Extended due dates schedule for GST returns till June 2020

Table of Contents

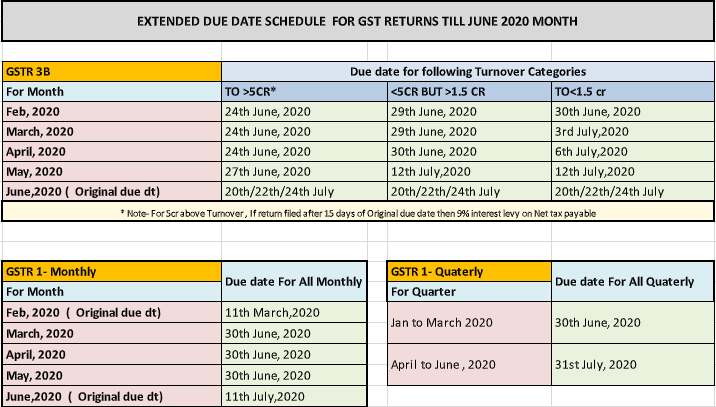

EXTENDED DUE DATE SCHEDULE FOR GST RETURNS TILL JUNE 2020 MONTH

As you aware that Due Dates extended for providing relief to taxpayers in view of COVID-19 pandemic, Below is the schedule for GST RETURNS

Related Topic:

GST Returns Due Dates for GTSR 1 and GSTR 3b

GSTR 3B Due date for following Turnover Categories

| For Month | TO >5CR* | <5CR BUT >1.5 CR | TO<1.5 cr |

| `Feb 2020 | 24th June 2020 | 29th June 2020 | 30th June 2020 |

| March 2020 | 24th June 2020 | 29th June 2020 | 3rd July 2020 |

| April 2020 | 24th June 2020 | 30th June 2020 | 6th July 2020 |

| May 2020 | 27th June 2020 | 12th July 2020 | 12th July 2020 |

| June 2020 ( Original due dt) | 20th/22th/24th July | 20th/22th/24th July | 20th/22th/24th July |

* Note– For 5cr above Turnover, If return filed after 15 days of Original due date then 9% interest levy on Net tax payable

GSTR 1- Monthly

| GSTR 1- Monthly | Due date For All Monthly |

| For Month | |

| Feb 2020 ( Original due dt) | 11th March 2020 |

| March 2020 | 30th June 2020 |

| April 2020 | 30th June 2020 |

| May 2020 | 30th June 2020 |

| June 2020 (Original due dt) | 11th July 2020 |

GSTR 1- Quaterly

| For Quarter | Due date For All Quaterly |

| Jan to March 2020 | 30th June 2020 |

| April to June 2020 | 31st July 2020 |

FOR COMPOSITION DEALERS

| Return | Period | Due date |

| GST CMP-08 | Jan to March 2020 | 07.07.2020 |

| GST CMP-08 ( Original Due dt) | April to June 2020 | 18.07.2020 |

| GSTR-4 return | FY 2019-20 | 15.07.2020 |

GSTR 7 Monthly – TDS RETURN

| For Month | For All Monthly |

| Feb 2020 | 10th March 2020 |

| March 2020 | 30th June 2020 |

| April 2020 | 30th June 2020 |

| May 2020 | 30th June 2020 |

What about Rule 36(4)?

Proviso inserted to Rule 36(4) w.e.f. 31.03.2020 – Temparary relaxation provided by Goverment

As per proviso inserted to rule 36(4), no adjustment is required to be made while filing GSTR-3B for the month of Feb 2020 to Aug 2020. However, a cumulative adjustment for the entire period of Feb 2020 to Sep 2020 shall be required to be made while filing GSTR-3B for the month of Sep 2020. Although its a good relief in the though time of Indian economy although the same is temporary as the entire adjustment is required to be made in Sep 2020.

Related Topic:

Due Date Compliance Calendar JULY 2021

Download the copy: