ANOTHER SIDE OF COIN ON EXTENSION OF DUE DATE OF ANNUAL RETURN

Table of Contents

DUE DATE OF ANNUAL RETURN:

Vide 7th Removal of Difficulty Order, 2019 issued on 26 August 2019, the due date of annual return for FY 17- 18 is extended to 30th Nov 2019. Naturally it has benefited business houses, consultants and executives for performing the working and furnishing the annual return. But at the same point of time it is important to see the other implications of this extension.

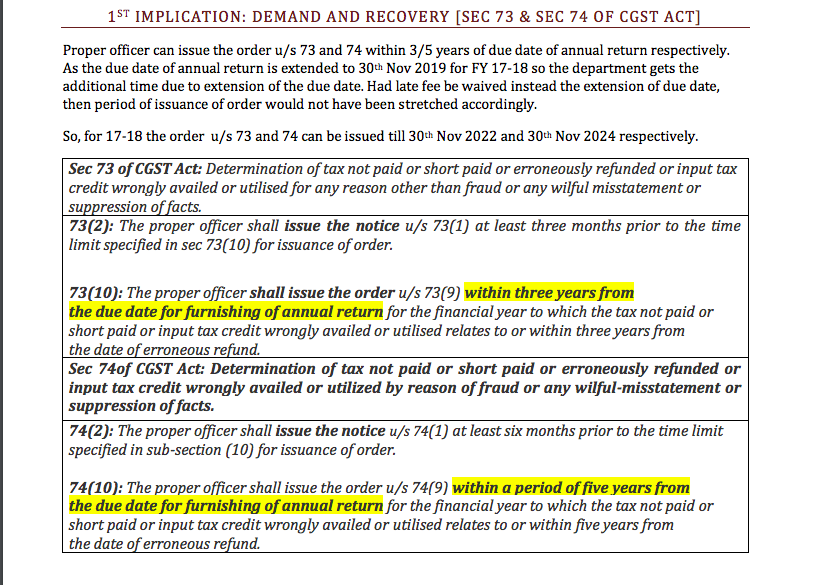

1ST IMPLICATION: DEMAND AND RECOVERY [SEC 73 & SEC 74 OF CGST ACT]

Proper officer can issue the order u/s 73 and 74 within 3/5 years of due date of annual return respectively. As the due date of annual return is extended to 30th Nov 2019 for FY 17-18 so the department gets the additional time due to extension of the due date. Had late fee be waived instead the extension of due date, then period of issuance of order would not have been stretched accordingly.

So, for 17-18 the order u/s 73 and 74 can be issued till 30th Nov 2022 and 30th Nov 2024 respectively.

73(2): The proper officer shall issue the notice u/s 73(1) at least three months prior to the time limit specified in sec 73(10) for issuance of order.

73(10): The proper officer shall issue the order u/s 73(9) within three years from the due date for furnishing of annual return for the financial year to which the tax not paid or short paid or input tax credit wrongly availed or utilised relates to or within three years from the date of erroneous refund.

Sec 74 of CGST Act: Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized by reason of fraud or any wilful-misstatement or suppression of facts.

74(2): The proper officer shall issue the notice u/s 74(1) at least six months prior to the time limit specified in sub-section (10) for issuance of order.

74(10): The proper officer shall issue the order u/s 74(9) within a period of five years from the due date for furnishing of annual return for the financial year to which the tax not paid or short paid or input tax credit wrongly availed or utilised relates to or within five years from the date of erroneous refund.

2ND IMPLICATION: PERIOD OF RETENTION OF ACCOUNTS (SEC 36 OF CGST ACT)

As per section 36 of CGST Act , books of account or other records u/s 35(1) are required to be retained till 72 months from the due date of furnishing the annual return. With the extension of due date of annual return for FY 17-18, the books of accounts and records for FY 17-18 u/s 35(1) shall have to be retained by every registered person till 30th Nov 2025.

Section 36: Every registered person required to keep and maintain books of account or other records in accordance with the provisions of sub-section (1) of section 35 shall retain them until the expiry of seventy-two months from the due date of furnishing of annual return for the year pertaining to such accounts and records.

3RD IMPLICATION: DUE DATE OF ITC [SEC 16(4) OF CGST ACT]

After having the decision of AAP And Co. Vs Union of India in Gujarat HC, it is clear that GSTR 3B is not the return u/s 39. And so, in absence of return u/s 39 the due date of annual return will be the determining factor for due date of ITC. So with this extension of due date of annual return , due date of ITC is now 30th Nov 2019.

Section 16(4): A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the due date of furnishing of the return under section 39 for the month of September following the end of financial year to which such invoice or invoice relating to such debit note pertains or furnishing of the relevant annual return, whichever is earlier.

Disclaimer: These are the personal views of author. Author is not responsible for any action taken based on this write up.

Vivek Laddha

Vivek Laddha

Jodhpur, India