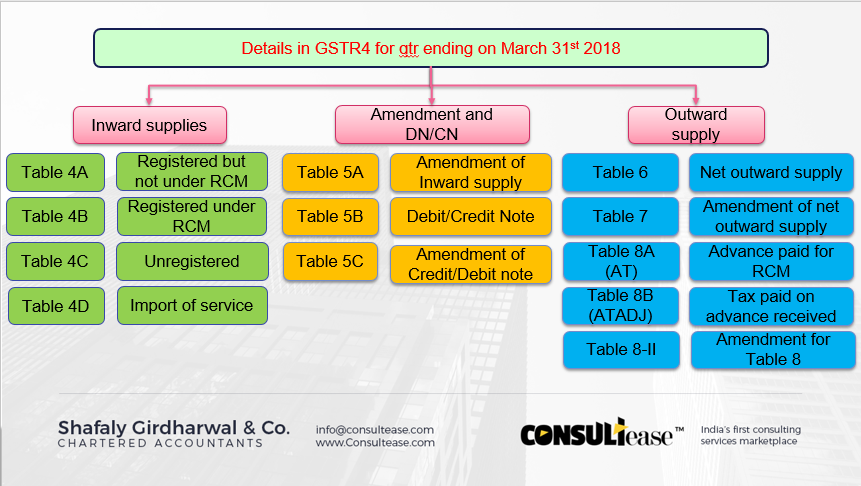

Filing of GSTR 4 for qtr ended on 31st March

Filing of GSTR 4 for qtr ended on 31st March:

New utility for the filing of GSTR 4 is released by CBIC.This utility is named as GST offline utility v2.1.Let us discuss some important points related to this utility.

- Information to be provided: Following tables are there in utility.

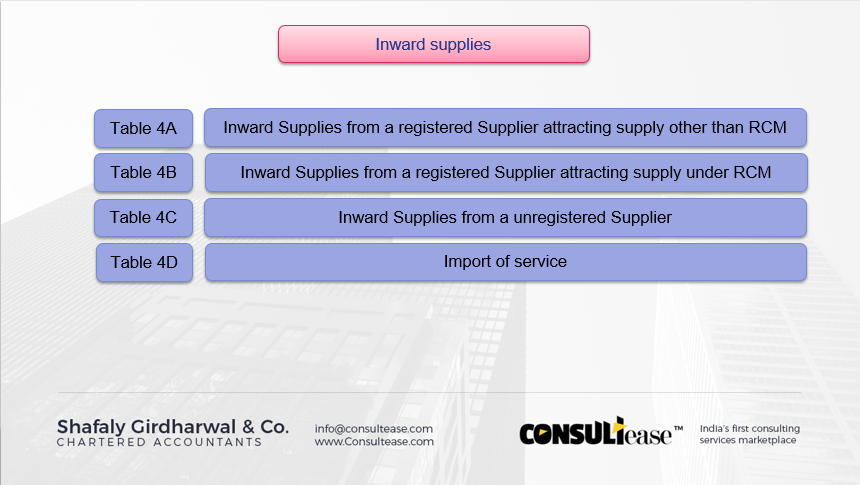

i) Table asking for inward supply details:

Table 4A to 4D covers the details of inward supply by a composition dealer.

- Table 4A: Inward supplies received from a registered person not attracting the reverse charge

- Table 4B: Inward supplies received from a registered person attracting the reverse charge.

- Table 4C: Inward supplies received from the unregistered supplier.

- Table 4D: Import of service

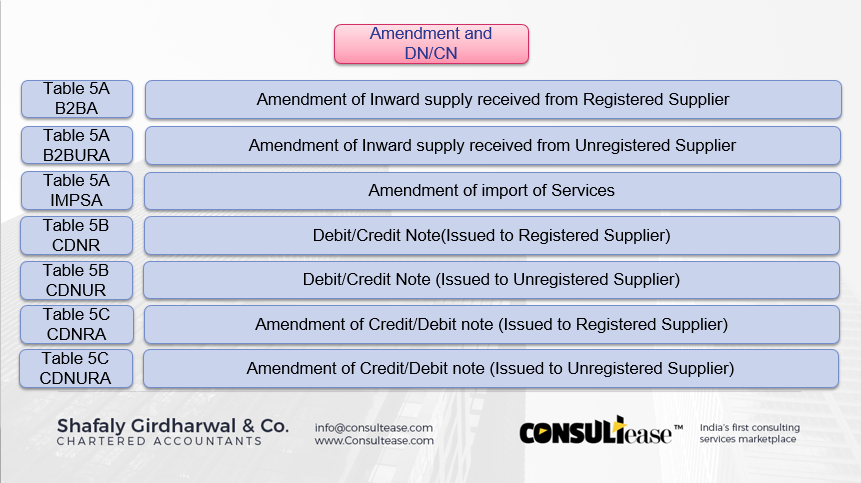

ii) Table for amendment of previous data and debit and credit notes

Table 5A to 5C covers the modification of previously filed data and debit credit notes

Table 5A(B2BA): This table covers the amendment of inward supply received from a registered supplier.

Table 5A(B2BURA): This table covers the amendment of inward supply received from an unregistered supplier.

Table 5A(IMPSA): This table covers the amendment of import of services.

Table 5B(CDNR): Debit/credit notes for registered

Table 5B(CDNUR): Debit /credit notes for unregistered

Table 5C(CDNRA): Amendment of debit/credit notes for registered

Table 5C(CDNURA): Amendment of debit/credit notes for unregistered

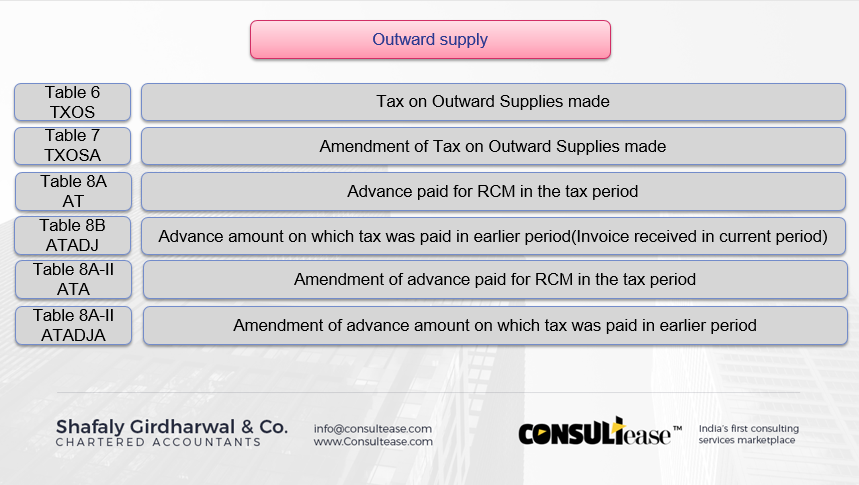

iii) Table for details of supply:

Table 6 (TXOS): Tax on outward supplies made will be disclosed in this table. This amount will be net of advance and goods returned.

Table 7(TXOSA): Amendment in Tax on outward supplies made will be disclosed in this table. This amount will be net of advance and goods returned.

Table 8A(AT): the Advance amount paid for reverse charge supplies in the tax period.

Table 8A-II (ATA): Amendment for the Advance amount paid for reverse charge supplies in the tax period.

Table 8B(ATADJ): Advance on which tax was paid in earlier period but the invoice is raised in the current period.

Table 8B-II (ATADJA): Amendment of Advance on which tax was paid in earlier period but the invoice is raised in the current period.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.