FAQs on GSTR 3b updated till Sept 2020

FAQs on GSTR 3b-

Every registered person is required to fill the details of their supplies. It is required to make the payment of correct tax to the government. Here we have compiled the FAQs on GSTR 3b. It is a return required to be filed by GST taxpayers.

What is GSTR 3b?

GSTR 3b is the regular return of GST. Every registered taxpayer is required to file it except the following.

- composition dealer,

- ISD,

- TDS and TCS deductor

The amount of tax payable is determined in GSTR 3b.

What is a step by step process to file GSTR 3b?

The GSTN portal is changed recently. New form GSTR 2b is also available. We need to follow these steps before filing GSTR 3b.

- Reconcile GSTR 2b with the purchase register. A tool to match GSTR 2b with the purchase register is available on the GSTN portal. First, match it with purchase details. The invoices matching with the 2b are eligible for ITC. In case of the missing bill, ITC is not available. You can request your supplier to include the invoice sin next month’s return. In that case, ITC is available next month when they will reflect in GSTR 2b.

- Match your sales figures with SGTR 1. The due date for filing of GSTR 1 is 11th. Thus it is already filed at the time of filing GSTR 3b. Every invoice entered in GSTR 1 should match with GSTR 3b tax liability. Now GSTRN portal will auto populate the figures of GSTR 1in GSTR 3b. It is easy to match.

- Then enter the data in GSTR 3b. Take care to enter it in the correct row.

Who is required to file GSTR 3b?

Section 39 of the CGST Act provides for filing of return. GSTR 3b is the prescribed return for section 39. (Rules amended retrospectively for that purpose). Every taxable person is required to take registration. There are different types of registrations in GST. Every regular taxpayer is required to file GSTR 3b.

What is the due date for the filing of GSTR 3b?

The due date for filing of GSTR 3b is the 20th of next month.

Example- For the month of January 2020 the due date is February 20th. But CBIC can extend the due dates via notification. Due dates for the lockdown period were extended. You can see the due dates chart here.

Which information is required for the filing of GSTR 3b?

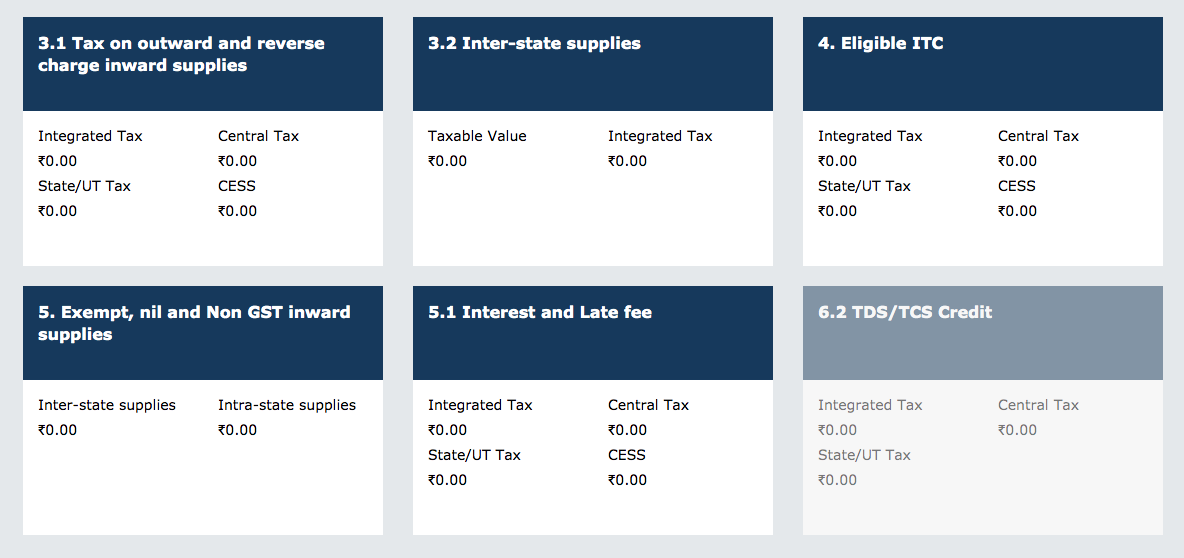

GSTR 3b contains 6 tables where data is fed.

Table 3.1- It contains 5 rows. The first one is called (a) and here we need to fill the normal taxable domestic supply. Then the second row is for Zero-rated supplies. It means the export and supply from and to an SEZ unit or developer. The third row is for exempted supplies. The next one is for inward supplies covered under the reverse charge. The last row is for Non-GST outward supplies. It covers the supplies where there is no GST levy.

Table 3.2 This table is for the data related to the interstate supply to unregistered persons. Supplies made to composition dealers and UIN holders are also covered here.

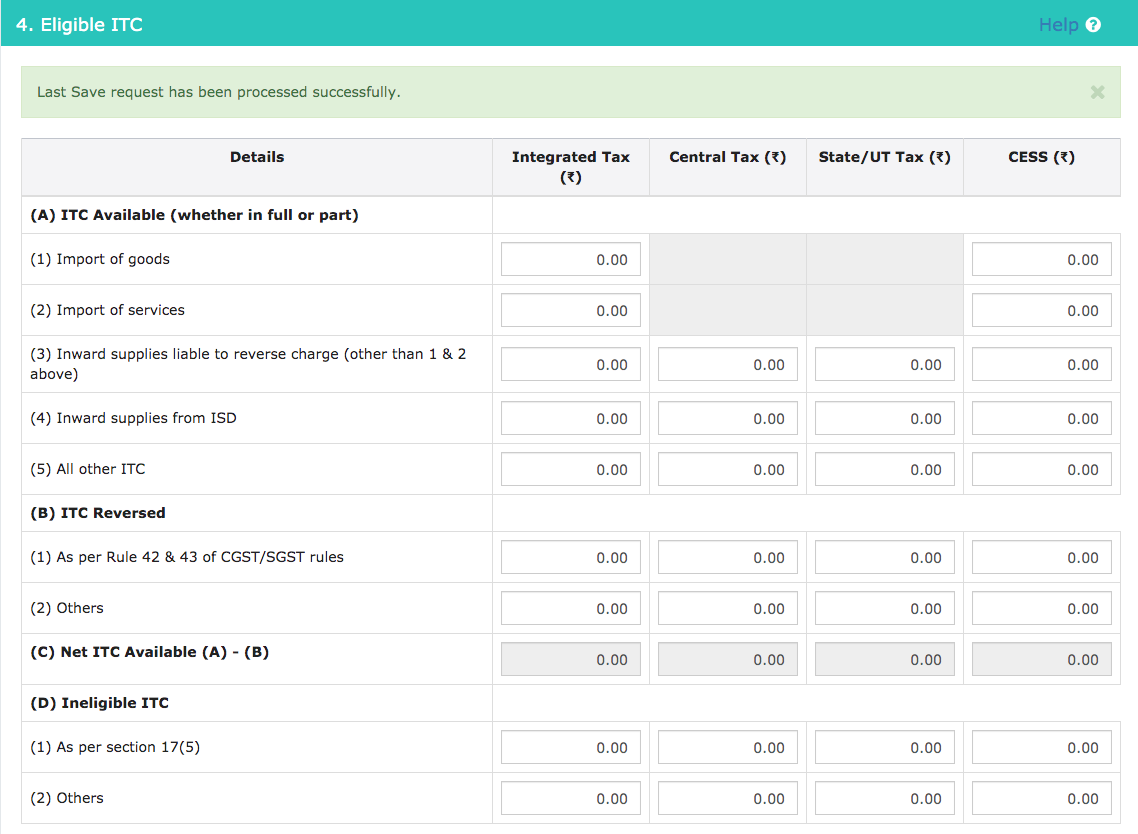

Table 4 – This is a table for eligible ITC. Information related to ITC can be filled here.

Table 5 Information related to the Exempted, Nil rated, and Non-GST inward supply is required in this table.

Table5.1 This table contains the data related to the interest and late fees. Late fees are fixed and auto-populates. But the interest figure is entered by the taxpayer.

Table 6.2 TDS and TCS credit are covered in this table. This credit is equivalent to the cash balance. You can use it in payment of output tax liability.

What are the late fees for late filing of GSTR 3b?

The late fees for late filing of GSTR 3b are Rs. 50 per day. This late fee is subject to a maximum of Rs. 10000 for each month. There are different amnesty schemes declared from time to time. You can take benefit of those schemes also.

What are the consequences of the late filing of GSTR 3b?

Following are the consequences for late filing-

- Delay in the claim of input tax credit

- Late fees for delay in filing of GSTR 3b

- Interest on the amount of tax paid after the due date

- The notice form the department

- Blockage of E-way bill

How to access GSTR 3b?

You can access the GSTR 3b at your GSTN dashboard. Click on the returns dashboard. Then you will get a checklist. Once you finish the checklist you can access the GSTR 3b.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.