E-Invoicing – Legal Provisions & Implementation Challenges

Table of Contents

- E-Invoicing – Legal Provisions & Implementation Challenges

- Why E-Invoicing?

- E-Invoice or Electronic Invoicing

- Who is required to issue E-Invoices?

- Relevant Notifications / Rules

- Persons Exempted

- Which transactions are covered by E-Invoicing Rules?

- B2C QR Code

- What about B2C Transactions by taxpayers with turnover over Rs 500 Crore?

- Terms and Definitions

- Invoice Reference Number (IRN)

- Invoice Registration Portal (IRP)

- Read & Download the full Copy in pdf:

E-Invoicing – Legal Provisions & Implementation Challenges

Why E-Invoicing?

• Digital Invoices / Accounting is a metric in Ease of Doing Business Ranking of countries

➢ India’s ranking moved up from 77 to 63 in 2019

• Moving digital will standardize various processes, reduce data entry errors, save cost

➢ 96% Cost Saving; 80% Time-saving; 15 times efficiency improvement

• Better compliance by Taxpayers simplifies audits

E-Invoice or Electronic Invoicing

- No prior standard under GST or any other statute

- Having a standard is a must for interoperability across various players (Supplier, Recipient, E-Way Bill System, Return Filing, Government)

- Interoperability between software Eliminates the need for data entry

- Other players Banks, Wholesale retail chain

Who is required to issue E-Invoices?

- CT NN 61/2020: Taxpayers with an aggregate turnover in a financial year above Rs 500 Crore from Oct 1, 2020.

- CT NN 88/2020 Taxpayers with an aggregate turnover in a financial year above Rs 100 Crore from Jan 1, 2021

Relevant Notifications / Rules

- CGST Notification 68/2019

- Rule 48- Manner of issuing an invoice

→48(4) – FORM GST INV-1

→48(5) – Invoice other than the above is not valid

→48(6) – Multiple copies of an invoice not required

- CGST Notification 69/2019 – Notifies Common Portal

- CGST Notification 60/2020 – Specifies Schema/fields of INV-01

Related Topic:

Implementation of Labour Codes

Persons Exempted

Special Economic Zone (SEZ) Unit

Persons covered by CGST Rule 54 (Sub-rules (2), (3), (4), (4A)

• Insurer or a banking company or a financial institution, including NBFC Goods

• Transport Agency

• Passenger transportation service

• Admission to an exhibition of cinematograph films in multiplex screens

* Updated as per Notification 61/2020 -CT

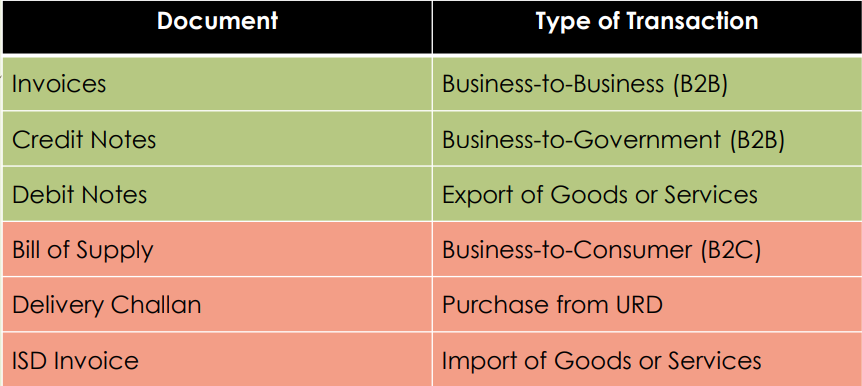

Which transactions are covered by E-Invoicing Rules?

Applicable only for B2B Notification 70/2019

B2C QR Code

What about B2C Transactions by taxpayers with turnover over Rs 500 Crore?

Notification 72/2019

Not an E-Invoice, Requires digital payment QR Code

Terms and Definitions

Invoice Reference Number (IRN)

- Combines Taxpayer GSTIN, Financial Year, Document Type, Invoice Number

- 64-digit alphanumeric number to uniquely identify an Invoice

- For computers only, humans can ignore this

→GSTIN: 33AADCG4992P1Z0

→Financial Year: 2019-20

→Document Type: Invoice Document Number: 2

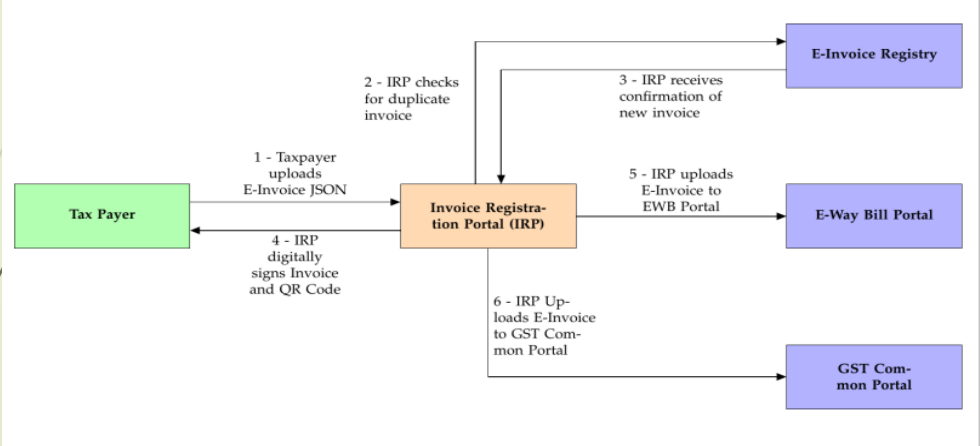

Invoice Registration Portal (IRP)

- Authorized by Government

→First IRP run by National Informatics Centre (NIC)

→Second IRP proposed to be run by Goods and Services Tax Network (GSTN)

- Verifies and acknowledges E-Invoices

- Replies within a blink of an eye

- Retains invoices for 24-hours

- Does not contain a listing of Invoices

Read & Download the full Copy in pdf:

CA Venu Gopal Gella

CA Venu Gopal Gella

Keep learning

Banglore, India

GST