[Matching tool released]FAQ’s on GSTR 2B with format

Table of Contents

- Latest update- GSTR 2b and purchase register matching tool

- What is GSTR-2B?

- What is the use of GSTR 2b?

- What is the difference between GSTR 2b and 2A?

- Who can access the GSTR 2b?

- How to access GSTR-2B on the GST portal?

- What is the format of GSTR 2b?

- What is the various information in Table 3 of GSTR 2A with important instructions?

- What is the data in Table 4 of GSTR 2B with instruction?

Latest update- GSTR 2b and purchase register matching tool

GSTN has released a utility to match the data in GSTR 2b with the purchase register. The tool can be downloaded from the GSTN portal. Go to downloads and click on “Matching offline Tool”

What is GSTR-2B?

A new auto-populated form is appearing on the GSTN portal. We can divide it into two parts. Eligible input tax credit and ineligible input tax credit. Invoice level details are given in GSTR 2B. You can also find the reason for the ineligibility of a particular credit. e.g. the place of supply is not in the state of the recipient.

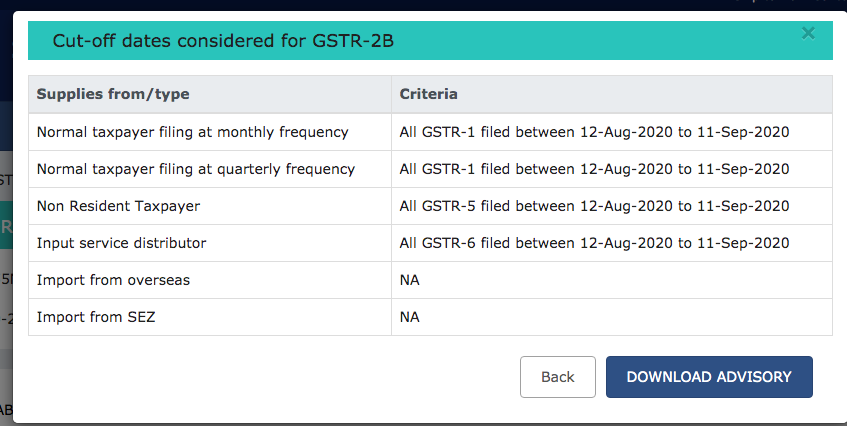

GSTR 2B is the statement of the input tax credit for a taxpayer. It is generated from the data uploaded in GSTR 1,5 and 6. The relevant data is auto-populated. It has a cut off date. Data filed up to that date is reflected. e.g. In GSTR 2B of August month, the data from 12 a.m. on 12th of August 2020 to 11:59 p.m. on 11th September 2020. You can see the various cut-offs in the image.

What is the use of GSTR 2b?

It can make the return filing easy. The taxpayer can see the data related to last month. Entire ITC available to him at the time of filing. Also, the spillover of past ITC to the next month can be managed easily. The chances of taking the ITC twice or missing it, are also reduced. It is required at the time of filing GTSR 3b. GST’s new returns are scrapped. But this form is going to fill that gap. Quite useful data arranged in a lucid manner.

What is the difference between GSTR 2b and 2A?

| GSTR 2B | GSTR 2A | |

| Nature | Static | Dynamic |

| Base date | GSTR 1,5,6 and import data from ICEGATE | GSTR 1,5,6,7, 8 |

| Frequency | Monthly | Monthly |

| Data updation | No | Yes |

| Reason for noneligibility of input tax credit | Yes | No |

Who can access the GSTR 2b?

Every registered person in GST can access this form on their GSTIN portal.

How to access GSTR-2B on the GST portal?

It can be accessed from the following path.

Login to GST Portal > Returns Dashboard > Select Return period > GSTR-2B.

What is the format of GSTR 2b?

It has the following tables.

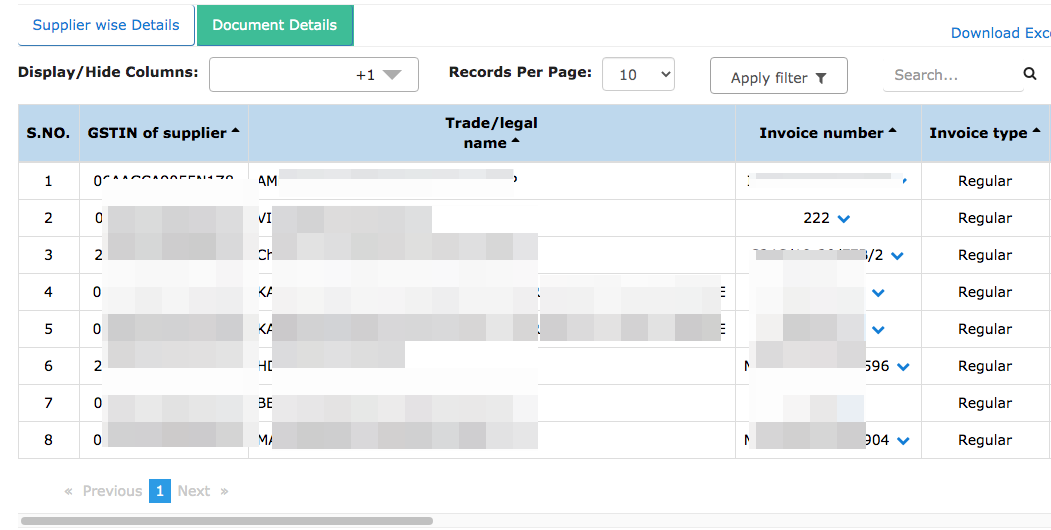

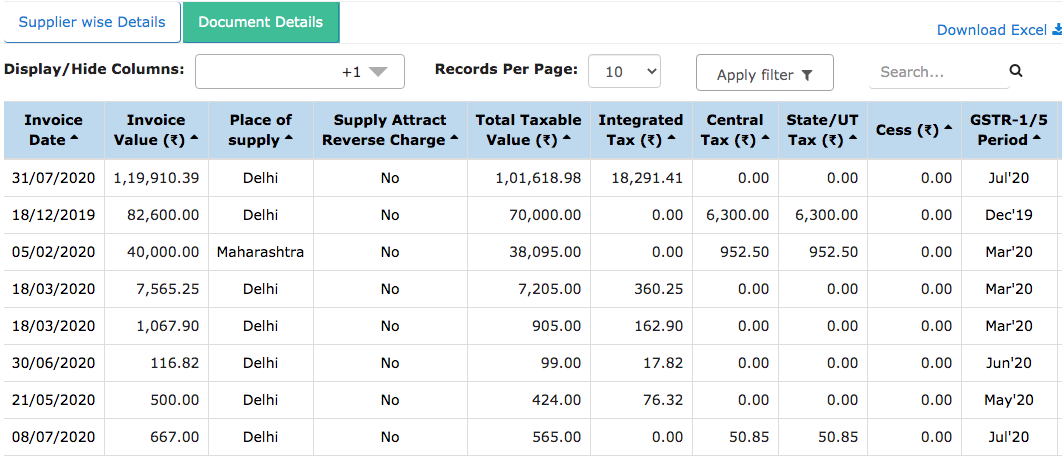

- Document Details

Information related to all documents is summarised in this table. Place of supply, date of invoice, name of the party is given. Also, the information related to the reverse charge of supply is covered.

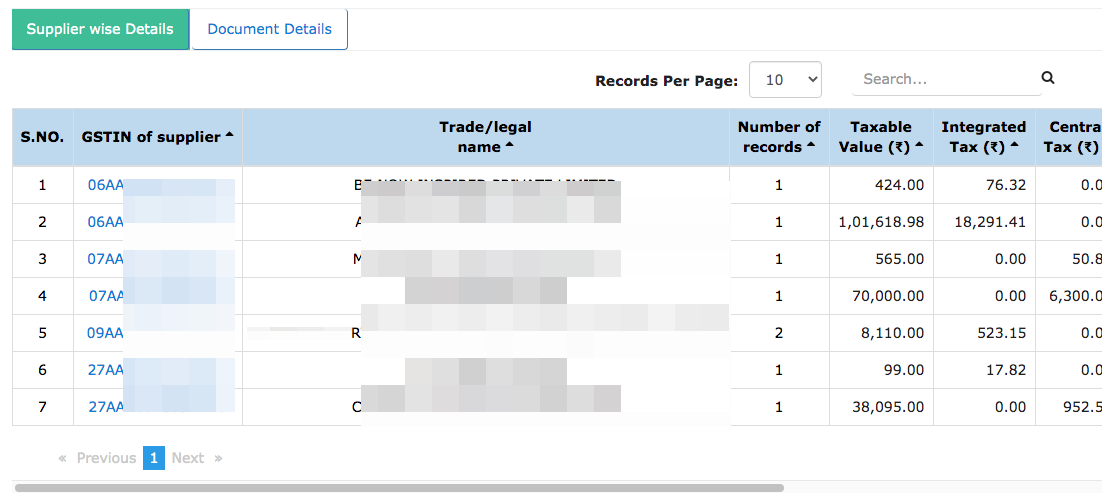

Supplier wise details

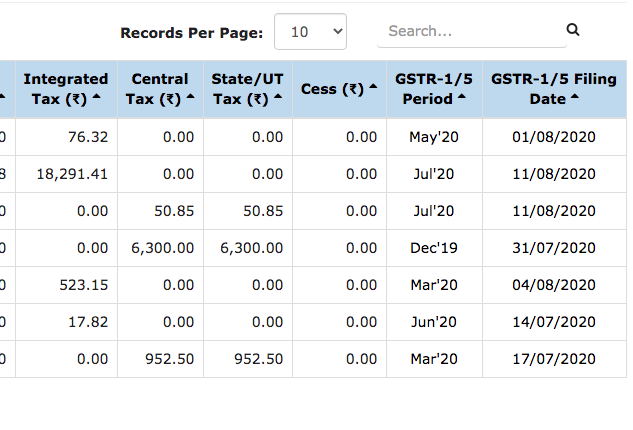

These are the various details available in GSTR 2B. Documents details and suppliers’ details are available. Details related to the availability of ITC is also available. Information about the filing of date of return is also given. The place of supply is also provided. In the case of place of supply in other states then the state of the recipient, GST credit is not available in GST. This information is also provided in this form.

What is the various information in Table 3 of GSTR 2A with important instructions?

| Heading | Instructions |

| All other ITC – Supplies from registered persons other than reverse charge |

i. This section consists of the details of supplies (other than those on which tax is to be paid on a reverse charge basis), which have been declared and filed by your suppliers in their FORM GSTR-1 and 5. ii. Negative credit, if any, may arise due to amendment in B2B– Invoices and B2B – Debit notes. Such credit shall be reversed in Table 4(B)(2) of FORM GSTR-3B. |

| Inward Supplies from ISD |

i. This section consists of the details of supplies, which have been declared and filed by an input service distributor in their FORM GSTR6. ii. Negative credit, if any, may arise due to amendment in ISD Amendments – Invoices. Such credit shall be reversed in table 4(B)(2) of FORM GSTR-3B. |

| Inward Supplies liable for reverse charge |

i. This section consists of the details of supplies on which tax is to be paid on reverse charge basis, which have been declared and filed by your suppliers in their FORM GSTR-1. ii. These supplies shall be declared in Table 3.1(d) of FORM GSTR-3B for payment of tax. Credit may be availed under Table 4(A)(3) of FORM GSTR-3B on payment of tax. |

| Import of Goods |

i. This section provides the details of IGST paid on import of goods from overseas and inward supply of goods from SEZ units/developers on bill of entry and amendment thereof. These details are updated on a near real-time basis from the ICEGATE system. ii. This table contains the data of imports made by you (GSTIN) in the month for which GSTR-2B is being generated for. iii. The ICEGATE reference date is the date from which the recipient is eligible to take input tax credit. iv. The table also provides if the Bill of entry was amended. v. Information is provided in the tables based on data received from ICEGATE. Information on certain imports such as courier imports may not be available. vi. This data will be made available from GSTR-2B of August 2020 onwards (i.e. 12th September 2020). |

| Others |

i. This section consists of the details of credit notes received and amendment thereof which have been declared and filed by your suppliers in their FORM GSTR-1,5 and 6. ii. Such credit shall be reversed under Table 4(B)(2) of FORM GSTR-3B. If this value is negative, then credit may be reclaimed subject to reversal of the same on an earlier instance. |

What is the data in Table 4 of GSTR 2B with instruction?

| Table | Heading | Instructions |

| Table 4 | All other ITC – Supplies from registered persons other than reverse charge |

i. This section consists of the detail of supplies, which have been declared and filed by an input service distributor in their FORM GSTR-6 but satisfy either of the two conditions mentioned at Sr. No. 11 above. ii. This is for information only and such credit shall not be taken in FORM GSTR-3B. |

| Table 4 | Inward Supplies from ISD |

i. This section consists of the detail of supplies, which have been declared and filed by an input service distributor in their FORM GSTR-6 but satisfy either of the two conditions mentioned at Sr. No. 11 above. ii. This is for information only and such credit shall not be taken in FORM GSTR-3B. |

| Table 4 | Inward Supplies liable for reverse charge |

i. This section consists of the details of supplies liable for reverse charge, which have been declared and filed by your suppliers in their FORM GSTR-1 but satisfy either of the two conditions mentioned at Sr. No. 11 above. ii. These supplies shall be declared in Table 3.1(d) of FORM GSTR-3B for payment of tax. However, credit shall not be taken in FORM GSTR-3B.

|

| Table 4 | Others |

i. This section consists details the credit notes received and amendment thereof which have been declared and filed by your suppliers in their FORM GSTR-1,5 and 6 but satisfy either of the two conditions mentioned at Sr. No. 11 above. ii. Such credit shall be reversed under Table 4(B)(2) of FORM GSTR-3B. |

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.