Due Date of GSTR 9 and 9C Extended

Extension of the due dates for Annual Returns and Reconciliation Statement for 2018-19.

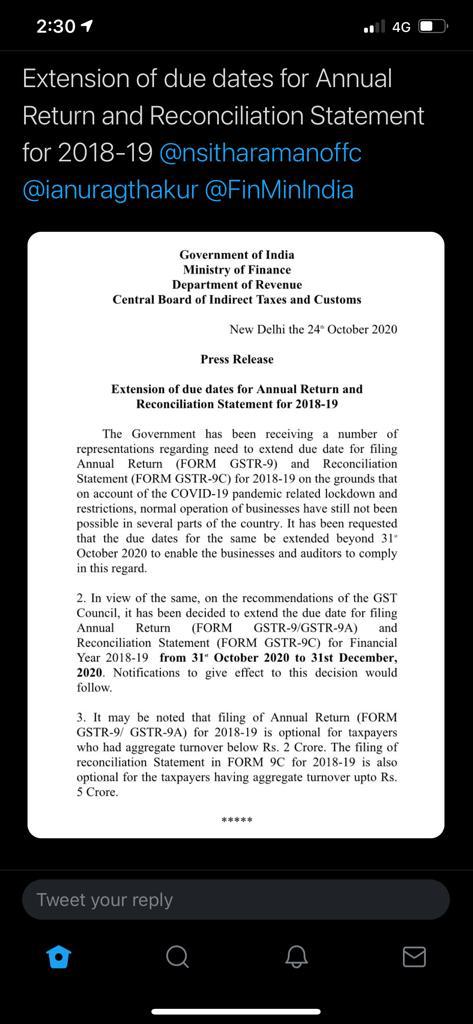

The government has been receiving a number of representations regarding the need to extend due dates for filing Annual Return (Form GSTR-9) and Reconciliation Statement (FORM GSTR-9C) for 2018-19 on the grounds that on account of the COVID-19 pandemic related lockdown and restrictions, the normal operation of businesses have still not been possible in several parts of the country. It has been requested that the due dates for the same be extended beyond 31st October 2020 to enable the businesses and auditors to comply in this regard.

Related Topic:

Relaxations Not Available For FY 2019-20 And Onwards In Filing GSTR 9 And 9C

2. In view of the same, on the recommendations of the GST Council, it has been decided to extend the due dates for filing Annual Return (Form GSTR-9/ GSTR-9A) and Reconciliation Statement (FORM GSTR-9C) for Financial Year 2018-19 from 31st October 2020 to 31st December 2020. Notification to give effect to this decision would follow.

3. It may be noted that filing of Annual return (Form GSTR-9/ GSTR-9A) for 2018-19 is optional for taxpayers who had aggregate turnover below Rs. 2 Crore. The filing of Reconciliation Statement in FORM GSTR-9C for 2018-19 is also optional for taxpayers having aggregate turnover up to Rs. 5 Crore.

Related Topic:

GSTR 9 and 9C –FY 2020-21

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.