Exemption for goods reimported into India.

Notification No. 45/2017 – Customs

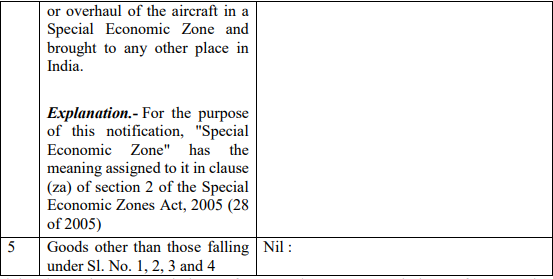

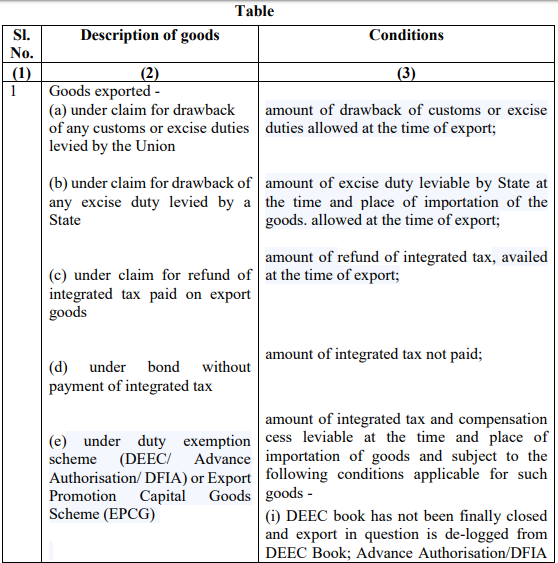

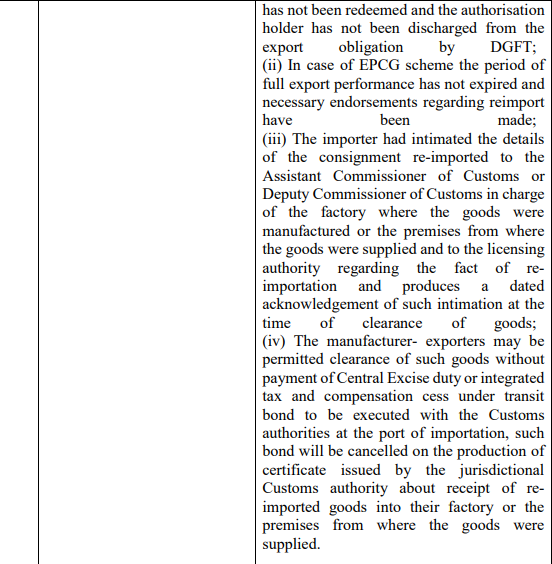

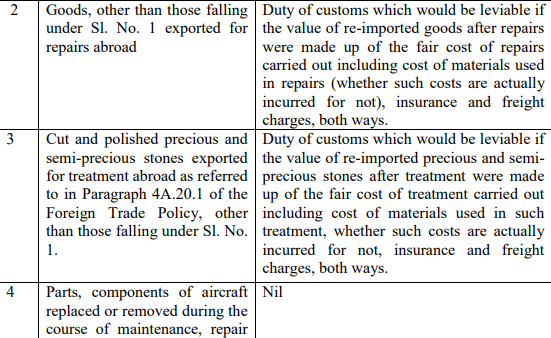

G.S.R. (E).-In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act, 1962 (52 of 1962) the Central Government, on being satisfied that it is necessary for the public interest so to do, hereby exempts the goods falling within any Chapter of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) and specified in column (2) of the Table below when re-imported into India, from so much of the duty of customs leviable thereon which is specified in the said First Schedule, and the whole of the integrated tax, compensation cess leviable thereon respectively under sub-section (7) and (9) of section 3 of the said Customs Tariff Act, as is in excess of the amount indicated in the corresponding entry in column (3) of the said Table.

Download the copy:

Provided that the Assistant Commissioner of Customs/ Deputy Commissioner of Customs is satisfied that-

(a) in the case of Bhutan, the machinery and equipment other than those exported under Duty Exemption Scheme(DEEC/Advance Authorisation/DFIA) or Export Promotion Capital Goods Scheme(EPCG) or Duty Entitlement Passbook Scheme(DEPB) or any reward scheme of Chapter 3 of Foreign Trade Policy are re-imported within seven years after their exportation or within such extended period, not exceeding three years, as may be allowed by the Principal Commissioner of Customs or Commissioner of Customs, as the case may be, on sufficient cause being shown for the delay;

(b) in all other cases, the goods other than those exported under Duty Exemption Scheme(DEEC/Advance Authorisation/DFIA) or Export Promotion Capital Goods Scheme(EPCG) or Duty Entitlement Passbook Scheme (DEPB) or any reward scheme of Chapter 3 of Foreign Trade Policy are re-imported within three years after their exportation or within such extended period, not exceeding two years, as the Principal Commissioner of Customs or Commissioner of Customs, as the case may be, on sufficient cause being shown for the delay may be allowed;

(c) in the case of goods exported under the Duty Exemption Scheme(DEEC/Advance Authorisation/DFIA) or Export Promotion Capital Goods Scheme(EPCG) or Duty Entitlement Passbook Scheme (DEPB) or any reward scheme of Chapter 3 of Foreign Trade Policy, re-importation of such goods takes place within one year of exportation or such extended period not exceeding one more year as the Principal Commissioner of Customs or Commissioner of Customs, as the case may be, on sufficient cause being shown for the delay may be allowed;

(d) the goods are the same which were exported;

(e) in the case of goods falling under Sr. No. 2 of the Table there has been no change in ownership of the goods between the time of export of such goods and re-import thereof;

(f) in the case of the goods falling under Serial numbers 1 and 3 of the Table and where the value of exported goods was counted towards fulfillment of export obligation, the amount of customs duties leviable on the duty-free inputs obtained from Nominated Agencies but for the exemption availed under the Ministry of Finance (Department of Revenue) Notification No. 56/2000-Customs dated the 5th May 2000 [vide G.S.R. 399 (E), dated the 5th May 2000] and notification No. 57/2000-Customs dated the 8th May 2000 [vide G.S.R. 413 (E), dated the 8th May 2000] shall also be paid in addition to amount of duty specified in column (3) of the Table;

(g) in the case of goods falling under Sl. No. 4 of the Table, the goods are returned to the owner of the aircraft without any sale; Provided further that nothing contained in this notification shall apply to re-imported goods –

(a) which had been exported by a hundred percent, export-oriented undertaking or a unit in a Free Trade Zone as defined under section 3 of the Central Excise Act, 1944 (1 of 1944);

(b) which had been exported from a public warehouse or a private warehouse appointed or licensed, as the case may be, under section 57 or section 58 of the Customs Act, 1962 (52 of 1962);

(c) which fall under the Fourth Schedule to the Central Excise Act, 1944 (1of 1944).

2. This Notification will apply to the exports for which order permitting clearance and loading under section 51 of the Customs Act, 1962, has been given on or after the 01st day of July 2017.

3. This notification shall come into force with effect from the 1 st day of July 2017.

Explanation. – For the purposes of this notification, –

(a) the goods shall not be deemed to be the same if these are re-imported after being subjected to re-manufacturing or reprocessing through melting, recycling or recasting abroad.;

(b) ‘Foreign Trade Policy’ means Foreign Trade Policy, 2015 – 2020 notified by the Government of India in the Ministry of Commerce and Industry published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section (ii) vide notification No. 01/2015-2020, dated the 1st April 2015;

(c) ‘Nominated agencies’ means,-

(i)Metals and Minerals Trading Corporation Limited (MMTC);

(ii) Handicraft and Handloom Export Corporation (HHEC);

(iii) State Trading Corporation (STC);

(iv) Project and Equipment Corporation of India Ltd. (PEC);

(v) STCL Ltd;

(vi) MSTC Ltd;

(vii) Diamond India Limited (DIL);

(viii) Four Star Export House from Gems & Jewellery sector and Five Star Export House from any sector as may be recognized as nominated agencies by Regional Authority in terms of the Foreign Trade Policy;

(ix) any bank as authorized by Reserve Bank of India as Nominated Agency

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.