GST Annual Return: Form, Rules and Penalty

GST Annual Return: Step by Step Guide with Form, Rules and Penalty:

GST Annual return is notified recently. It is a compilation of data declared in all returns filed during the first year of GST.In this article we will discuss all the provisions related to annual return in GST.

Who is required to file GST Annual Return:

Every registered taxpayer is required to file an annual return. Only following are not required to file an annual return:

- A Casual Taxable Person (CTP)

- A non resident taxable person (NRTP)

- An Input service distributor (ISD)

- TDS deductor

Which form is required to be filed:

There are different forms for different filers.

| Registered Person: Rule 80(1) | GSTR 9 |

| Composition Dealer : Rule 80(1) | GSTR 9A |

| TCS : Rule 80(2) | GSTR 9B |

| Audit TO > 2 crores : Rule 80(3) | GSTR 9C |

- i. In case of shifting from normal to composition or vice versa during the year, Both returns will be filed.

- ii. E-commerce operators are not required to file the annual return this year as they were notified after 31st March 2018.

What are the information we need to give in GST Annual Return:

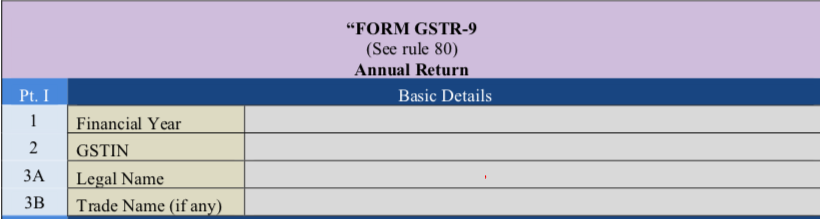

- Following informations are required in an annual return in GST1. Part I: Basic info:

- Terms used:

- GSTIN: Goods and Services Tax Identification Number

- b. UQC: Unit Quantity Code

- HSN: Harmonized System of Nomenclature Code

- The details for the period between July 2017 to March 2018 are to be provided in this return.

(Most of these informations will be auto populated)

GST annual return part I

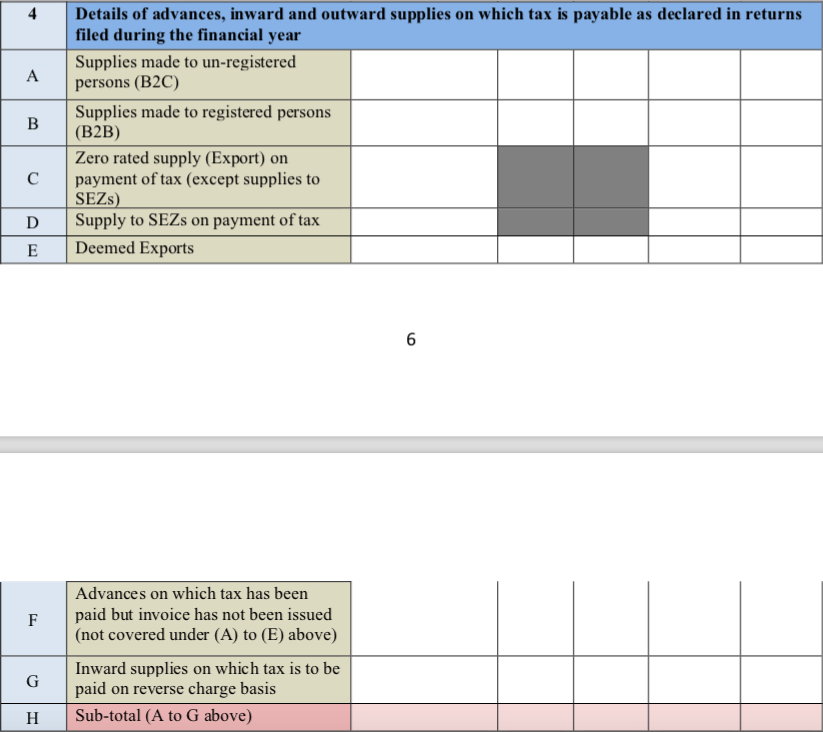

2. Part II: Details of Outward and inward supplies declared during the financial year

Part II consists of the details of all outward supplies & advances received during the financial year for which the annual return is filed. The details filled in Part II is a consolidation of all the supplies declared by the taxpayer in the returns filed during the financial year.It contains table 4 and table 5.

Format of Table 4 of GST Annual Return

Table 4 of GST Annual Return Analysis:

Table 4 contains the Details of advances, inward and outward supplies on which tax is payable as declared in returns filed during the financial year. It has sub -table from A to N.

| Sl. no. | Information | Instruction |

| A |

Supplies made to un-registered persons (B2C) |

Aggregate value of supplies made to consumers and unregistered persons on which tax has been paid shall be declared here. These will include details of supplies made through E-Commerce operators and are to be declared as net of credit notes or debit notes issued in this regard. Table 5, Table 7 along with respective amendments in Table 9 and Table 10 of FORM GSTR-1 may be used for filling up these details. |

| B |

Supplies made to registered persons (B2B) |

Aggregate value of supplies made to registered persons (including supplies made to UINs) on which tax has been paid shall be declared here. These will include supplies made through E-Commerce operators but shall not include supplies on which tax is to be paid by the recipient on reverse charge basis. Details of debit and credit notes are to be mentioned separately. Table 4A and Table 4C of FORM GSTR-1 may be used for filling up these details. |

| C |

Zero rated supply (Export) on payment of tax (except supplies to SEZs) |

Aggregate value of exports (except supplies to SEZs) on which tax has been paid shall be declared here. Table 6A of FORM GSTR-1 may be used for filling up these details. |

| D |

Supply to SEZs on payment of tax |

Aggregate value of supplies to SEZs on which tax has been paid shall be declared here. Table 6B of GSTR-1 may be used for filling up these details. |

| E |

Deemed Exports |

Aggregate value of supplies in the nature of deemed exports on which tax has been paid shall be declared here. Table 6C of FORM GSTR-1 may be used for filling up these details. |

| F |

Advances on which tax has been paid but invoice has not been issued (not covered under (A) to (E) above) |

Details of all unadjusted advances i.e. advance has been received and tax has been paid but invoice has not been issued in the current year shall be declared here. Table 11A of FORM GSTR-1 may be used for filling up these details. |

| G |

Inward supplies on which tax is to be paid on reverse charge basis |

Aggregate value of all inward supplies (including advances and net of credit and debit notes) on which tax is to be paid by the recipient (i.e.by the person filing the annual return) on reverse charge basis. This shall include supplies received from registered persons, unregistered persons on which tax is levied on reverse charge basis. This shall also include aggregate value of all import of services. Table 3.1(d) of FORM GSTR-3B may be used for filling up these details. |

| H |

Sub-total (A to G above) |

|

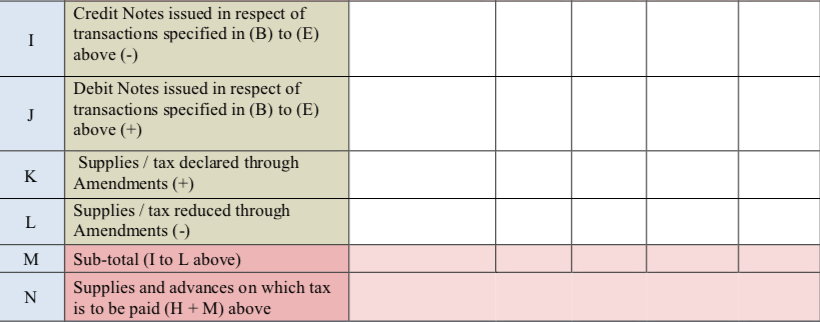

| I |

Credit Notes issued in respect of transactions specified in (B) to (E) above (-) |

Aggregate value of credit notes issued in respect of B to B supplies (4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E) shall be declared here. Table 9B of FORM GSTR-1 may be used for filling up these details. |

| J |

Debit Notes issued in respect of transactions specified in (B) to (E) above (+) |

Aggregate value of debit notes issued in respect of B to B supplies (4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E) shall be declared here. Table 9B of FORM GSTR-1 may be used for filling up these details. |

| K |

Supplies / tax declared through Amendments (+) |

Details of amendments made to B to B supplies (4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E), credit notes (4I), debit notes (4J) and refund vouchers shall be declared here. Table 9A and Table 9C of FORM GSTR-1 may be used for filling up these details. |

| L |

Supplies / tax declared through Amendments (-) |

Details of amendments made to B to B supplies (4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E), credit notes (4I), debit notes (4J) and refund vouchers shall be declared here. Table 9A and Table 9C of FORM GSTR-1 may be used for filling up these details. |

| M |

Sub-total (I to L above) |

The sum total of the row 4I to 4L is to be filled in the row. |

| N |

Supplies and advances on which tax is to be paid (H + M) above |

The sum of 4H and 4M which provides us the taxable supplies/value. |

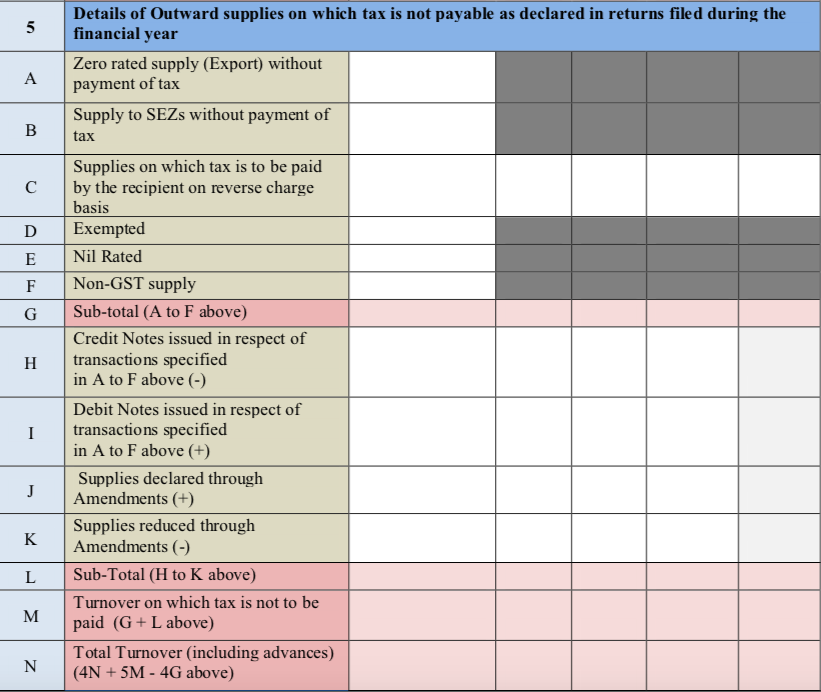

Format of Table 5 of GST Annual Return

Table 5 of GST Annual Return: Analysis

| Sl. No. | Information | Instruction |

| A. |

Zero-rated supply (Export) without payment of tax |

Aggregate value of exports (except supplies to SEZs) on which tax has not been paid shall be declared here. Table 6A of FORM GSTR-1 may be used for filling up these details. |

| B. |

Supply to SEZs without payment of tax |

Aggregate value of supplies to SEZs on which tax has not been paid shall be declared here. Table 6B of GSTR-1 may be used for filling up these details. |

| C. |

Supplies on which tax is to be paid by the recipient on reverse charge basis |

Aggregate value of supplies made to registered persons on which tax is payable by the recipient on reverse charge basis. Details of debit and credit notes are to be mentioned separately. Table 4B of FORM GSTR-1 may be used for filling up these details. |

| D. |

Exempted |

The aggregate value of exempted supplies shall be declared here. Table 8 of FORM GSTR-1 may be used for filling up these details. The value of “no supply” shall also be declared here. |

| E. |

Nil Rated |

The aggregate value of Nil Rated supplies shall be declared here. Table 8 of FORM GSTR-1 may be used for filling up these details. The value of “no supply” shall also be declared here. |

| F. |

Non-GST supply |

The aggregate value of Non-GST supplies shall be declared here. Table 8 of FORM GSTR-1 may be used for filling up these details. The value of “no supply” shall also be declared here. |

| G. |

Sub-total (A to F above) |

The sum of 5A to 5F is to be filled in here for the total supply made during the Financial Year on which tax is not to be paid. |

| H |

Credit Notes issued in respect of transactions specified

|

Aggregate value of credit notes issued in respect of supplies declared in 5A,5B,5C, 5D, 5E and 5F shall be declared here. Table 9B of FORM GSTR-1 may be used for filling up these details. |

| I |

Debit Notes issued in respect of transactions specified |

Aggregate value of credit notes issued in respect of supplies declared in 5A,5B,5C, 5D, 5E and 5F shall be declared here. Table 9B of FORM GSTR-1 may be used for filling up these details. |

| J |

Supplies declared through Amendments (+) |

Details of amendments made to exports (except supplies to SEZs) and supplies to SEZs on which tax has not been paid shall be declared here. Table 9A and Table 9C of FORM GSTR-1 may be used for filling up these details. |

| K |

Supplies reduced through Amendments (-) |

Details of amendments made to exports (except supplies to SEZs) and supplies to SEZs on which tax has not been paid shall be declared here. Table 9A and Table 9C of FORM GSTR-1 may be used for filling up these details. |

| L |

Sub-Total (H to K above) |

The sum of 5H to 5K is to be filled in here for the adjustments or corrections supply made during the Financial Year. |

| M |

Turnover on which tax is not to be paid (G + L above) |

The sum of 5G to 5L is to be filled in here for the total supply made during the Financial Year on which tax was not to be paid. |

| N |

Total Turnover (including advances) (4N + 5M – 4G above) |

Total turnover including the sum of all the supplies (with additional supplies and amendments) on which tax is payable and tax is not payable shall be declared here. This shall also include the amount of advances on which tax is paid but invoices have not been issued in the current year. However, this shall not include the aggregate value of inward supplies on which tax is paid by the recipient (i.e. by the person filing the annual return) on the reverse charge basis. |

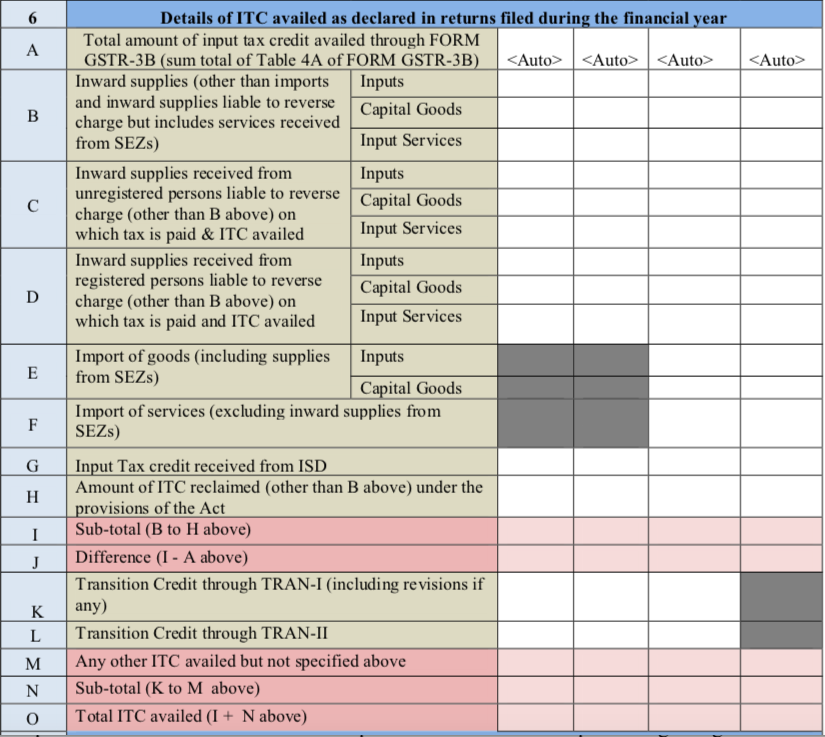

PART III: Details of ITC as declared in returns filed during the financial year

Format of table 6 of GST Annual return

Table 6: Details of ITC availed as declared in returns filed during the financial year

| A. |

The total amount of input tax credit availed through FORM GSTR-3B |

Auto-populated from table no. 4A of GSTR-3B |

| B. |

Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) |

Input, Capital Goods and Input services to be given separately |

| C. |

Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed |

Input, Capital Goods and Input services to be given separately |

| D. |

Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed |

The aggregate value of input tax credit availed on all inward supplies received from registered persons on which tax is payable on reverse charge basis shall be declared here. It may be noted that the total ITC availed is to be classified as ITC on inputs, capital goods, and input services. Table 4(A)(3) of FORM GSTR-3B may be used for filling up these details. |

| E. |

Import of goods (including supplies from SEZs) |

Details of input tax credit availed on import of goods including supply of goods received from SEZs shall be declared here. It may be noted that the total ITC availed is to be classified as ITC on inputs and capital goods. Table 4(A)(1) of FORM GSTR-3B may be used for filling up these details. |

| F. |

Import of services (excluding inward supplies from SEZs) |

Details of input tax credit availed on import of services (excluding inward supplies from SEZs) shall be declared here. Table 4(A)(2) of FORM GSTR-3B may be used for filling up these details. |

| G. |

Input Tax credit received from ISD |

Aggregate value of input tax credit received from input service distributor shall be declared here. Table 4(A)(4) of FORM GSTR-3B may be used for filling up these details. |

| H. | Amount of ITC reclaimed (other than B above) under the provisions of the Act | Aggregate value of input tax credit availed, reversed and reclaimed under the provisions of the Act shall be declared here. |

| I. | Sub-total (B to H above) |

The sum total of 6B to 6H is to be filled here. Which provides the total liable input tax credit. |

| J. |

Difference (I – A above) |

The difference between the total amount of input tax credit availed through FORM GSTR-3B and input tax credit declared in row B to H shall be declared here. Ideally, this amount should be zero. |

| K. | Transition Credit through TRAN-I (including revisions if any) |

Details of transition credit received in the electronic credit ledger on filing of FORM GST TRAN-I including revision of TRAN-I (whether upwards or downwards), if any shall be declared here. The period for submitting declaration in TRAN-I extended till 31-Jan-2019 and due date of filing FORM. |

| L. |

Transition Credit through TRAN-II |

Details of transition credit received in the electronic credit ledger after filing of FORM GST TRAN-II shall be declared here. |

| M. |

Any other ITC availed but not specified above |

Details of ITC availed but not covered in any of heads specified under 6B to 6L above shall be declared here. Details of ITC availed through FORM ITC-01 and FORM ITC-02 in the financial year shall be declared here. |

| N. | Sub-total (K to M above) | The sum of 6K to 6M is to be filled. Which gives the ITC availed for unspecified and Transitional credit. |

| O. | Total ITC availed (I + N above) | The sum of 6I and 6N, which gives the total ITC availed. |

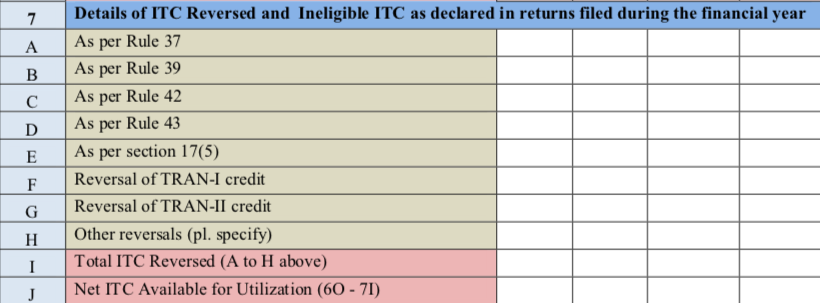

Format of table 7 of GST Annual return:

Analysis of Table 7 of GST Annual Return

Details of ITC Reversed and Ineligible ITC as declared in returns filed during the financial year

Details of input tax credit reversed due to ineligibility or reversals required under rule 37, 39,42 and 43 of the CGST Rules, 2017 shall be declared here. This column should also contain details of any input tax credit reversed under section 17(5) of the CGST Act, 2017 and details of ineligible transition credit claimed under FORM GST TRAN-I or FORM GST TRAN-II and then subsequently reversed. Table 4(B) of FORM GSTR-3B may be used for filling up these details. Any ITC reversed through FORM ITC -03 shall be declared in 7H.

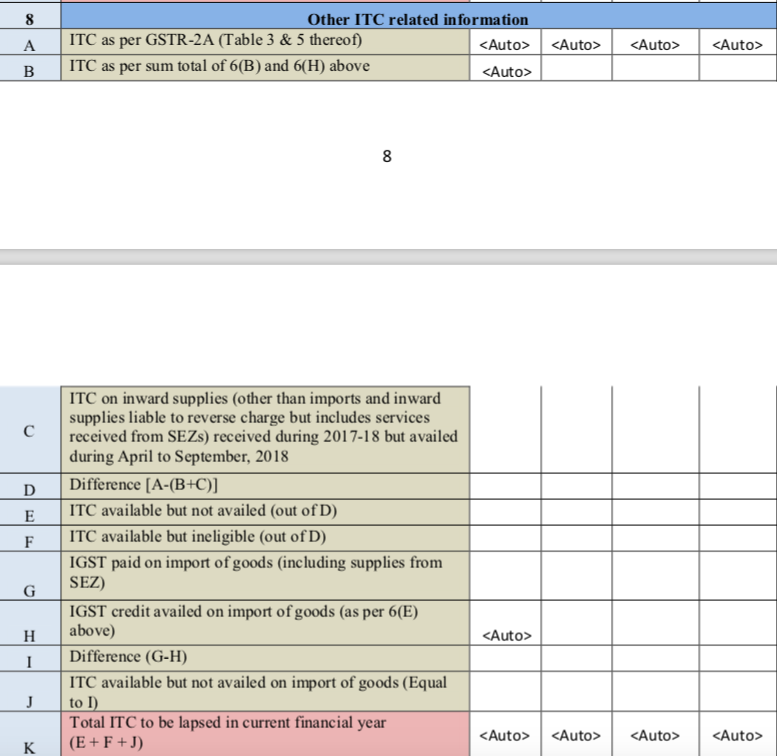

Format of table 8 of GST Annual return:

Analysis of Table 8: Other ITC related information

| A. |

ITC as per GSTR-2A (Table 3 & 5 thereof) |

The total credit available for inwards supplies (other than imports and inwards supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 and reflected in FORM GSTR-2A (table 3 & 5 only) shall be auto-populated in this table. This would be the aggregate of all the input tax credit that has been declared by the corresponding suppliers in their FORM GSTR-I. |

| B. |

ITC as per sum total of 6(B) and 6(H) above |

The input tax credit as declared in Table 6B and 6H shall be auto-populated here. |

| C. | ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 but availed during April to September, 2018 | Aggregate value of input tax credit availed on all inward supplies (except those on which tax is payable on reverse charge basis but includes supply of services received from SEZs) received during July 2017 to March 2018 but credit on which was availed between April to September 2018 shall be declared here. Table 4(A)(5) of FORM GSTR-3B may be used for filling up these details. |

| D. | Difference [A-(B+C)] | The difference is to be calculated in the ITC reflects in GSTR-2A and Crediot availed. |

| E. |

ITC available but not availed (out of D) |

Aggregate value of the input tax credit which was available in FORM GSTR-2A (table 3 & 5 only) but not availed in any of the FORM GSTR-3B returns shall be declared here. The credit shall be classified as credit which was available and not availed. The sum total of both the rows should be equal to difference in 8D. |

| F. |

ITC available but ineligible (out of D) |

Aggregate value of the input tax credit which was available in FORM GSTR-2A (table 3 & 5 only) but not availed in any of the FORM GSTR-3B returns shall be declared here. The credit shall be classified as credit which was available and the credit was not availed as the same was ineligible. The sum total of both the rows should be equal to difference in 8D. |

| G. | IGST paid on import of goods (including supplies from SEZ) |

Aggregate value of IGST paid at the time of imports (including imports from SEZs) during the financial year shall be declared here. |

| H. | IGST credit availed on import of goods (as per 6(E) above) |

The input tax credit as declared in Table 6E shall be auto-populated here. |

| I. |

Difference (G-H) |

The difference of row 8G and 8H. Which reflects the ITC available on import but not availed. |

| J. | ITC available but not availed on import of goods (Equal to I) | The ITC not availed on imports (Should be equal to 8I). |

| K. | Total ITC to be lapsed in current financial year (E + F + J) | The total input tax credit which shall lapse for the current financial year shall be computed in this row. |

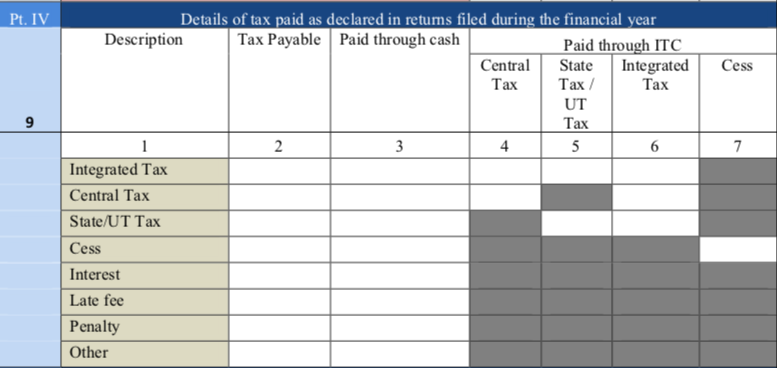

Format of Table 9 of GST Annual Return

Part-IV: Details of tax paid as declared in returns filed during the financial year

Part IV is the actual tax paid during the financial year. Payment of tax under Table 6.1 of FORM GSTR-3B may be used for filling up these details.

part-V: Particulars of the transactions for the previous FY declared in returns of April to September of current FY or up to date of filing of annual return of previous FY whichever is earlier

Part V consists of particulars of transactions for the previous financial year but declared in the returns of April to September of current FY or date of filing of Annual Return for previous financial year (for example in the annual return for the FY 2017-18, the transactions declared in April to September 2018 for the FY 2017-18 shall be declared), whichever is earlier.

Table 10: Supplies / tax declared through Amendments (+) (net of debit notes)

Details of additions or amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of FORM GSTR-1 of April to September of the current financial year or date of filing of Annual Return for the previous financial year, whichever is earlier shall be declared here.

Table 11: Supplies / tax declared through Amendments (-) (net of credit notes)

Details of additions or amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of FORM GSTR-1 of April to September of the current financial year or date of filing of Annual Return for the previous financial year, whichever is earlier shall be declared here.

Table 12: Reversal of ITC availed during previous financial year

Aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April to September of the current financial year or date of filing of Annual Return for previous financial year , whichever is earlier shall be declared here. Table 4(B) of FORM GSTR-3B may be used for filling up these details.

Table 13: ITC availed for the previous financial year

Details of ITC for goods or services received in the previous financial year but ITC for the same was availed in returns filed for the months of April to September of the current financial year or date of filing of Annual Return for the previous financial year whichever is earlier shall be declared here. Table 4(A) of FORM GSTR-3B may be used for filling up these details.

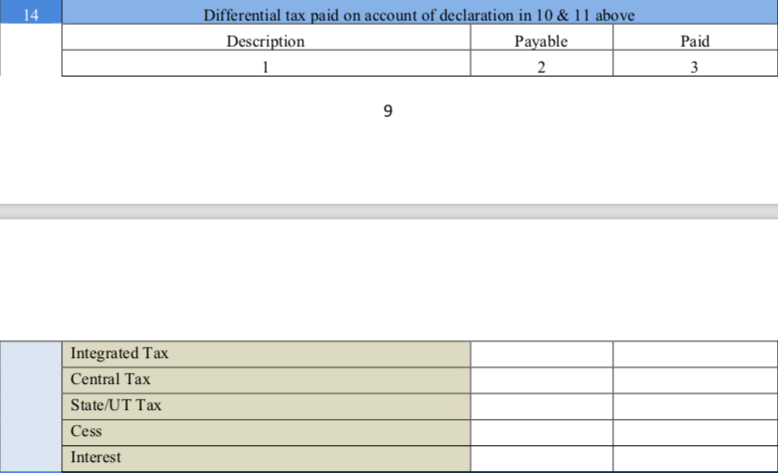

Format of Table 14 of Annual Return:

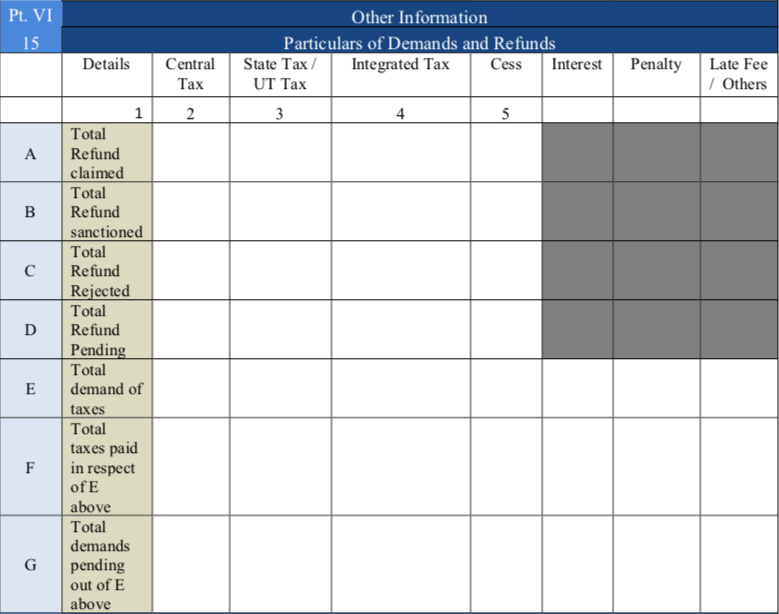

Format of Table 15 of GST Annual Return:

Analysis of Table 15 of GST Annual Return:

Part-VI: Other information consists of details of other information.

| A. |

Total Refund claimed |

Aggregate value of refunds claimed, sanctioned, rejected and pending for processing shall be declared here. Refund claimed will be the aggregate value of all the refund claims filed in the financial year and will include refunds which have been sanctioned, rejected or are pending for processing. Refund sanctioned means the aggregate value of all refund sanction orders. Refund pending will be the aggregate amount in all refund application for which acknowledgement has been received and will exclude provisional refunds received. These will not include details of non-GST refund claims. |

| B. |

Total Refund sanctioned |

Aggregate value of refunds claimed, sanctioned, rejected and pending for processing shall be declared here. Refund claimed will be the aggregate value of all the refund claims filed in the financial year and will include refunds which have been sanctioned, rejected or are pending for processing. Refund sanctioned means the aggregate value of all refund sanction orders. Refund pending will be the aggregate amount in all refund application for which acknowledgement has been received and will exclude provisional refunds received. These will not include details of non-GST refund claims. |

| C. |

Total Refund Rejected |

Aggregate value of refunds claimed, sanctioned, rejected and pending for processing shall be declared here. Refund claimed will be the aggregate value of all the refund claims filed in the financial year and will include refunds which have been sanctioned, rejected or are pending for processing. Refund sanctioned means the aggregate value of all refund sanction orders. Refund pending will be the aggregate amount in all refund application for which acknowledgement has been received and will exclude provisional refunds received. These will not include details of non-GST refund claims. |

| D. |

Total Refund Pending |

Aggregate value of refunds claimed, sanctioned, rejected and pending for processing shall be declared here. Refund claimed will be the aggregate value of all the refund claims filed in the financial year and will include refunds which have been sanctioned, rejected or are pending for processing. Refund sanctioned means the aggregate value of all refund sanction orders. Refund pending will be the aggregate amount in all refund application for which acknowledgement has been received and will exclude provisional refunds received. These will not include details of non-GST refund claims. |

| E |

Total demand of taxes |

Aggregate value of demands of taxes for which an order confirming the demand has been issued by the adjudicating authority shall be declared here. Aggregate value of taxes paid out of the total value of confirmed demand as declared in 15E above shall be declared here. Aggregate value of demands pending recovery out of 15E above shall be declared here. |

| F. |

Total taxes paid in respect of E above |

Aggregate value of demands of taxes for which an order confirming the demand has been issued by the adjudicating authority shall be declared here. Aggregate value of taxes paid out of the total value of confirmed demand as declared in 15E above shall be declared here. Aggregate value of demands pending recovery out of 15E above shall be declared here. |

| G. |

Total demands pending out of E above |

Aggregate value of demands of taxes for which an order confirming the demand has been issued by the adjudicating authority shall be declared here. Aggregate value of taxes paid out of the total value of confirmed demand as declared in 15E above shall be declared here. Aggregate value of demands pending recovery out of 15E above shall be declared here. |

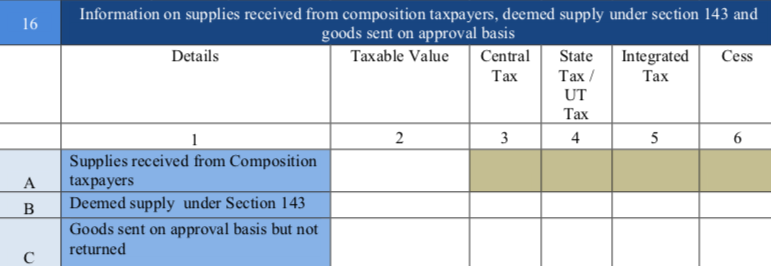

Format of Table 16 of Annual Return:

Analysis of table 16 of Annual return:

Information on supplies received from composition taxpayers, deemed supply under section 143 and goods sent on approval basis

| A. | Supplies received from Composition taxpayers | Aggregate value of supplies received from composition taxpayers shall be declared here. Table 5 of FORM GSTR-3B may be used for filling up these details. |

| B. |

Deemed supply under Section 143 |

Aggregate value of all deemed supplies from the principal to the job-worker in terms of sub-section (3) and sub-section (4) of Section 143 of the CGST Act shall be declared here. |

| C. | Goods sent on approval basis but not returned |

Aggregate value of all deemed supplies for goods which were sent on approval basis but were not returned to the principal supplier within one eighty days of such supply shall be declared here. |

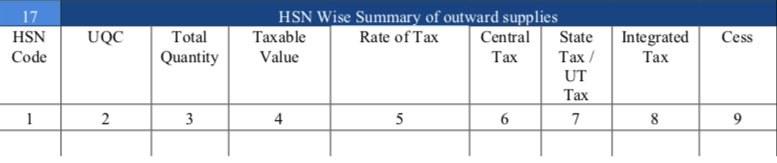

Format of Table 17 of GST Annual return

Analysis of Table 17 of GST Annual Return : HSN Wise Summary of outward supplies

Summary of supplies effected and received against a particular HSN code to be reported only in this table. It will be optional for taxpayers having annual turnover up to ₹ 1.50 Cr. It will be mandatory to report HSN code at two digits level for taxpayers having annual turnover in the preceding year above ₹ 1.50 Cr but upto ₹ 5.00 Cr and at four digits’ level for taxpayers having annual turnover above ₹ 5.00 Cr. UQC details to be furnished only for supply of goods. Quantity is to be reported net of returns. Table 12 of FORM GSTR-1 may be used for filling up details in Table 17.

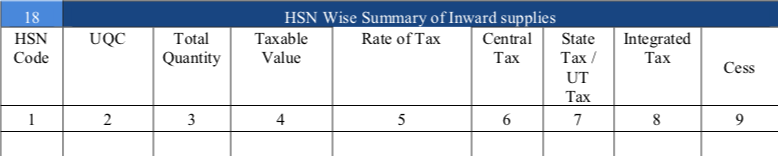

Format of table 18 of GST Annual Return

Analysis of Table 18: HSN Wise Summary of Inward supplies

Summary of supplies effected and received against a particular HSN code to be reported only in this table. It will be optional for taxpayers having annual turnover up to ₹ 1.50 Cr. It will be mandatory to report HSN code at two digits level for taxpayers having annual turnover in the preceding year above ₹ 1.50 Cr but upto ₹ 5.00 Cr and at four digits’ level for taxpayers having annual turnover above ₹ 5.00 Cr. UQC details to be furnished only for supply of goods. Quantity is to be reported net of returns. Table 12 of FORM GSTR-1 may be used for filling up details in Table 17.

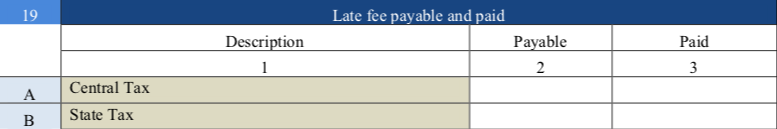

Format of Table 19 of GST Annual Return:

Analysis of Table 19 of GST Annual Return: Late fee payable and paid

Late fee will be payable if annual return is filed after the due date.

What is late fees or penalty for not filing annual return

- Section 47(2) provides that in case of failure to submit the annual return within the specified time, a late fee shall be leviable. The said late fee will be Rs. 100 per day during which such failure continues subject to a maximum of a quarter percent of the turnover in the State/UT. There will be equal late fee under the respective State/UT GST law.

- However, there is no specific penalty prescribed in the GST Law for not getting the accounts audited by a Chartered Accountant or a Cost Accountant. Therefore, in terms of Section 125 of CGST Act he shall be subjected to penalty up to 25,000/-. This section deals with general penalty and gets attracted where any person, who contravenes any of the provisions this Act, or any rules made thereunder for which no penalty is separately provided. Similar provision also exists under State/UT GST law as well.

What is due date for filing of annual return

- 31st December of next year

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.