format of GST Appeal Final Commissioner (Appeal)

Table of Contents

Format of GST Appeal to Final Commissioner (Appeal)

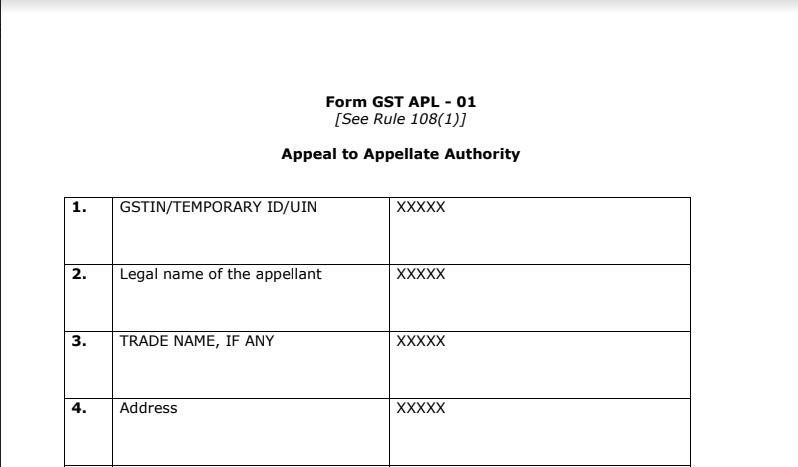

Format of GST Appeal- Form GST APL – 01

[See Rule 108(1)]

Appeal to Appellate Authority

| 1. | GSTIN/TEMPORARY ID/UIN | XXXXX |

| 2. | The legal name of the appellant | XXXXX |

| 3. | TRADE NAME, IF ANY | XXXXX |

| 4. | Address | XXXXX |

| 5. | Order No & Date | Order in Form XXX issued vide Ref No. XXX dated XXX. |

| 6. | Designation of the officer passing the order appealed against | XXXXXXX |

| 7. | Date of communication of the order appealed against | XXXXX |

| 8. | Name of the authorized representative | XXXXX |

| 9. | Details of the case under dispute – | The case relates to allegations raised by the revenue of purchases made from a fraudulent firm by the dealer (appellant) |

| (i) | Brief issue of the case under dispute – | Input Tax Credit denied by the revenue on the basis of verification of business premises of supplier M/s XXXXX GSTIN XXXXXX and alleging that the supplier was non-existent. |

| (ii) | Description and classification of goods/ services in dispute | Articles of cement, of concrete or of artificial stone, whether or not reinforced; such as Tiles, flagstones, bricks and similar articles, Building blocks and bricks, Cement bricks under HSN 6810 |

| (iii) | Period of dispute | XXX-XXX |

| (iv) | The amount under dispute: | XXXXX |

| Description | Central tax | State tax | Integrated tax | Cess |

| a) Tax/ Cess | XXX | XXX | XXX | XXX |

| b) Interest | XXX | XXX | XXX | XXX |

| c) Penalty | XXX | XXX` | XXX | XXX |

| d) Fees | XXX | XXX | XXX | XXX |

| e) Other charges |

XXX | XXX | XXX | XXX |

| (v) | The market value of seized goods | NA |

| 10. | Whether the appellant wishes to be heard in person | Yes |

| 11. | Statement of facts | As Per Annexure-A |

| 12. | Grounds of appeal | As Per Annexure-B |

| 13. | Prayer | As per Ground of Appeal |

14. Amount of demand created, admitted, and disputed

| Particulars of demand /refund |

Particulars | Central tax |

State tax |

Integrated tax |

Cess | Total Amount |

||

| Amount of Demand Created (A) |

a) Tax/ Cess | XXX | XXX | XXX | X | XXXX | XXXXX | |

| b) Interest | XXX | XXX | XXX | X | XXXX | |||

| c) Penalty | XXX | XXX | XXX | X | XXXX | |||

| d) Fees | XXX | XXX | XXX | X | XXXX | |||

| e) Other charges |

XXX | XXX | XXX | X | XXXX | |||

| Amount of Demand admitted (B) |

a) Tax/ Cess | XXX | XXX | XXX | X | XXXX | XXXXX | |

| b) Interest | XXX | XXX | XXX | X | XXXX | |||

| c) Penalty | XXX | XXX | XXX | X | XXXX | |||

| d) Fees | XXX | XXX | XXX | X | XXXX | |||

| e) Other charges |

XXX | XXX | XXX | X | XXXX | |||

| Amount of Demand disputed (C) |

a) Tax/ Cess | XXX | XXX | XXX | X | XXXX | XXXXX | |

| b) Interest | XXX | XXX | XXX | X | XXXX | |||

| c) Penalty | XXX | XXX | XXX | X | XXXX | |||

| d) Fees | XXX | XXX | XXX | X | XXXX | |||

| e) Other charges |

XXX | XXX | XXX | X | XXXX | |||

Related Topic:

PRINCIPLE GOVERNING CONDONATION OF DELAY IN FILING OF APPEAL

ANNEXURE-A

STATEMENT OF FACTS

1) M/s XXXXXX Distt. Panipat (Hry) -132103 (hereinafter referred to as the Appellant) is filing the present appeal against the impugned Order-in-Original in Form GST XXX issued vide Ref No. XXXXX dated XXXXX the Learned Excise & Taxation Officer cum Proper Officer of State Tax, Panipat. Copy of the impugned Order-in-Original is enclosed as Annexure-1.

2) Vide the above impugned Order-in-Original in Form GST XXX issued vide Ref No. XXXXX dated XXXXX the Learned Excise & Taxation Officer cum Proper Officer of State Tax, Panipat has observed that:-

(1) A written reply dated XXXXX submitted by the taxpayer has been perused and not found legally tenable. Hence, the taxpayer is liable to pay tax, interest, and penalty for the reason mentioned in the show-cause notice. Therefore, keeping in view facts of the case and relevant record placed on file, the proposed tax, interest, and penalty is hereby confirmed and the taxpayer is directed to pay the following amount within thirty days of the receipt of this order, failing which action will be taken as per law.

3) M/s XXXXX Distt. Panipat (Hry) (hereinafter also referred to as ‘the appellant’), is registered as a Normal tax Payer under section 22 of the CGST Act 2017 having GSTIN XXXXX and are engaged in the activities of manufacturing of Blocks falling under HSN 6810. Principal input i.e. Cement required for doing taxable activities is procured by the appellant from registered Dealers (GST Normal Tax Payers) including M/s XXXXX under cover of Tax invoice as prescribed under rule 46 of the CGST Act 2017. The appellant is also filing regularly and properly the Tax returns i.e. GSTR-1 & GSTR-3B as prescribed under section 39 of the CGST Act 2017. The appellant is also maintaining the necessary record/accounts of final products as well as the inputs.

Related Topic:

PRINCIPLE GOVERNING FILING OF APPEAL BEFORE FIRST APPELLATE AUTHORITY.

Read & Download the full copy in pdf:

Advocate Dinesh Verma

Advocate Dinesh Verma