faceless tax-assessment system “can lead to erroneous assessment”-Madras HC

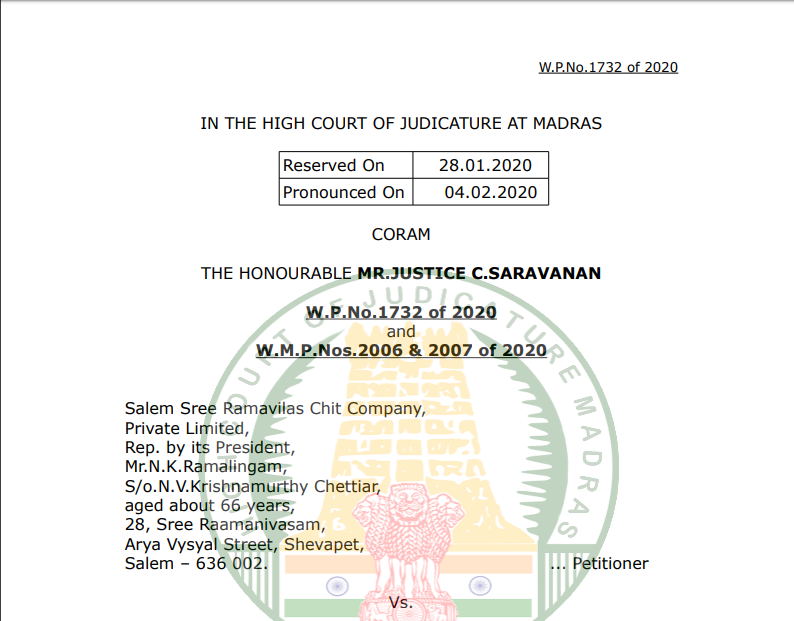

Case covered:

Salem Sree Ramavilas Chit Company

Versus

The Deputy Commissioner of Income Tax

Facts of the case:

In the Writ Petition, the petitioner has challenged the impugned order passed by the respondent on 27.12.2019 in respect of the amount received by the petitioner post demonetization i.e., between 09.11.2016 and 31.12.2016.

It is the contention of the petitioner that in the impugned order, the respondent Deputy Commissioner has erroneously come to a conclusion that the petitioner has not properly explained the deposit of cash amounting Rs.67,37,500/- collected during the demonetization into their account and that the petitioner has claimed the source of cash deposit during demonetization as the accumulated cash balance as on 08.11.2016 wrongly. In the impugned order, it has been concluded that the petitioner has not properly explained the source and the purpose of huge cash along with party wise break up as was requested vide notice dated 20.06.2019 and 29.10.2019 under Section 142(1) of the Income Tax Act, 1961.

Observations of the court:

Since the assessment proceedings no longer involve human interaction and are based on records alone, the assessment proceeding should have commenced much earlier so that before passing the assessment order, the respondent assessing officer could have come to a definite conclusion on facts after fully understanding the nature of business of the petitioner. It appears that the return of income was filed by the petitioner on 02.11.2017. However, the assessment proceeding commenced much later towards the end of the period prescribed under section 153 of the Income Tax Act, 1961. In my view, assessment proceeding under the changed scenario would require proper determination of facts by proper exchange and flow of correspondence between the petitioner and the respondent Assessing Officer.

Under these circumstances, the impugned order is set aside and the case is remitted back to the respondent to pass a fresh order within a period of sixty days from date of receipt of a copy of this order. The petitioner shall file additional representation if any by treating the impugned order as the show cause notice within a period of thirty days from the date of receipt of a copy of this order. Since the Government of India has done away with the human interaction during the assessment proceedings, it is expected that the petitioner will clearly explain its stand in writing so that the respondent assessing officer can come to an objective conclusion on facts based on the records alone. It is made clear that the respondent will have to come to an independent conclusion on facts uninfluenced by any of the observations contained herein.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.