Grounds of arrest should be informed to complete proceedings under section 19 of PMLA 2002 (Pdf Attach)

Table of Contents

Cases Covered:

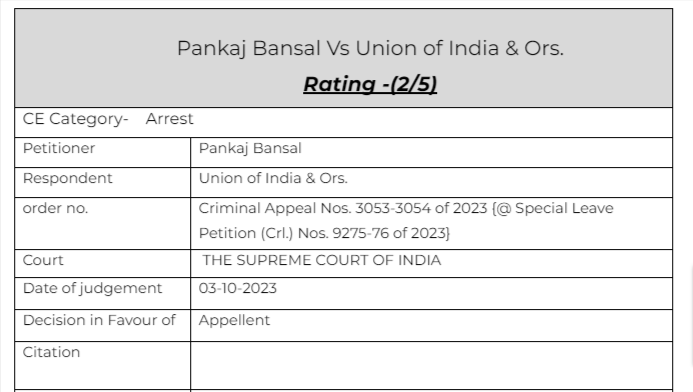

Pankaj Bansal Vs Union of India & Ors

.

Facts of the cases:

The summons were issued to Pankaj Bansal and Basant Bansal for a case by ED. While they were in the Office of ED, another summon was issued and they were arrested.

They pleaded to read down section 19 of PMLA 2002.

Earlier By the order dated 20.07.2023, the Division Bench opined that, as the constitutional validity of Section 19 of the Prevention of Money Laundering Act, 2002 (for brevity, ‘the Act of 2002’), had been upheld by the Supreme Court, the challenge to the same by the writ petitioners could not be considered only because of the fact that a review petition was pending before the Supreme Court. The prayer of The writ petitioners to that effect was accordingly rejected.

Observation & Judgement of the Court:

Three important facts craved out by the honorable court were-

Though the appellants did not challenge the constitutional validity of Section 19 of the Act of 2002 in their writ petitions and had only sought ‘reading down’ and/or ‘reading into’ the provisions thereof in the light of the judgment of this Court in Vijay Madanlal Choudhary and others vs. Union of India and others1,the Division Bench of the Punjab & Haryana High Court failed to note this distinction and disallowed their prayer under the mistaken 12022 (10) SCALE 577 the mere passing of an order of remand would not be sufficient in itself to validate the appellants’ arrests, Ground of arrest should be communicated the applicant.

Read and download the Full Pankaj Bansal Vs Union of India & Ors

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.