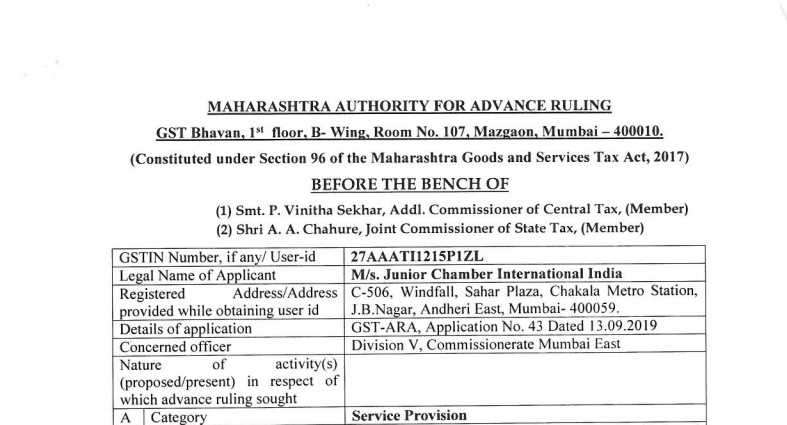

GST ARA order in case M/s. Junior Chamber International India

Table of Contents

Case Covered:

Junior Chamber International India

Facts of the case:

The present application was filed under Section 97 of the Goods and Services Tax Act, 2017 [ hereinafter referred to as ”the CGST Act and MGST Act”] by M/s. Junior Chamber International India, the applicant, seeking an advance ruling in respect of the following questions:

- Since the amount collected as membership fees from Local Organisation Member(LOM’s) is in the nature of the affiliation fees which is applied for the purpose of meeting the objects of the trust such as various administration expenses, etc. As also there is no furtherance of business in this activity and neither any services are rendered nor any goods are being traded, so also as there are no provisions of services to its members, whether GST is applicable on such membership fees received?

- Whether other incomes received by the trust is liable to GST?

The preliminary hearing in the matter was fixed on 02.01.2020. The applicant has submitted a letter dated 01.01.2020 and requested that they may be allowed to voluntarily withdraw their subject application filed on 13.09.2019.

The request of the applicant to withdraw the application voluntarily and unconditionally is hereby allowed, without going into the merits of detailed facts of the case.

Order:

(Under Section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act,2017)

The Application in GST ARA Form No. 01 of M/s. Junior Chamber International India, vide reference ARA No. 43 dated 13.09.2019 is disposed of, as being withdrawn voluntarily and unconditionally.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.