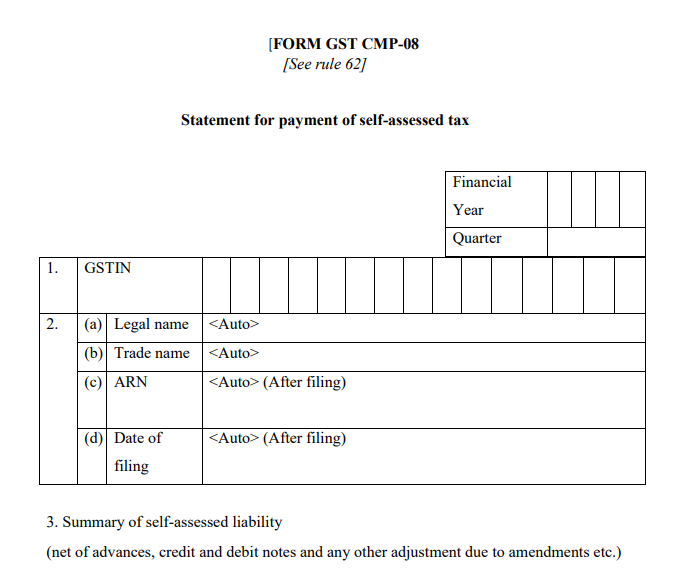

Format of “Form”- CMP 08

Table of Contents

Introduction

A composition dealer is required to file CMP 08. Earlier they were required to file GSTR 4 on quarterly basis. Thereafter, rule 62 was amended in which CMP 08 is required to be filed as a quarterly statement. Details of sales, tax payable in RCM and tax on outward sales are reported in this statement. This statement is filed on payment of the final amount of tax. Moreover, composition dealers are neither eligible for input tax credit nor they can charge tax on outward supplies from the customers.

Rate at which tax is payable under composition levy :

- Manufacturers: 1% of turnover in a state or turnover in union territory

- Restaurants and eating outlets covered by para 6 clause (b) of schedule II: 5% of turnover in a state or turnover in union territory.

- Traders: 1% of Taxable turnover in state or union territory.

Thus they need to pay tax on total outward supply *tax rate, without adjustment of ITC.

Purpose

A composition dealer is required to make payment of taxes on a quarterly basis. This statement CMP 08 has been prescribed for such payment. Outward supply details net of amendments is required to be provided along with inward supplies on which tax is required to be paid on a reverse charge basis.

Due date

Form GST CMP-08 is a statement to be furnished by a composition dealer ending each quarter. Thus, the due date to file GST CMP-08 is 18th of the month following the quarter for which tax payment needs to be made by the composition dealer.

Related Topic:

What is CMP 08 ? How to handle negative liability and format of letter to deptt.

Late fees and Interest

Section 47 of CGST Act prescribes late fees for returns u/s 37, 38, 39 & 45 for delay in filing of returns. Since CMP 08 is a statement and it’s not a return, therefore, no late fees shall be levied.

However, every registered person shall have to pay interest of 18% p.a if he fails to pay tax on or before the due date u/s 50. Thus the interest is to be calculated on the amount of tax to be paid by the registered person.