[Blockage form 15th Oct] e way bill in GST :When and how to make

Table of Contents

- Latest Updates related to e way bill in GST.

- What is an e way bill in GST?

- When an e way bill is mandatory under GST Law?

- E way bill for the bill to ship to transactions in GST

- Who is required to issue e way bill in GST?

- What is the penalty for non-issuance of the e way bill in GST

- How to make an E-way bill in GST?

- How to make an E-way bill when there is no Invoice?

- How to make an E-way bill for the Export of Goods?

- When E-way bills facility can be blocked?

- How to make an e way bill for Goods sent for Job work?

Latest Updates related to e way bill in GST.

The E-way bill can be blocked if the GSTR 3b is not filed for 2 months. This provision is applicable from 15th October. Initially, it is applicable for the taxpayers having a turnover of more than Rs. 5 Crore. The turnover limit is PAN based.

The validity of E-way bills issues during the lockdown period- up to 24th March 2020 is extended to 30th June.

What is an e way bill in GST?

An e way bill is a document for the movement of goods. The movement may be due to supply or other reasons. It is mandatory in GST. There is a penalty of an amount equal to the amount of tax if e way bill is not there.

Example- M/s Satyachandra Sent their machine to job worker, small tasks for their job work. In this case, e way bill is mandatory as there is a movement of goods.

Related Topic:

Best ppt on E-way bill

When an e way bill is mandatory under GST Law?

An E-way bill is required for the movement of goods. It is not about sales or supply. Even if there are no supply E-way bills are required. It ensures that goods are not moving to evade the tax. Movement of goods without payment of tax or vice versa is an offense. E-way bills ensure that a movement is as per transaction recorded.

As per the provisions of section 68 read with rule 138 of CGST rules, every movement should be accompanied by an E-way bill. Although transactions are less than Rs. 50000 are exempted.

Related Topic:

NO TAX & PENALTY U/S 129 OF GST FOR NON-GENERATION OF E-WAY BILL

E way bill for the bill to ship to transactions in GST

A bill to ship to the transaction means a transaction when the goods are delivered to another person. A bill to person order the delivery of goods to some other person.

e.g. Mr. Jainco ordered 30000 wireless mouse to Mr. Zenith. He received an order for the same quantity from Mr. Asabga located in Jaipur. HE ordered Zenith to deliver the goods ar Jaipur. This is a “bill to ship to” transaction.

You can enter the delivery address in the ship-to location. The details of the buyer can be entered into the “bill to” option.

Related Topic:

Penalty of the 1000 rupees for minor mistakes in E-way bill

Who is required to issue e way bill in GST?

Every person causing the movement of goods is required to issue an E-way bill. It may be a supplier or recipient or even a transporter. Generally, it is prepared by the supplier. In most cases, the supplier is liable for the movement of goods. But if a recipient takes delivery at the supplier’s factory gate. The recipient is liable for the E-way bill. As he is doing the movement of goods.

Related Topic:

Download latest user manual of e-way bill

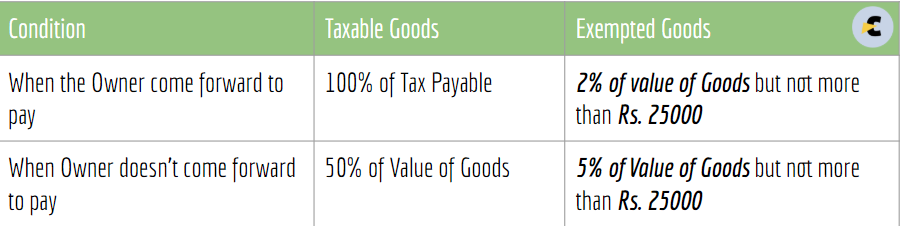

What is the penalty for non-issuance of the e way bill in GST

If the E-way bill is not issued. The vehicle can be detained along with goods. It can be released on the payment of the penalty. The following penalty can be levied.

If the abovementioned penalty is not paid, goods can be seized. In that case, the vest to the government. Authorities can sell it to recover the dues.

Related Topic:

E-Way bill — Flowchart & amp and salient features

How to make an E-way bill in GST?

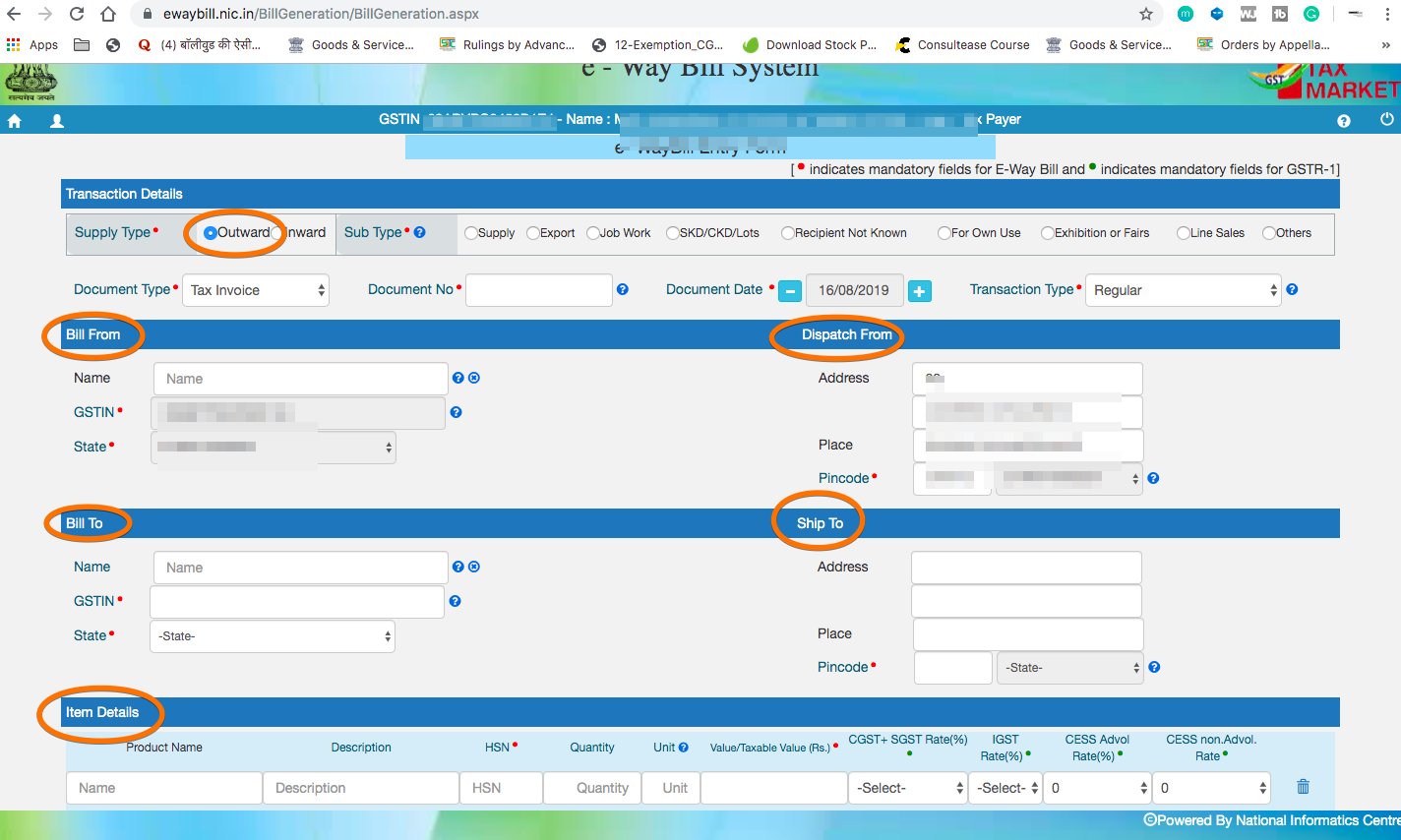

Go to the website of E-way bill portal. Enter your login id and password. Now you can fill Part A of the E-way bill. It contains information about the consigner, Consignee, and address. The following data is required to prepare an E-way bill.

- Name and GSTIN of Supplier. (If registered)

- Name and GSTIN of the recipient. (If registered)

- Address of Dispatch location.

- Address of Delivery location.

- Description of Goods

- Distance in KM. ( Now distance is automatically calculated by Pin code entered in the address.)

- Classification and amount of Tax

- Invoice/ Delivery Challan details

- Details of Transporter & vehicle number

Related Topic:

PPT on E-Way Bill and Process

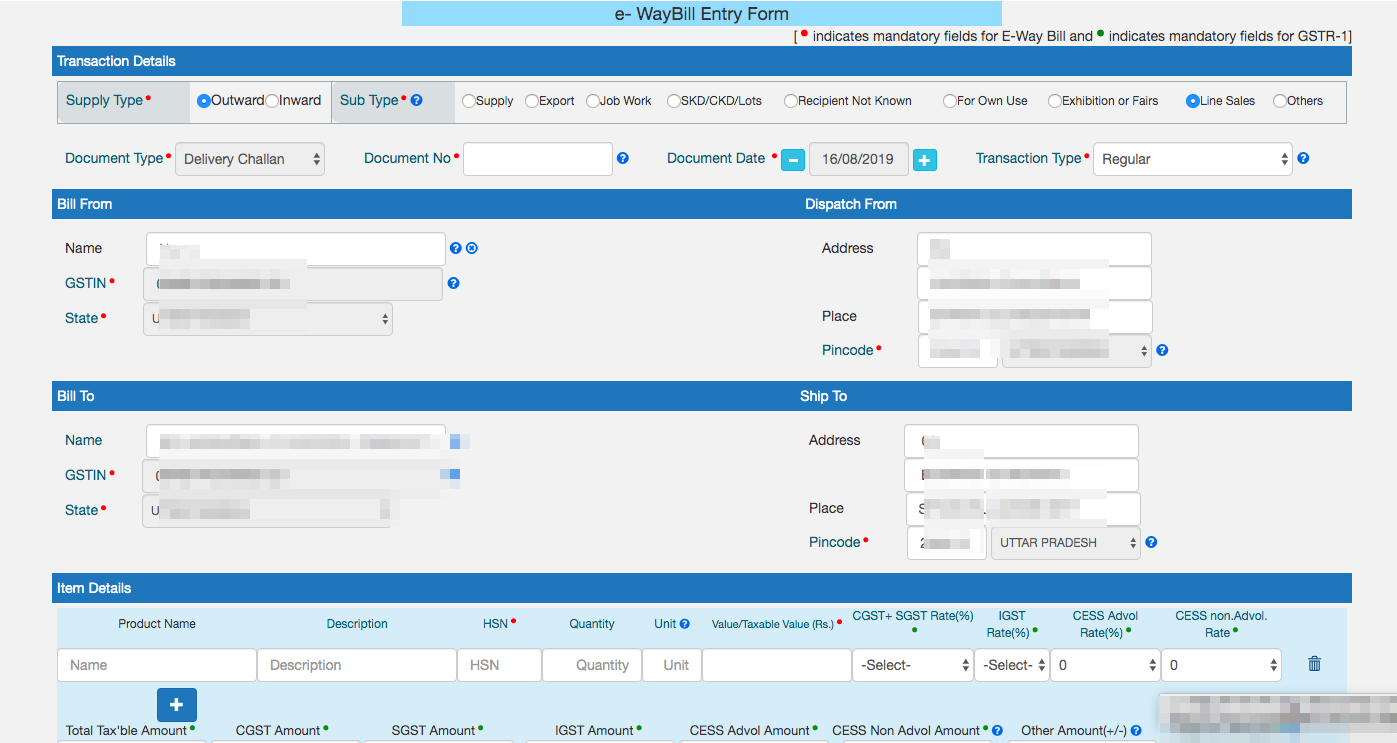

How to make an E-way bill when there is no Invoice?

As I stated earlier, E-way bills are connected to the movement of Goods. Even is there is no sale or supply. E-way bill is required. Whenever there is a movement of Goods. The E-way bill is mandatory except for some exceptions. But in case of movement without supply, there is no Invoice. In this case, a Delivery Challan can be issued. E-way bill can be prepared based on Delivery Challan. It contains the description of Goods. The details of the consignor and consignee, dispatch, and delivery address. It also contains the reason for movement. It should be clearly mentioned.

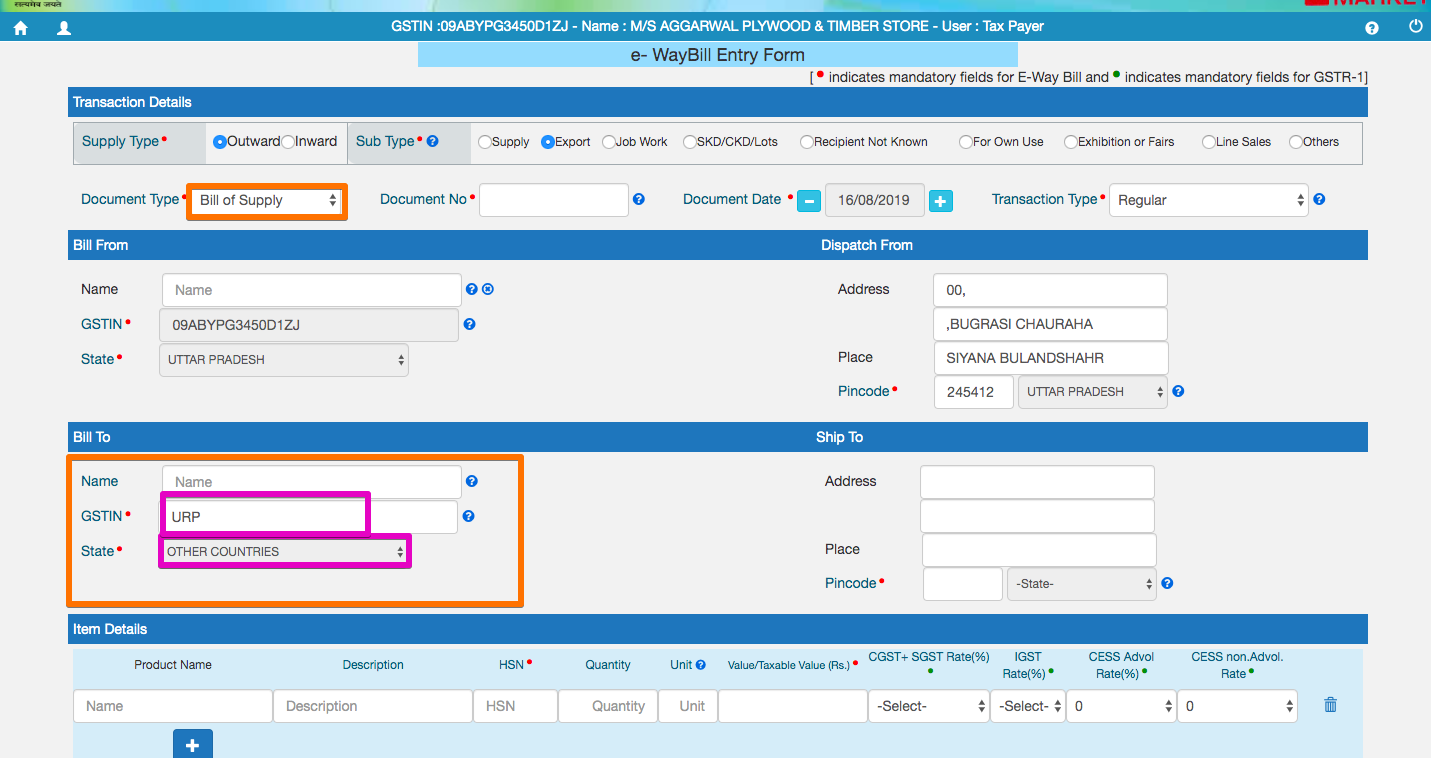

How to make an E-way bill for the Export of Goods?

In the case of export, the first Goods move to the port. Then they are dispatched to the ship or plane to move outside. Select the Export head while making the E-way bill for export. All other hears will automatically change. Now the address on the invoice will be of a location outside India. You can select outside location text in the dispatch address. In recipient details, you can select the unregistered recipient. You can read E-way bill mechanism for all instances at this post.

When E-way bills facility can be blocked?

For normal taxpayer: Non-filing of GSTR 3b for 2 months.

For compositions dealer: Non-filing of return for two quarters.

This can be unblocked once the return is filed. No E-way bill can be generated by a taxpayer is it is blocked.

How to make an E-way bill for goods sold to a registered recipient?

E way bill in GST needs the details of the invoice. Please remember that we can make it on a delivery challan also. In this case, the invoice is raised. The following details can be entered into the E-way bill.

- Part A of the E-way bill will contain the details of the supplier, buyer, and description of goods.

- Select outward on the portal like in the image below, Bill from will be auto-filled. Dispatch from will automatically be the address of the supplier. You can edit this field. When the goods are dispatched from a place other than the place of the supplier. It will vary from the auto-populated details. Thus you need to change them accordingly.

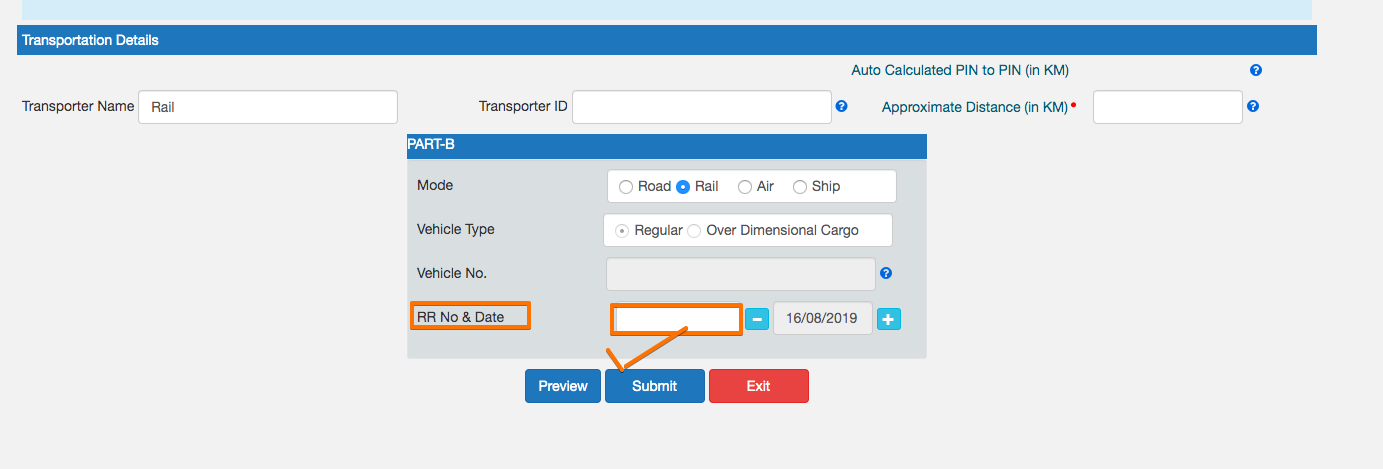

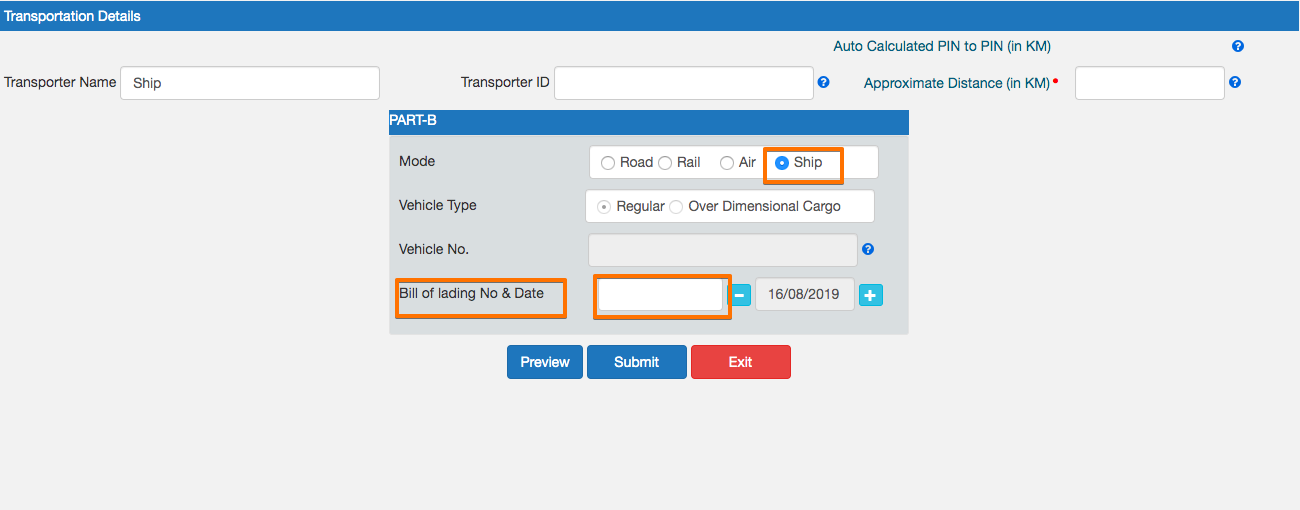

How to make an E-way bill when goods are transported via Train, Ship or Air?

Sometimes goods move via train, ship, or Air. They still need a movement via the road to reach the dispatch location. In this case, an E-way bill can be prepared from the location of the supplier to the location of dispatch.

For movement from factory/godown/supplier’s place to location of further movement:

This movement will take place on the invoice as goods are moving due to supply. When they are not moving for supply an e-way bill can be prepared on the delivery challan. You can enter the address of the location of further movement in a dispatch to.

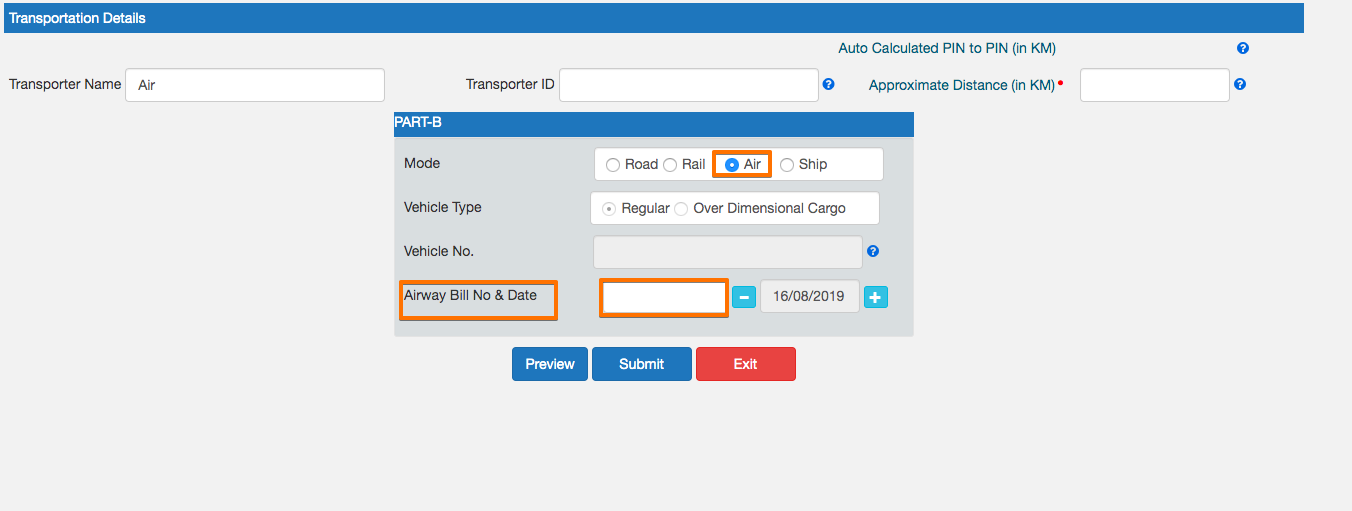

For the movement via Train, Ship, or Air

Select Train, Ship, or Air in part b of the E-way bill. Then details of their respective receipts can be entered. See in the image below. Once you choose the means, a window to enter relevant details will open.

It is clear from the images above that relevant entry open once you choose Rail, Air or Ship.

How to make an e way bill for Goods sent to port for Export?

When goods are moving for export they leave for the port of dispatch. In this case the delivery challan, copy of the invoice can be attached. The details of goods can be entered in the description. In this case, an invoice will bear the words” for export with or without payment of tax”. The copy of the invoice will help in the acknowledgment of goods. Also, select “Export” at e way bill portal while making the E-way bill in GST for export.

As soon as we select export, the invoice is replaced by a bill of supply. In bill to GSTIN is filled with URP and the state is filled with other countries.

How to make an e way bill for Line Items?

This is used when the goods are taken out from the premises of the taxpayers for the sales at the doorsteps of the clients. The goods are taken out with the ‘Delivery Challan’ and whenever the sales are made to the clients, the ‘Taxable Invoice’ or ‘Bill of Supply’ is issued to the amount of the sale taken place. We need to select “line item” in headings on the E-way bill portal. It automatically copies the details of the supplier in the bill to and ship to.

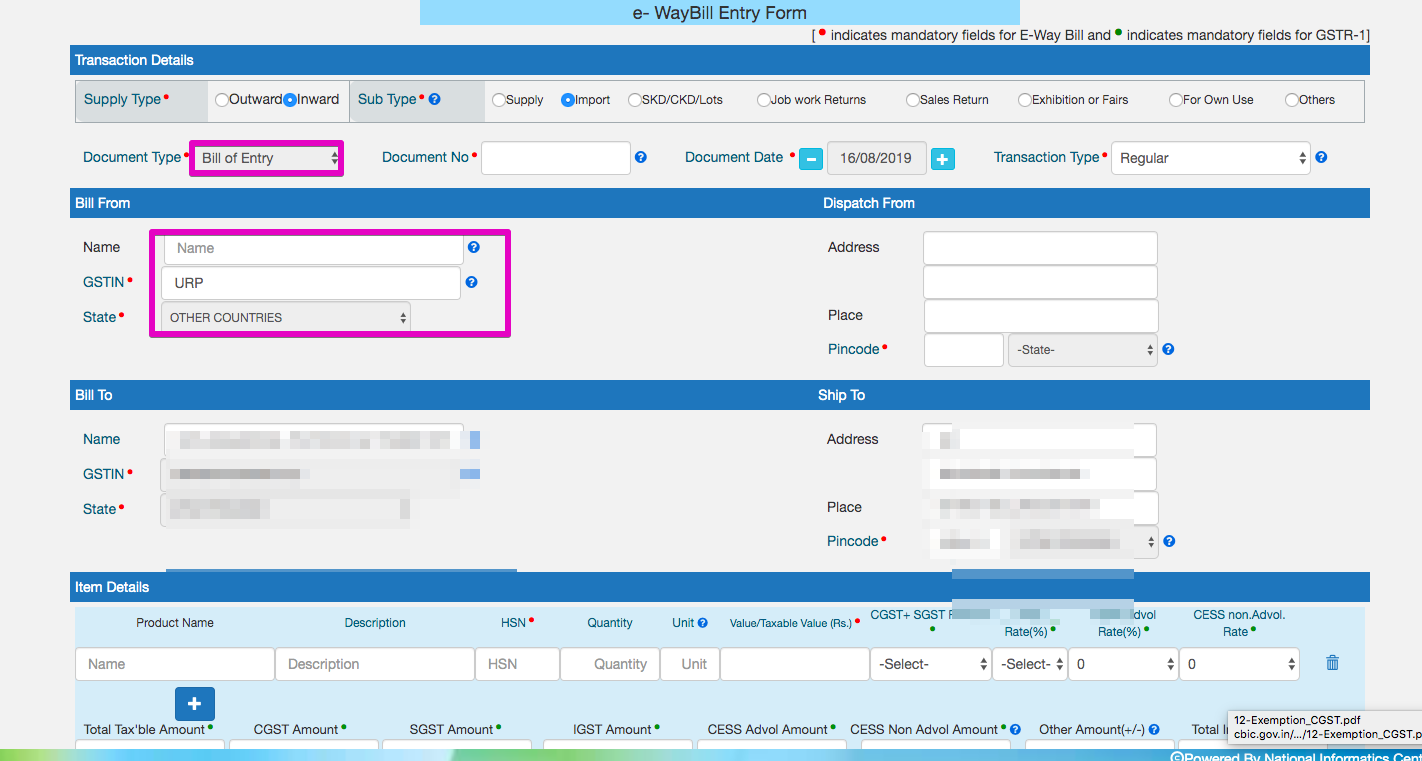

How to make an e way bill for goods imported into India?

When goods are imported to India, a Bill of entry is filed. There can be two types of bill of entry. First is a bill of entry for home consumption and bill of entry for warehousing. In both cases, there can be two scenarios. The goods are dispatched to the location of buyer or they may be dispatched to some other location. This can be reflected by selecting inward in main headings and import in secondary headings.

When you select inward and import it changes the invoice with the bill of entry. GSTIN is filled with URP and the state is filled with other countries.

How to make an e way bill for Goods sent for Job work?

Section 143 of CGST Act provide for the sending of goods to Job worker. The goods can be sent from the factory or the principal’s place. They can also be sent directly from seller to job worker without entering into the principal’s place.

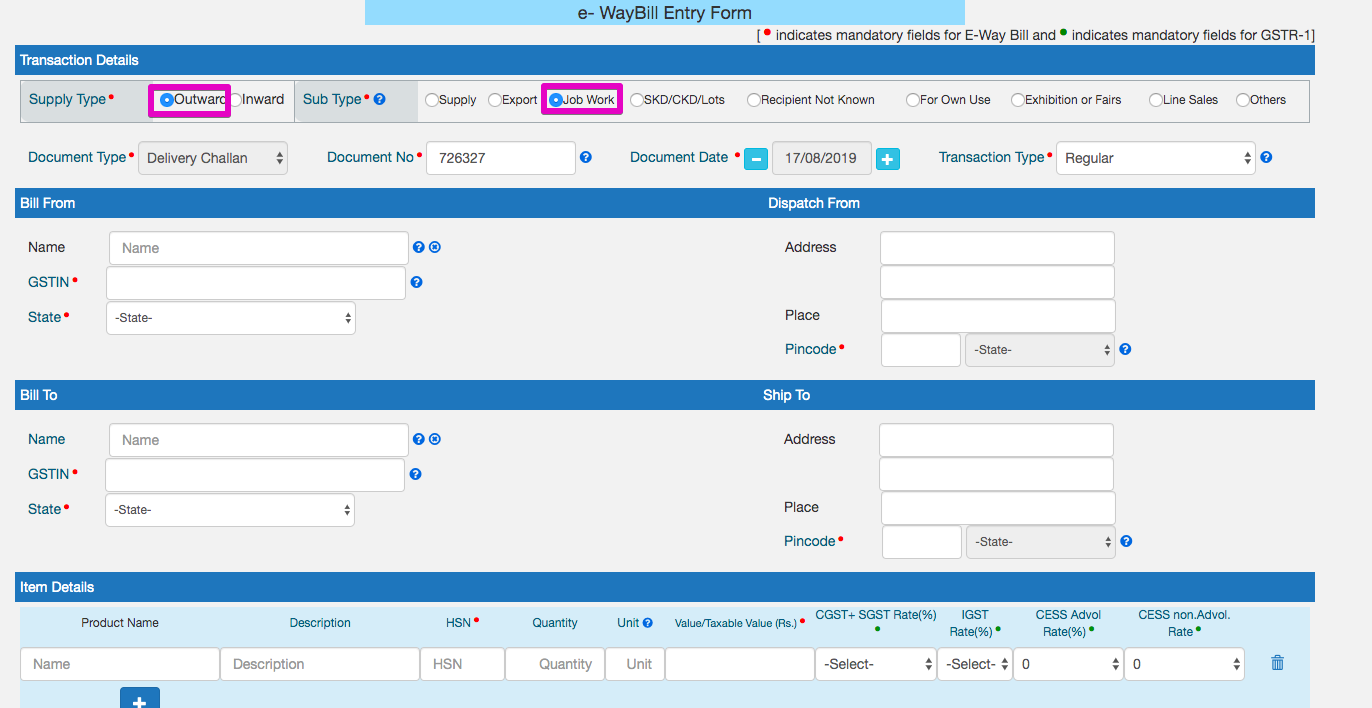

Select outward at Eway bill portal in main headings and job work in secondary tabs. Check the highlighted portion in the image attached below.

How to make an E-way bill for Goods received back from Job worker?

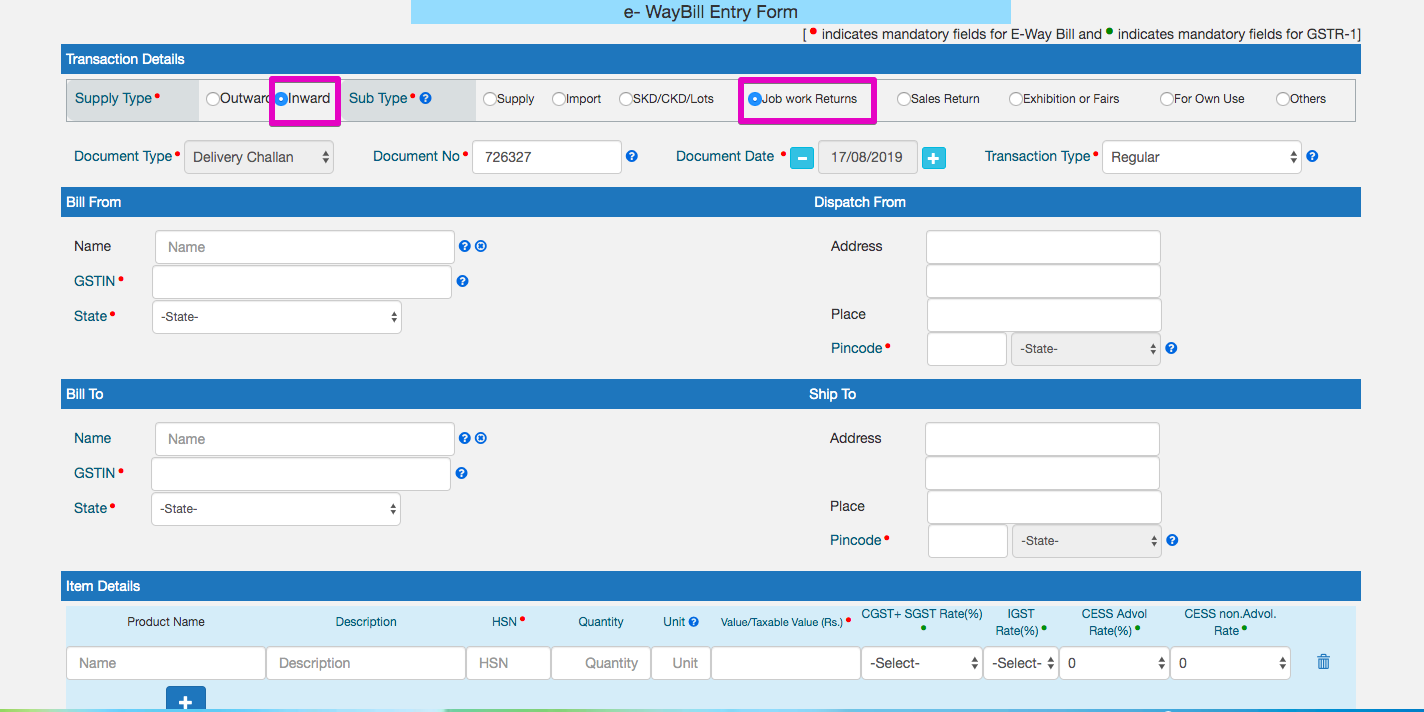

In this case, movement is taking place on the cover of a delivery challan. Select inward in the main headings of E-way bill portal and job work in secondary headings.

How to make an e way bill for goods sent from one job worker to another job worker?

CBIC Circular No.38/12/2018 dated 26th March 2018 covers these cases. A job worker can use a copy of the delivery challan issued by the supplier. He can even issue a new delivery challan.

How to make an e way bill for goods sent to branch in another state for use?

In this case, goods will move under the cover of a delivery challan. The details of the delivery challan will be filled in the E-way bill portal.

How to make an e way bill for goods moving to a branch in the same state?

Even in case of movement of goods to a branch in the same state Delivery challan is required. E-Way bill will also be required.

How to make an E-way bill for Goods sent for rent?

Goods are moving but not for sale. When the movement of goods is for reasons other than a sale, the E-way bill can be prepared on the basis of details in the delivery challan.

How to make an E-way bill for Goods sent for an exhibition?

When goods are sent for an exhibition there is no invoice. There is no supply. On the E-way bill portal, you can select Exhibition and can prepare E-way bill.

How to make an e way bill for goods moving for repair?

Many times we need to send goods for a repair. There can be two types of movement. A movement for repair in India or outside India. The movement in India will be on delivery challan and return will also be on the delivery challan. When goods are moving outside India, They will become an export by virtue of the definition of export in GST. Which says that moving goods from a place in India to a place outside India is export. In a recent clarification, CBIC said that this is not supplied because goods are not being supplied. Their movement is for the purpose of repair. Thus E-ay bill up to port is required. Then movement will be via customs procedures.

How to make an e way bill for movement other than supply?

Rule 55 of CGST Rules provide for the movement of goods on the delivery challan. When goods move for a reason other than supply. A Delivery challan can be made. Invoice is not required in this case.

These were some instances for E-way bill in GST. Hope this article is useful for you. I have tried to cover all the possible instances. Still, you can post your issue in QA section of our website.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.