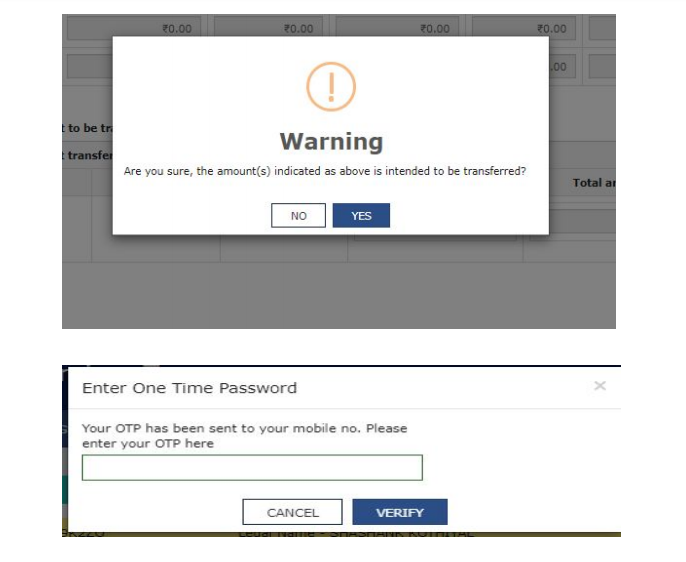

8. Click on “File GST PMT-09” and enter the OTP.

9. The success message is displayed and ARN will be sent to your e-mail address and mobile phone number.

10. After the successfully filing of PMT-09, the amount will get updated to the cash ledger.

11. A taxpayer can also view the filed PMT-09 with the same path (Services > Ledgers > Electronic Cash Ledger).

Read the copy:

CS Shashank Kothiyal

CS Shashank Kothiyal

Honesty Speaks Itself.

East Delhi, India

Company Secretary (Certfied GST Professional) with more than 2.5 years of experience in GST Related Work.