Filing reply to Form GST DRC-22

The Tax Official has issued Form GST DRC-22 to the concerned authorities for provisional attachment of my property, bank accounts, etc. How can I file reply to Form GST DRC-22 against proceedings initiated against me?

To file reply to Form GST DRC-22 against proceedings initiated against you by Tax Officer, for recovery of taxes by attaching your property, perform following steps:

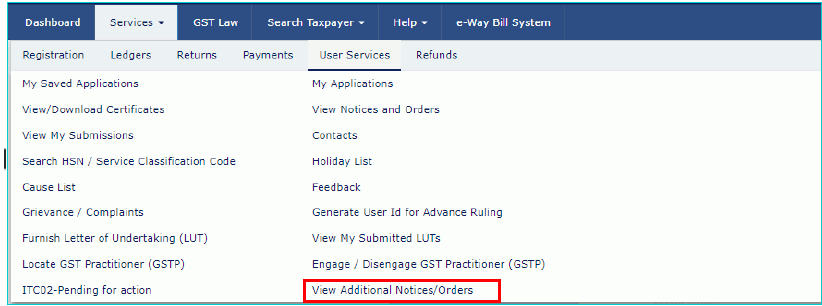

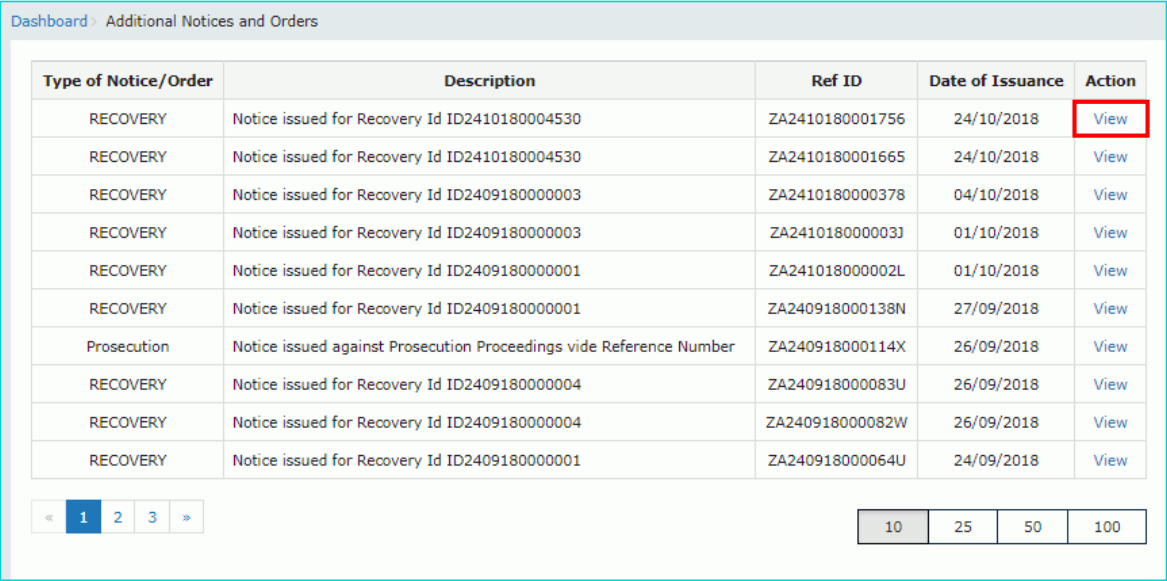

A.Navigate to View additional notices/ Orders page to view notices and orders issued against you by tax official.

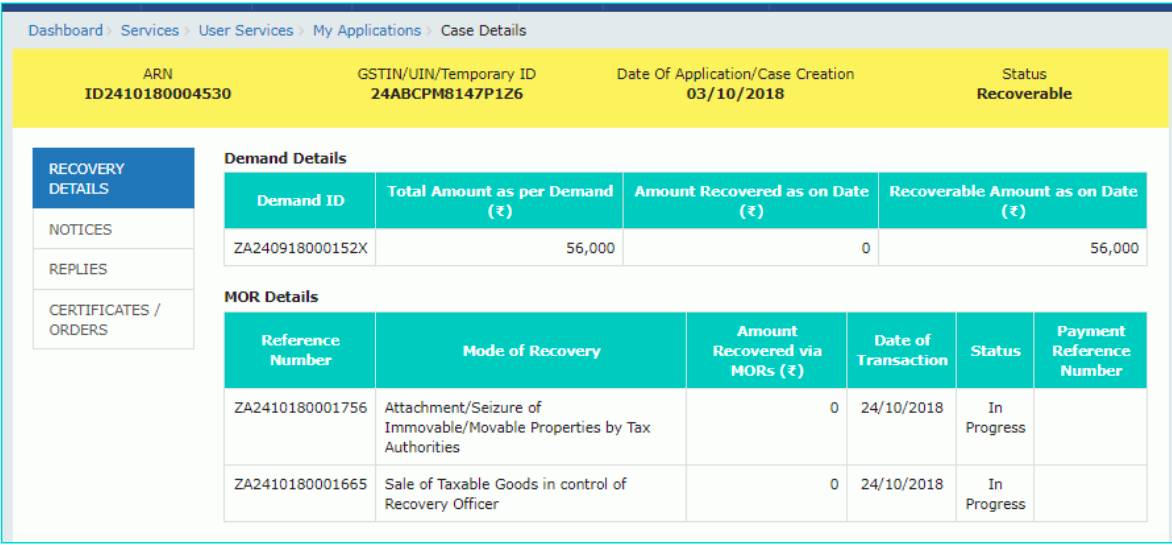

B.Take action using recovery details tab of case details screen: View recovery details.

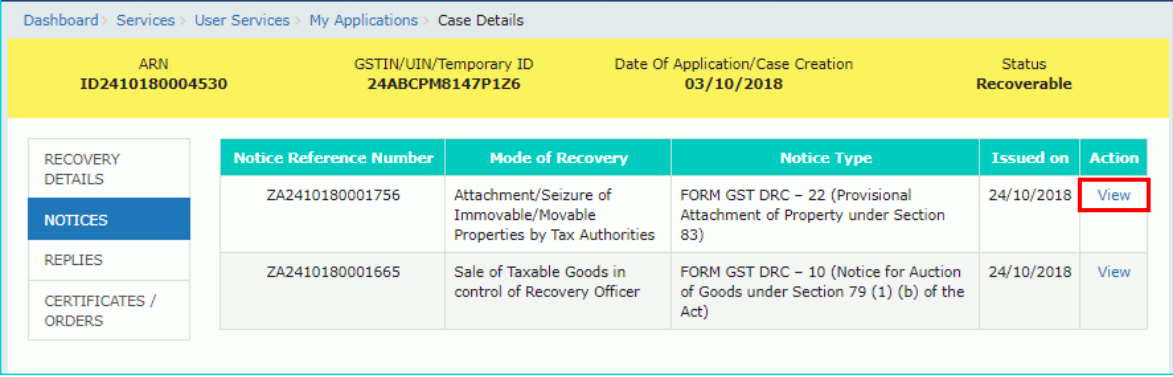

C.Take action using Notices tab of case details screen: View issued notices.

D.Take action using replies tab of case details screen: View/ add your reply to the issued notice.

E.Take action using Certificates/ Orders tab of case details screen: View issued order or certificate

Click each hyperlink about to know more:

B. Take action using recovery details tab of case details screen: View recovery details.

To view the recovery details, perform following steps:

1. Navigate to Services > User Services > View Additional Notices/Orders option.

2. Click View.

3. On the Case Details page of that particular taxpayer, select the RECOVERY DETAILS tab, if it is not selected by default. This tab displays all the details of demand issued and mode of recovery.

Go back to the main menu.

C. Take action using Notices tab of case details screen: View issued notices.

To view issued notices by the Tax Official, perform following steps:

1. On the Case Details page of that particular taxpayer, select the NOTICES tab, if it is not selected by default. This tab displays all the notices issued by the Tax Official.

2. Click the View link in the Action column of the table to download notices issued into your machine and view them.

Go back to the main menu.

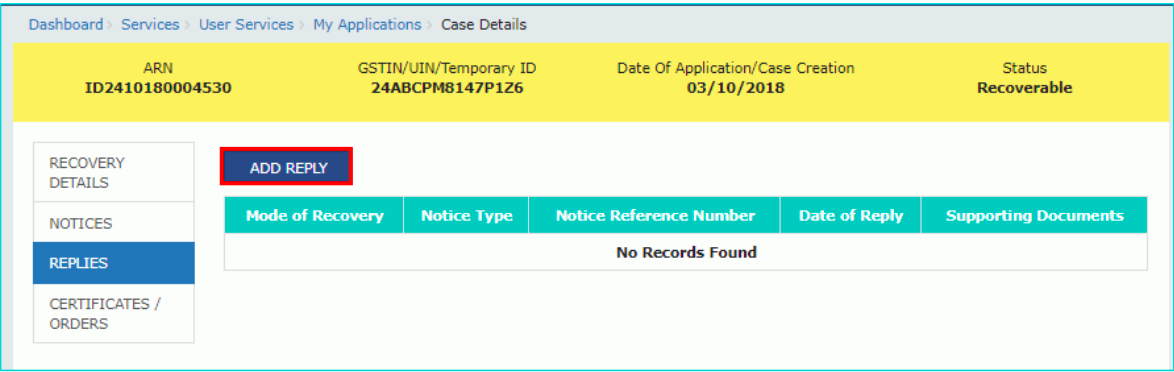

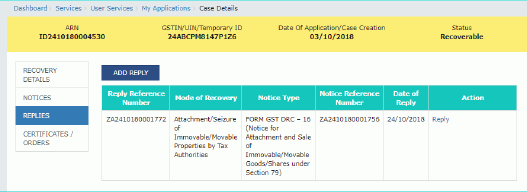

D.Take action using replies tab of case details screen: View/ add your reply to the issued notice.

To view or add your reply to the to Form GST DRC-22, perform following steps:

1. On the Case Details page of that particular taxpayer, select the REPLIES tab. This tab will

display the replies you will file against the Notices issued by the Tax Official. To add a reply, click ADD REPLY.

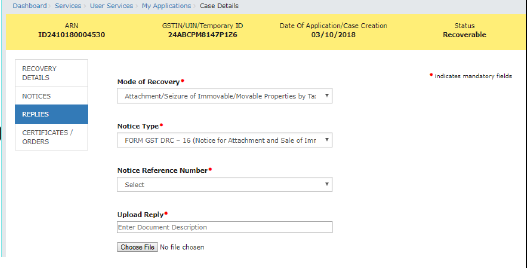

2. The REPLY page is displayed.

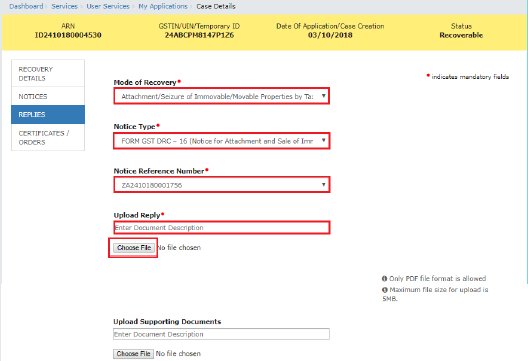

3. Select the Mode of Recovery, Notice Type and Notice Reference Number from the drop-down list.

3. Select the Mode of Recovery, Notice Type and Notice Reference Number from the drop-down list.

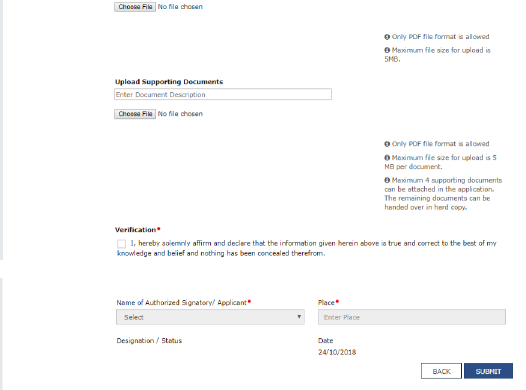

4. Click Choose File to upload your reply and upload any supporting document(s) related to your reply, if any.

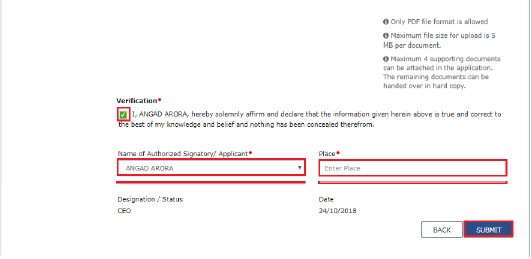

5. Select the Verification check-box and select the name of the authorized signatory.

6. Enter the Place where the form is filed.

7.CLICK SUBMIT.

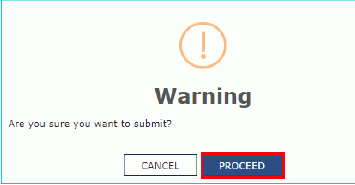

8. Click PROCEED.

8. Click PROCEED.

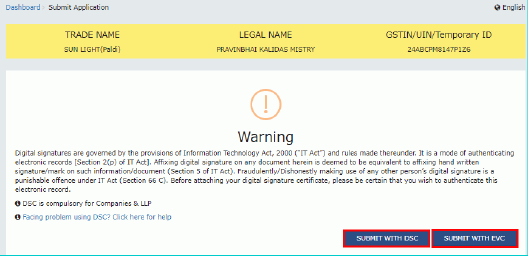

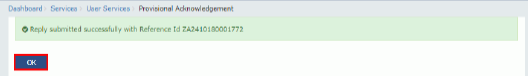

9. Submit Application page is displayed. Click ISSUE WITH DSC or ISSUE WITH EVC. 10. A success message is displayed with the generated Reference number. Click OK.

10. A success message is displayed with the generated Reference number. Click OK.

11. The updated REPLIES tab is displayed, with the record of the filed reply in a table. You can also click the documents in the Action section of the table to download them.

Note: Once you file your reply successfully, following actions take place on the GST Portal:

Note: Once you file your reply successfully, following actions take place on the GST Portal:

You will receive an acknowledgement intimation via your registered email and SMS, along with the generated RFN.

Your reply will be available on Tax Official’s dashboard.

Go back to the main menu.

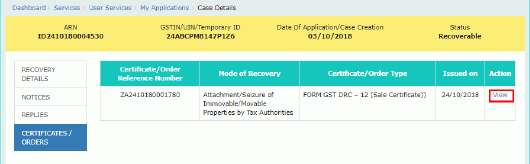

E.Take action using Certificates/ Orders tab of case details screen: View issued order or certificate.

To download order issued against your case, perform following steps:

1. On the Case Details page of that particular taxpayer, click the CERTIFICATES / ORDERS tab. This tab provides you an option to view the issued order or certificate, with all its attached documents, in PDF mode.

2. Click the View link in the Action column of the table to download and view them. Go back to the main menu.

Go back to the main menu.

B S Seethapathi Rao

B S Seethapathi Rao

East Godavari, India