FAQ’s on TCS on goods u/s 206C(1H) from 1-10-2020

What is TCS on goods u/s 206C(1H)

This is a new TCS on goods u/s 206C(1H) of the income tax Act. It is applicable when the total gross receipts or turnover in the previous year was more than Rs. 10 crores. This provision is applicable to from 1-10-2020. Thus the previous year is 2019-20.

- For calculation of Rs. 10 crores goods and services both are considered.

- Gross receipts or turnover are relevant for 10 crore turnover.

Whose TCS will be collected u/s 206C(1H)?

TCS will be deducted from a person when the receipts of sale consideration are more than Rs. 50 lac from that person. The receipt shall be for the sale of goods.

Whether the TCS is applicable to the sale of services also?

No, this is a TCS only on goods. It is not applicable to receipts from the sale of services.

When we need to deposit the TCS u/s u/s 206C(1H) is required to be deposited?

Just like other TDS, it shall be deposited by the 7th of next month.

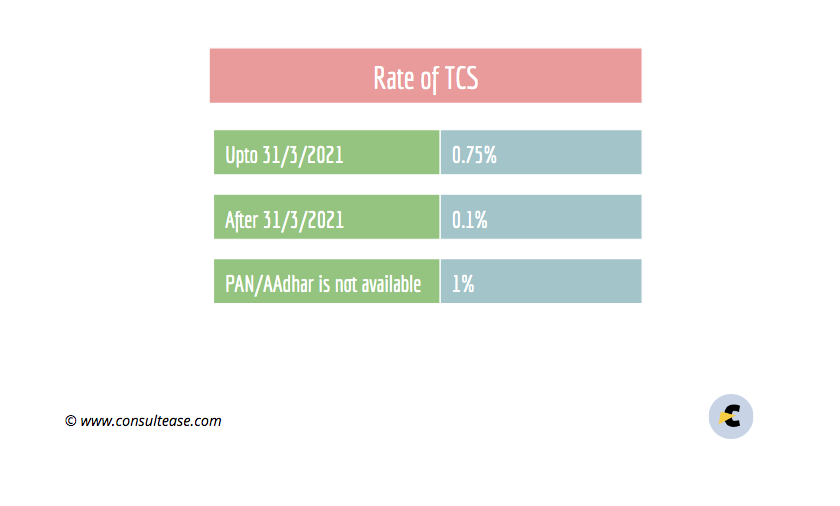

What is the rate of TCS on goods u/s 206C(1H)?

The rate of TCS on goods u/s 206C(1H) is 0.1% of receipts above Rs. 50,00,000. But up to 31st March 2021, the rate is reduced by 25%. Thus the effective rate up to 31st March 2021 is 0.075%.

When the PAN and Aadhar of the deductee are not available, the rate will be 1%.

Example- Mr. X received an amount of Rs. 40 lac from Mr. Y. He then got Rs. 20 lac from Mr. Y. The Rate of TCS is 0.075% of Rs. 10 lac (40+20-50)

Now if Mr. Y cant provides the PAN or Aadhar, the TCS rate is 1%.

For receipts after March 2021, the rate will be 0.1%

What is the duration for receipt of Rs.50 lac for TCS on goods u/s 206C(1H)?

It should be from 1st April 2020 to 31st March 2021. We need to consider the full year and not the receipts after 1-10-2020.

Whether the receipt of Rs. 50 lac for TCS on goods u/s 206C(1H) is inclusive of GST?

No, The TCS is on consideration for sales of Goods. The amount of tax is not a consideration.

Can the TCS on goods u/s 206C(1H) be collected when there is other TCS, already applicable?

No, This TCS is applicable only when there is no other TCS.

Example- In the case of sale of the car to consumer TCS is already applicable. Thus TCS on goods u/s 206C(1H) will not be applicable. But for sale by the dealer to dealer, normal TCS is not applicable. In this case, the TCS on goods u/s 206C(1H) will be applicable.

Whether the advance is also included in the threshold of Rs. 50lac?

We need to look at the total receipts for a year. That receipt may be as an advance or after-sale amount. In any case, if the total number of receipts is less than Rs. 50 lac. The TCS is not applicable.

Whether the inter-branch transfers will also be included for TCS on goods u/s 206C(1H)?

There is a lack of clarification in this regard. But the term receipt is used. But if the branch doesn’t have a separate PAN how TCS can be deducted.

What is the applicability of TCS u/s 206C(1H)?

The applicability of 206C(1H) is on payments received after 1-10-2020.

Example- Mr. X received Rs. 1 Crore from Mr. Y up to 30th September. Then He received Rs. 1 lac on 5th October. TCS is deductible on Rs. 1 lac. But to see the threshold limit we need to consider the full year.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.