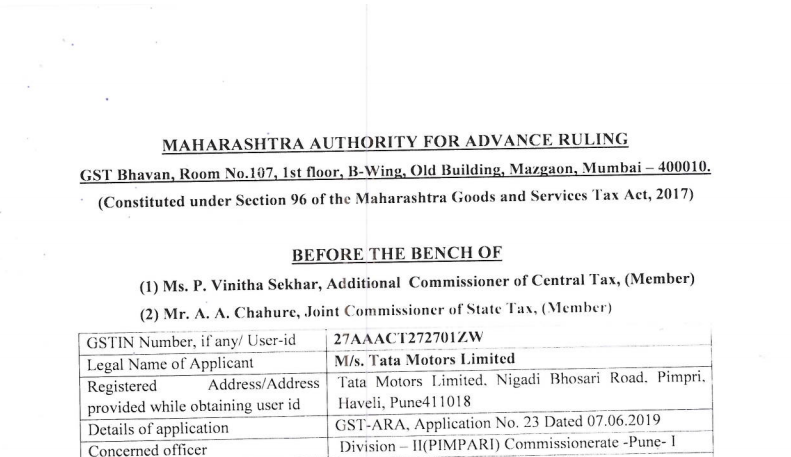

Maharashtra AAR in the case of M/s. Tata Motors Limited

Table of Contents

Case Covered:

M/s. Tata Motors Limited

Facts of the Case:

The present application has been filed under Section 97 of the Goods and Services Tax Act, 2017, and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and the MGST Act” respectively] by M/s. Tata Motors Limited. the applicant, seeking an advance ruling in respect of the following questions.

- Whether input tax credit (ITC) available to Applicant on GST charged by a service provider on the hiring of bus/motor vehicle having a seating capacity of more than thirteen people for the transportation of employees to & from the workplace?

- Whether GST is applicable to the nominal amount recovered by Applicants from employees for the usage of employee bus transportation facility in a non-air conditioned bus?

- If ITC is available as per question no. (1 ) above, whether it will be restricted to the extent of the cost borne by the Applicant (employer)?

Observations:

We have gone through the facts of the case, documents on record, and submissions made by both, the applicant as well as the jurisdictional office.

The applicant has submitted that they have engaged a service provider to provide a bus transportation facility to its employees in the non-air-conditioned bus having a seating capacity of more than 13 people. The first question raised by them is whether they are entitled to avail ITC of the GST paid to such service provider.

To answer the question of whether the applicant is entitled to avail Input Tax Credit (ITC) of GST charged on such inward supply as in the subject case. we refer to the provisions of Chapter V of the CGST Act, 2017 comprising of Sections 16 to 21.

Ruling:

Question:- 1. Whether input tax credit (ITC) available to Applicant on GST charged by a service provider on the hiring of bus/motor vehicle having a seating capacity of more than thirteen people for the transportation of employees to & from the workplace?

Answer:- ITC is available to the applicant but only after 01.02.2019.

Question:- 2. Whether GST is applicable to the nominal amount recovered by Applicants from employees for the usage of employee bus transportation facility in a non-air conditioned bus?

Answer:- Answered in the negative.

Question:- 3. If ITC is available as per question no. (1 ) above, whether it will be restricted to the extent of the cost borne by the Applicant (employer)?

Answer:- Answered in the affirmative.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.