Format of Declaration to be taken from Salaried Employee by Employer to deduct TDS in Old or New IT Slab Rates

Table of Contents

Format of Declaration to be taken from Salaried Employee by Employer to deduct TDS in Old or New IT Slab Rates

The Finance Act 2020, has introduced new section 115BAC, as per this provision the assessee has an option whether to pay tax as per new slab rates or the old slab rates including employees for Financial Year 2020-21 the Assessment Year 2021-22. Where the employee opts for a new tax regime then the employee has to forgo some of the tax concessions under the existing income tax act, whereas if the employee opts for the old tax regime then he will get the benefits of deduction under the income tax act. Format of Declaration to be taken from Salaried Employee by employer is release by Income Tax Deptt.

The provision is made applicable for the Individual/ HUF and the individual can exercise the option at the time of filing the return of income. If the individual assessee is a salaried employee then he opts the scheme on a yearly basis. It means the individual can switch to the tax regime of his choice in the next year.

For opting for the scheme, the employee has to give a declaration to the deductor of his intention to opt for an old or new tax scheme as per his choice. Upon such intimation, the employer shall compute his total income and make TDS thereon in accordance with the provision of section 115BAC of the Act. The declaration made by the employee cannot be changed. However, at the time of filing Returns, he can again choose one more time. Also Next year he can choose again if the employee wishes to switch method.

Employers are confused with the format and mode of declaration

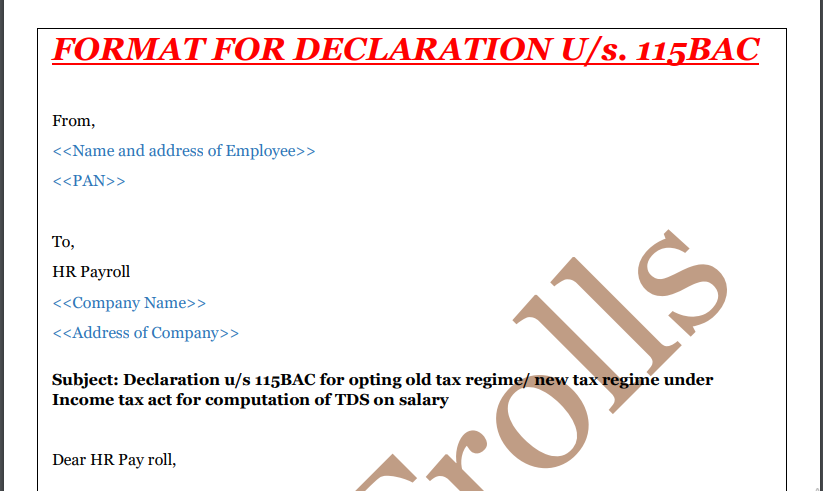

The Format of the declaration is a simple form which is attached below.

Read & download the format in pdf:

CA Rohit Kapoor

CA Rohit Kapoor

Delhi, India

CA Rohit Kapoor is a member of the Institute of Chartered Accountants of India (ICAI) and has vast experience in Direct Taxes with the working experience of 8+ Years. Rohit has also delivered Sessions in the Workshops, Training Session, etc. organized by RSMS, RAK, BCI, PSF, etc. He is also on the Board of Various Public Companies and National Level NGOs.