Discounts under GST

Discounts under GST

Hey all!! Do you know or about Discounts under GST. Well, let us know more.

I am section 15(3)of the CGST Act. I cover the important provision of discounts in GST.

Do you Know??

Every discount provided by the supplier doesn’t mean the same is allowed as the deduction from transaction value.

To understand the same through some prevalent practices in relation to discounts:

- Discount which is given before/at the time of supply

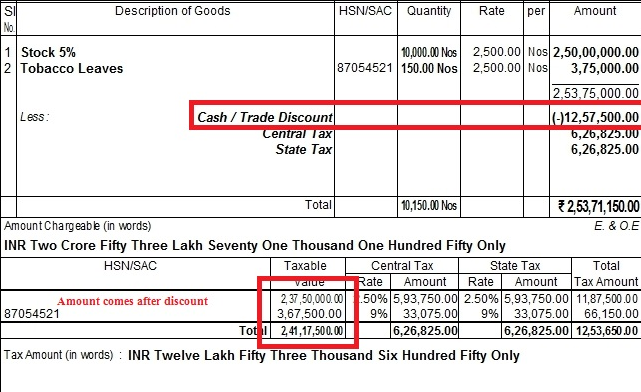

Discount which is given before or at the time of supply and such discount has been duly recorded in the invoice issued in case of such supply shall not form part of transaction value.

In other words, we can say transaction value(the value on which GST is payable) shall be the selling price less such discount.

Example: Trader A purchases 100 pieces of the washing machine from wholesale dealer @24000/- washing machine. Now the wholesaler offers a discount of 10% which is clearly stated in the invoice, in this transaction value shall be:

Sale Price for 100 washing machine 24,00,000

(100washing machine of Rs 24000 each)

Less: Discount offered mentioned in the invoice (2,40,000)

(10% of consideration)

Transaction Value 21,60,000

IGST@18% 3,88,800

Invoice value 25,48,800

2)Discount which is given after supply

Discount which is given after the supply shall not form part of transaction value if all the below mentioned conditions are complied with:

- The discount is established in terms of the agreement entered into at or before the time of supply

- The discount is specifically linked to the relevant invoices

- ITC attributable to such discount has been reversed by the buyer

In simple words:

1.Firstly the discount should be known before/at the time of supply.

This means quantum of discount should be known i.e the percentage of discount/or there should be some predetermined criterion on the basis of which such discount shall be given.

Some discounts of the categories like trade discount, quantity-based discount, performance-based discount, early payment incentive etc.

Example: The Seller agrees to a post-sale discount of Rs 1500 each on invoices whose payment is received within 14 days.

This type of discount was known at the time of supply though shall be given by seller post-sale.

2. Secondly, the discount should be specifically linked to relevant invoices.

Example: In continuation of the above example, suppose there were 10 invoices whose payment was received early. Now the supplier shall issue the credit note for such invoices, mentioning the invoice number in respect of which discount is offered. The credit note should be for the value of the discount and the related GST on it.

3. Thirdly, the ITC as is attributable to the discount has been reversed by the buyer.

This means the buyer should reverse the credit on discount related to such invoices.

Example: Let suppose, there was an invoice dated 20.05.2018, invoice no XYZ/18-19/268 issued to buyer ABC Pvt Ltd

Taxable value: 268000

IGST@18% 48240

Invoice value 316240

ABC must have availed the ITC of Rs 48,240/- in the GSTR3B for the month of May 2018.

Subsequently, as the payment was made within 14 days of the invoice, XYZ Ltd. issued a credit note on 06.06.2018 offering a discount of Rs 1500 along with applicable IGST @18% of Rs.270/-Value of credit note is 1,770/-

To ensure such discount doesn’t form part of the transaction value, the supplier should ensure that the buyer has reversed the credit of such discount.

Resultantly, ABC should reverse credit of Rs 270 in the GSTR3B for July 2018. The buyer should accept the credit notes details reflecting in his gstr2A relating to such discounts.

Let us revise:

The crux was post-sale discounts to be eligible for deduction from transaction value is:

1. The discount has to be established in terms of the agreement signed before/at the time of sale.

2. It should be linked to the specific invoice

3.ITC reversed of such discount by the buyer.

3)The last type of discounts shall be one which is neither agreed before or at the time of supply and are subsequently offered by the supplier.

In such cases, no reduction in transaction value shall be available to the supplier nor any GST amount shall be mentioned in the credit notes related to such discount.

Examples of such discount shall be the price protection/special discount which are offered on the ad-hoc basis by the buyer.

Some Practical Observations

- In case of post-sale discounts, it is rather the responsibility of the supplier to ensure that GST credit has been reversed by the buyer.

- Therefore sometimes it is observed that even in case of discounts where the GST can be reversed, the seller doesn’t mention the GST in the credit note as the reversal of credit by the buyer is always uncertain.

|

Type of discount |

Whether deductible from transaction value |

Condition, if any |

|

Discount at the time of supply |

Yes |

Discount should be duly recorded on the invoice itself |

|

Discount after the supply/ post-sale |

Yes |

a. Discount should be known at the time of transaction b. Credit note issued should have reference to the original invoice/ linked to original invoice c. Buyer should reverse the portion corresponding to discount on the Credit availed earlier |

I hope through this article, I was able to explain discounts under GST to some extend.