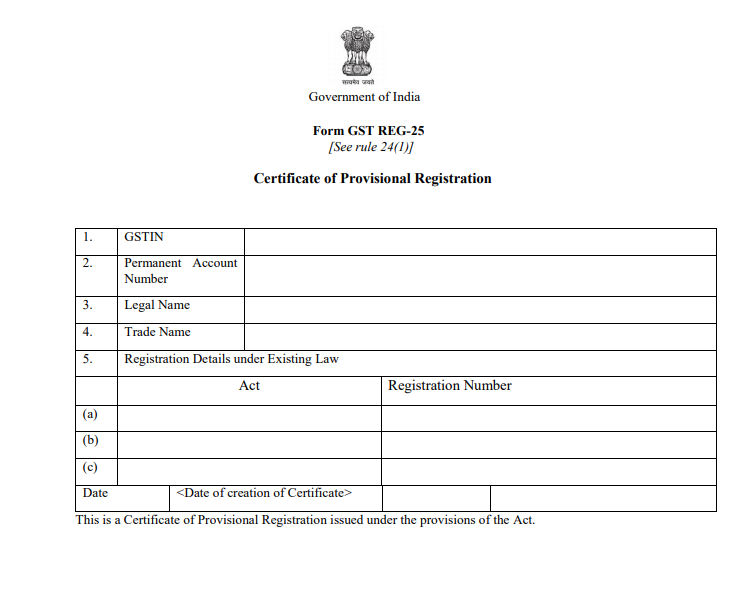

Format of “Form” – REG 25

Table of Contents

Introduction

REG 25 is a certificate of provisional registration under GST. Every taxpayer registered under excise/VAT/service tax enrolls on a common portal. He provides his email ID and mobile number for verification purposes. On enrollment:

- Taxpayer gets provisional certificate of registration in form GST REG 25 which contains GSTIN.

- Where the taxpayer is having multiple registrations under previous law on the basis of single PAN, then, single provisional registration is granted under GST.

Related Topic:

Format of “Form” – REG 14

- A person with centralized registration under service tax will be granted only one GST provisional registration in the State in which he is registered under the service tax

This registration is on a provisional basis.

Related Topic:

Format of “Form” – REG 21

Final Registration

- Person liable to register or for voluntary registration, make an application in form GST REG 26.

- Submit information in three months, if required.

- If information is correct, the officer grants final registration in REG 06.

- Officer will issue show cause notice in GST REG 27. Cancellation of provisional registration in REG 28 after giving reasonable opportunity of being herd.

- But where the reply is satisfactory, order under form GST REG 20 is issued to nullify show cause notice.

Related Topic:

List for state-wise threshold for registration in GST

Cancellation of provisional registration

- Where a person registered under Pre GST law is not required to obtain registration under GST laws. He can apply for cancellation of registration in 30 days from the appointed date.

- He has to submit an application electronically in FORM GST REG-29 at the Common Portal for cancellation of the registration granted to him.

- After inquiry, authorized officer will cancel the registration.