Draft reply on 36(4) notices: Download PDF

Table of Contents

Draft reply on 36(4) notices

(Disclaimer: It is just a draft, please take professional help while making a formal reply. It is only for educational purposes)

Date…………………

To, Proper Officer, Range………………………………

………………………………. ( Central/state Jurisdiction)

Dear Sir/Madam,

Sub: Email notification No……………dated……………

Ref: GST Registration Number:

Sir/Madam, our clients are in receipt of following email sent through no-reply@sampark.gov.in on 25/01/2020 which notifies as under: –

Dear ………………………. (GSTIN number),

As you are aware, Rule 36(4) of the CGST Rules 2017 notified w.e.f. 09.10.2019, restricts Availment of credit to 120% of the eligible credit based on invoices/debit notes uploaded by the supplier in their GSTR-1s. From 1st January 2020, the eligibility has got reduced to 110% of such eligible credit.

2. Records indicate that in your GSTR-3B return for Nov2019 you have availed credit of Rs……………… more than the credit admissible under Rule 36(4) of the tax reflected in your GSTR 2A for the said period.

3. You are advised to reverse the amount of credit availed in excess. In case such credit has been utilised for paying tax, the same may be deposited through FORM DRC-03 with applicable interest.

4. In case the opportunity for voluntary compliance as suggested is not availed, appropriate action for recovery of excess ITC availed with interest and imposition of penalty shall be initiated as per the law

Copy of Email enclosed (As per Annexure A)

Reply may be sent ( only for educational purposes)

Sir/Madam, in view of above email notification we would like to state as under: –

1. As per Circular No 128/47/2019 -GST dated 23.12.2019 – No.GST/INV/DIN/01/19-20, it is mandatory to quote DIN Number on any communications issued to RTP (Registered Tax Payer) which includes email too in connection with search authorisation, summons, arrest memos, inspection notices etc. and such DIN number can be verified by all the stakeholders in general………………considering above circular , email issued to us is not a valid and nevertheless we are sharing our working of ITC claim for the purpose of your verification which confirms that we have not claimed any ITC in excess of the limit specified as per Rule 36(4) of the CGST Rules 2017 notified w.e.f 9.10.2019 even though such rules in our opinion is not effective as corresponding changes on the law are yet to made effective by notifying effective date of section under CGST Act viz. section 43A(4) read with section 41.

2. Copy of above circular is enclosed herewith for your kind perusal and consideration. (As per Annexure B). Though above communications needs to be issued by Proper Officer but looking at the content of the email it appears that it is not issued by any Proper Officer and the same has been verified by us in user services section of View Notices and orders as well as View additional Notices and Orders ( Snap Shot of such pages as downloaded from www.gst.govdotin through https://servicesdotgstdotgov.in/services/auth/notices and https://servicesdotgstdotgov.in/litserv/auth/viewadnlntcord enclosed vide Annexure C & D). As the notice is not issued by the Proper Officer, we conclude the same to be void ab initio or it can be fake or spam emails generated by anyone. You are requested to verify the authenticity of such email.

3. We are enclosing herewith following information for your kind perusal and consideration: –

a. Copy of GSTR 3B filed for the month of …………. (As per Annexure E)

b. Copy of GSTR 1 filed for the month of ………. (As per Annexure F);

c. Downloaded copy of GSTR 2A as on ……………………. (As per Annexure G);

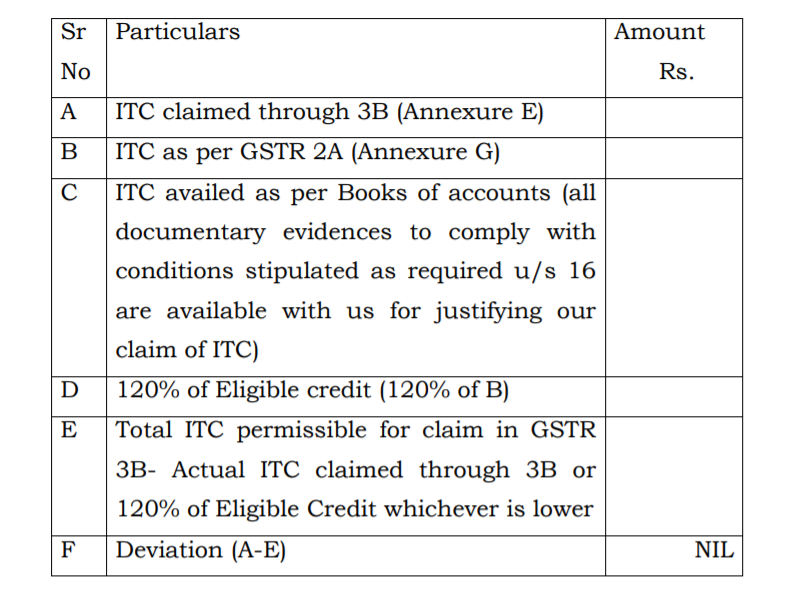

d. Working of ITC claimed for the month of……………….in the form of Tabulation of ITC claim working which is as under: –

e. From above working you will observe that ITC claimed is well within the limits of Rule 36(4) even though such provisions and thus it doesn’t require any kind of Suo motto reversal by us.

4. Even though above email is in contravention of law but still as law abiding stakeholders, we would state that you will find above working are correct and you will agree that there is no need of any kind of ITC reversals by us pursuant to above email.

5. Even though on GSTN portal facility to calculate above kind of limit of 120% of eligible credit is not permitted but we have tried to calculate such working to comply with the provisions of the law.

We hope you will find above submissions in order.

If you still desire any further clarifications then undersigned can be contacted on …………………………….

Thanking you,

Sincerely yours

Download PDF

Nitin Bhuta

Nitin Bhuta

Presently, he is actively involved with limited scale of doing Audits, Direct & Indirect Taxation, Management Advisory as well as handling of litigation matters, etc. of Corporate as Well as Non-Corporate persons. Presently, he is actively involved vetting out of drafted legal documents pertaining to business arrangements from the tax compliance perspective.