Forex Loss is Revenue Expenditure: M/s Coffee Day

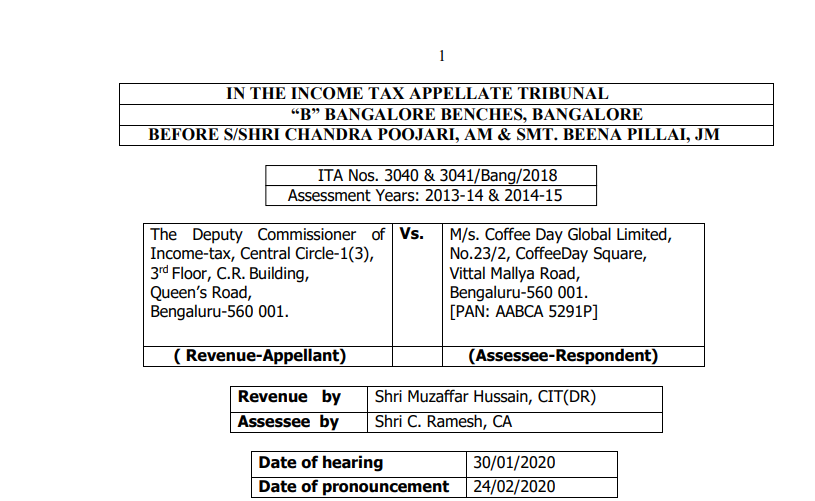

Case Covered:

The Deputy Commissioner of Income-tax

Versus

M/s. Coffee Day Global Limited

Facts of the case:

The facts of the issue as narrated in ITA No. 3040/Bang/2018 are that the Assessing Officer by placing reliance on the CBDT Circular No. 5/2014 dated 11/02/2014 quantified the disallowance u/s. 14A r.w.Rule 8D(2)(iii) of the I.T. Rules. The Assessing Officer considered the following investment made by the assessee for the purpose of disallowance u/s. 14A r.w. Rule 8D(2)(iii)

Observations of the court:

The ratio of the above decision is whether the gain or loss should be brought to tax or allowed as deduction depends upon whether the foreign currency transactions were carried on account of capital or revenue items. If the foreign currency transactions are undertaken on capital account, the gain made out of such transaction is outside ambit of taxation, of course, subject to the application of provisions of section 43A of the Act. If the transactions are undertaken are on account of revenue items, the gain is clearly taxable and so the loss also is clearly allowable. In the present case, in the assessment year 2013-2014, Rs.18.12 crore represents the notional forex loss that is the reinstatement of loan as on 31st March by marking to marketing rate and the balance amount is incurred on actual payment made during the year. In the assessment year 2014-2015, Rs.25.55 crore represents notional forex loss as above and the balance amount is incurred on actual payment during the year. The Assessing Officer except making the bald assertion that the transactions were undertaken on account of capital items no evidence was brought on record to establish that the foreign currency transactions were undertaken on capital items.

The Supreme Court in the case of CIT vs. Woodward Governor India Pvt. Ltd. (2009) 312 ITR 254 had already held that the actual payment was not a condition precedent for making the adjustment in respect of foreign currency transactions at the end of the closing year. We are, therefore, unable to concur or agree with the view of the Assessing Officer that liability could arise only when the contract would have matured as such a stand is totally divorced from the accounting principles and is in variance with the principle upheld by the Apex Court in the case of Woodward Governor India Pvt. Ltd. (supra). It is also not in dispute that assessee is following the mercantile system of accounting consistently. The foreign exchange loss is due to the reinstatement of the accounts at the end of the financial year as well as loss incurred on account of exchange fluctuation on repayment of borrowings is similar to the interest expenditure and it is to be allowed as revenue expenditure u/s 37 of the I.T.Act, as per the accounting standard approved by the Institute of Chartered Accountants of India. Hence, we do not find any infirmity in the finding of the CIT(A) on this issue and confirm the same. This ground of appeals of the Revenue is dismissed.

As a result, the appeals of the Revenue are partly allowed. Order pronounced on this 24th day of February 2020

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.