Fresh Panel Appointed to Handle GST Litigation at Various Courts

Table of Contents

Fresh Panel Appointed to Handle GST Litigation at Various Courts

Government of India

Ministry of Finance

Department of Revenue

(Central Board of Indirect Taxes & Customs)

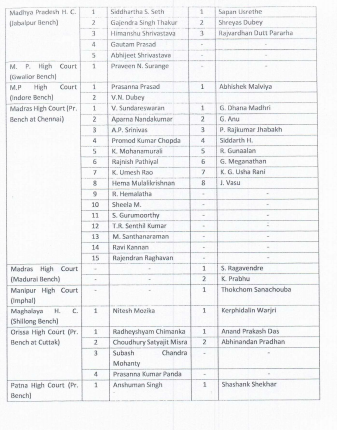

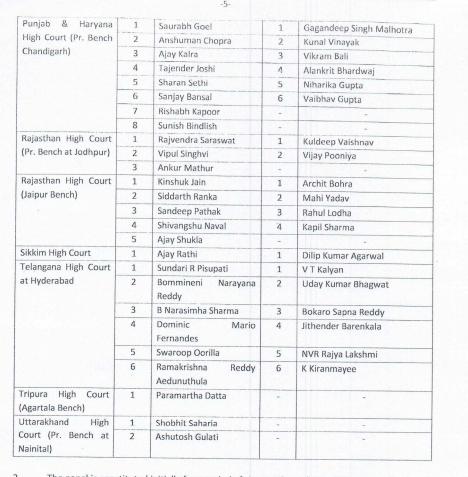

Legal Cell

Order

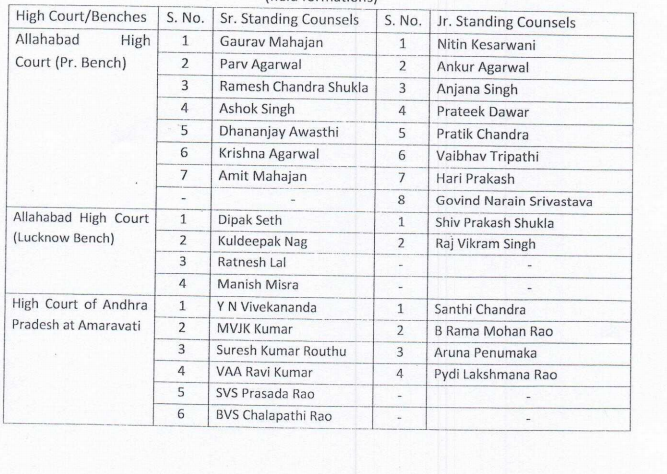

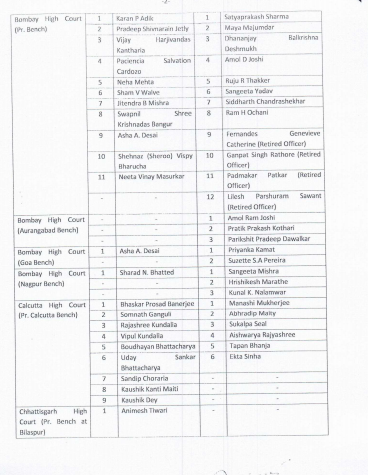

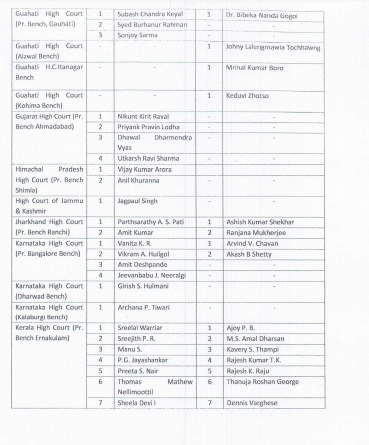

The President of India is pleased to appoint a fresh panel of Sr./Jr. Standing Counsels of CBIC to handle litigation of indirect Taxes before various High Courts (other than Delhi High Court) and other fora, in terms of Instruction F. No. 278A/43/2007- Legal dated 05.12.2007, as per following details. The engagement of these Sr./Jr. Standing Counsels is subject to the terms and conditions as laid down in the said instruction dated 05.12.2007 and instruction F. No. 278A/50/2011- Legal dated 14.09.2012.

(Feild Formations)

2. The panel is constituted initially for a period of six months and on satisfactory performance, the same shall be continued for the remaining period of two and a half years.

3. It is clarified that field formation (GST/Customs formations) may avail services of the Sr./Jr. Standing Counsels who have been appointed vide Board’s order F. No. 278A/07/2019 – Legal (Pt. III) dated 01.10.2020 ( copy available on CBIC website) for handling DRI/DGGI cases of Indirect Taxes before various High Courts and other fora.

4. These issues with the concurrence of the Ministry of Law & Justice vide their ID No. J- 12013/35/2019- Judl. dated 12.05.2020 and the Integrated Finance Unit (IFU) Dy. No. 298/IFU-EC/2020 dated 11.09.2020.

(Anish Gupta)

OSD (Legal)

Copy to:

- All Principal Cheif Commissioners/ Cheif Commissioners of CGST & CE, Customs & Customs (Prev.)

- All Principal Director Generals/ Director Generals of CGST & CE, Customs

- All Joint Secretaries/ Commissioners under CBIC

- Special Secretary, GST Council, Jeevan Bharti Building, Connaught Place, New Delhi.

- CEO, Goods, and Services Tax Network, East Wing, 4th Floor, World Mark- I, Tower ‘B’, Aerocity, New Delhi

- Judicial Section, Department of Legal Affairs, M/o Law & Justice (Ref. their ID No. J-12013/55/2019- Judl. dated 25.06.2020)

Read the Order:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.