FORM GSTR-10 Final Return under GST

FORM GSTR-10: Final Return under GST

FORM GSTR-10

(See rule 81)

Final Return

| 1. | GSTIN | |

| 2. | Legal Name | |

| 3. | Trade Name, if any | |

| 4. | Address for future correspondence | |

| 5. | The effective date of cancellation of registration

(Date of closure of business or the date from which registration is to be canceled) |

|

| 6. | The reference number of the cancellation order | |

| 7. | Date of the cancellation order | |

8. Details of inputs held in stock, inputs contained in semi-finished or finished goods held in stock, and capital goods/plant and machinery on which input tax credit is required to be reversed and paid back to Government.

| Sr.

No. |

GSTIN | Invoice/Bill of Entry | Description of inputs held in stock, inputs contained in semi-finished or finished goods held in stock and capital goods /plant and machinery | Unit Quantity Code (UQC) | Qty | Value (As adjusted by debit/credit note) | Input tax credit/Tax payable (whichever is higher) (Rs.) | |||||||||

| No. | Date | Central tax | State/ Union territory tax | Integrated tax | Cess | |||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |||||

| 8 (a) Inputs held in stock (where the invoice is available) | ||||||||||||||||

| 8 (b) Inputs contained in semi-finished or finished goods held in stock (where the invoice is available) | ||||||||||||||||

| 8 (c) Capital goods/plant and machinery held in stock | ||||||||||||||||

| 8 (d) Inputs held in stock or inputs as contained in semi-finished /finished goods held in stock (where the invoice is not available) | ||||||||||||||||

9. Amount of tax payable and paid (based on Table 8)

| Sr.

No. |

Description | ITC reversible/Tax payable | Tax paid along with the application for cancellation of registration (GST REG-16) | Balance tax payable (3-4) | Amount paid through

debit to electronic cash ledger |

Amount paid through debit to electronic credit ledger | |||

| Central Tax | State/ Union territory Tax | State/ Union territory Tax | Cess | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 1. | Central Tax | ||||||||

| 2. | State/ Union territory Tax | ||||||||

| 3. | Integrated Tax | ||||||||

| 4. | Cess | ||||||||

10. Interest, the late fee payable and paid

| Description | Amount payable | Amount Paid |

| 1 | 2 | 3 |

| (I) Interest on account of | ||

| (a) Integrated Tax | ||

| (b) Central Tax | ||

| (c) State/Union territory Tax | ||

| (d) Cess | ||

| (II) Late fee | ||

| (a) Central Tax | ||

| (b) State/Union territory tax | ||

11. Verification

I hereby solemnly affirm and declare that the information given hereinabove is true and correct to the best of my knowledge and belief and nothing has been concealed therefrom.

Signature of authorized signatory _______________________________________

Name _______________________________________

Designation/Status ____________________________

Date – dd/mm/yyyy

Instructions:

1. This form is not required to be filed by taxpayers or persons who are registered as:-

(i) Input Service Distributors;

(ii) Persons paying tax under section 10;

(iii) Non-resident taxable person;

(iv) Persons required to deduct tax at source under section 51; and

(v) Persons required to collect tax at source under section 52.

2. Details of stock of inputs, inputs contained in semi-finished or finished goods and stock of capital goods/plant and machinery on which input tax credit has been availed.

3. Following points need to be taken care of while providing details of stock at Sl. No.8:

(i) where the tax invoices related to the inputs held in stock or inputs contained in semi-finished or finished goods held in stock are not available, the registered person shall estimate the amount under sub-rule (3) of rule 44 based on prevailing market price of the goods;

(ii) in case of capital goods/ plant and machinery, the value should be the invoice value reduced by 1/60th per month or part thereof from the date of invoice/purchase taking useful life as five years.

4. The details furnished in accordance with sub-rule (3) of rule 44 in the Table at Sl. No. 8 (against entry 8 (d)) shall be duly certified by a practicing chartered accountant or cost accountant. Copy of the certificate shall be uploaded while filling the details.”;

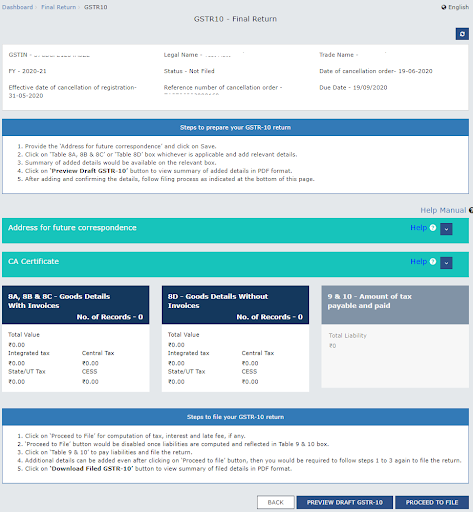

Here is a Screenshot of GSTR-10 from the GST portal.

Related Topic:

Steps to Resolve The Error “Invalid Summary Payload” in GSTR-10.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.