Exempted by product is also liable for ITC reversal (Pdf Attach)

Table of Contents

Cases Covered:

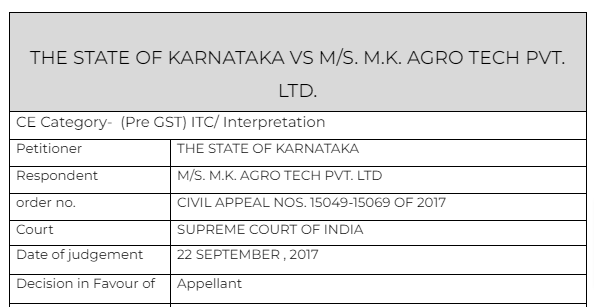

THE STATE OF KARNATAKA VS M/S. M.K. AGRO TECH PVT. LTD.

Citations:

1. Commissioner of Central Excise, Jaipur v. Mahavir Aluminum Ltd.

2. Ravi Prakash Refineries Private Ltd. v. State of Karnataka

3. Ravi Prakash Refineries Private Ltd. v. State of Karnataka Manufacturing Co. Ltd

4. Commissioner of Income Tax-III v. Calcutta Knitwears, Ludhiana

5. State of Madhya Pradesh v.Rakesh Kohli & Anr

6. V.V.S. Sugars v. Government of Andhra Pradesh & Ors

7. Godrej & Boyce Mfg. Co. Pvt. Ltd. & Ors. v. Commissioner of Sales Tax and Others

8. Balaji & Ors. v. State of Andhra Pradesh & Ors.

9. Jayam and Company v. Assistant Commissioner and Another

Facts of the cases:

It pertains to the construction of Section 17 of the Karnataka Value Added Tax (Act), 2003 [hereinafter referred to ‘KVAT Act’] read with Rule 131 of the Karnataka Value Added Tax Rules, 2005 (hereinafter referred to as the ‘KVAT Rules, 2005’).

State has taken the view that the assessee would be entitled to only partial rebate of input tax because of the reason that though output tax is paid on sunflower oil, it is not paid on the sale of de-oiled cake.

The take of Taxpayer was-

Sunflower oil cake, as an input, is used in its entirety in the extraction of sunflower oil. De-oiled cake is not the result of any manufacturing process but is only a by-product. Therefore, sale of such by-product, even when it is exempted from output tax, would not have any bearing.

The High Court in its impugned judgment has accepted this position adopted by the assessee thereby giving full input tax deduction.

The case was then submitted to the Honorable Supreme Court

Observations & Judgement of the court:

On literal interpretation of Section 17 it can be gathered that it does not distinguish between by-product, ancillary product, intermediary product or final product. The expressions used are ‘goods’ and ‘sale’ of such goods is covered under Section 17. Both these ingredients stand satisfied as de-oiled cakes are goods and the respondent assessee had sold those goods for valuable consideration. We may point out there that the assessing authorities recorded a clear finding, which was accepted by the Tribunal as well, that records and statement of accounts of the respondent assessee clearly stipulates that after solvent extraction is completed, 88% of de-oiled cake remains and only 12% remains is the oil which is further refined in the refinery. This clearly shows that major outcome (88%) of the solvent extraction plant is de-oiled cake which in itself is a marketable good having market value.

The aforesaid reasons given by us are sufficient to hold that Section 17 gets attracted in the instant case and the view taken by the High Court is erroneous. Therefore, it is not necessary for this Court to deal with the other contention of the appellant State viz. whether de-oiled cake itself amounts to manufacture or not.

Read & Download the Full THE STATE OF KARNATAKA VS M/S. M.K. AGRO TECH PVT. LTD.

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.