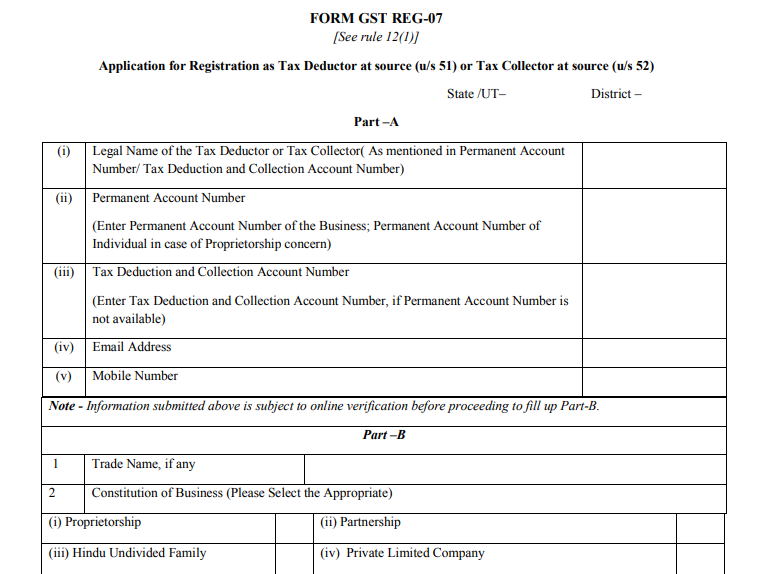

Format of “Form”- REG 07

Table of Contents

Introduction

REG 07 is the form for TDS & TCS deductors. TDS requirement is on government departments whereas TCS is deducted by E-commerce operators.

They need to deposit it into the account of government and issue a certificate of tax deduction/collection.

The normal rate of TDS or TCS is 1% each on amount of collection.

Applicability

Tax Deducted at Source:

TDS deduction rate is 1%. Following are persons specified to deduct tax:

- Government department

- Local authority

- Governmental agencies

- Notified persons

Deduct TDS only when the total value of supply under a single contract exceeds Rs 2,50,000.

Tax Collected at Source:

E-commerce operators are notified for TCS provisions. TCS rate for E commerce operators is 1%. Such rate is applicable on Net value.

Collect tax only when an e-commerce operator collects consideration on behalf of the supplier.

Here, net value means value after deducting all returns or adjustments of goods or services, if any.

Related Topic:

Format of “Form” – REG 25

Grant of Registration Certificate

Details in this form are verified by the proper officer. Registration certificate is issued in form REG 06 after successful verification.

Officer is bound to issue certificate within three days from date of application submission.

Related Topic:

Format of “Form” – REG 21

On satisfaction of officer after inquiry that a person is not liable to deduct or collect tax, he may cancel the registration through order in form REG 08.