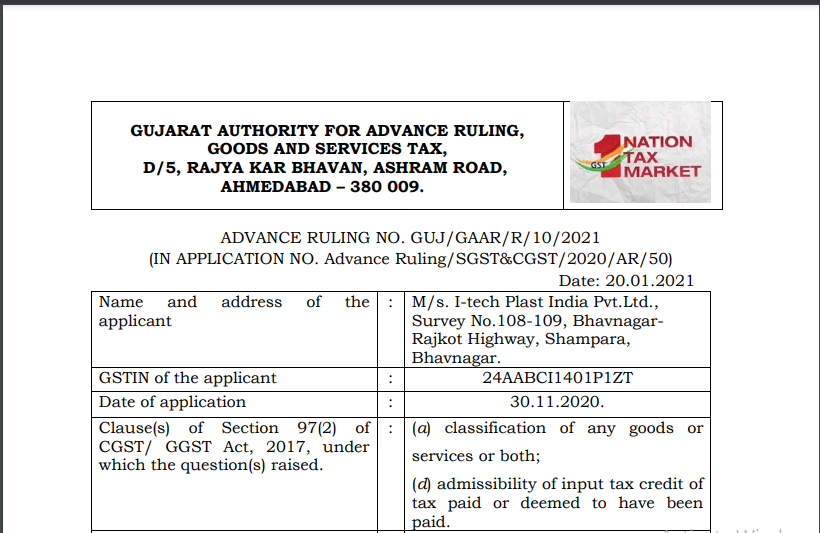

Gujarat AAR in the case of M/s. I-tech Plast India Pvt. Ltd.

Table of Contents

Case Covered:

M/s. I-tech Plast India Pvt. Ltd.

Facts of the Case:

The applicant M/s. I-tech Plast India Pvt.Ltd., Survey No.108-109, Bhavnagar-Rajkot Highway, Shampara, Bhavnagar is engaged in the business of manufacturing and supply of toys made up of plastic and/or rubber or both wherein essentially plastic is the main component. The applicant has stated that as per their understanding, the plastic toys manufactured and supplied by the applicant would squarely be eligible to be classified under Chapter Heading 9503.

Related Topic:

Gujarat AAR in the case of M/s. Sterlite Technologies Ltd

The applicant has submitted that a perusal of the aforesaid provisions read with explanation to the Notification No. 01/2017-Central Tax(Rate) shows that in order to determine the rate of CGST leviable on the product in question, it is paramount to determine the classification of the product in question under Customs Tariff Act, 1975; that the Customs Tariff is generally based on the tariff classification adopted by World Customs Organisation in its Harmonized Commodity Description of Coding System (hereinafter referred to as ‘HSN’). Hence, wherever a Chapter of Customs Tariff is aligned with the corresponding Chapter of HSN, then the HSN explanatory notes explaining the scope of headings of that Chapter would have persuasive value in the determination of the scope of headings of correspondence Chapter of Central Excise Tariff. The aforesaid position has been laid down by the Hon’ble Supreme Court in the following decisions:

(a) Camlin limited vs. CCE-2008(230)ELT 193 (SC).

(b) Coen Bharat Limited vs. CCE-2007(217) ELT 165 (SC).

(c) CCE vs. Bakelite Hylam Limited-1997(91) ELT 13(SC).

Related Topic:

Gujarat AAR in the case of M/s Gujarat Narmada Valley Fertilizers & Chemicals Ltd.

Observations:

On going through the particulars to be contained in the debit note as per the e-flyer issued by the Board, it can be seen that as per entry (g) above, serial number and date of the corresponding tax invoice or, as the case may be, the bill of supply is to be provided in the debit note. Therefore, the very purpose of making the aforementioned entry in the debit note is to enable the recipient of the supply to correlate the said debit note with the original invoice issued by the supplier and to take credit of the same in his input tax credit account. Thus from a combined reading of the definition of ‘debit note’, sub-section (3) of Section 34 of the CGST Act, 2017, and the particulars to be provided in a debit note issued under GST, it is amply clear that the debit note is not an independent document or an invoice in itself and is connected to an invoice as it is issued in pursuance to change in the value of an invoice. It, therefore, follows that the financial year to which a debit note pertains is invariably the financial year in which the original invoice (related to the said debit note) was issued. In view of the aforementioned discussions, and in light of the provisions of amended sub-section(4) of Section 16 of the CGST Act, 2017(amended w.e.f. 01.01.2021), we conclude that the applicant shall be entitled to claim the input tax credit only in respect of debit notes issued by the supplier towards the transactions entered into and goods supplied to the applicant during the financial year 2018-19, on or before the due date of furnishing of the return under section 39 for the month of September following the end of the said financial year 2018-19 or furnishing of the relevant annual return, whichever is earlier.

Ruling:

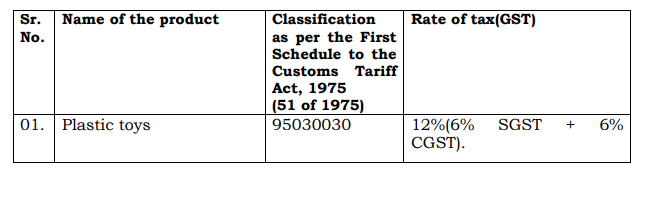

Question-1: What is the appropriate classification and rate of GST applicable on the supply of Plastic Toys under CGST and SGST?

Answer: The classification of the product ‘Plastic toys’ manufactured and supplied by the applicant M/s. I-tech Plast India Pvt. Ltd., Survey No.108-109, Bhavnagar-Rajkot Highway, Shampara, Bhavnagar (as per the First Schedule to the Customs Tariff Act, 1975(51 of 1975) as well as the corresponding rate of GST (as per Notification No.01/2017-Central Tax(Rate) dated 28.06.2017 (as amended from time to time) is as detailed in the table below:

Question-2: Can the applicant claim Input Tax Credit in relation to CGST/SGST separately in debit notes issued by the supplier in the current financial year i.e. 2020-21, towards the transactions for the period 2018-19?”

Answer: The applicant cannot claim Input Tax Credit in relation to CGST/SGST separately in debit notes issued by the supplier in the current financial year i.e. 2020-21, towards the transactions for the period 2018-19 for the reasons discussed hereinabove.

Read & Download the full Ruling in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.