Download IGST Act with amendments till date

IGST – updated till date IGST Act with amendments: Updated till August 2020

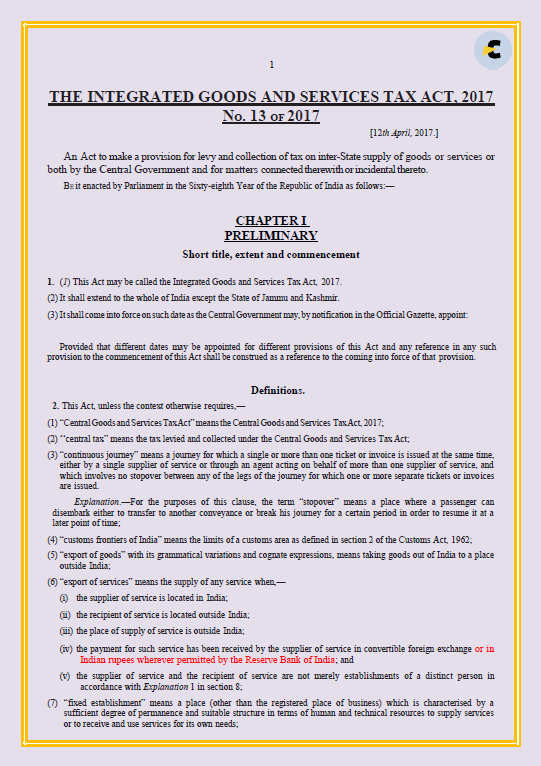

Integrated goods & services tax aka IGST Act with amendments is provided here to download. IGST Act has very few provisions. Section 20 borrows most of the provisions from the CGST Act. You can download it by clicking at the image in the post. In this document, all amendments in the IGST Act are included. The following changes are covered:

Provisions related to Interstate & intrastate supply are covered in IGST Act. PoS covered by section 10,11,12 & 13 of IGST Act. Section 10& 11 covers PoS for the supply of goods whereas section 12 & 13 covers the PoS for the supply of services.

- IGST Amendment Act of 2018

- Finance bill 2019.

Related Topic:

Advisory in relation to Invoicing related to Exports on payment of IGST

Why it is useful?

Changes via amendment Act 2018 are highlighted by red color. The FInance bill proposed some changes in the IGST Act. They are highlighted by blue color.

Some important definitions are changed. Like the definition of export of services is changed. Earlier exporters were facing an issue related to export to Nepal & Bhutan. RBI allowed them to make payment in Indian rupees. But the definition of export of services makes it mandatory to receive payment in foreign currency. Now it is corrected.

Related Topic:

Refund For Exports With Payment of IGST

Place of supply for transportation of goods: Section 12(8) of the IGST Act is also amended. The service of transportation of goods was taxable earlier. Although even after amendment it is still taxable. The change has mentioned that PoS when goods are moving outside India, is the destination of goods. It was done to make transportation of export goods, a zero-rated supply. But the change has failed to do so. Because to qualify as an export recipient shall be outside India. In this case, the recipient is still in India. Thus it is still a taxable supply.

Related Topic:

Section 10(1)(a) IGST Act –Place of Supply

In case you need it frequently you can download our PDF. The Act available at the CBIC website is bare and it doesn’t include the changes via amendment Acts. I hope it is of use to you.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.